Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Nervos Network (CKB) is a Bitcoin-adjacent Layer-1 designed to scale Bitcoin’s functionality. Its base layer, the Common Knowledge Base (Nervos CKB), uses Proof-of-Work but generalizes Bitcoin’s UTXO model with a custom Cell Model that supports arbitrary state and computation. Nervos CKB also includes CKB-VM, a virtual machine based on RISC-V that supports smart contracts and multiple programming languages, including C and Rust.

Nervos CKB launched in November 2019 and has since introduced RGB++, an asset issuance protocol that maps Bitcoin-based assets to Nervos CKB cells through isomorphic binding. These assets retain Bitcoin’s settlement guarantees while benefiting from Nervos CKB’s programmability.

To expand interoperability and programmability, Nervos introduced the RGB++ Layer in July 2024. It extends RGB++ to other UTXO-based networks and enables smart contracts for RGB++ assets. Nervos also launched Fiber Network in February 2025, a Lightning-compatible payment channel system designed for low-cost, multi-token transfers that remain interoperable with Bitcoin.

For a full primer on Nervos, refer to our Initiation of Coverage report.

Research Contents

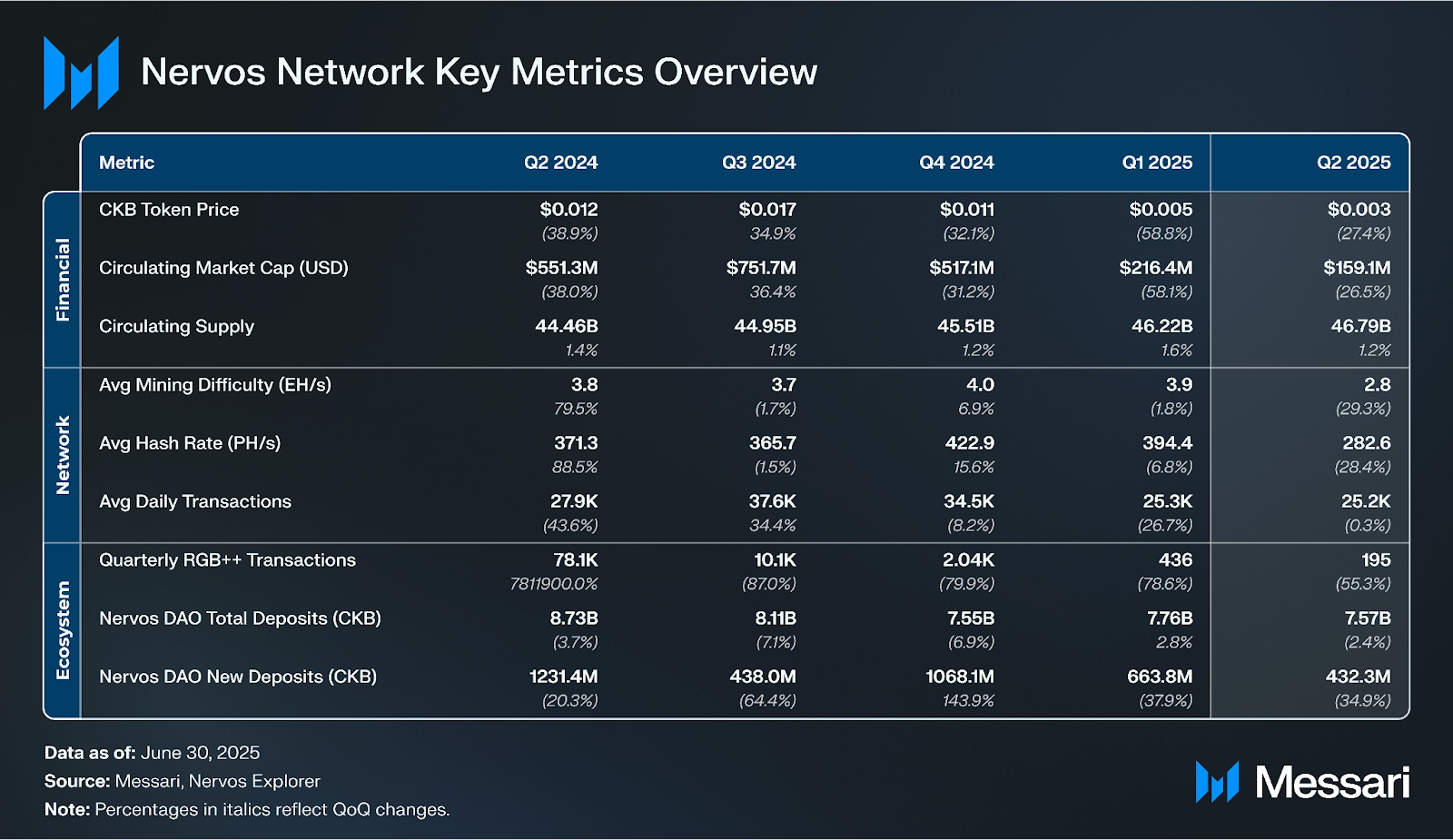

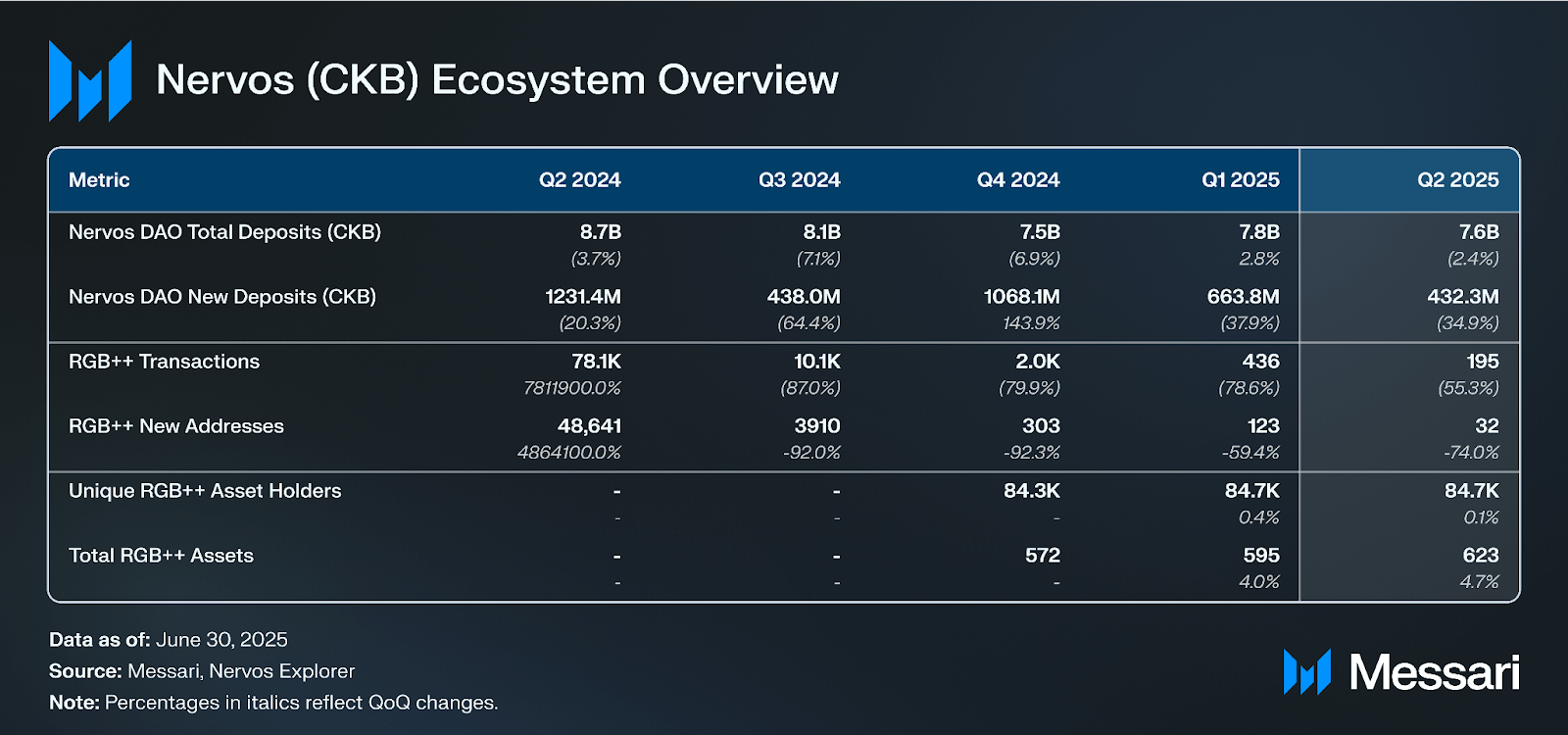

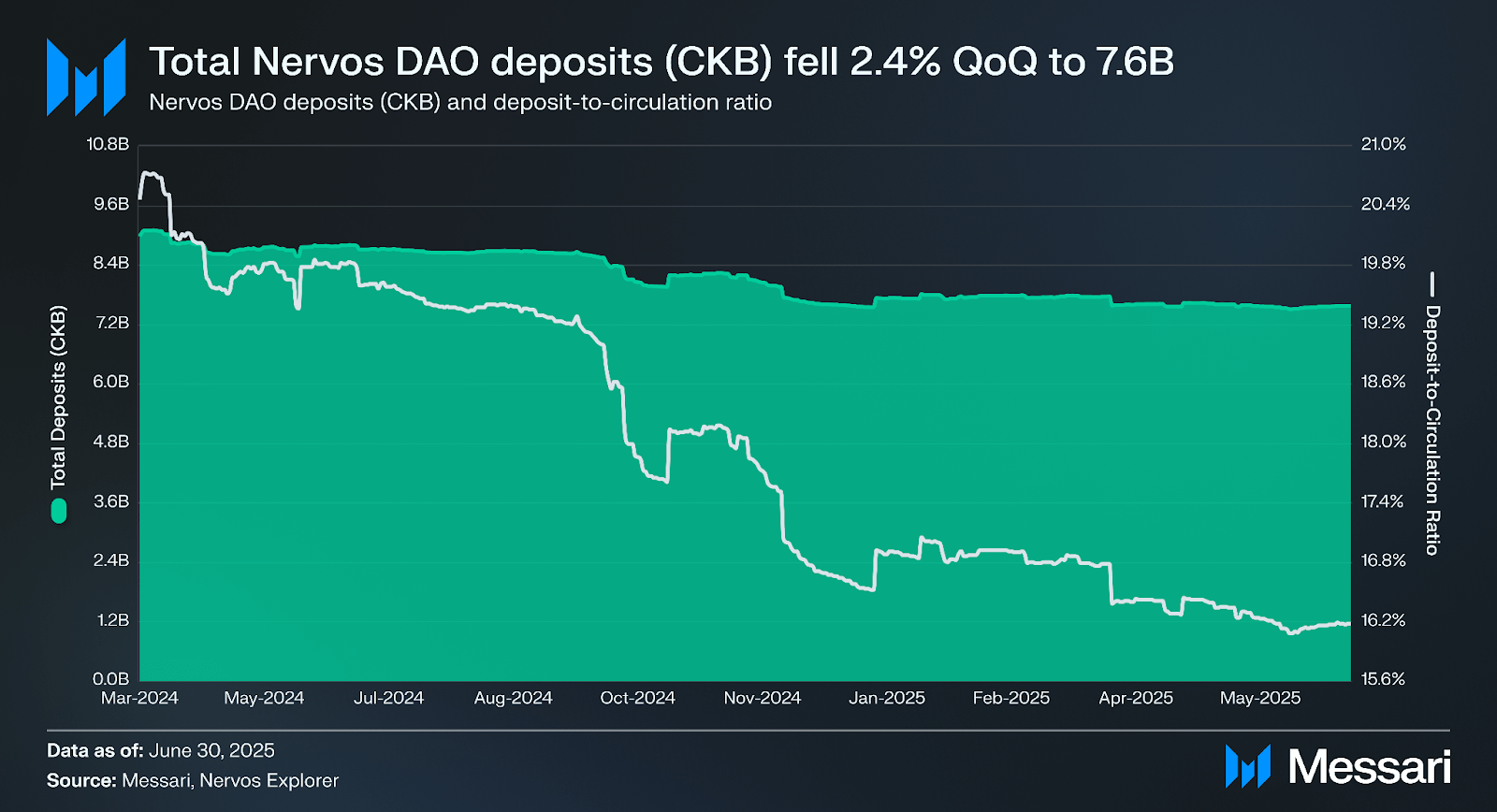

Total deposits in the Nervos DAO declined 2.4% QoQ to 7.6 billion CKB by the end of Q2 2025. The deposit-to-circulation ratio, which tracks the ratio between Nervos DAO deposits and CKB’s circulating supply, fell to 16.2% by the end of June.

Nervos DAO allows CKB holders to offset dilution from the network’s ongoing issuance. By locking tokens into the DAO smart contract, users earn rewards from secondary issuance at an APR that matches the annual secondary issuance rate. This rate gradually decreases as total supply grows. Deposits require a minimum of 102 CKB and can be made at any time, but withdrawals are only allowed at the end of each 30-day cycle.

