Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Caldera functions as the central deployment hub for a diverse and interoperable ecosystem of rollups. With Caldera’s Rollup Engine, developers can launch rollups using popular tech stacks like OP Stack, Arbitrum Nitro, or ZK Stack. As of August 2025, Caldera powers over 100 chains, has cleared over 1 billion transactions, and holds $500 million in TVL across all chains. More than 28 million addresses interact with Caldera chains. Caldera was used to deploy some of the industry’s most active rollups, including Manta Pacific, ApeChain, B3, Kinto, and Bluwhale’s Oceanum, which host applications like DeFi, AI, and Gaming. The protocol has attracted support from Founders Fund, Dragonfly, and Sequoia Capital, complemented by crypto-focused funds such as Ethereal Ventures (established by Ethereum co-founder Joseph Lubin) and the Web3 accelerator Alliance DAO.

With this foundation, Caldera enables powerful appchains through rollups, custom environments tailored to application-specific needs. For example, B3’s gaming rollup offers gasless transactions, so users can join and play without funding a wallet. T3rn, a cross-chain interoperability platform, uses a custom Arbitrum L3 to optimize bidding and attestation. Space and Time, a ZK-powered data warehouse, allows for indexed verifiable data to the zkSync Elastic Chain Caldera’s Rollup Engine makes these tailored appchains possible, supporting ecosystems from fast-paced gaming to strict compliance.

After helping teams launch over 100 rollups since April 2023, Caldera is now tackling a deeper problem: blockchain fragmentation.

