Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Futureverse, founded in 2022, integrates blockchain, AI, and immersive experiences to build a decentralized metaverse. Formed through merge of 11 companies, it offers a unified ecosystem with a three-layer technology stack:

The Root Network’s multi-token economy, led by ROOT, supports governance, staking rewards, and ecosystem activities. In 2025, the protocol introduced RootRewards, a loyalty program distributing non-transferable Root Points (RP) for onchain participation, digital identity engagement, and NFT ownership. RP can be redeemed for ROOT during defined reward cycles, aligning user participation with long-term ecosystem growth.

This Pulse report provides a focused update on RootRewards traction, UBF infrastructure developments, and strategic partnerships that advanced Futureverse’s mission in 2025.

For a full primer on Futureverse, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord/ TRN

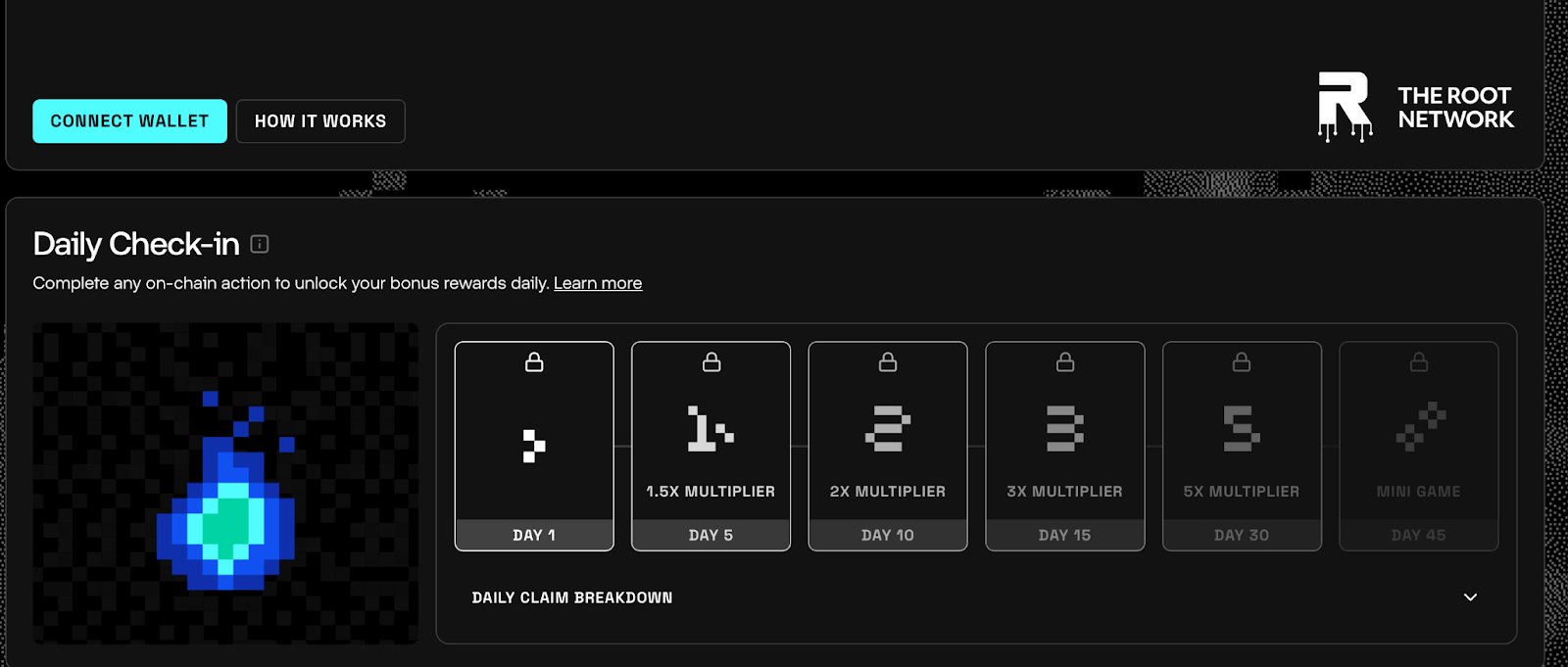

Futureverse launched the RootRewards program in March 2025 to incentivize sustained engagement across The Root Network. Designed as a loyalty system, RootRewards allows both users and builders to earn rewards through onchain activity, digital identity integration, and broader ecosystem participation. The program aims to drive long-term alignment between protocol growth and user behavior, while avoiding the unsustainable incentives often seen in short-term token distribution campaigns.