NervDAO is a wallet interface that simplifies access to the Nervos DAO. It supports deposits and withdrawals through CKB-compatible wallets like Metamask, UTXO Global, and JoyID.

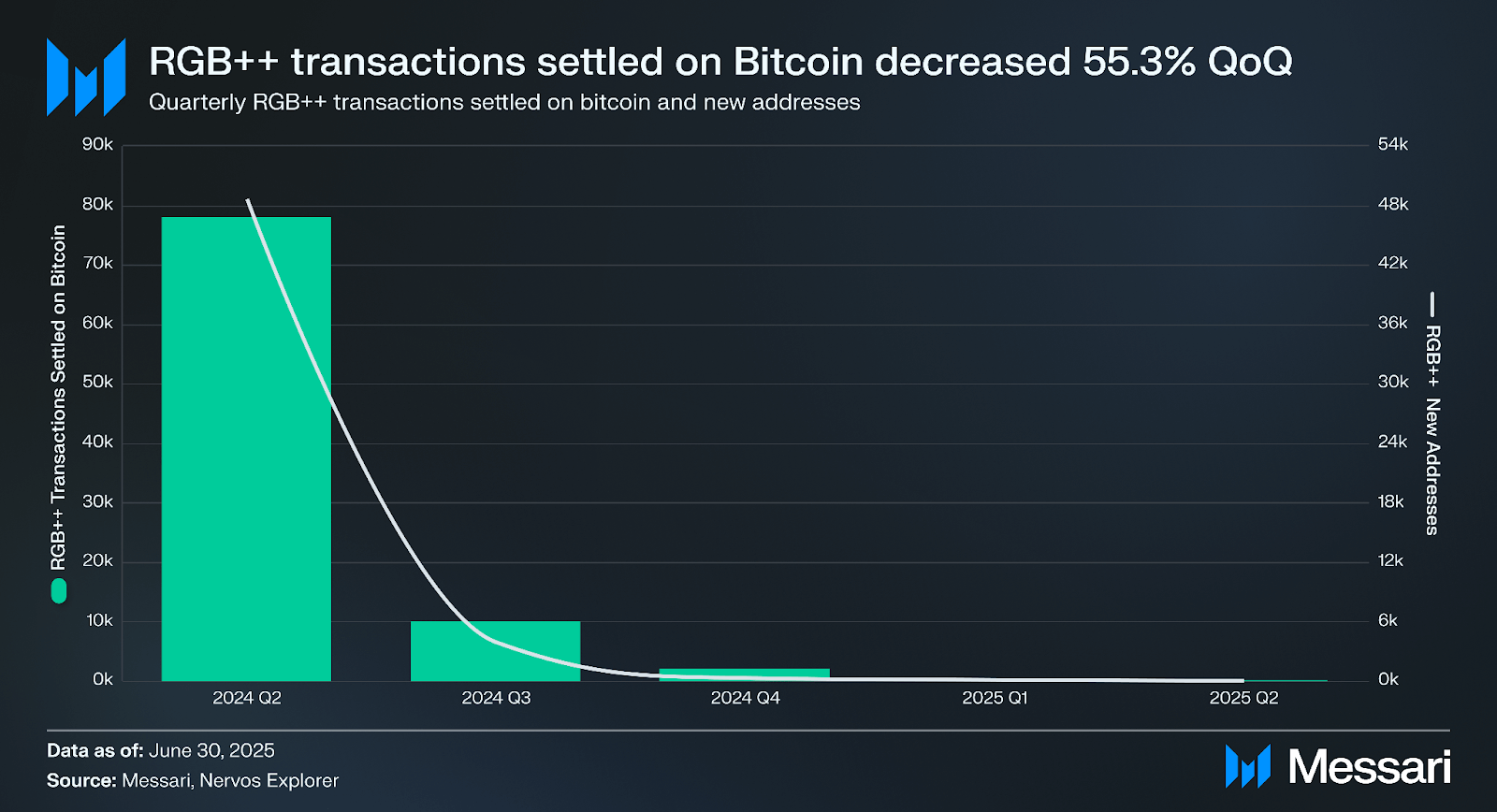

In Q2 2025, usage on RGB++ continued to decline. The total number of transactions fell 55.3% QoQ to 195. Also, total newly mapped Bitcoin addresses dropped 74% QoQ to 32. However, there was a slight uptick in new asset creation on RGB++, increasing 4.7% QoQ to 623.

RGB++ is a protocol built on Nervos that connects the Bitcoin and Nervos ecosystems by mapping Bitcoin’s transaction outputs (UTXOs) to Nervos’ cell-based storage. This enables more advanced management of digital assets, smart contracts, and applications, which make it possible to securely issue and manage complex assets on Bitcoin-backed blockchains.

One of the most pivotal developments this quarter was the decision to sunset Nervos’s Layer-2 and bridge solutions, Godwoken and Force Bridge. Godwoken was an EVM-compatible optimistic rollup on Nervos CKB, and Force Bridge was a crosschain bridge connecting Nervos with Ethereum and other networks. On June 1, 2025, the Nervos team announced the official wind-down of Godwoken and Force Bridge on a phased schedule. The stated rationale was to free up resources and focus on UTXO-native innovations (like Web5 and the Bitcoin-friendly Fiber Network), effectively making way for “the next era” of the ecosystem.

Under the sunset plan, Godwoken’s L2 network stopped accepting new activity from June and entered an “exit only” mode. Users were given an exit window from June 1 through Oct. 31, 2025 to withdraw any assets from Godwoken back to Nervos CKB using the Godwoken bridge interface. After October, Godwoken will be put into a frozen state (preserving data for auditability but no longer processing transactions).

Similarly, the Force Bridge (which locked assets on Nervos CKB in exchange for tokens on other networks) is being shut down with a longer grace period until Nov. 30, 2025 for users to bridge assets back out to source networks. Any funds remaining unclaimed after that will be handled manually by the bridge operators (Magickbase team), with final snapshots published and a process for retrieval (potentially subject to fees). On Dec. 1, 2025, the Force Bridge will be fully turned off.

The reason for this move was partly strategic and partly due to security/maintenance concerns. In May, just as the sunset was being announced, Nervos fell victim to a hack on the Force Bridge, losing roughly $3 million in bridged assets. Hackers stole 257k USDT, 539 ETH, 898k USDC, 60k DAI and other tokens, which they laundered via Tornado Cash. The breach prompted an immediate pause of Force Bridge operations.