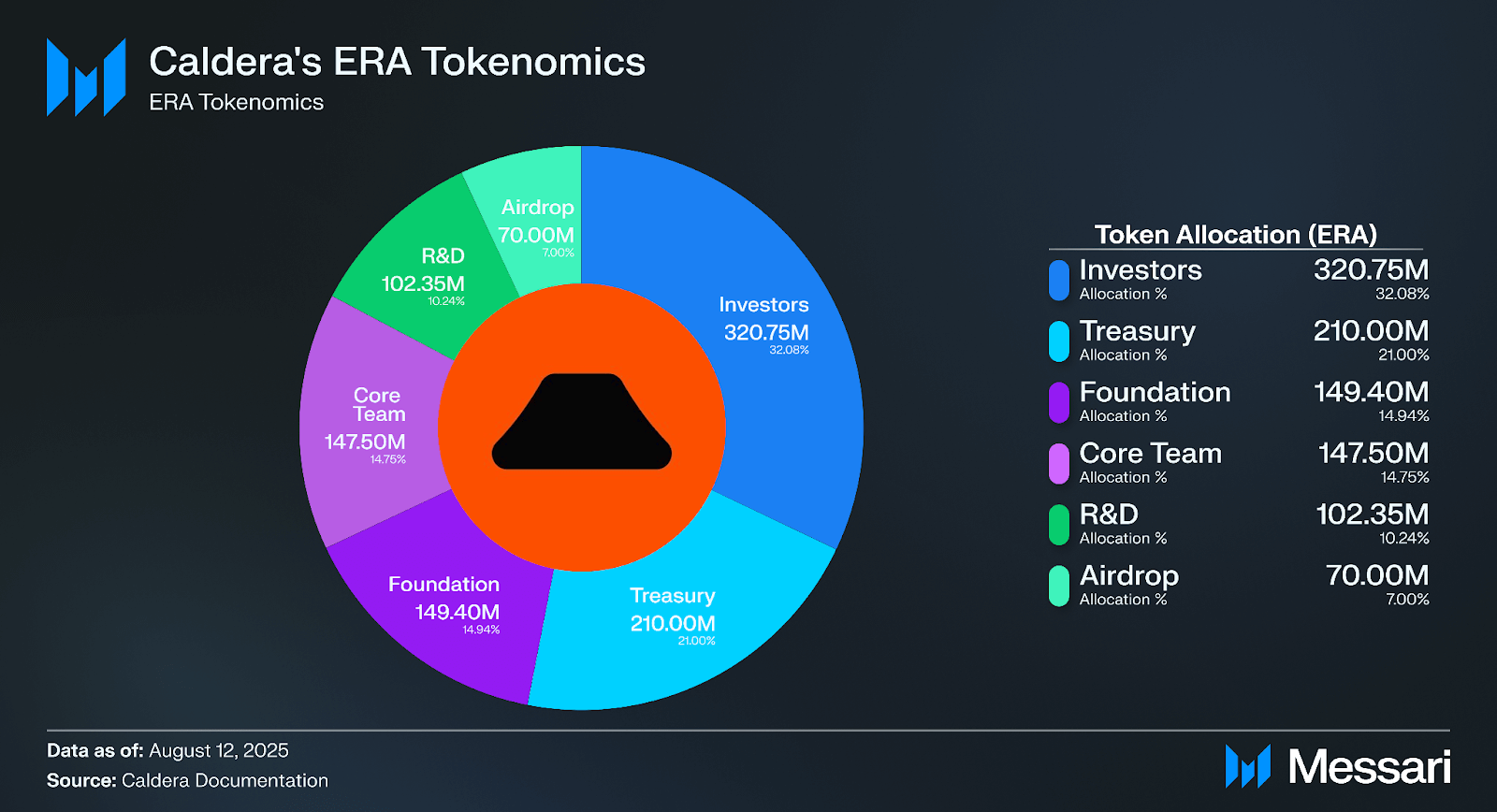

The ERA token is Caldera’s native asset and underpins the Metalayer’s validator, liquidity, and governance systems. The total supply is fixed at 1 billion tokens, allocated to balance long-term protocol development with immediate ecosystem needs. The distribution framework is designed to reward contributors who build, secure, and actively use Caldera’s “Internet of Chains” while minimizing short-term sell pressure.

