Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

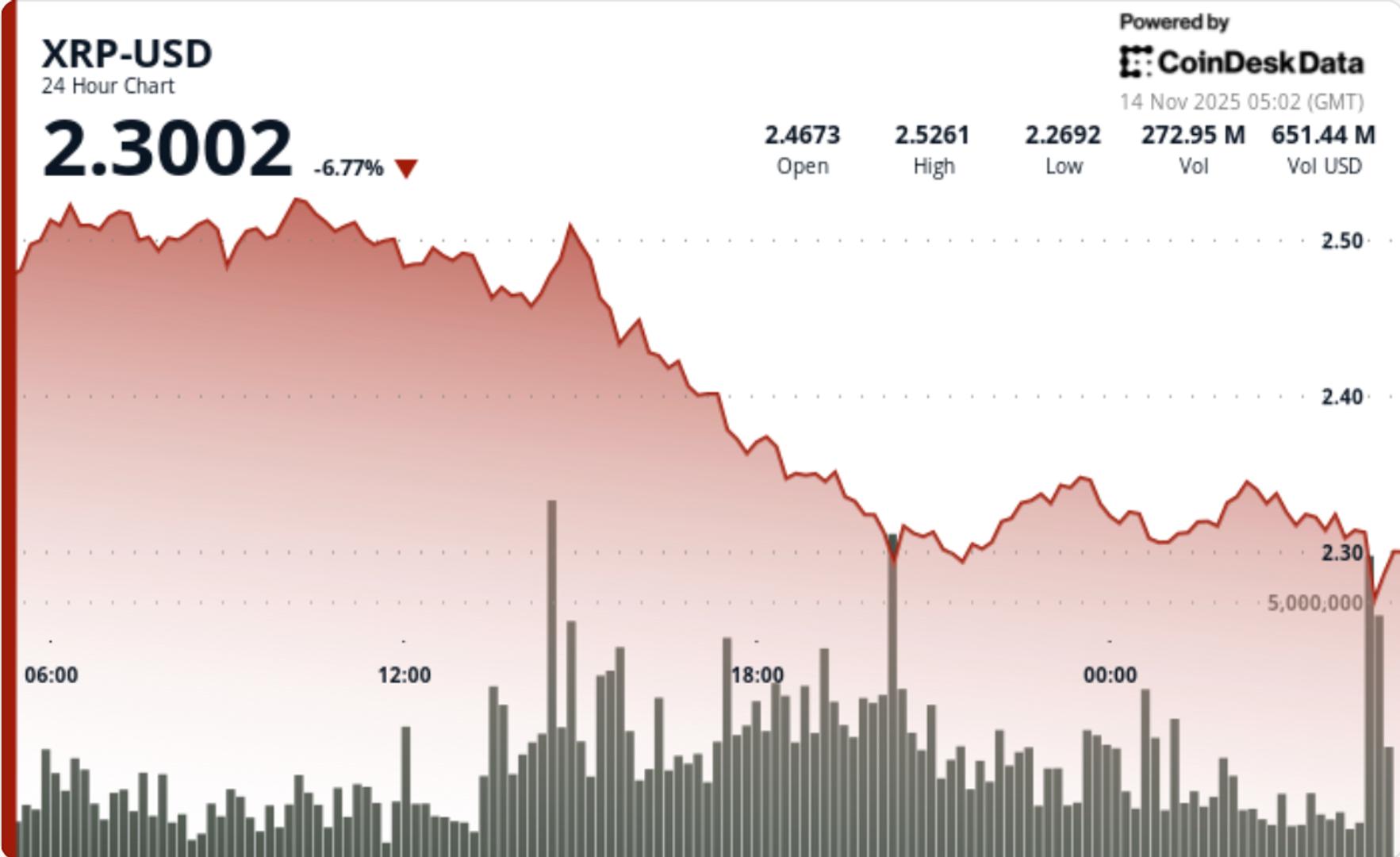

Brutal selloff breaks the psychological $2.30 floor, erasing recent gains as distribution overwhelms historic XRPC debut.

The session confirmed a complete technical breakdown with obvious structural damage:

Support/Resistance:

• $2.29 – $2.30 becomes a primary support after the violation of the psychological plan

• Older support to $2.36, $2.40and $2.47 it now acts as stacked resistance

• Invalidation for bulls requires a decisive recognition of $2.36

Volume profile:

• Total session volume 157.9 m (+46%) confirms the distribution of institutional quality

• Breakdown sequence shown 254% hourly volume spike, typical of movements driven by liquidation

• No significant recovery volume appeared during post-crash consolidation

Chart structure:

• The descending triangle support failed decisively, killing the early reversal setup

• New low range forming between $2.29 – $2.33

• Breakdown aligns with medium-term downtrend in broader crypto indices

Momentum Indicators:

• Oversold emerging intraday signals, but no confirmation of trend reversal

• Breakdown occurred under key EMAs; 50D/200D cross continues to slope bearishly

XRP is now at a pivotal inflection point:

• Holding $2.29 is essential – failure exposes a fast movement in the $2.00 – $2.20 demand area

• Any recovery must first recover $2.36 before the bulls regain technical control

• ETF inflows will be the next volatility catalyst; Early XRPC volume during market opening will indicate whether institutions are treating the listing as an accumulation opportunity or a liquidity event

• On-chain flows around the 110.5M XRP Whale transfers remain a wildcard – exchange rate inflows confirm additional downside risk

• Sentiment remains fragile through majors; Beta-sensitive assets like XRP will respond disproportionately to broader market weakness