RootRewards distributes non-transferable, offchain loyalty points known as Root Points (RP) in exchange for eligible onchain behavior, ecosystem activity, and identity-linked participation. Unlike typical loyalty systems, RP can be redeemed for ROOT tokens during defined reward cycles, establishing a clear connection between ecosystem contribution and liquid rewards.

Source: The Root Network

Source: The Root Network

Users earn RP through eligible actions such as:

RP accrual is dynamically weighted to favor high-value, sustained activity. NFT holders receive additional multipliers based on their FutureScore, a composite identity score derived from the type and volume of collectibles in their wallet.

RootRewards ran limited-time campaigns such as Candy x Cool Cats and Candy x MLB, each offering up to 10 million RP through seasonal quests tied to NFT ownership, FuturePass activity, and UBF-enabled app interactions.

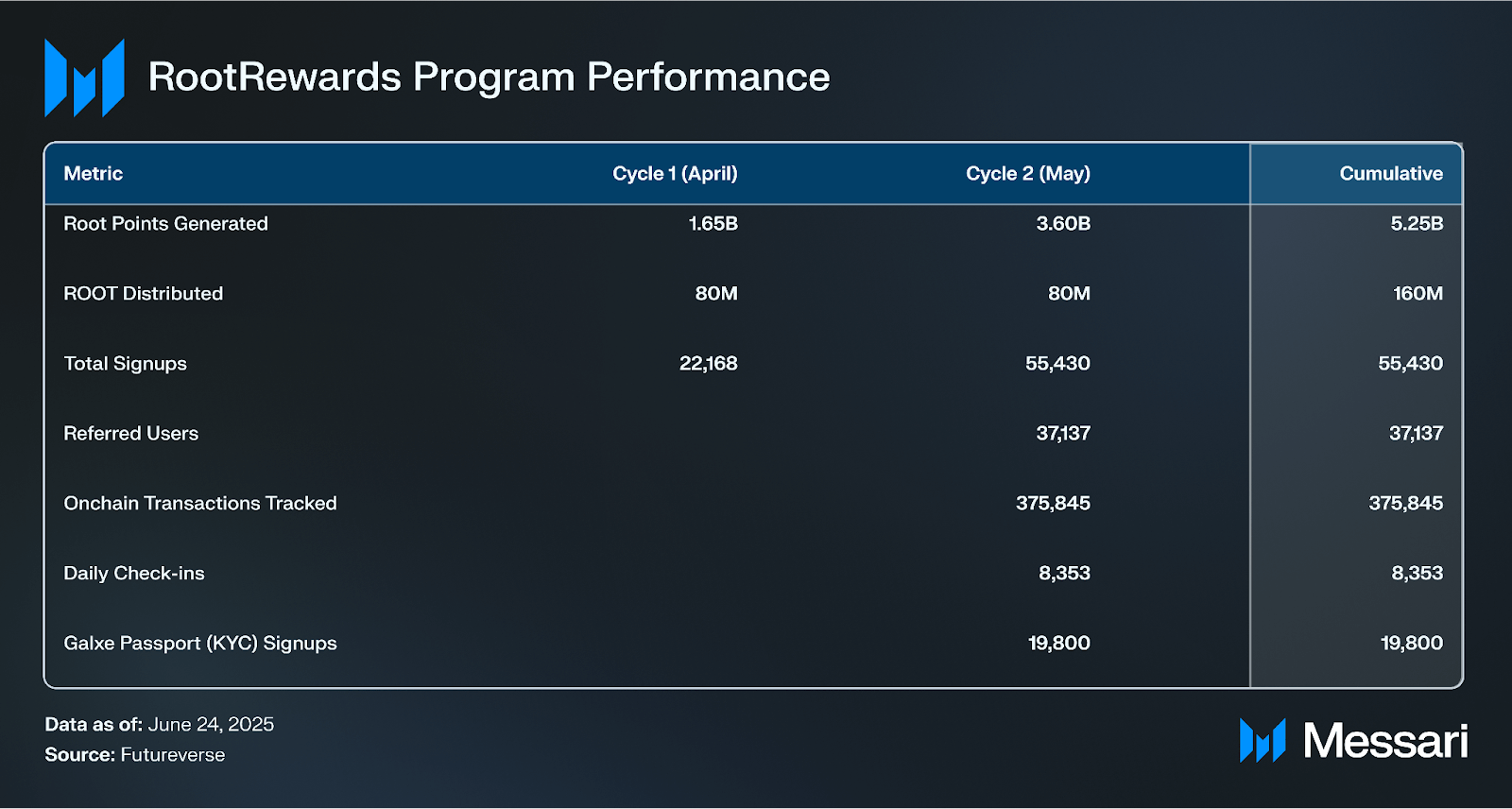

As of June 2025, over 5.2 billion RP had been generated across the first two reward cycles, 1.65 billion in April and 3.6 billion in May, resulting in the distribution of 160 million ROOT to participants. Onchain redemption mechanisms are now live, enabling users to claim their earned rewards directly via smart contracts, adding transparency and finality to the process.