In Q2 2025, Nervos deepened its alignment with the Bitcoin ecosystem by prioritizing Lightning Network integration. The Fiber Network, Nervos’s Lightning-compatible payment channel system, launched on mainnet in February and saw active development throughout the quarter. It introduced multi-hop routed payments, multi-asset channels, and Lightning-compatible invoices. Fiber also included security features like a watchtower service, with improvements such as PTLCs and channel rebalancing in progress. Wallet integration advanced through tests with JoyID, a smart-account wallet aiming to support Lightning-style payments. In parallel, Nervos’s collaboration with PolyCrypt to develop Perun state channels added another layer to its off-chain scaling stack.

Nervos hosted a dedicated “Bitcoin Stage” at the Hong Kong Web Festival in April, which showcased Lightning-based applications and featured projects like NVAP and Seal. The event included a demonstration of USDI, a Nervos CKB-native stablecoin with a fee-free bridge from USDT and USDC, which showed how assets can move between Bitcoin and Nervos seamlessly.

The Nervos Community Catalyst initiative officially launched in May 2025 as a structured effort to support community engagement and grassroots contributions. This quarterly report summarizes activities across its core tracks and outlines progress made in setting up the program, onboarding contributors, and piloting initial outputs. It also introduces the CKB Bounty Board as a complementary mechanism for incentivizing task-based participation. The focus during Q2 was on infrastructure setup, participant onboarding, and piloting contributions in preparation for deeper initiatives in Q3:

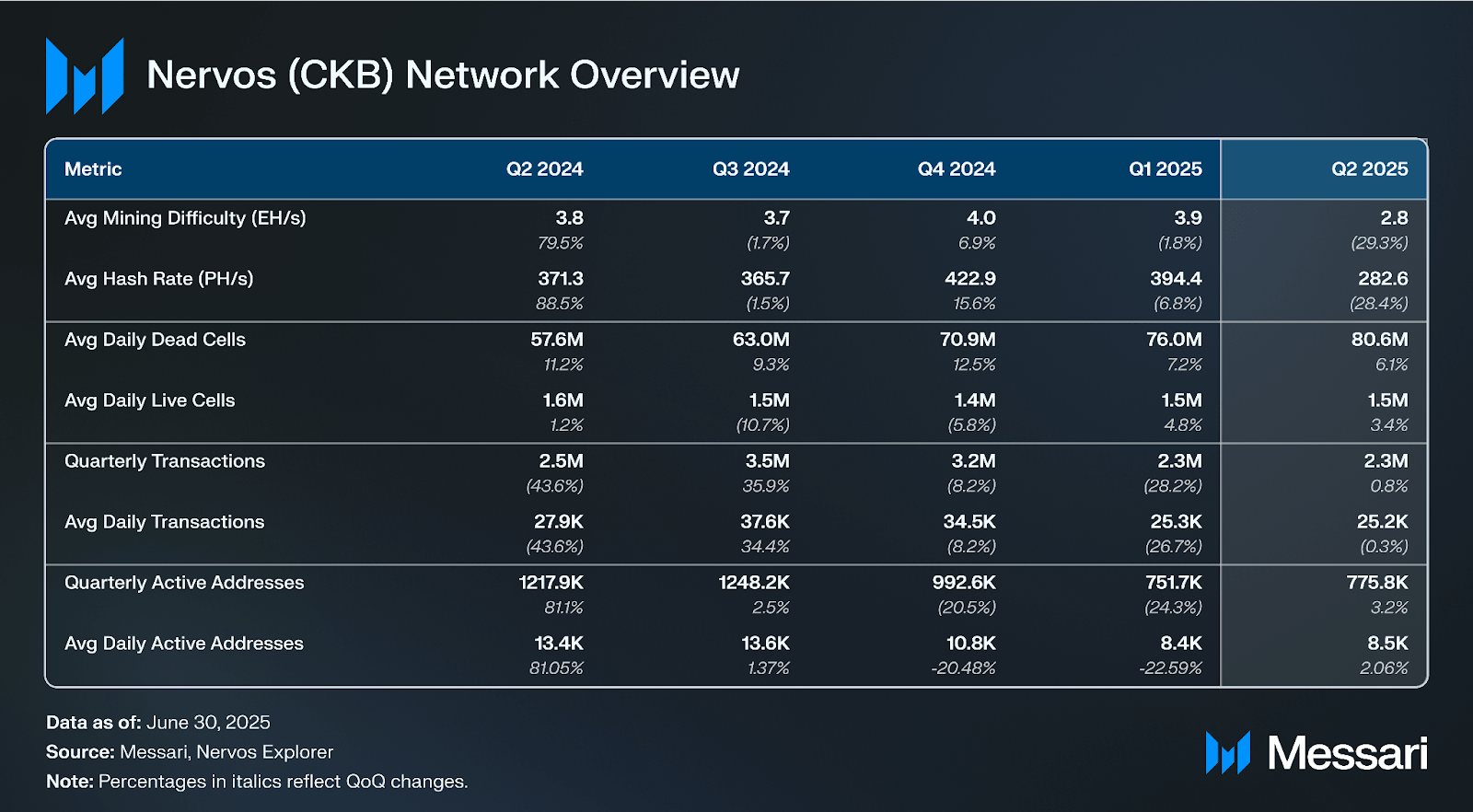

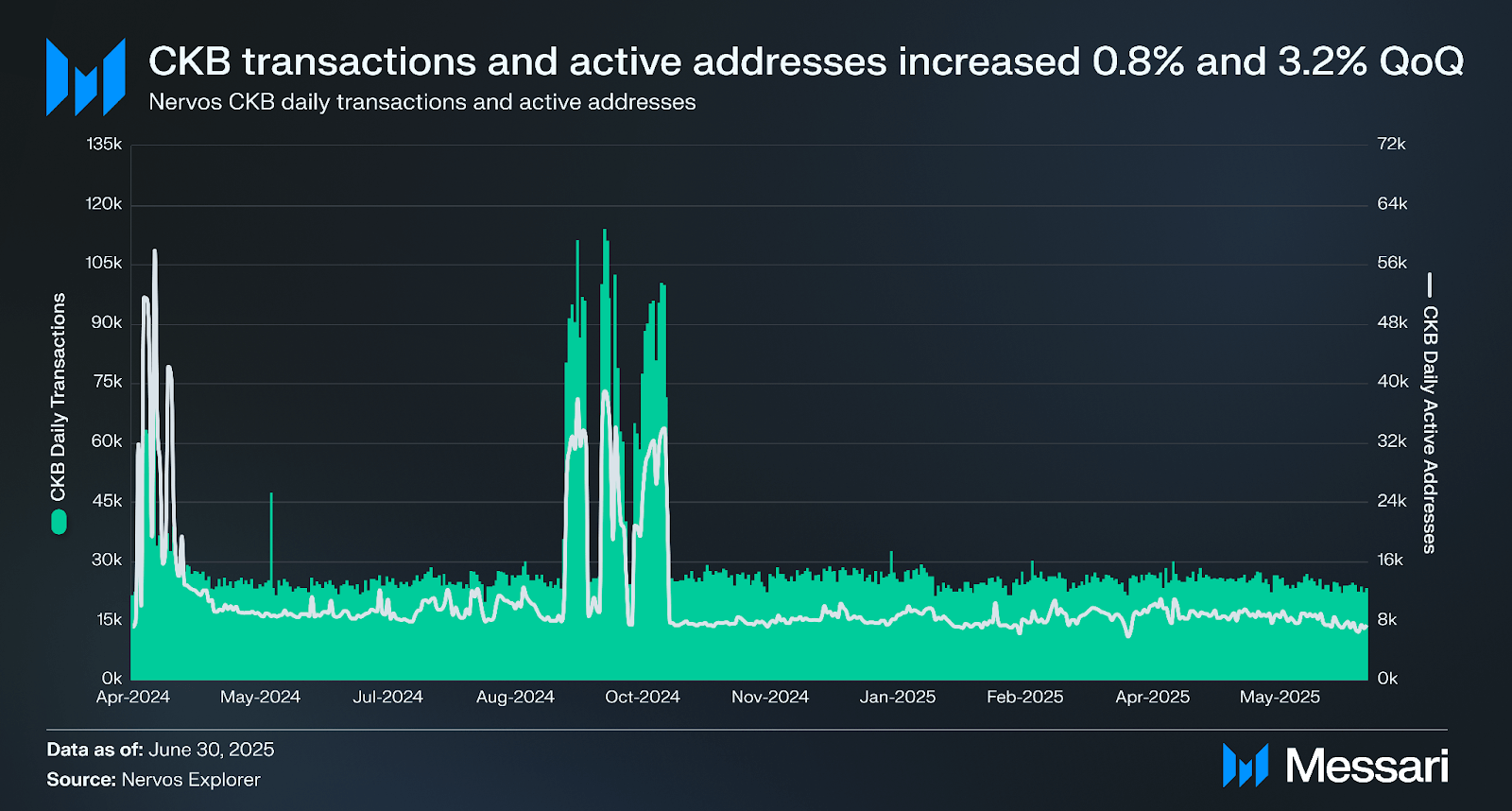

Activity on Nervos CKB increased modestly in Q2 2025. Total transactions rose 0.8% QoQ to 2.3 million, while active addresses grew 3.2% to 775,800. The average number of daily active addresses also increased 2% QoQ to 8,500.

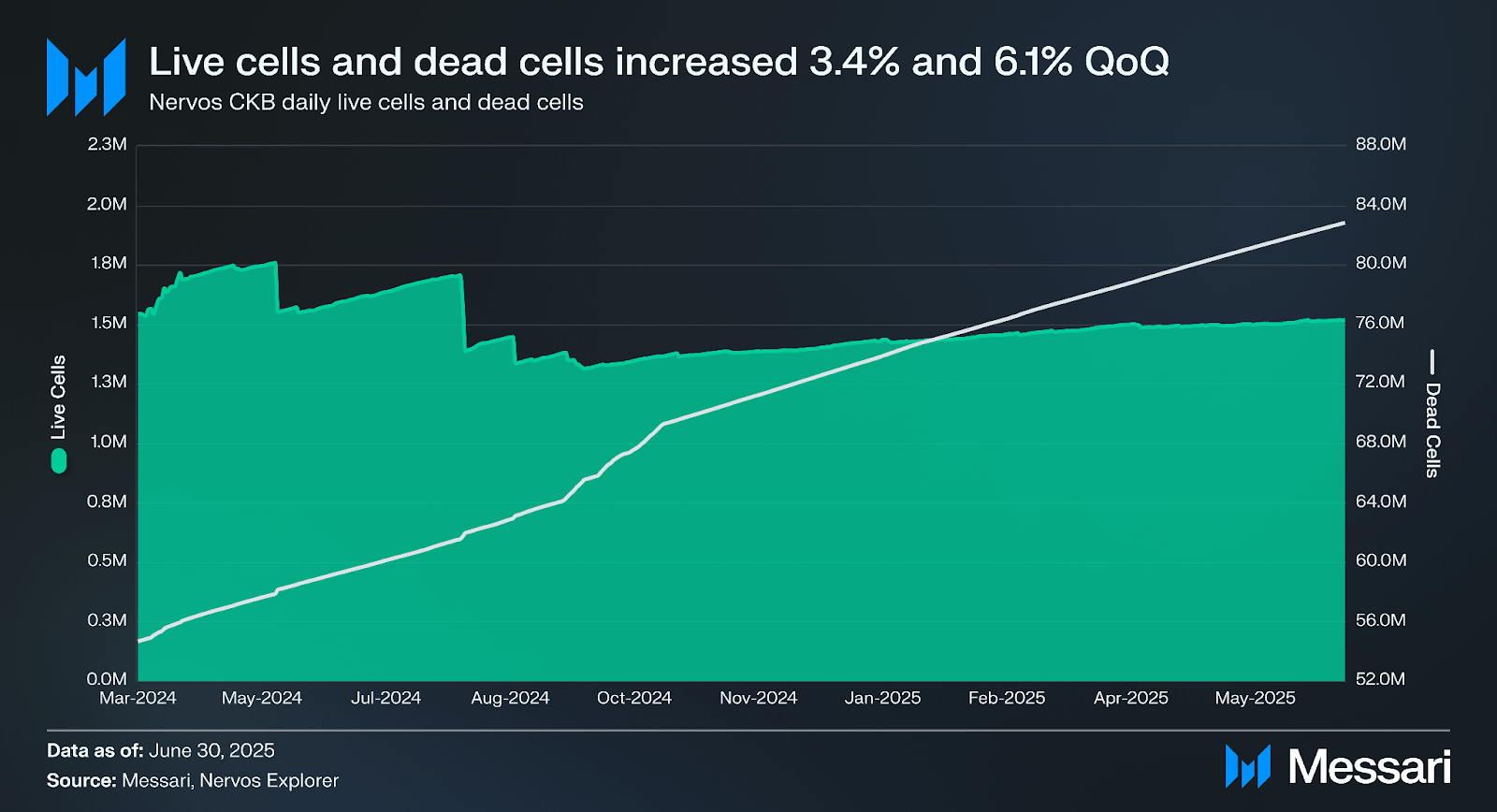

Cell activity on Nervos CKB increased in Q2 2025. The average number of daily live cells rose 3.4% QoQ to 1.5 million, continuing growth from Q1’25. Total dead cells also grew, rising 6.1% QoQ to 80.6 million.

