Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The crypto market is down today and by a significantly higher percentage than in the past days, with the capitalization of the cryptocurrency market decreased by 5.6%, which now stands at $3.38 trillion. 96 of the top 100 coins have fallen in the last 24 hours. At the same time, the total volume of crypto trade is $254 billion.

TLDR:

At the time of writing, all of the top 10 coins by market capitalization have seen their prices decrease in the last 24 hours.

Bitcoin (BTC) has fallen by 6.2% since this time yesterday, currently trading at $97,033.

Ethereum (ETH) is down 9.2%, now changing hands at $3,208. This, with Lido Staked Ether (STETH)is the highest drop in the category.

Solana (SUN) is in second place, having fallen 8.6% to the price of $142.

The smallest drop is 2.3%. Tron (TRX)which now stands at $0.2927.

When it comes to the top 100 coins, only four are green. Among these, Zcash (ZEC) appreciated the most, increasing to the price of $507.

Leo Token (LEO) followed with a rise of 2% to $9.17.

On the other hand, three currencies saw double-digit drops. History (IP) fell 15%, now trading at $3.34.

It is followed by Aave (AAVE). 13.6% and Ivy (HBAR). 10.4% to $185 and $0.1606, respectively.

Nic Puckrin, crypto analyst and co-founder of The Coin Bureauargues that the “crypto market has struggled to regain momentum from the October pandemonium.”

“Bitcoin seems to be fighting one battle after another, dragged down by the strength of the US dollar and higher Treasury yields, long-term holders, and macro uncertainty,” he says.

Puckrin finds it “disturbing” to see crypto and tech stocks diverge when they typically move in lockstep. This dynamic shows that BTC “is not just a proxy for the Nasdaq.”

Rather, it is more sensitive to macro headwinds and liquidity concerns and is “perfectly placed to break even once those concerns dissipate.”

In particular, as the US reopens and data begins to recover, “we may see the price of BTC fluctuate in the coming weeks.”

The real test could be the interest rate decision in the United States on December 10. However, “it remains likely that the news will be positive, which could set the stage for a Santa rally in crypto and other risk assets,” concludes Puckrin.

In addition, Dom Harz, co-founder of BOBCommented on institutional involvement in BTC as the price of the coin drops below $100,000.

“Despite the recent price movement, 2025 has been the year of institutional investment in digital assets, with institutions now holding more than 4 million BTC,” Harz writes in an email comment.

These institutions are “increasingly seeking to store excess cash in DeFi vaults for higher yield opportunities. These two movements are converging with Bitcoin DeFi; moving the world’s largest digital asset beyond a store of value and into a yield generating asset.”

He continues: “As the mainstream appetite for DeFi grows, serious technological advances unlock the utility of Bitcoin. The main players in institutional cryptography and Bitcoin DeFi adoption open access to BTCFi, where institutions can exploit yield opportunities for their BTC holdings. Bitcoin DeFi is ready to be at the forefront of the global financial system from Wall Street to Main Street.”

At the time of writing on Friday morning, BTC fell below the $100,000 mark and the $96,000 level, which now stands at $97,033.

The coin fell from an intraday high of $103,737 to a low of $96,170. It is now down 4.7% in a week, 13.7% in a month, and 22.9% from its all-time high.

We can see BTC retracement towards $94,500 and further towards the $90,000 level. A higher dive could drag it lower. On the contrary, if there is a change in the course, the coin could go up to $100,000 and move towards $103,000.

Ethereum is currently changing hands at $3,208. It fell from today’s high of $3,545 to the current low of $3,126.

During the past week, it has been trading between $3,172 and $3,633. ETH is down 4.3% in a day, 22.2% in a month, and 35.1% from its ATH.

ETH may continue to fall today and in the next few days. Should that happen, it could retreat below the $3,000 level – far from the near $5,000 zone where it was just weeks ago. If there is a market rebound, the coin could return to the territory of $3,500 and potentially $3,650.

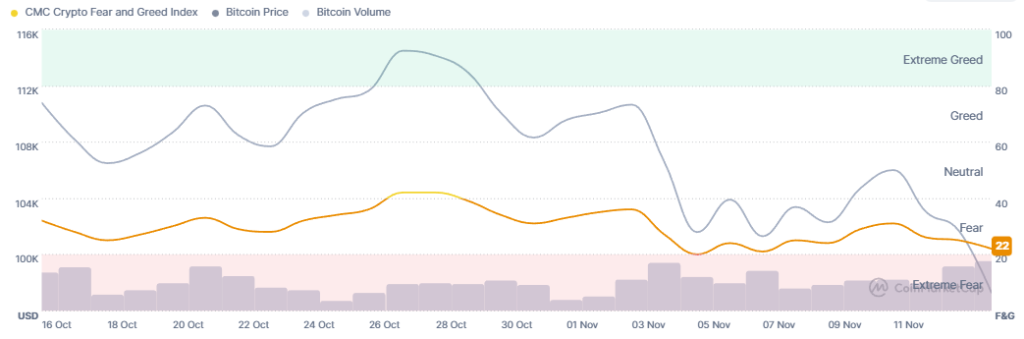

Meanwhile, the sentiment of the crypto market has decreased again, keeping firmly at the fear zone and moving to extreme fear. The index of fear and greed of crypto fell from 25 yesterday to 22 today.

Some investors are selling assets, driven by fear and concern about ever-falling prices. If the market continues to ride this instability, it may decline further.

However, if the assets are oversold, as a high fear can sometimes indicate, the market could see a rebound. Undervalued prices could also present a potential buying opportunity.

On Thursday, the United States BTC spot exchange-traded funds (ETFs) registered $869.86 million in outflows, the highest since February 2025 and the second highest recorded. The total net outflow came back to $60.21 billion, but is still above $60 billion.

Ten of the 12 BTC ETFs recorded negative flows, and there were no positive flows. Gray scale leaving $256.64 million. It is followed by BlackRock $256.64 million. Another triple-figure is $119.93 million from Fidelity.

At the same time, the US ETH ETF continued its streak of flow, recording another one $259.72 million starting November 13th. The total net inflow came back to $13.31 billion.

Five of the new funds recorded outflows. There were no positive flows. BlackRock is the reddest among these, leaving $137.31 million. Gray scale followed with $67.91 in outflows.

Meanwhile, Canary Capital’s XRPCthe first US spot exchange-trading fund offers direct exposure to XRPmade its debut on Thursday with $58 million in trading volume.

Such remarkable opening performances indicate that there is a growing institutional appetite for exposure to other major assets, in addition to BTC and ETH.

The crypto market declined again over the past day, and the stock market closed much lower on Thursday, dragged down by technology stocks. At closing time on November 13, the S&P 500 decreased by 1.66%, the Nasdaq-100 decreased by 2.05%, and the Dow Jones Industrial Average it fell by 1.65%.

The market may see an extended decline in the coming days as investor concerns persist. However, if there are macroeconomic and/or geopolitical signals that remove these concerns and reassure investors, the market could see a rebound.