Source: The Root Network

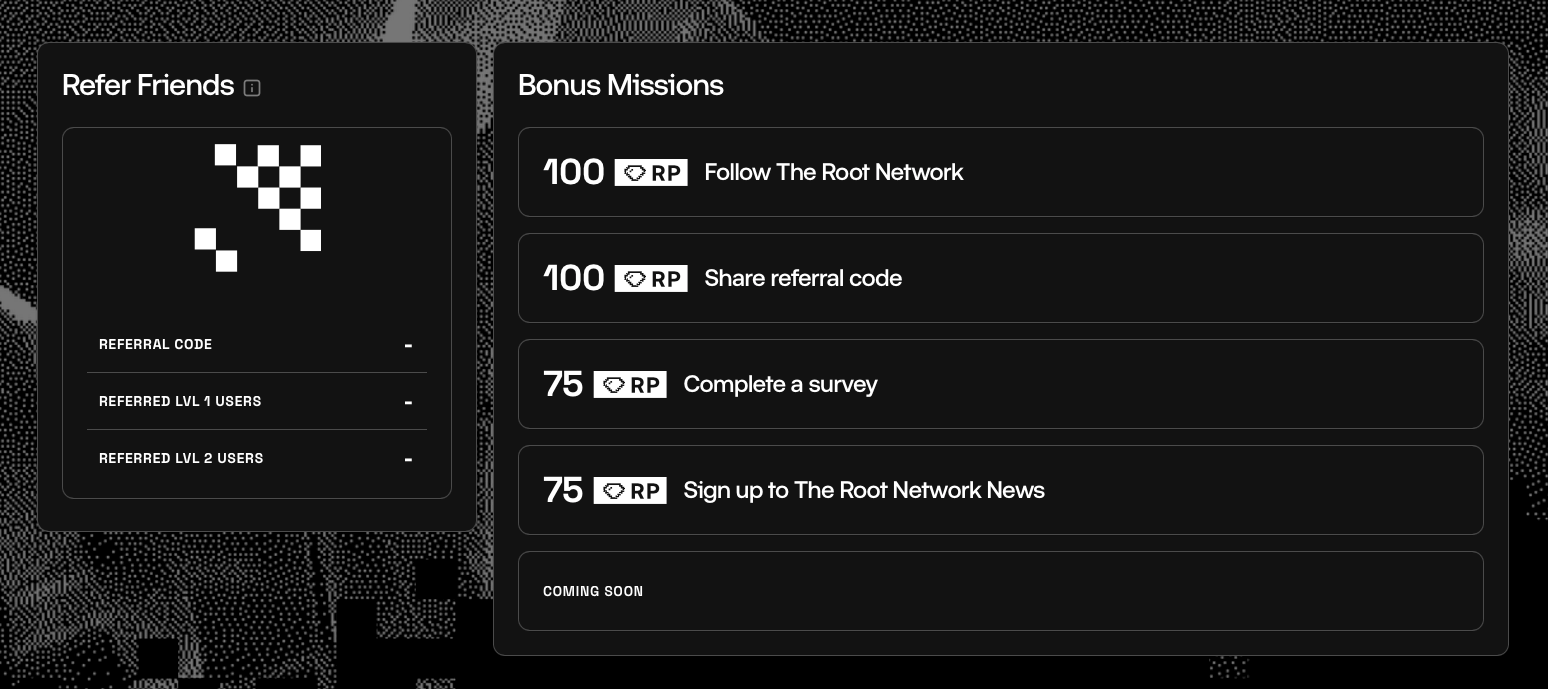

To support organic growth, RootRewards incorporates a referral system that rewards both first- and second-degree invites. Referrers earn 15% of the RP generated by their direct invitees and 7.5% from indirect invitees. By late May, over 30,000 referral links had been shared, resulting in over 37,000 referred users joining the network. These incentives have contributed to rapid user onboarding and network expansion.

FuturePass acts as the gateway for identity-aware participation in the RootRewards system. Each FuturePass is linked to a corresponding Externally Owned Account (EOA), enabling the network to contextualize both user behavior (e.g., staking, transactions) and identity-linked traits (e.g., NFT ownership, campaign engagement). This structure allows RootRewards to reward users more intelligently by factoring both behavioral and identity-based inputs into RP distribution.

Following the launch of RootRewards, FuturePass issuance grew nearly 4x, from approximately 546,000 on March 12 to over 2.1 million by June 23. With each FuturePass paired to an EOA, total registered wallets on The Root Network reached 4.2 million, reinforcing identity-layer adoption as a central driver of ecosystem activity.