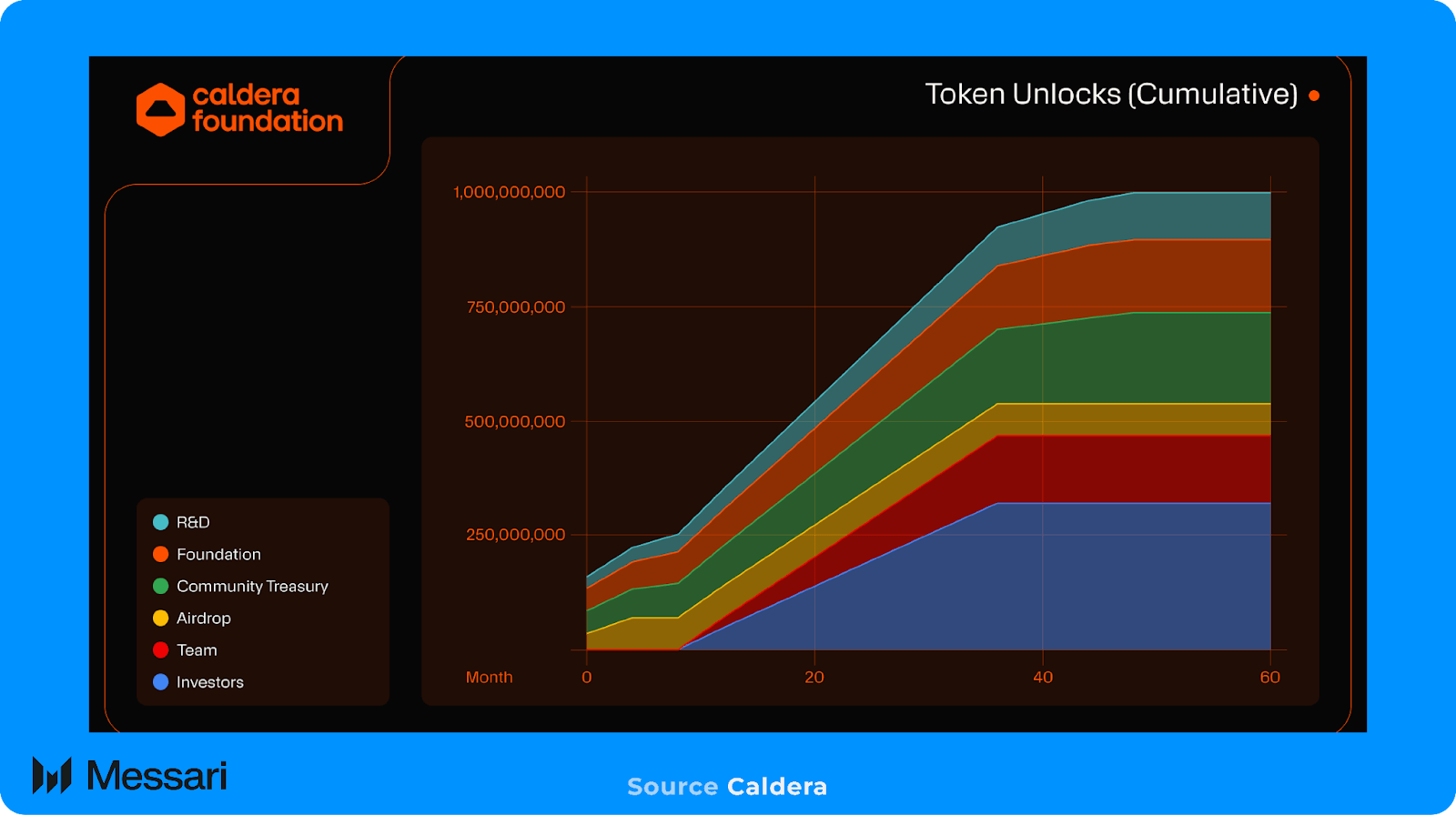

Initial unlocked tokens in the Foundation and Community Treasury allocations are being used to support the TGE via exchange programs and liquidity provider loans. The staged release schedule ensures that major stakeholder groups remain aligned over multi-year horizons while reserving immediate liquidity for network bootstrapping and price stability.

