Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

CleanCore Solutions’ aggressive push into Dogecoin as an official treasury asset has sparked a market backlash, with the company’s shares collapsing nearly 78% in the past month, as investors weigh deep quarterly losses and a sharp drop in DOGE’s price.

The stock, which trades under the ticker ZONE on the NYSE American, fell to a record low of $0.3818 this week and ended Thursday’s session down almost 12%.

The decline continued on Friday, deepening concerns about its crypto-heavy balance sheet.

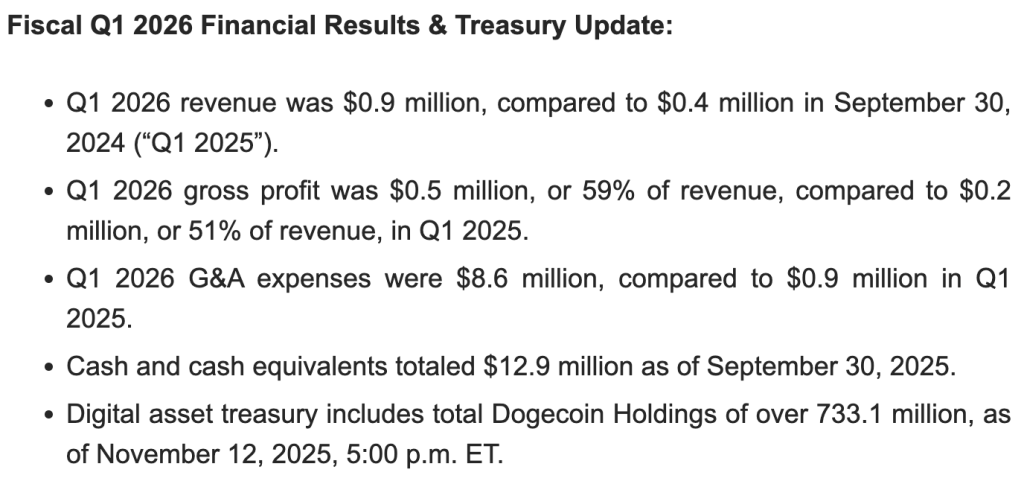

The dive comes just days after CleanCore reported its fiscal first quarter results for the period ending September 30, which revealed a growing net loss of $13.4 million, compared to $0.9 million during the same period last year.

While revenue doubled over the year to $0.9 million, and gross profit improved to $0.5 million, the company’s expenses increased.

General and administrative expenses increased to $8.6 million from $0.9 million, driven by professional fees, stock-based compensation, new salaries and insurance costs related to its Dogecoin treasury rollout.

The company has placed Dogecoin at the center of its financial strategy.

CleanCore closed a $175 million private placement to build its “official” Dogecoin Treasury, in partnership with House of Doge, using Bitstamp from Robinhood as its trading venue.

The company accumulated more than 733 million DOGE, worth about $117.5 million as of November 12.

He reiterated his long-term goal of acquiring 5% of the circulating supply of Dogecoin to expand the real utility of the token.

CEO Clayton Adams said the firm is looking to position Dogecoin as a “trust reserve asset” and remains committed despite recent market volatility.

“Our financial results during the quarter reflected several one-time expenses related to our treasury strategy transaction, while our core business experienced growth and cash flow on a stand-alone basis,” Adams said.

But the timing was ruthless. The price of Dogecoin has fallen more than 21% in the past month, slipping below $0.17 as it tests a long-term support level that will hold until the end of 2023.

Analysts warn that DOGE is showing a severe technical breakdown, with momentum turning bearish and key indicators weakening.

DOGE is currently trading near $0.163, down nearly 7% in the last 24 hours.

A break below the multi-year support trendline could trigger a broader decline, potentially marking the end of the cycle that began in late 2023.

CleanCore’s largest DOGE purchase was at an average price above current levels.

Its first major acquisition on September 5 totaled 285.4 million DOGE at about $0.238 per token, followed by additional acquisitions that boosted its treasury. over 700 million DOGE since mid-October.

The company briefly reported more than $20 million in unrealized gains earlier in the quarter, but those evaporated in the recession.

The Dogecoin bet attracted more than 80 institutional investors, including Pantera, GSR, FalconX and Borderless Capital.

CleanCore’s treasury plan also aligns with a broader wave of corporate involvement in Dogecoin-related initiatives.

Among those developments, DogeHash Technologies is expanding its mining footprint after securing a $2.5 million loan from Thumzup Media to deploy more than 500 new ASIC miners, bringing its fleet to more than 4,000 machines by the end of the year.

While these broader ecosystem moves have shown strong momentum, CleanCore’s stock hasn’t benefited.

Although up more than 60% year to date, ZONE is now trading well below the reported net asset value of its Dogecoin treasury.