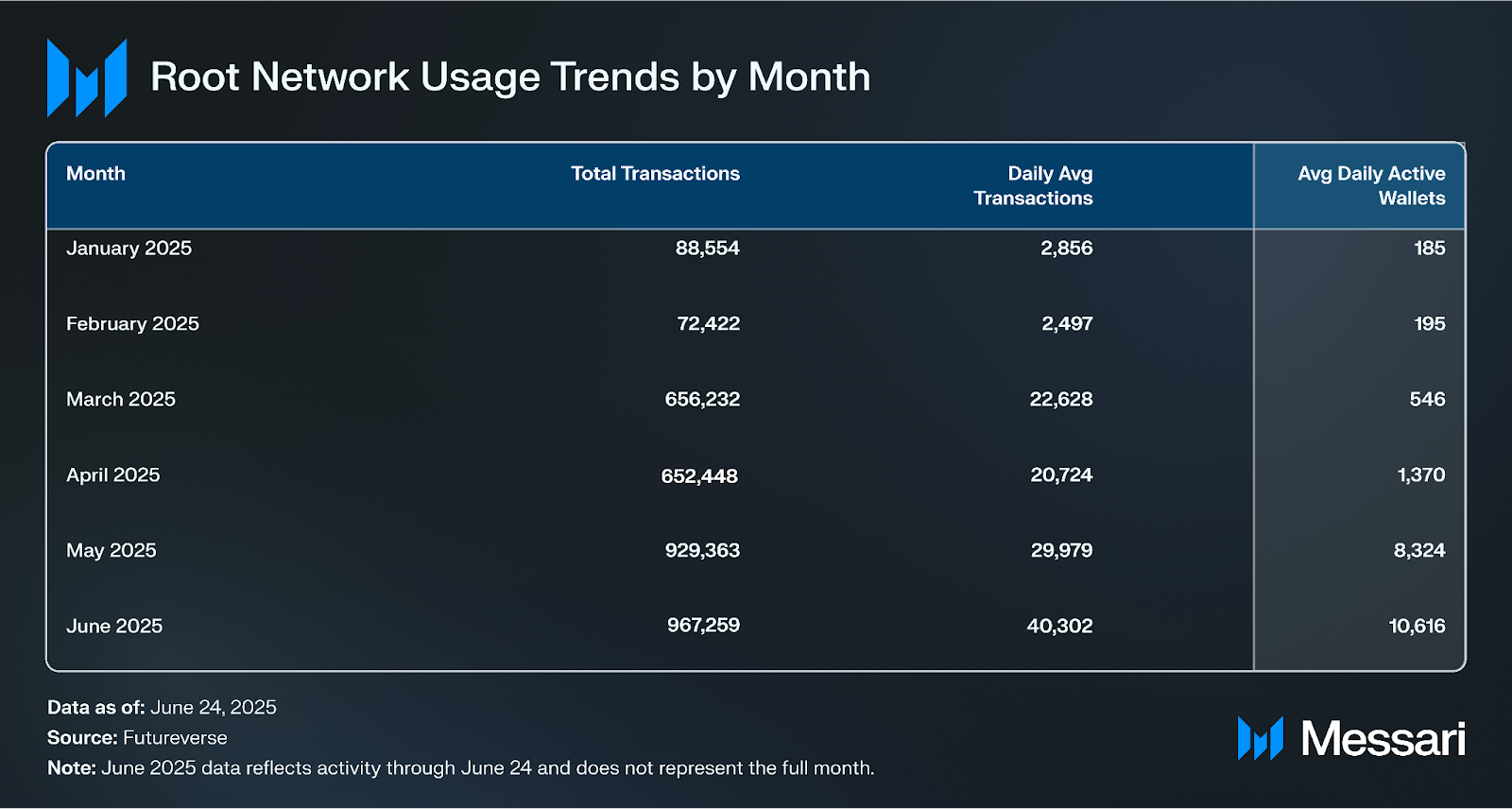

Onchain activity accelerated alongside this expansion. Monthly transaction volume increased from about 88,000 in January to over 967,000 by June 24, representing an approximately 11x gain. In March, the month RootRewards launched, transactions climbed 47% from approximately 660,000.

Daily active wallets (DAWs) also grew significantly, rising from around 550 in early March to over 10,600 by late June, a 1,827% increase. The largest spike occurred during the program’s rollout, with steady growth through Q2 as more users became eligible.

These trends show that RootRewards played a critical role in driving user acquisition and retention. By incentivizing identity creation via FuturePass and sustained onchain engagement, the program contributed to a measurable expansion in both wallet infrastructure and network activity.

