Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

U.S.-traded Bitcoin ETFs saw a total net outflow of $869.86 million on Thursday, registering the second largest since launch.

In order SoSoValue dataGrayscale Mini Trust (BTC) recorded the largest outflow of $318.2 million, followed by BlackRock (IBIT), which saw $256.6 million of blood. Meanwhile, Fidelity (FBTC) and Bitwise (BITB) had $119.93 million and $47.03 million in net inflows, respectively.

Over the past three weeks, investors have pulled out about $2.64 billion, signaling caution across the industry due to impending regulatory developments, market corrections and macroeconomic events.

Thursday’s flow coincides with Bitcoin slipping below the $100K mark for the first time in 188 days.

The total amount of liquidations in the cryptocurrency market reached $ 316 million in leveraged long positions, According to data Coinglass. This prompted many traders to exit their positions.

Liquidations in crypto are mainly linked to long positions which are leveraged bets that anticipate the price increase.

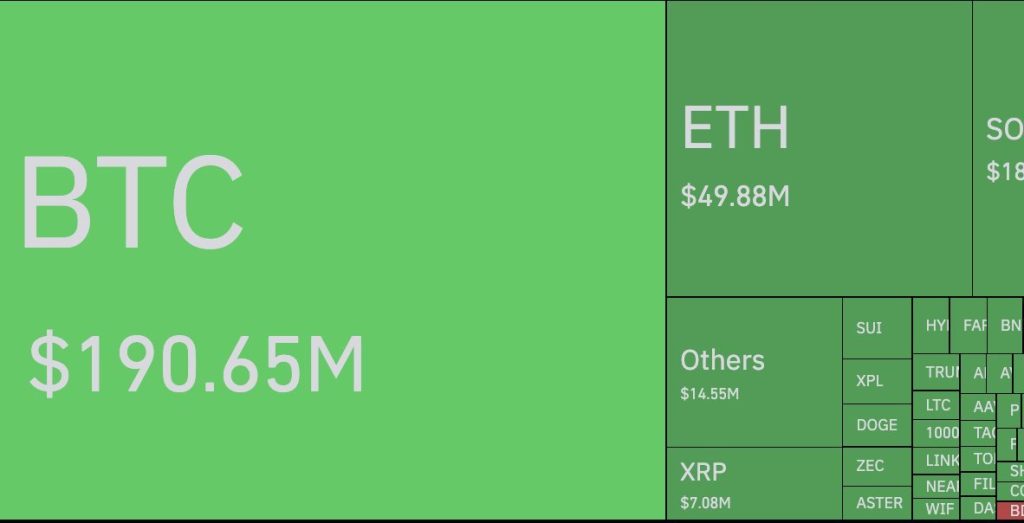

Data noted that Bitcoin liquidations amounted to $190.65 million in one hour, while Ethereum liquidations reached $49.88 million.

Meanwhile, Ether ETFs also recorded an inflow of $259.72 million, the highest since October 13.

On Friday, Bitcoin fell below $100K, hitting its lowest in more than six months. The largest crypto by total market value fell to $96,682.00 during the Asian hour, and is currently trading at $96.94K at press time.

BTC fell 6.2% in the last 24 hours, undercutting the broader crypto market’s 6.15% drop. BTC broke below the critical 23.6% Fibonacci retracement levels at $111,958.

Meanwhile, the Fear & Greed Index (22/100) suggests that sentiment remains fragile.

Investors noted that the slip below $100K “wiped out weeks of optimism.”

“Unless institutional buyers step back, we may be stuck moving sideways… or sliding further down,” wrote one user.

Tim Enneking, managing partner of Psalion, said that many factors contribute to the price of BTC. This includes continued skepticism in many quarters, the “bubble” feeling from all treasury companies, the expected end of the bull market in the current four-year cycle and concerns about a macroeconomic slowdown.

Enneking told Forbes that investors need to adjust to how much the value of digital assets has risen all these years.