Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

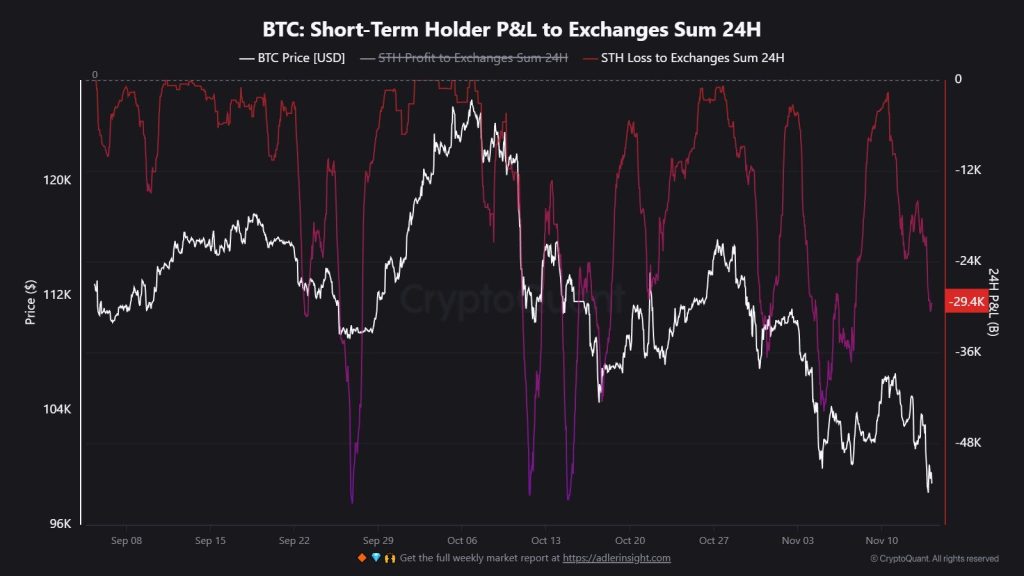

Short term Bitcoin holders just dumped 29,400 BTC on losing exchanges, raising fresh concerns about market pressure as the cryptocurrency moves close to critical support levels.

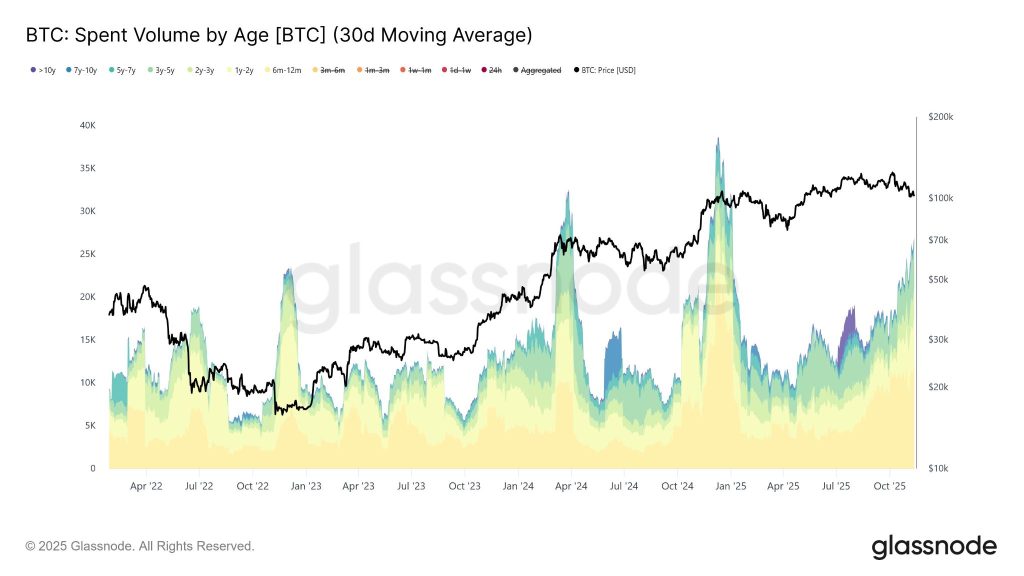

The sell-off comes amid heavy distribution from long-term holders, who sold around 815,000 BTC in the past month, the highest level since January 2024, while overall market conditions remain bearish, with Bitcoin testing its 365-day moving average at $102,000.

Despite the concerning headlines, analysts urge investors to maintain perspective.

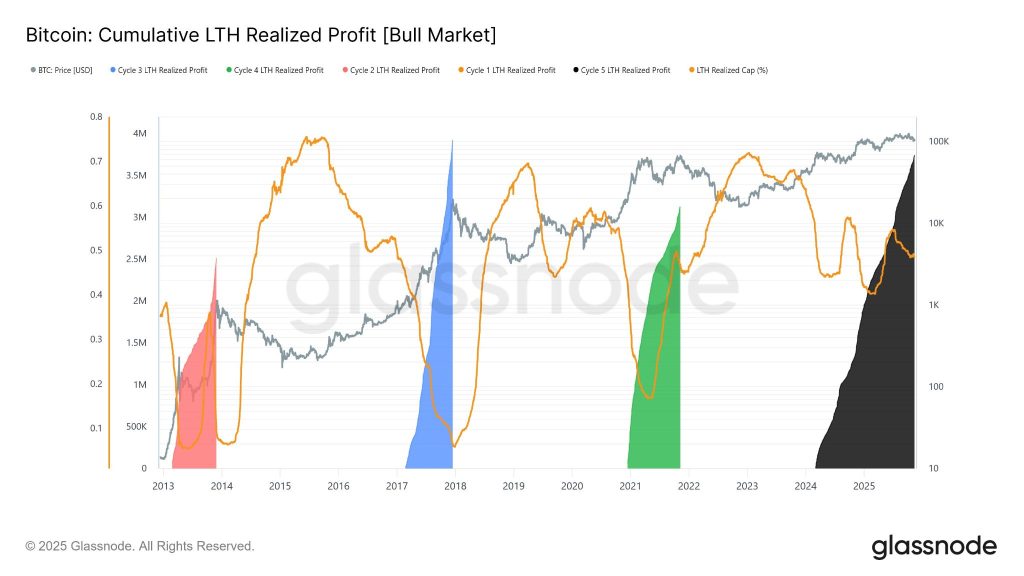

Glassnode data reveals that profit from long-term holders has grown from around 12,500 BTC daily in early July to 26,500 BTC daily currently, representing normal bull market behavior rather than a coordinated exodus.

