Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin fell below $95,000, breaking through its weakest level since May. It has raised concerns that a deeper recession may develop. The downtrend extends a month-long loss of momentum that began shortly after the October high. It leaves BTC around 20% lower and forces traders to reassess the durability of the recent bull cycle.

With rate policy uncertainty intensifying and rare market visibility of US data clouding market visibility, December’s holdings are higher than at any point this year.

The latest shock came as analysts warned that several key US economic releases for October may not be released at all following the prolonged government shutdown. The absence of core metrics, including CPI, employment data and consumer trends, has left the Federal Reserve with limited visibility ahead of its December policy meeting.

Nic Puckrin, co-founder of The Coin Bureau, described the situation as a “black hole in the data pipeline”, noting that policy makers are forced to navigate sensitive economic conditions with much less information than usual.

The Fed resumed its rate-cutting cycle in September, delivering two reductions but keeping the door open for further adjustments. Still, traders now see only a 50% chance of another cut next month, according to CME FedWatch, down sharply from the first week.

Concerns have deepened after Goldman Sachs suggested that the United States could have the largest monthly decline in employment since 2020, a risk that is difficult to verify without official reports. As uncertainty grows, investors have shifted toward safety, pushing for high-beta assets like Bitcoin.

Crypto markets responded quickly to the deteriorating macro picture. The widely tracked Fear & Greed Index fell to 22, its lowest reading since April, signaling growing anxiety in digital assets.

Analysts note that Bitcoin’s decoupling from recent rallies in stocks and precious metals may indicate deeper risk aversion.

Key feeling pressures include:

Bitcoin’s daily chart shows a clean break below the long-term uptrend line, transferring the structure into a developing downtrend. A rejection candle at $99,000 underlined the seller’s control, while the price is now above a critical liquidity band between $94,500 and $92,000.

The RSI rests near 31, showing pressure but not a confirmed bottom. The price action resembles a classic model of “break-and-retest”: support pierced BTC, tried to regain, and failed – often a precursor to the extended crash.

A further rejection at $97,000-$99,000 will likely expose $91,600, followed by a deeper move towards $83,000, a major volume node from earlier in the cycle.

A bullish reversal remains possible if buyers recover $99,000 with a decisive candle close. That would open a recovery path towards $104,600, then $116,200.

As volatility compresses, the next breakout-up or down-can set the tone for December trading and set the stage for the initial cycle build-up before the next phase of expansion.

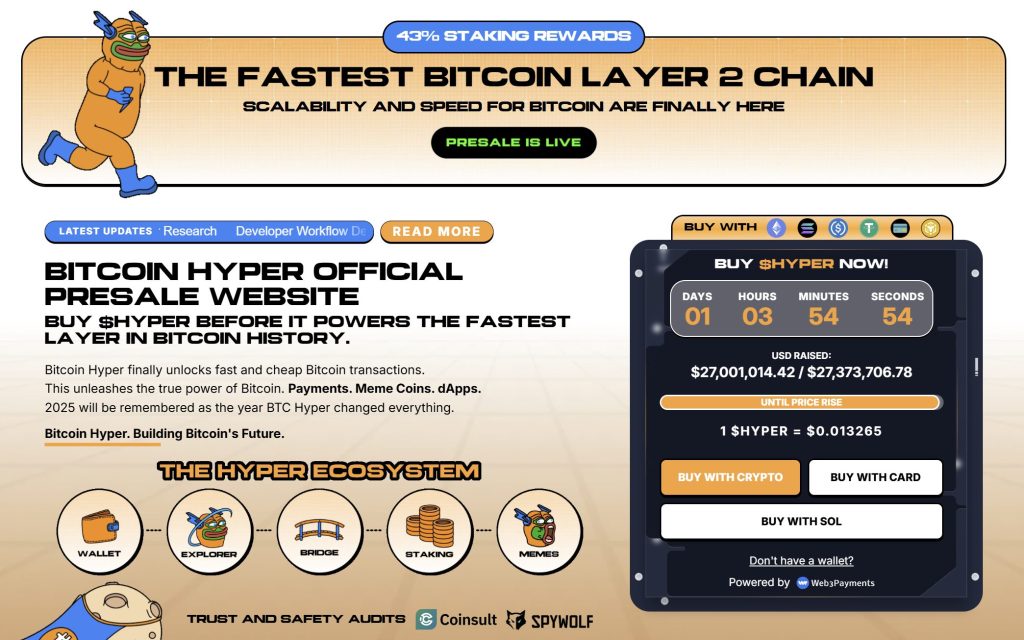

Bitcoin Hyper ($ HYPER) brings a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what was always missing: Solana-level speed.

Built as Bitcoin’s first native Layer 2 powered by the Solana Virtual Machine (SVM), it combines Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consultthe project emphasizes reliability and scalability as adoption develops. And the momentum is already strong. The presale exceeded $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity grows and the demand for efficient BTC-based applications increases, Bitcoin Hyper stands out as the bridge that connects two of the largest crypto ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it back fast, flexible and fun.

Click here to participate in the Presale