Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Czech National Bank (CNB) has purchased $1 million worth of Bitcoin and other digital assets, calling it a “test portfolio,” its first direct exposure to cryptocurrencies.

the move, announced on Thursday, marks a cautious step toward understanding how blockchain-based assets could fit into future financial systems.

According to the CNB, the portfolio includes Bitcoin (BTC), a stablecoin pegged to the US dollar, and a tokenized bank deposit.

Made out of the bank’s international reserves, the purchase provides hands-on experience in managing digital assets rather than indicating a change in policy or reserve.

Governor Aleš Michl said that the initiative started at the beginning of 2025 to explain how decentralized assets could complement traditional assets.

The project, approved by the Board of the Bank on October 30, followed an internal review concluding that digital assets are becoming a growing feature of institutional portfolios worldwide.

“The goal is to test every process involved in managing digital assets, from custody and key management to security and AML compliance,” Michl said. “We plan to share our findings in the next two to three years.”

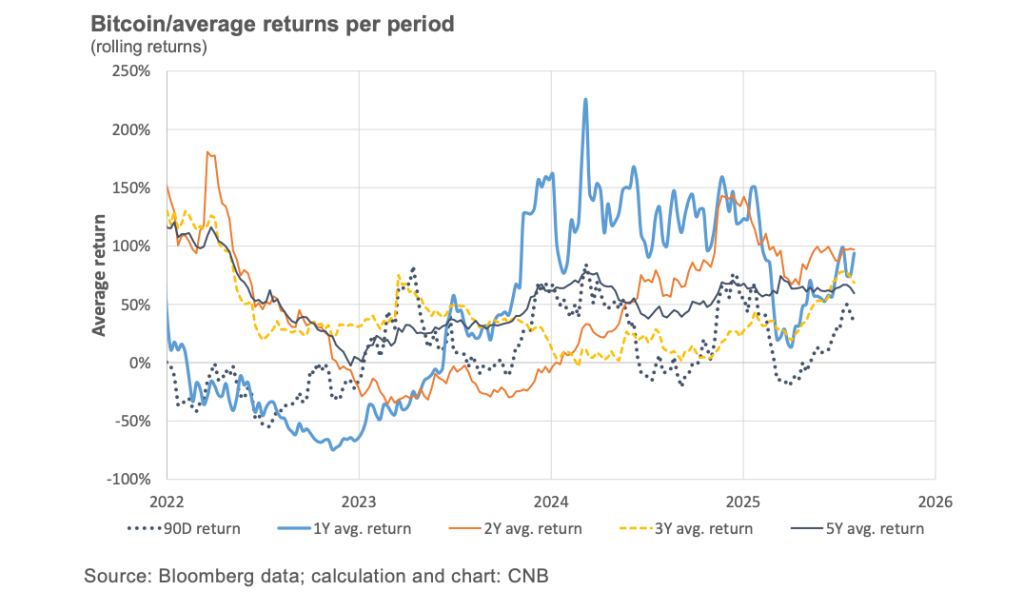

Officials said the purchase would not affect the bank’s €140 billion foreign reserves. The small allocation, they said, protects the bank from Bitcoin price volatility.

Through the program, the CNB will study how blockchain technology could affect payments, settlement and liability.

Technical teams will test wallet operations, multi-signature checks, and audit procedures for on-chain transactions.

Each asset in the portfolio serves a distinct purpose: Bitcoin represents decentralized money; him stablecoinfiat-backed stability; and the tokenized deposit, a bridge to regulated finance.

Michl called it part of a long-term modernization effort. “The crown will still remain our legal currency, but new forms of money and investment are emerging, and we want to be ready,” he said.

The decision follows nearly a year of internal debate over the role of Bitcoin in the Czech Republic’s reserves. Michl started the idea in January 2025I suggest a small purchase of Bitcoin for diversification.

From February, he argued that central banks should study the underlying technology of Bitcoin rather than ignore it.

Not all board members agree. Jan Kubicek, another member of the Bank’s Board, warned that Bitcoin’s volatility and legal uncertainties made it unsuitable for reserves. Their caution led to a compromise: a limited pilot program instead of a formal reserve.

Michl had initially proposed investing up to 5% of the country’s reserves in Bitcoin, a move that would have made the Czech Republic the first western central bank to publicly hold the asset.

That was the plan rejectedbut the test portfolio of $1 million serves as a practical medium, allowing the CNB to gain operational experience without changing its budget.

Alongside the test portfolio, the CNB has launched the CNB Lab, a center focused on emerging financial technologies. The Laboratory will research AI applications, instant payments and tokenized instruments, expanding the bank’s technical capacity for future digital finance.

The Czech initiative comes as European regulators cautiously explore the potential of blockchain. No EU central bank currently holds Bitcoin in its reserves, but discussions around tokenized bonds, regulated stablecoins and a digital euro have accelerated.

In October, nine European banks have revealed plans for a G7-backed stablecoinwhile the European Central Bank continues to test prototypes of the digital euro.

Against this background, the step of the CNB, small but tangible, distinguishes it as one of the few Western monetary authorities directly engaged with crypto-assets.

“The past performance of Bitcoin is impressive,” the CNB noted, “but its volatility remains incomparable to conventional assets. This project is to learn, not to invest.”