Recent narratives saying “OG Whales Dumping” or describing “Bitcoin’s Silent IPO” have sparked debate in the crypto market.

However, on-chain analysis by Glassnode shows that long-term holders have realized profits throughout this cycle exactly as they did in previous bull runs.

By the end of August, the scale of profits taken by experienced investors after breaking all-time highs had risen to levels fully consistent with the tops of the previous cycle.

Even if you isolate whale wallets that are seven years old or older, passing over 1,000 BTC per hour, the data tells a consistent story.

These high-magnitude expenses occurred in every major bull phase; however, what stands out now is its frequency, which appears more regular and evenly spaced, indicating a persistent, staggered distribution rather than a sudden, coordinated sale.

Meanwhile, Bitcoin holders realized net profits of $3.0 billion on November 7, a relatively high level comparable to the profits seen in October.

Net realized losses have been virtually non-existent, indicating that holders have not capitulated – a necessary condition to form a price fund, according to CryptoQuant analysis.

Currently, Bitcoin sits around its 365-day moving average of $102,000, a key technical and psychological support level that has acted as ultimate support throughout this bull cycle.

Ki Young Ju, CEO of CryptoQuant, emphasized that investors who entered Bitcoin six to twelve months ago have a cost basis close to $94,000.

“Personally, I don’t think the bear cycle is confirmed unless we lose that level,“Ju said.I’d rather wait than jump to conclusions.“

Alex Adler too identified two critical correction levels: $87,000 and $74,000.

The $87,000 level is derived from a conservative Bitcoin valuation model, which explains 87% of the price variation through on-chain activity, with a backtest score of 95 out of 100.

Failure to retrace the 365-day moving average may accelerate a deeper correction, according to the latest research from CryptoQuant.

Specifically, Hunter Horsley from Bitwise offered a contrasting perspective on market cycles.

“We talk about 4 year cycles – But the reality is that the model is based on a past era of crypto,” Horsley noticed.

“Since the launch of the Bitcoin ETF and the new administration, we have entered a new market structure: new players, new dynamics, new reasons that people buy and sell.“

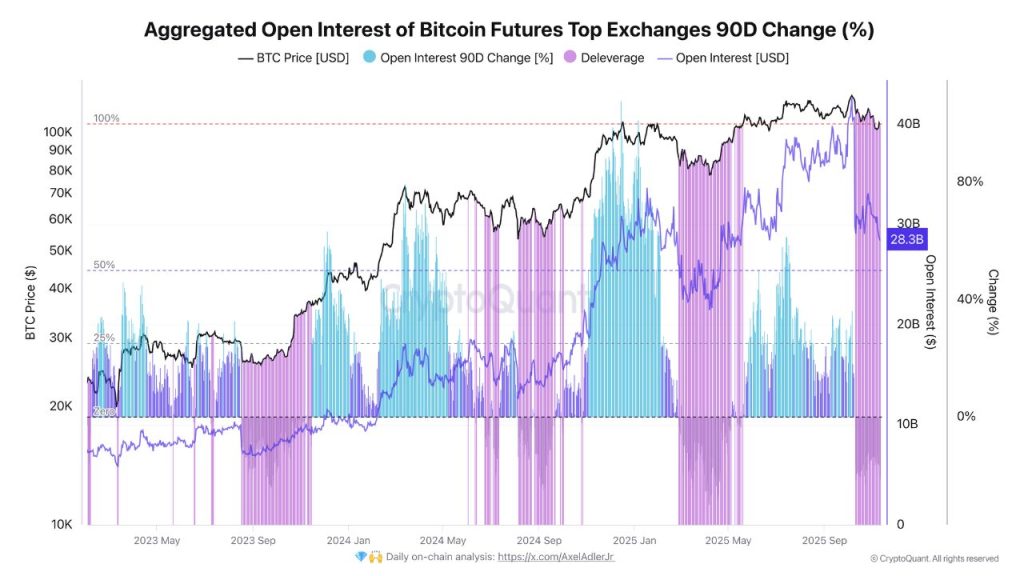

The derivatives market, which represents between 70% and 80% of the total trading volume, has entered a phase of deleveraging since the liquidation event of October 10.

Open interest is down 21% over the past three months, with leverage gradually cooling as liquidations continue to remove excess risk.

During the previous corrections in September 2024 and April 2025, open interest decreased by approximately 24% and 29% respectively.

Current levels are approaching similar patterns that, in bullish market phases, often precede trend reversals helping to clear the market and allow it to rebuild on healthier foundations.

Despite the bearish technical picture, spot demand showed signs of recovery after contracting on October 8.

As speculated on the key opinion leaders, three factors contributed to the change in sentiment:

However, some market observers note that prediction markets, DeFi innovations and institutional adoption continue to advance behind the scenes, potentially establishing stronger fundamentals for 2026, regardless of near-term price action.