Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

For decades, gold has anchored global portfolios as the quintessential safe-haven asset. But over the past ten years, bitcoin has quickly emerged as its digital counterpart – and, in many cases, its outperformer.

New research from Dovile Silenskyte, Director of Digital Asset Research at WisdomTree, suggests that investors no longer need to choose between the two. Instead, the data increasingly supports a combined approach, where gold provides stability and bitcoin offers asymmetric upside.

The safety features of gold remain structurally intact. Its scarcity, established role in global markets and historical performance during periods of stress have kept it resilient.

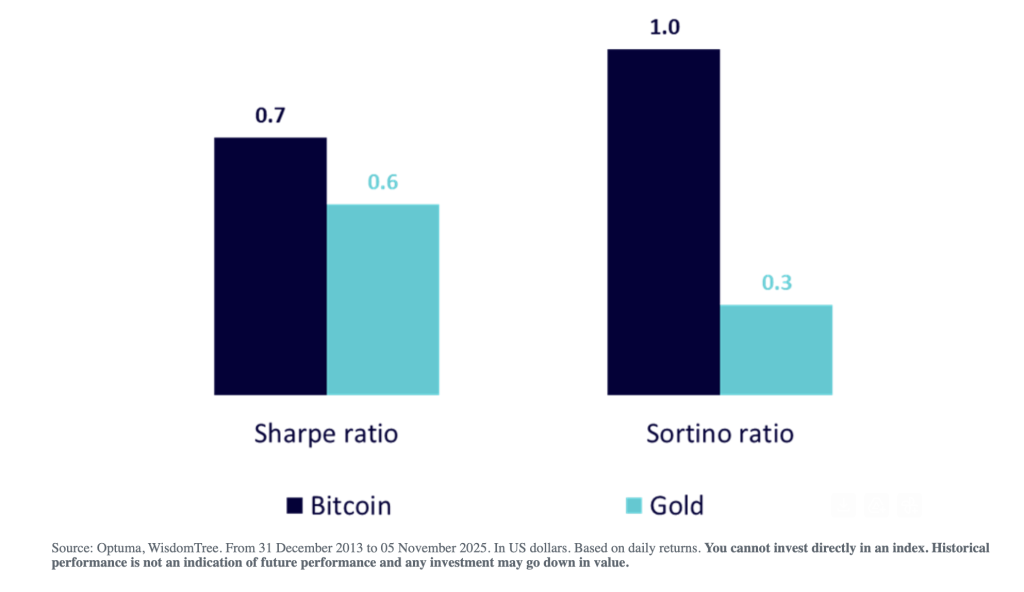

Since 2013, gold has posted annual returns of 10.4% with volatility of 14.5%, providing a Sharpe ratio of 0.6, according to Silenskyte analysis.

Bitcoin, however, has changed the paradigm. Over the same period, it generated annualized returns of 50.5% with 67.0% volatility, resulting in a Sharpe ratio of 0.7 – marginally outperforming gold on a risk basis, despite its extreme swings.

On the Sortino report, which focuses on downside risk, the gap is even wider: 1.0 for bitcoin versus 0.3 for gold. In simple terms, bitcoin has historically compensated investors more efficiently for the risk taken.

“Even with high volatility, bitcoin has offered superior returns for the risks,” notes Silenskyte.

Bitcoin’s volatility is often cited as the primary reason some investors remain hesitant. However, Silenskyte’s research shows that this volatility has decreased significantly in the last decade. Its 90-day annualized volatility has compressed from above 150% to below 40%, putting it in a range of many commodities.

At the same time, liquidity has deepened, with daily spot volumes comparable to the major S&P 500 stocks. Derivatives markets – especially futures and options – provide sophisticated hedging tools that make volatility increasingly manageable for institutional allocators.

“Volatility is a tax, but a decline,” says Silenskyte.

Rather than competing, bitcoin and gold appear to hedge different types of macro risks. Gold thrives during inflation, geopolitical turmoil and periods of negative real yields. Bitcoin, with its 21-million-supply cap and decentralized issuance, serves as a hedge against fiat debasement and technological disruption.

Importantly, bitcoin and gold show a long-term correlation of only 6%, according to him WisdomTree. This gives it powerful diversification properties: gold anchors the defensive side of a portfolio, while bitcoin provides convex upside driven by digital adoption.

WisdomTree’s model shows that adding even 1% bitcoin to a traditional 60/40 portfolio can increase the Sharpe ratio by 0.06, with only a marginal change in maximum drawdowns.

The takeaway from Silenskyte’s research is clear: gold remains fundamental, but bitcoin increases opportunity. As digital assets mature, the case for treating the two as complementary – not rival – hedges becomes stronger.

Together, they widen the safe haven spectrum for the modern investor.