Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Alibaba is developing a deposit-token payment system designed to simplify global commerce as it works on the increasingly strict stance Beijing has taken toward stablecoins, according to the new report and comments from company executives.

The effort reflects a broader push among Chinese companies to modernize cross-border payments without provoking a regulatory backlash as authorities tighten control over digital currencies.

The initiative comes from Alibaba’s fast-growing cross-border e-commerce division, which on Friday also announced a new AI-powered subscription service aimed at boosting revenue.

Kuo Zhang, president of Alibaba.com, told CNBC that the company was preparing to use tokenized versions of the euro and the US dollar to settle international B2B payments more efficiently.

These tokens, often referred to as “deposit tokens,” are issued by regulated banks and backed directly by customer deposits, distinguishing them from privately issued stablecoins that regulators in Beijing have repeatedly warned against.

Zhang said Alibaba is waiting tokenized payments to reduce settlement times, cut intermediary fees, and allow funds to move “simultaneously” in markets such as the United States, Europe, Hong Kong, Singapore and mainland China.

He added that Alibaba.com plans to partner with global banking companies, including JPMorgan, whose own tokenization system, JPMD, officially launched this year for institutional clients.

The timing drew the examination. In July and August, Chinese companies, including JD.com and Alibaba subsidiary Ant Group, Lobby to issue yuan-based stablecoins in Hong Kong.

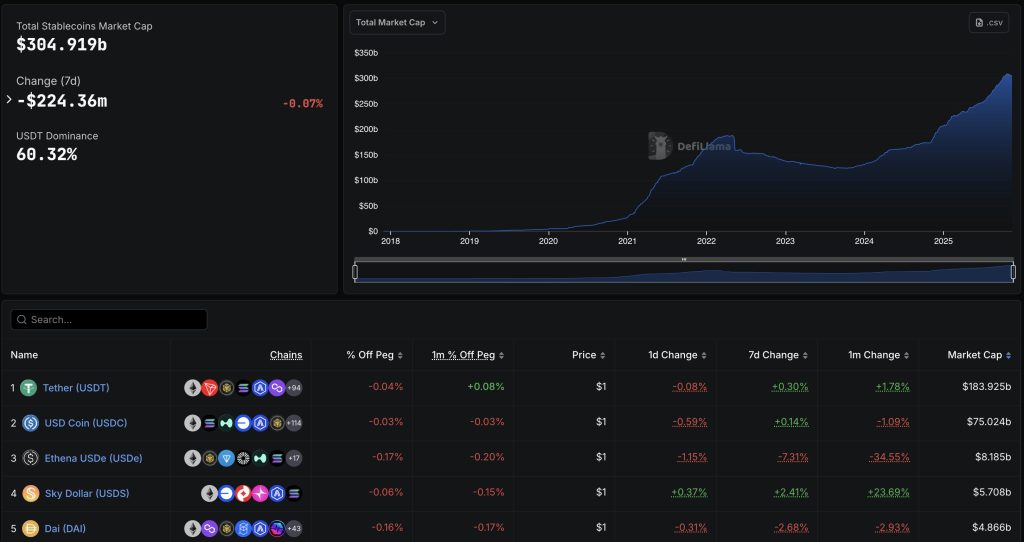

Their goal was to counter the overwhelming dominance of US dollar stablecoins, which account for more than 90% of the $304.9 billion market.

However, in October, both Businesses have put these ambitions on hold after the People’s Bank of China and other regulators privately instructed major tech companies to halt any plans to issue or return stablecoins, even in the newly regulated environment of Hong Kong.

Officials have expressed concern that privately issued fiat-backed tokens could erode the state’s monetary authority.

Regulators have since doubled down, warning companies not to publish stablecoin research or hold seminars on the topic, citing risks of fraud and illicit finance.

PBoC Governor Pan Gongsheng called last month stablecoins a growing threat to global financial stability and reaffirmed China’s zero-tolerance policy toward private digital currencies, even as the digital yuan continues to expand.

Against this backdrop, Alibaba’s shift towards tokenized bank deposits reflects a calculated move, using a blockchain-based facility while avoiding the political sensitivities around stablecoins.

Tokenized deposits allow payments to be processed in distributed systems, but remain entirely in the banking sector, supported by fiat currency held on the balance sheet.

This mechanism aligns more closely with Beijing’s preference for state-linked digital finance rather than private token issuance.

Zhang said Alibaba.com plans to launch “pay agents” in December, an AI-driven tool that automatically writes commercial contracts between buyers and suppliers by analyzing their message history.

This feature is part of the company’s broader strategy to upgrade its B2B ecosystem with artificial intelligence.

Its new search product “AI Mode” allows companies to compare suppliers by price, logistics and production capacity.

Alibaba expects to charge about $20 a month or $99 a year for the service, creating a new subscription-based revenue stream.

The company’s renewed technology push comes as Chinese AI models gain global attention. At the end of October, Alibaba Qwen 3 Max posted a 108% gain in a live crypto trading contestsurpassing many Western AI systems.

Only DeepSeek, another Chinese model, gave higher returns, while OpenAI’s GPT-5 and Google’s Gemini 2.5 Pro recorded steep losses.