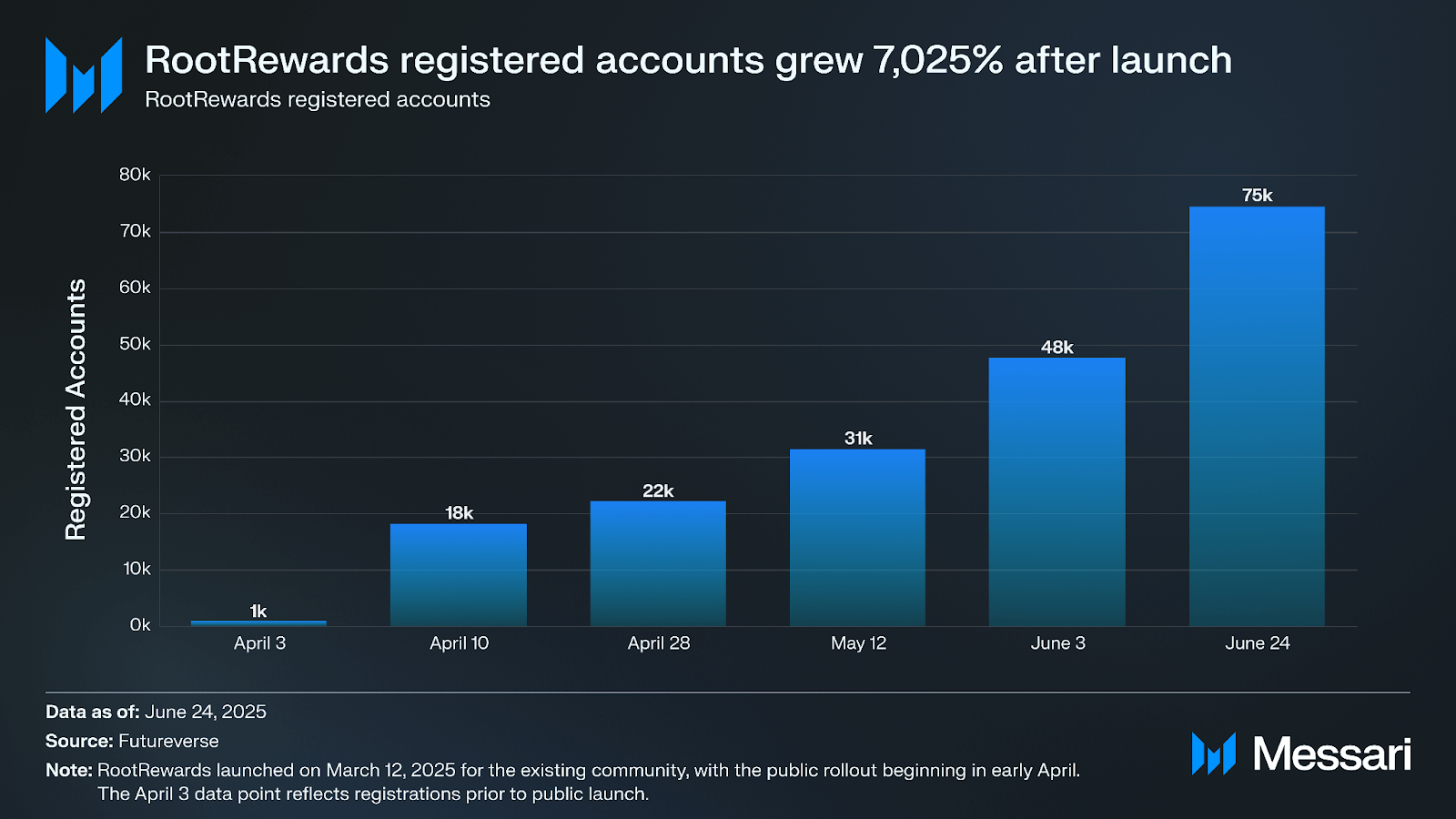

In addition to infrastructure-wide growth, RootRewards recorded consistent growth in program participation, with registered accounts increasing from just over 1,000 at launch to approximately 75,000 by June 24, an increase of over 7,000% within three months.