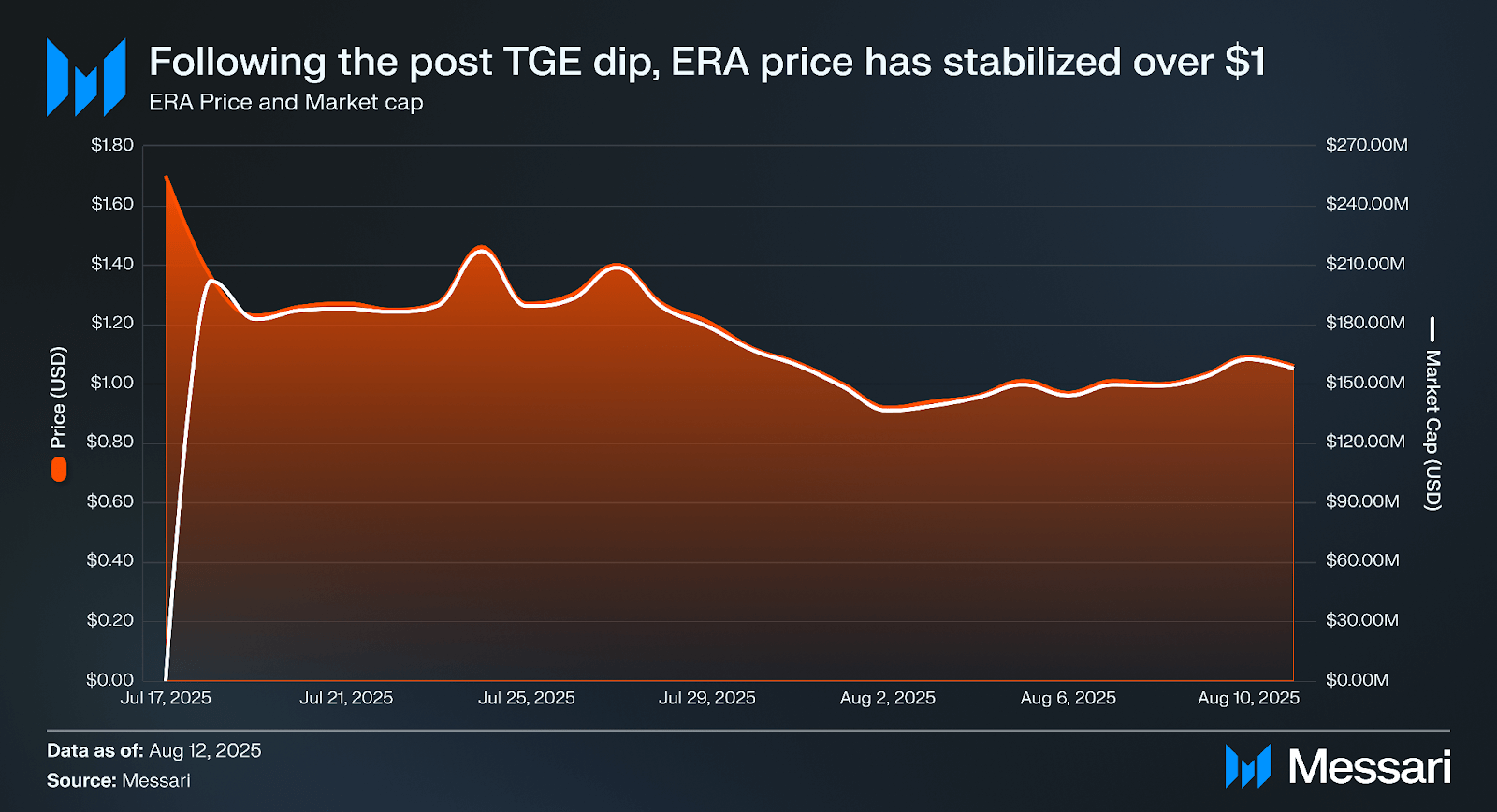

ERA launched on July 17, 2025, at a price of $1.70. As expected, ERA’s price was volatile post-TGE as liquidity deepened and the token went through price discovery. Over the first week post-TGE, price and market cap fluctuated, reaching a short-term high of $1.46 and $216.8 million on July 24.

Following this peak, ERA entered a gradual downtrend, bottoming at $0.92 on August 2 with a market cap of $136.4 million. This was followed by a modest recovery, with prices rebounding to $1.09 and the market cap reaching $162.3 million on August 10, showing stability and a strong foundation over $1.00.

The launch phase was characterized by typical post-TGE volatility as the market absorbed initial liquidity incentives, exchange programs, and early airdrops. Price action suggests the token is finding an equilibrium range while maintaining a fully diluted valuation in line with comparable infrastructure protocols in the Ethereum scaling sector.