Nervos CKB stores its network state using a UTXO-based cell model. Cell activity is divided into live and dead cells. Live cells are available for future transactions, smart contract execution, and data storage. Dead cells, while no longer usable as transaction inputs, contain valuable data that can be accessed and referenced and still contribute to the blockchain’s history and data traceability.

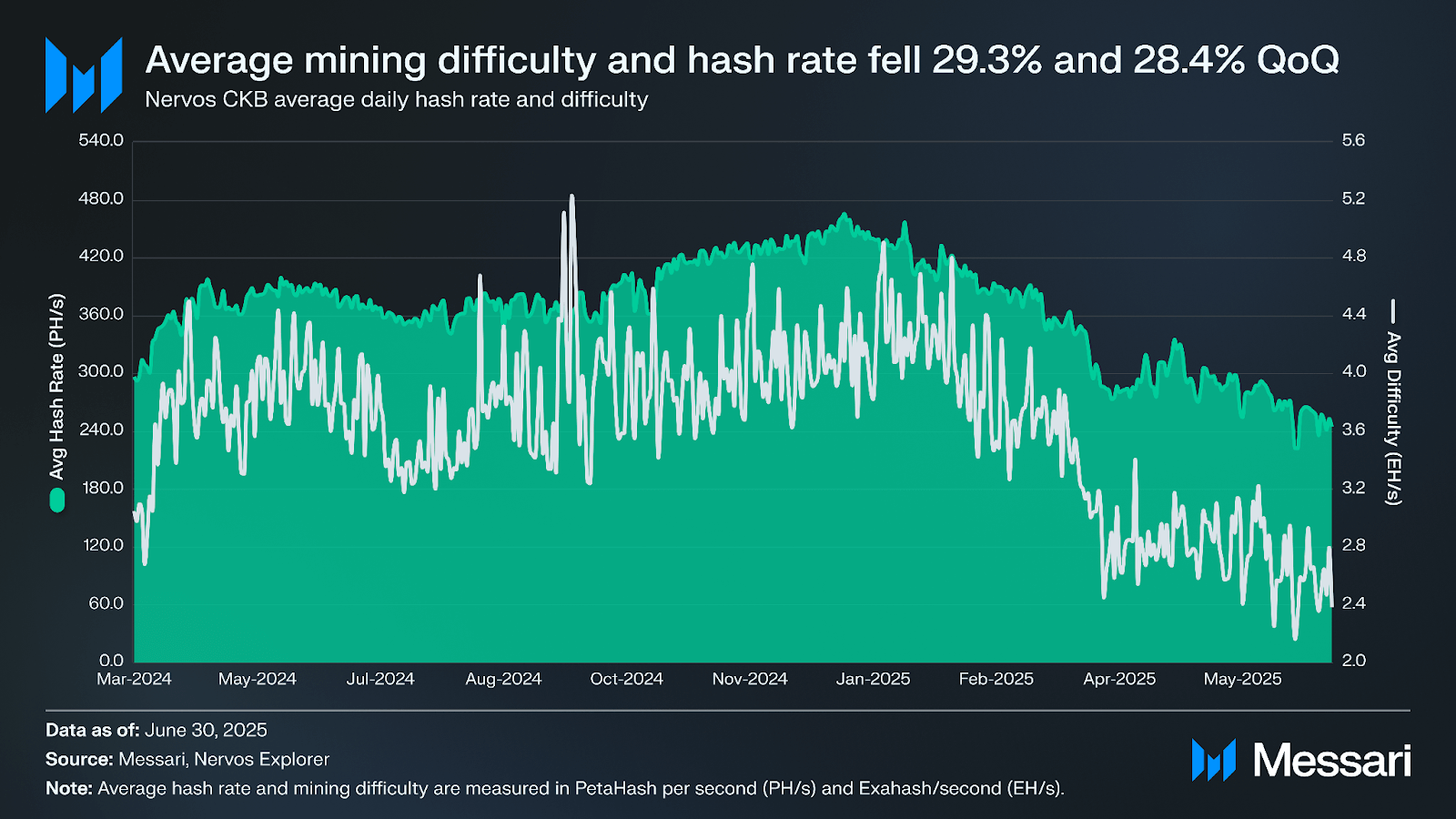

In Q2 2025, Nervos CKB’s average hash rate fell 28.4% QoQ to 282.6 PH/s. Mining difficulty also declined, dropping 29.3% QoQ to 2.8 EH/s.

Nervos’ CKB uses a Proof-of-Work (PoW) consensus mechanism, where miners validate transactions and produce new blocks by solving cryptographic puzzles. For each block, miners earn the full base issuance reward, a portion of the secondary issuance, and additional fees from Proposal and Commit Rewards.

The hash rate reflects the total computational power dedicated to mining and serves as a proxy for network security. A higher hash rate implies greater resistance to attacks. Difficulty adjusts to maintain a steady block production rate and reflects how hard it is to mine a new block.

The second hard fork in Nervos CKB’s history, titled” CKB Edition Meepo”, introduced upgrades to the network’s scripting capabilities. Most notable was a new syscall called Spawn, which allows one script to invoke another with isolated memory and unrestricted data transfer. This mechanism simplifies contract logic while improving execution control and composability.

The Meepo release also marked the official deployment of CKB-VM V2, the updated virtual machine powering smart contracts on Nervos CKB. Enhancements include:

The core development team (TeamCKB) delivered multiple software releases and improvements during the quarter:

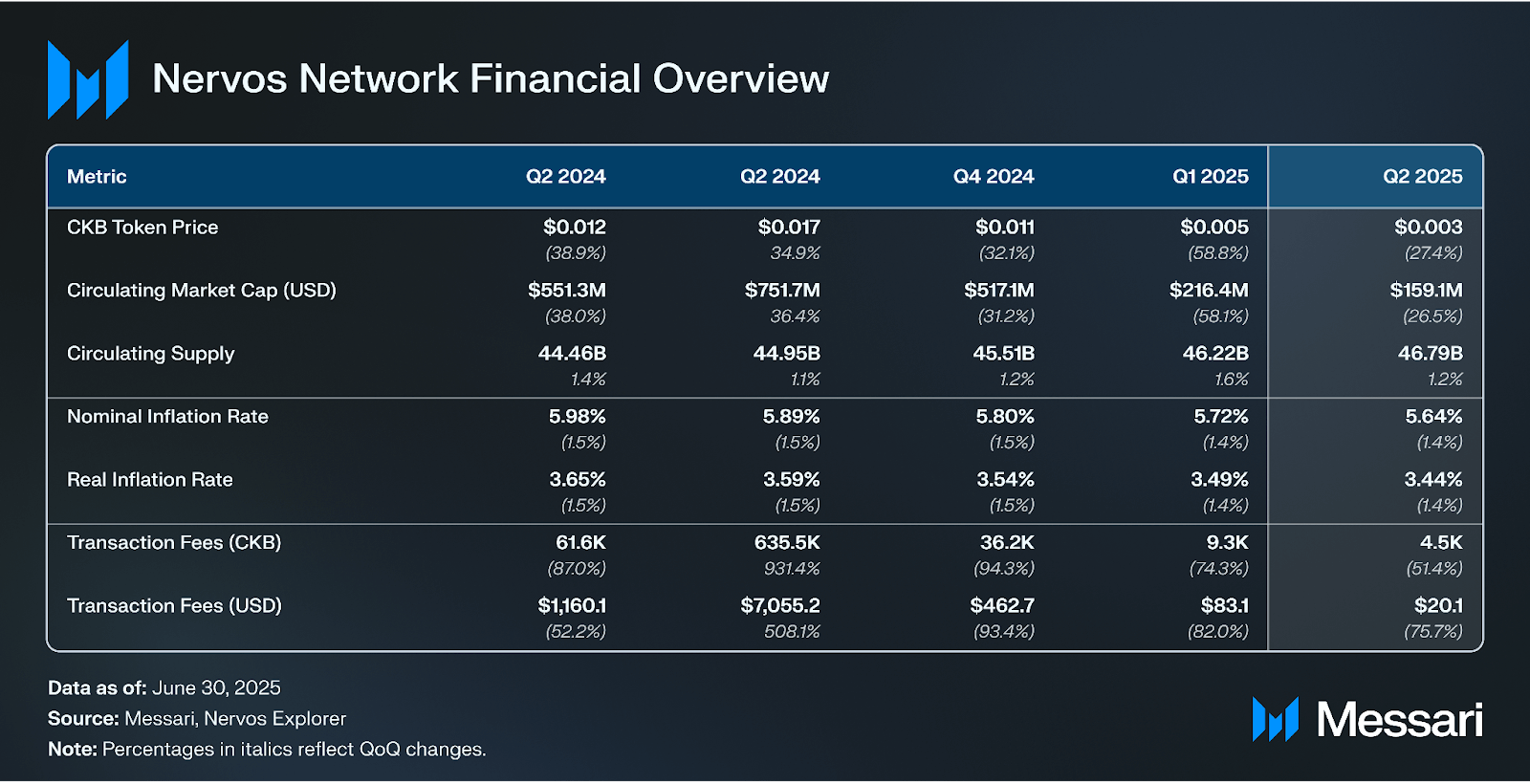

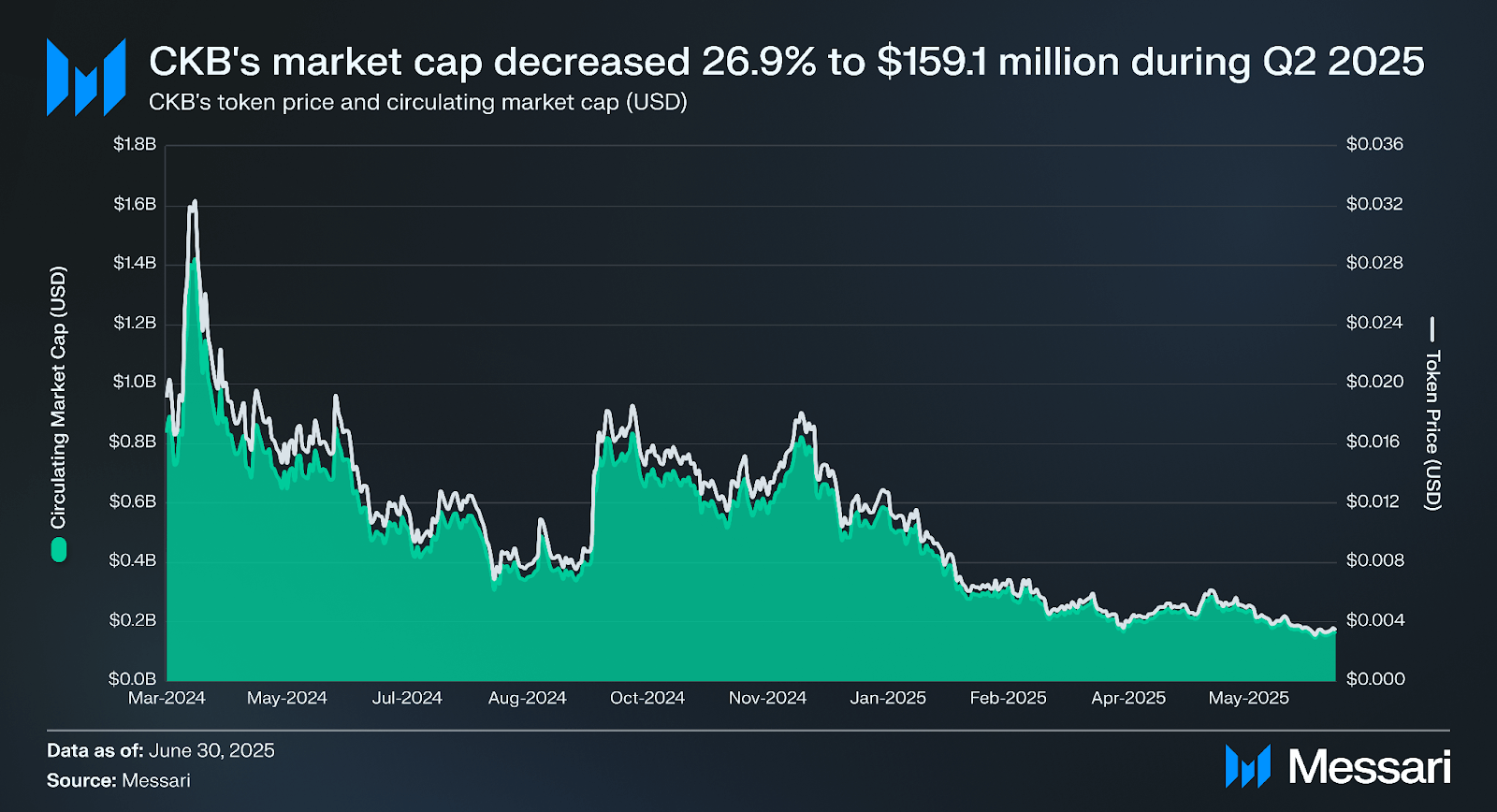

CKB’s price fell 27.4% QoQ from $0.005 to $0.003 in Q2 2025. The circulating supply increased 1.2% to 46.8 billion, resulting in the circulating market cap declining 26.5% to $159.1 million. CKB’s market cap rank increased from 165th to 242nd, indicating underperformance of the broader market.

