Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The cryptocurrency market enters the weekend in one of those awkward setups where nothing collapses directly, but everything feels heavier than yesterday, especially after a $1.11 billion round of liquidations across majors like BTC and ETH.

Liquidity never recovered after the mid-week sell-off, derivatives were overloaded, and by Friday morning, most charts simply reflected forced positioning rather than any fresh narrative or directional conviction.

The XRP liquidation sheet is the cleanest snapshot of what went wrong in the last 24 hours. CoinGlass it shows $24.46 million in long liquidations versus $3.04 million in shorts over 24 hours, an 800% imbalance which basically tells you longs piled up at the worst possible time and wiped out in one sweep.

Price action corresponds to elimination. XRP continued to slide in the low $2.28-$2.30 pocket, and every micro-bounce in $2.32-$2.33 was sold immediately. The market has printed a range of highs and lows in the intraday frames, showing zero appetite to fight sales or absorb liquidations.

Heatmaps confirm the structure: the entire 24-hour cluster for XRP it is green on the long side and hardly registers anything significant for shorts. This was not organic distribution; it was a lever that was pulled out of the system, and the chart just followed the metrics.

If the market remains soft, XRP may have to test the liquidity shelf below $2.27 because that zone has not been exploited and traders do not like unfinished business at the end of the week.

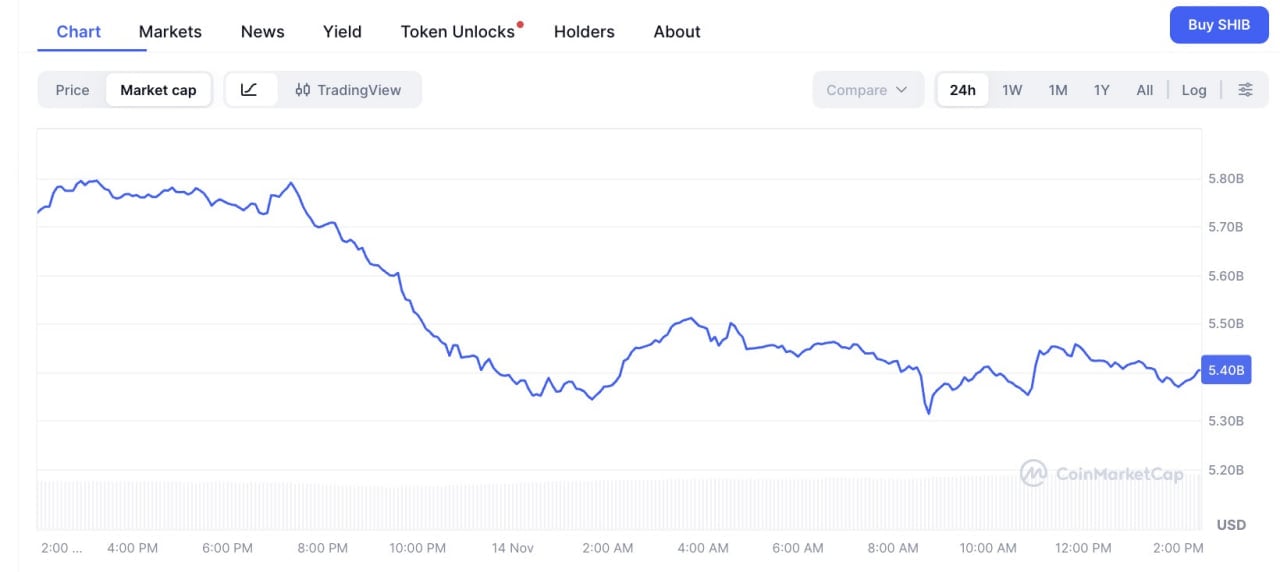

SHIB made one of the day’s most brutal percentage moves, dropping about $420 million in market capitalization — $5.8 billion to $5.4 billion — in a clean 24-hour sweep. No separate catalyst, no isolated drama, just a simple chain reaction: Bitcoin fell below $100,000, the majors cleared leverage and SHIB did what SHIB does in those moments, which is to follow the pressure without trying to resist.

The chart shows the asset sliding into the pocket of $0.000009, spending time below the band before pushing back towards $0.0000092, but the lack of volume tells you immediately that it was not driven by accumulation; it was the market rebounding after a forced relaxation.

Liquidity on SHIB remains concentrated in a narrow corridor of $0.00000900-$0.00000930. To get out of it, the market either needs a new liquidation peak or a new batch of buyers, and neither factor is yet visible. With BTC still in corrective mode, SHIB remains tied to larger market flows rather than any internal trend.

Bitcoin’s slip below $100,000 triggered another round of speculative decoding around CZ positions. BTC is trading around $96,600-$97,300 after failing to hold the morning bounce.

According to CoinGlass, the long liquidation pile for BTC hit $472.45 million in 24 hours, against only $37.51 million in shorts. CZ then published: “Every dip, some people think it’s the end of time. Time goes on.”

The market immediately ran into another puzzle. Why this always happens:

Is CZ doing it intentionally? No one knows. But his positions always land right before or immediately after a visible market inflection, which keeps traders locked on the numbers that he removes, regardless of whether they are random or not.

From a structural standpoint, BTC now sits a layer above the key liquidity zone at $95,500-$96,000. If the long-term sell-off continues at the current pace, the market will likely probe that zone before attempting a recovery.

The week closes with crypto still digesting yesterday’s relaxation, leverage still misaligned and buyers refusing to move to these levels. With BTC stuck under six digits and altcoins trading on defensive autopilot, the tone over the weekend remains cautious.