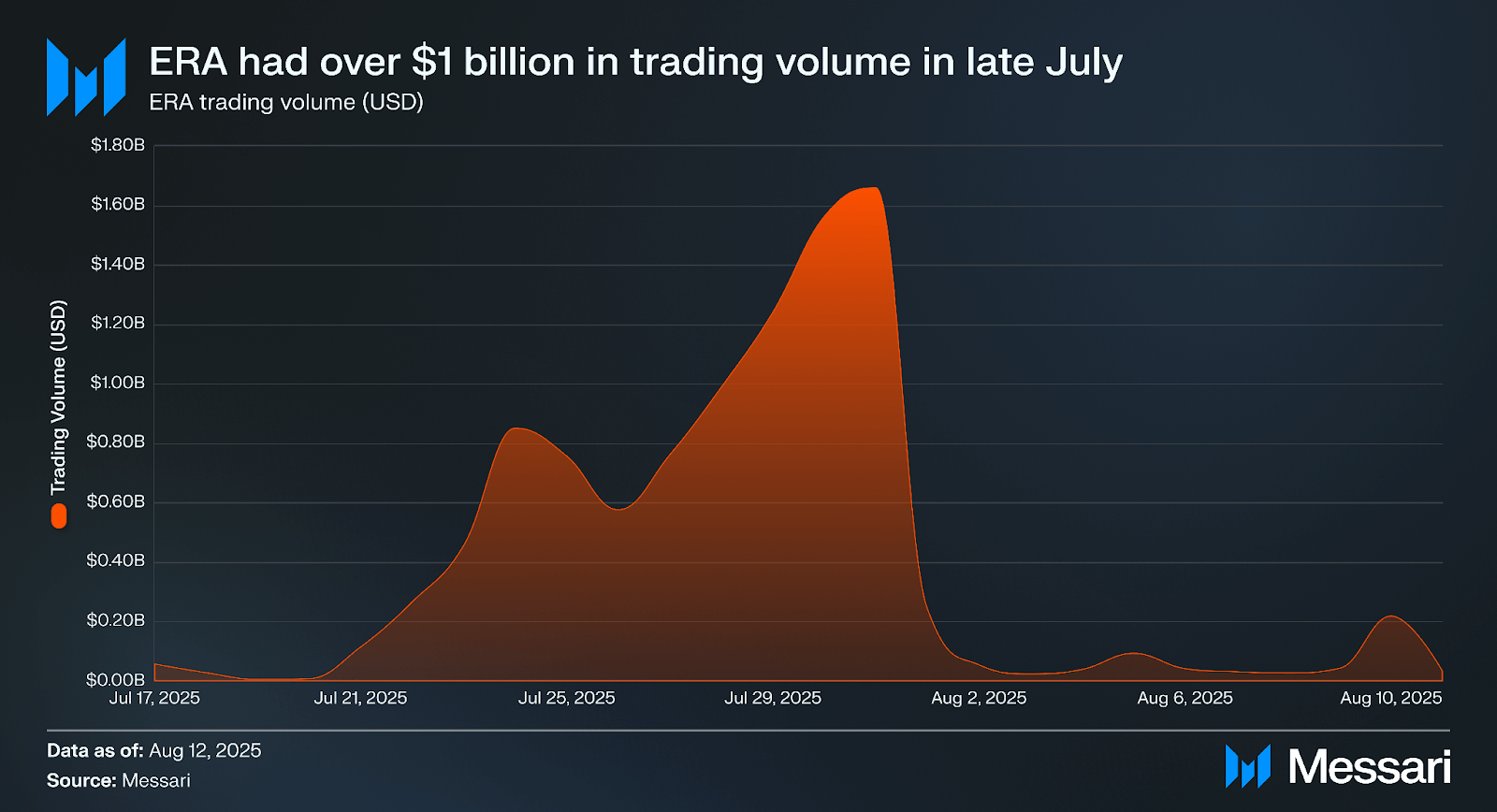

ERA’s trading volume has been quite variable since launch, reflecting both initial liquidity events and subsequent market normalization. ERA had $59.1 million in volume at its debut on July 17, 2025, followed by a decline to $7.2 million by July 19 as early speculative flows subsided.

A significant surge then began on July 21, driven by increased exchange listings and liquidity provisioning. Total daily volume rose from $116.2 million to a peak of more than $1.66 billion on July 31. This period coincided with the release of additional liquidity from the Foundation and Community Treasury allocations to support market depth.

Following this peak, volumes dropped sharply, falling below $100 million in early August, with intermittent spikes, notably $220.2 million on August 10, likely tied to short-term speculative rotations and bridge-related activity.