CKByte (CKB) is the native token of Nervos Network, used to maintain Nervos CKB’s security and incentivize efficient data storage. Specifically, CKB is employed to (i) grant tokenholders data storage rights, (ii) settle network transaction fees, and (iii) distribute block rewards to miners for securing the network.

Nervos CKB addresses state bloat through a token-based rent model, whereby users are required to lock CKB to store data onchain. These locked tokens are subject to dilution through an annual inflation mechanism known as secondary issuance. Rather than charging fees directly, 1.34 billion CKB tokens are minted per year and distributed to miners and Nervos DAO participants. The model ensures that users occupying blockchain state incur an indirect rent through inflation, as they do not receive newly minted tokens. A portion of the issuance previously earmarked for the Treasury Fund is currently being burned, though it may be redirected to an onchain treasury in the future.

As of the end of Q2 2025, over 822.3 million CKB tokens have been distributed to miners since November 2019 as part of secondary issuance. Over 1.37 billion CKB have accrued to Nervos DAO depositors, who offset inflation by locking their tokens in the protocol. Meanwhile, around 5.53 billion CKB have been permanently burned.

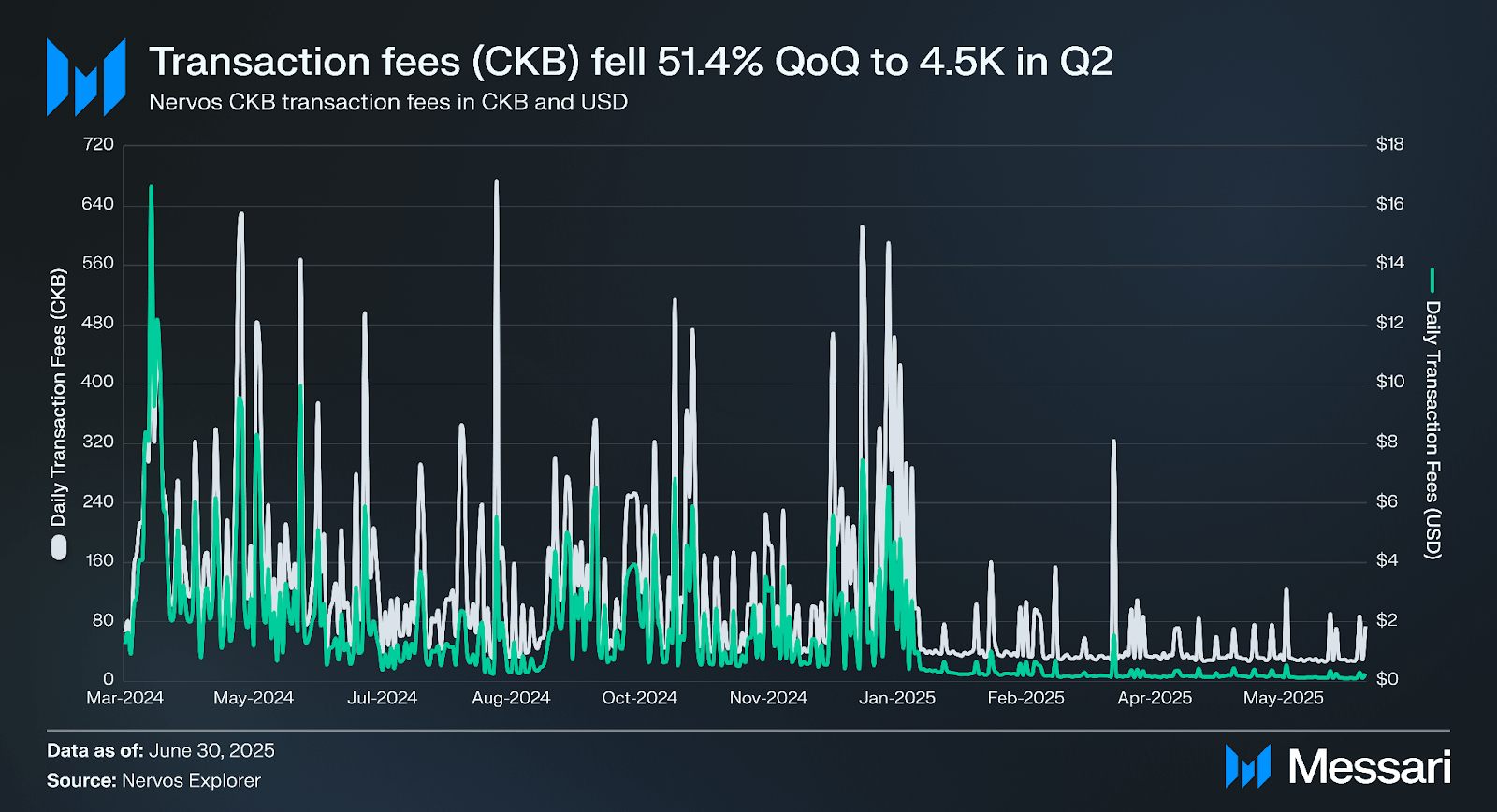

Transaction fees declined 51.4% QoQ to 4,500 CKB in Q2 2025. Average daily fees in CKB fell from 97 to 40, down 58.5% QoQ. On Nervos CKB, transaction fees are paid in CKB and distributed to miners along with block rewards from the network’s secondary issuance.

Nervos spent Q2 2025 preparing for its Meepo hard fork, the most significant Layer-1 upgrade since launch. Meepo introduced a new virtual machine, modular contract execution via the Spawn syscall, and lower transaction costs through VM optimizations. These changes improve script composability and make Nervos more attractive for developers building on the UTXO model. While onchain activity and token performance remained weak, the protocol upgrades created a stronger foundation for the network’s future.

The quarter also marked a broader strategic shift. Nervos shut down Godwoken and Force Bridge, ending its EVM and cross-chain bridge efforts to focus on Bitcoin-based infrastructure and offchain scaling. The Fiber Network expanded its Lightning-compatible payments stack, and the community launched new initiatives through the Catalyst program and bounty board. These moves point to a leaner ecosystem focused on UTXO-native design, Bitcoin interoperability, and long-term builder engagement.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Gehirn Limited. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.