Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The multibillion-dollar “pig slaughter” scam industry, once treated as a consumer fraud problem, is now being described as a growing national security concern, according to a new discussion with Chainalysis and anti-fraud investigators.

In a recent podcast, Andrew Fierman, head of national security intelligence at Chainalysis, and former prosecutor Erin West, founder of Operation Shamrock, detailed how pig slaughter has evolved into a transnational crime pattern that combines human trafficking, money laundering and crypto-driven fraud.

Both experts warned that the scale of these schemes and the criminal networks behind them has expanded far beyond traditional scam activity.

West said the threat now touches every corner of the financial system. “If someone touches the money in any way, you are part of it,” he said, stressing that the problem requires deeper awareness from banks, exchanges and regulators.

Pig Slaughter Scams they rely on long-term social engineering. Criminals build trust with victims, often through dating apps, social media, or unsolicited messages, before leading them to fake cryptocurrency investment platforms.

The goal is to “fat” victims with false profits before draining their accounts entirely.

Fierman and West described how criminal gangs in Southeast Asia run dormitory-style compounds where trafficked workers are forced to operate these schemes.

The victims abroad lose their life savings, while the victims in the compounds are held against their will and coerced into participating.

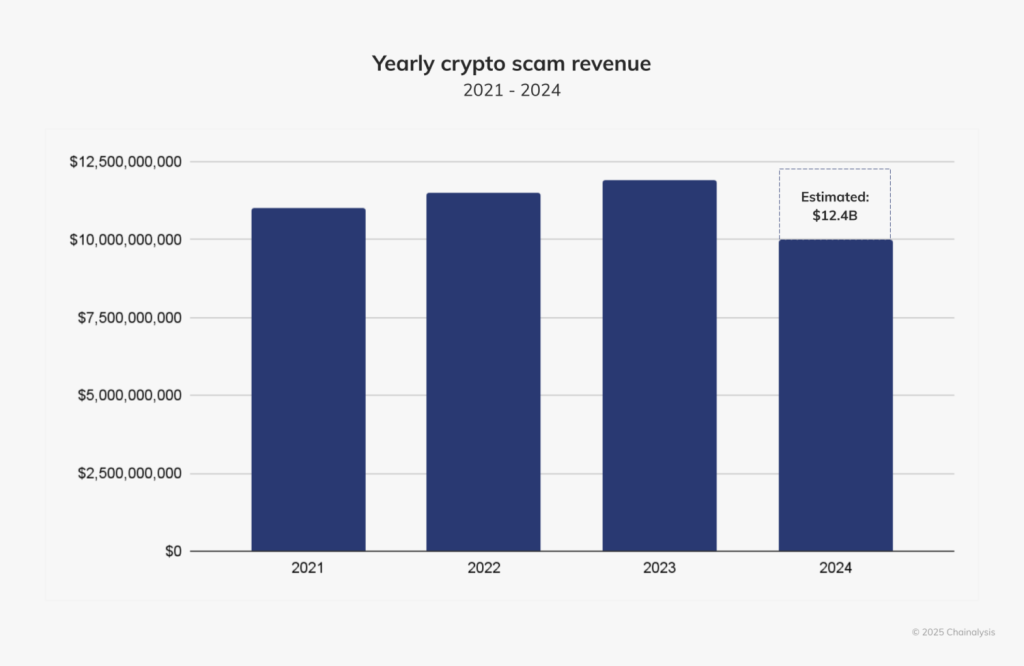

Chainalysis data shows that pig slaughtering activity has grown by nearly 40% in 2024, contributing to more than $9.9 billion in overall crypto scam revenue that year.

The United States Department of Justice collected about $225 million related to these scams in 2023one of many early indicators of how big the ecosystem has become.

Experts also pointed out a secondary layer of exploitation that often goes unreported.

After victims are defrauded, they are often contacted again by fake recovery companies posing as law enforcement or private investigators.

“Once that happens to you, you’re going to be put on a list,” West said. “You’re also more likely to get hit again.”

The increase in pig slaughter scams is developing with a series of major international enforcement actions.

In October, US authorities announce largest-ever crypto seizure linked to global online fraudtargeting Cambodia-based Prince Holding Group and its chairman, Chen Zhi.

At the same time, the Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned 146 people and entities connected to the groupdescribing it as a transnational criminal enterprise engaged in fraud, extortion and forced labour.

The involvement of the private sector has expanded with these government efforts. In August, Tether froze nearly $50 million in USDT linked to a pig slaughter ring based in Southeast Asia after investigators traced funds to 19 addresses.

the same month, Binance has joined the T3+ intelligence initiativeled by TRON, Tether, and TRM Labs, helping to freeze nearly $6 million related to another scam case.

The exchange said its internal systems prevented 7.5 million users from losing nearly $10 billion to fraud between December 2022 and May 2025.

Coinbase has participated in similar efforts. In June, the exchange assisted the US Secret Service in recovering $225 million in USDTone of the largest crypto agencies.

Investigators traced the funds to 140 OKX accounts, many registered under trafficked victims forced to carry out scam operations.

The scale of losses continues to rise. The latest FBI Internet crime report shows Americans lost more than $9 billion to online investment fraud last year.

TRM Labs estimates that more than $53 billion in crypto-related fraud has been tracked worldwide by 2023—probably only a fraction of actual losses.