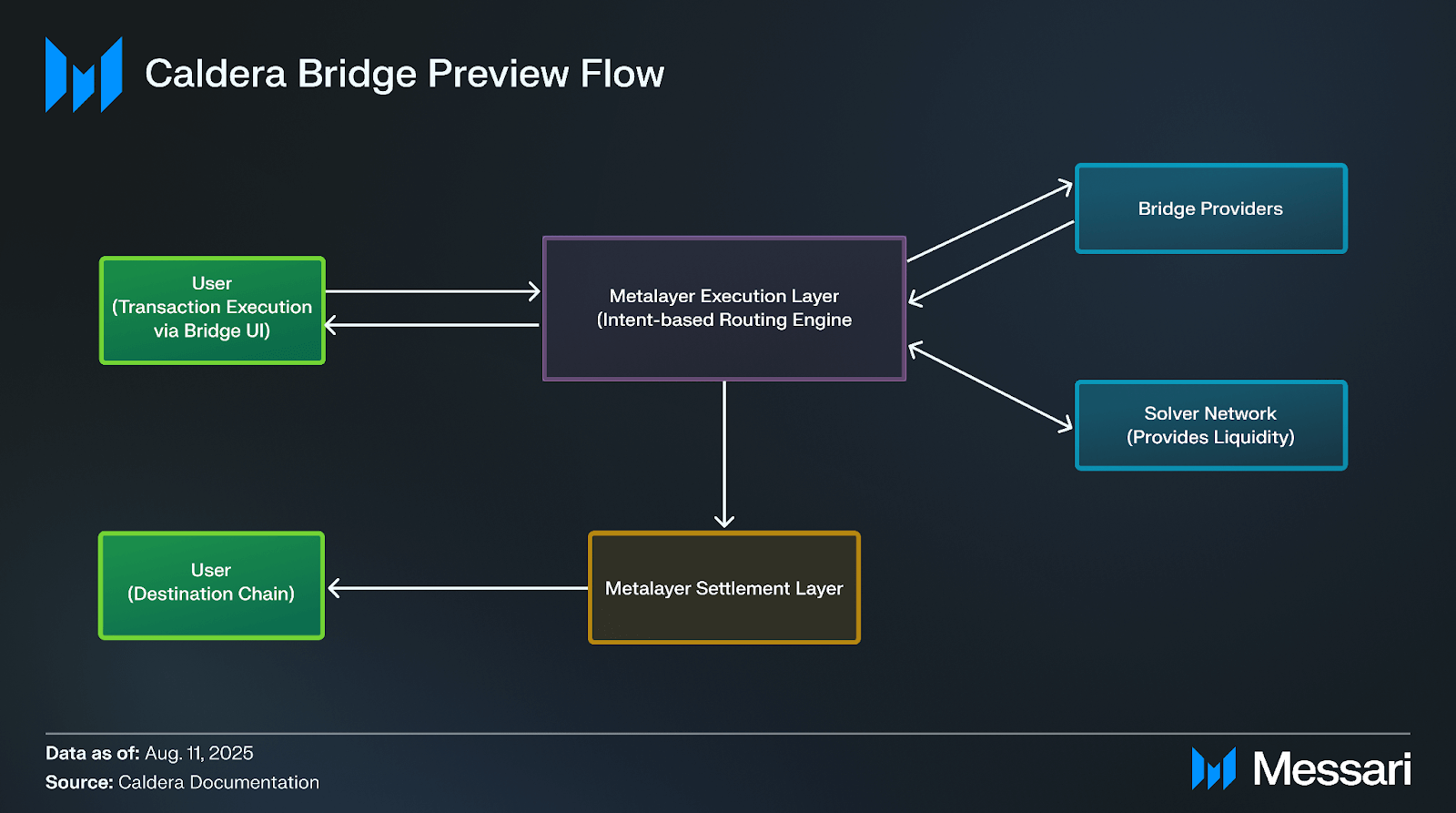

The Caldera Bridge Preview is the first consumer-facing product built on the Metalayer, Caldera’s interoperability protocol. It functions as a bridge aggregator that sources real-time quotes from multiple bridge providers, selecting optimal routes based on cost, latency, and available liquidity. This architecture addresses the limitations of canonical rollup bridges, which often impose multi-day withdrawal delays, and avoids the fragmented experience of using multiple third-party interfaces.

The bridge operates on top of the Metalayer’s intent-based execution layer. Users submit a transfer goal (e.g., “send 500 USDC from B3 to Manta Pacific”), and the routing engine queries integrated partners, including Eco for stablecoin-specific routes, to identify the fastest and cheapest settlement path. A solver network competes to fulfill the request, typically providing near-instant destination chain liquidity and later reconciling balances through the Metalayer’s settlement layer. Security is enforced by ERA-staked validators operating within the Metalayer’s Interchain Security Modules, which verify the authenticity of cross-chain messages before settlement.

Liquidity is unified across all Caldera-connected chains and integrated bridges, allowing transfers from a single interface without the need to manage multiple wrapped assets or token standards. Initial support covers Ethereum, Caldera L2/L3 rollups, BSC, and major L2s like Base, with planned expansion to additional EVM-compatible and non-EVM networks. The phased rollout prioritizes active bridge users for early access to test performance and usability before general availability.

The Caldera Bridge operates as an execution-layer application on top of the Metalayer:

This design ensures that every rollup launched through the Caldera Rollup Engine has immediate access to the bridge aggregator without additional integration work. Applications can therefore offer fast and secure cross-chain transfers from day one.

Caldera continues to expand its ecosystem through partnerships that extend its modular rollup and interoperability stack into new verticals. Recent collaborations highlight how the Rollup Engine and Metalayer provide infrastructure for decentralized compute, immersive media streaming, and gaming-focused ecosystems. Together, these integrations demonstrate Caldera’s role as a foundation for high-throughput, application-specific rollups that interoperate by default.

NodeOps Network, a decentralized physical infrastructure (DePIN) layer for on-demand compute, partnered with Caldera to deploy its blockchain infrastructure and integrate directly into the Metalayer. Built as an Arbitrum Orbit L3 with Caldera’s Rollup Engine, the NodeOps Orchestrator Network operates as an adaptive compute marketplace connecting buyers and providers across chains.

The partnership spans two dimensions of Caldera’s modular stack:

For developers, this reduces the complexity of accessing decentralized compute and embeds interoperability guarantees at the protocol layer. NodeOps becomes a critical DePIN component within Caldera’s modular ecosystem, combining compute, liquidity, and composability under one framework.

In August 2025, Caldera partnered with Mawari, a DePIN network for real-time 3D and extended reality (XR) streaming. Mawari leverages a globally distributed GPU network to provide rendering, storage, and bandwidth services for spatial computing. Its patented streaming protocol reduces bandwidth usage by 80% while maintaining low-latency, interactive performance for AI-powered AR/VR experiences.

