Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin just dropped below $100k for the first time in six months, and as you’d expect, altcoins were absolutely destroyed, and they’d already had a rough year to begin with.

Cardano feels the pain too. ADA just hit its lowest level in a year at $0.50, which is a bear market level. If it loses this level of support, we could be looking at a serious drop ahead.

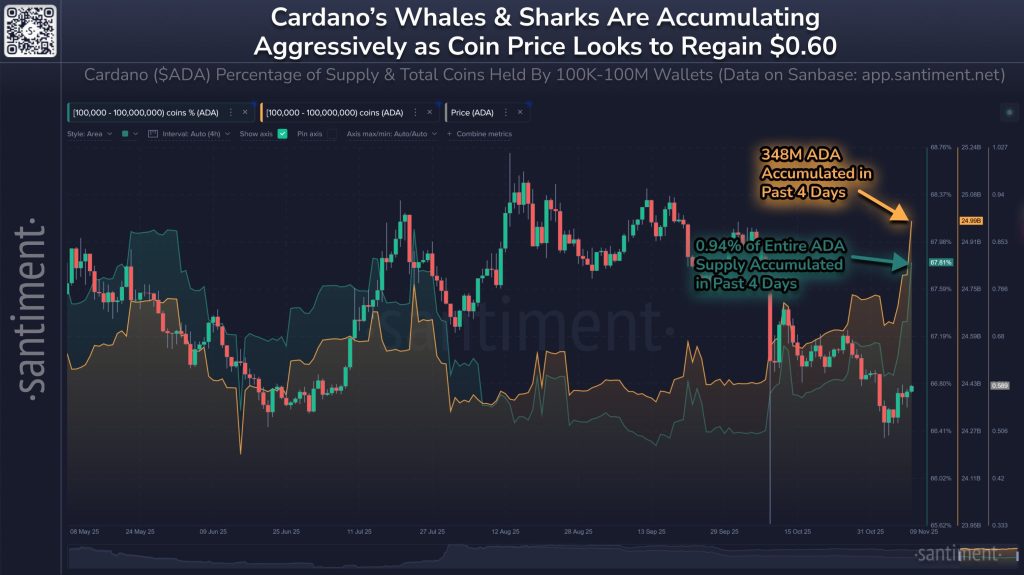

But here’s where it gets interesting: whales buy. Great holders only picked up more than 348 million ADA, for a value of about $200 million. That’s almost 1% of the entire supply. On top of that, Cardano’s Total Value Locked (TVL) just hit a 3-year high, and they recently launched Cardano Card.

Additionally, ADA has been added to the 21Shares Top 10 Crypto ETF, which is a pretty big deal for institutional recognition and could bring some serious buying pressure.

So here’s the scratcher: all signs point to the ecosystem growing and maturing. So why doesn’t the price reflect this? It’s the classic crypto puzzle: improve the fundamentals, the price of the price.

ADA is currently on the upside at $0.5157, hovering around the crucial support zone between $0.49 and $0.52 that has held it for weeks. If you zoom out, the bigger picture is not pretty. Cardano has been sliding downhill for months, dropping from around $0.70 to where we are now.

So what, what happens next? There are two paths here: either ADA bounces off this support and goes back to $0.5685 or maybe even $0.60 (this is the hopeful scenario), or it breaks and goes down further towards $0.48-$0.49, or worse, a scary one, isn’t it?

The RSI that is at 39.23 tells us that the ADA is close to oversold levels, but it is not quite there, and the flat MACD shows that there is zero momentum.

Think of it like watching someone balance on a tightrope. ADA either finds its footing here and recovers, or it reverses and continues to fall into deeper bear market levels.

While the rest of the market is drowning in the red, SUBBD is one of the few projects that is actually gaining momentum instead of losing it. Marketers are starting to rotate in platforms with real foundations and real use cases, and SUBBD lands right in that sweet spot.

SUBBD is building a hybrid crypto and AI-driven media platform aimed squarely at the broken subscriber economy. Instead of platforms taking the lion’s share and creators getting crumbs, SUBBD changes the model completely. Creators actually own their work, their audience and their revenue stream.

Fans get early drops, exclusive content and perks that make supporting their favorite creators feel personal, not transactional.

The big draw is the removal of middlemen. No algorithmic chokehold. No platform fees that drain creators dry. Only direct connections, direct earnings, and an AI layer that enhances content discovery in a way traditional platforms can’t match.

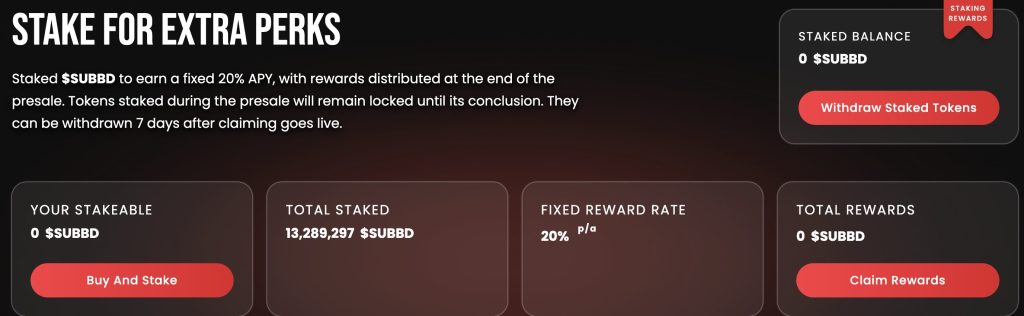

Investors are already awake. Presales closed at $1.34 million, and that number continues to climb as more people look for projects with staying power instead of hype cycles that die within a week.

Visit the official website here