By deploying on a Caldera rollup and connecting to the Metalayer, Mawari anchors quality-of-service (QoS) metrics, including latency, jitter, and dropped frames, directly onchain. Guardian nodes submit signed attestations that are batched and settled via Caldera, creating an auditable system for reputation and rewards tied to service quality.

Mawari’s technology has already seen adoption in Japan’s VTuber industry, with deployments by Brave group and Virtual Avex, both of which showcased vTubeXR at Expo 2025 Osaka. By combining distributed GPU rendering with blockchain-based QoS guarantees, Mawari delivers scalable XR content to consumer devices without requiring local high-end hardware.

For Caldera, the integration extends its ecosystem into immersive compute, demonstrating how DePIN infrastructure can interoperate with financial, gaming, and application-specific chains through the Metalayer.

XPLA, a Web3 gaming-focused L1, has partnered with Caldera to launch zkXPLA, a sovereign L2 ecosystem built with zkSync’s zkStack. zkXPLA provides developers with application-specific rollups that inherit Ethereum’s security and interoperate through shared bridging, supported by Caldera’s Rollup Engine and Metalayer.

The rollup ecosystem positions zkXPLA as a high-performance environment for dApps, DeFi, and gaming. Developers benefit from zkStack’s modular sovereignty along with Caldera’s infrastructure integrations, including performant RPCs, block explorers, indexers, and bridge interfaces. This reduces deployment costs while maintaining scalability and flexibility.

XPLA’s transition from a Tendermint-based L1 to a zkStack-powered L2 reflects a strategic pivot toward modular architecture. Its existing ecosystem, anchored by over 20 titles such as Summoners War: Chronicles and The Walking Dead: All-Stars, gains access to Ethereum liquidity and interoperability through the Metalayer. By joining a network that includes Kinto, Manta Pacific, and ApeChain, zkXPLA strengthens its role in gaming while aligning with Ethereum’s broader rollup-centric future.

Caldera has partnered with EigenCloud to integrate EigenDA V2 into its Rollup Engine, introducing a high-performance data availability (DA) layer capable of sustaining throughput of up to 100 MB/s. The integration directly addresses one of the primary bottlenecks for rollups: efficiently posting transaction data to ensure verifiability. While Ethereum L1 remains the canonical DA layer for security, its limited bandwidth and high costs constrain rollup scalability. EigenDA offers a complementary solution designed to lower costs and enable higher transaction capacity without requiring independent consensus.

EigenDA leverages Ethereum’s decentralized trust model by securing its network through ETH restaking. This architecture provides economic security while eliminating the overhead of a separate validator set. Several features distinguish EigenDA in the DA landscape:

Through the partnership, EigenDA V2 becomes a one-click integration option within the Caldera dashboard. New rollups can activate EigenDA at launch, while existing Caldera chains have the option to migrate for improved performance. This reduces the integration overhead typically required for advanced DA solutions, broadening access to scalable infrastructure for teams building on Caldera.

Caldera’s trajectory in Q2 and Q3 2025 highlights the maturation of its modular rollup ecosystem. The launch of the ERA token introduced a validator and liquidity-aligned asset model that secures the Metalayer while incentivizing ecosystem growth. Early trading reflected typical TGE volatility, but liquidity programs and treasury releases helped stabilize market performance above $1.00 with active participation across exchanges.

On the product side, the Caldera Bridge Preview brought the Metalayer’s interoperability into a user-facing application for the first time. By aggregating routes across bridge providers and securing transfers through ERA-staked validators, the bridge removes a longstanding barrier for new rollups by providing instant liquidity access without custom integrations.

Ecosystem expansion continued with NodeOps, Mawari, XPLA, and EigenCloud each deploying on Caldera to extend its reach into decentralized compute, immersive media streaming, and gaming. These partnerships illustrate the adaptability of Caldera’s modular stack: enabling compute marketplaces, anchoring real-time quality-of-service attestations onchain, and transitioning gaming ecosystems from L1 to sovereign zk-rollups.

Taken together, these developments reinforce Caldera’s position as a foundational infrastructure layer for Ethereum scaling. With the Rollup Engine powering deployment, the Metalayer standardizing interoperability, and ERA securing both, Caldera is evolving into a cohesive “Internet of Chains” that spans financial, compute, and content networks alike.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Caldera All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.