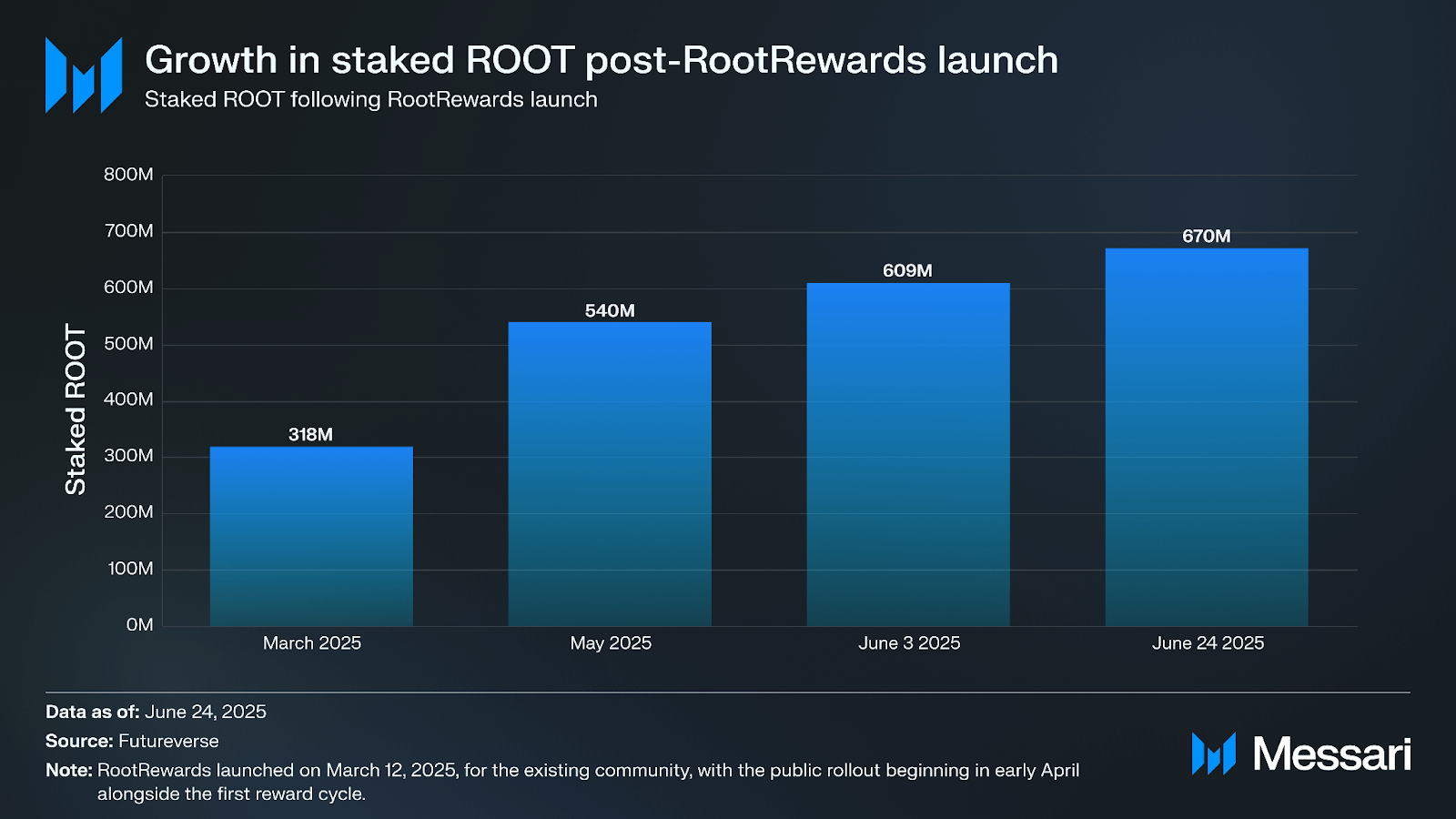

Following the launch of RootRewards in March 2025, the amount of staked ROOT on The Root Network more than doubled, from approximately 318 million to 670 million ROOT by late June, representing a 110% increase. Since staking is one of the primary actions eligible for Root Point (RP) accrual, this growth suggests that the program’s incentive design contributed to higher token lock-up and broader protocol participation. While other factors may also influence staking behavior, the timing of this increase aligns closely with the rollout of RootRewards, indicating early responsiveness to reward-based engagement mechanisms.

RootRewards also offers a developer-facing Grants and Rewards API, allowing builders to integrate RP distribution into their applications. This enables incentive customization based on user behavior within specific dApps or games. Builders are responsible for co-marketing, traffic generation, and performance reporting. This modular structure supports scalable, targeted reward campaigns and makes RootRewards a flexible mechanism for ecosystem-wide user activation.

To improve transparency and user access, The Root Network launched a dedicated RootRewards dashboard in Q2 2025. The dashboard allows participants to monitor RP accrual, check eligibility tiers, redeem rewards, and track historical participation across multiple campaigns.

From a strategic perspective, RootRewards addresses a critical challenge: how to fairly distribute incentives across a horizontally integrated ecosystem without introducing unnecessary token inflation. By decoupling early contribution from immediate financial gain, the system fosters durable engagement and enables flexible, modular campaign design, such as seasonal drops, in-game multipliers, and brand-specific activations.

Unlike most Web3 points programs, RootRewards offers direct, onchain redeemability for ROOT and is designed to operate across both EVM-compatible and native TRN environments. This network-agnostic flexibility ensures that incentives can be distributed and claimed across the full spectrum of dApps on The Root Network, supporting scalable and sustainable growth.

In addition to passive and identity-based participation incentives, Futureverse also introduced real-time gameplay rewards to deepen user engagement. In Q2 2025, the flagship title The Third Kingdom distributed over 300 million ROOT to players through activity-based rewards. Episode 2 added Mycelium, an in-game resource that can be redeemed for ROOT, creating a parallel value accrual mechanism tied to gameplay rather than point accumulation. While separate from the RootRewards program, this structure reinforces the protocol’s incentive design by embedding token distribution directly into immersive, interoperable experiences.

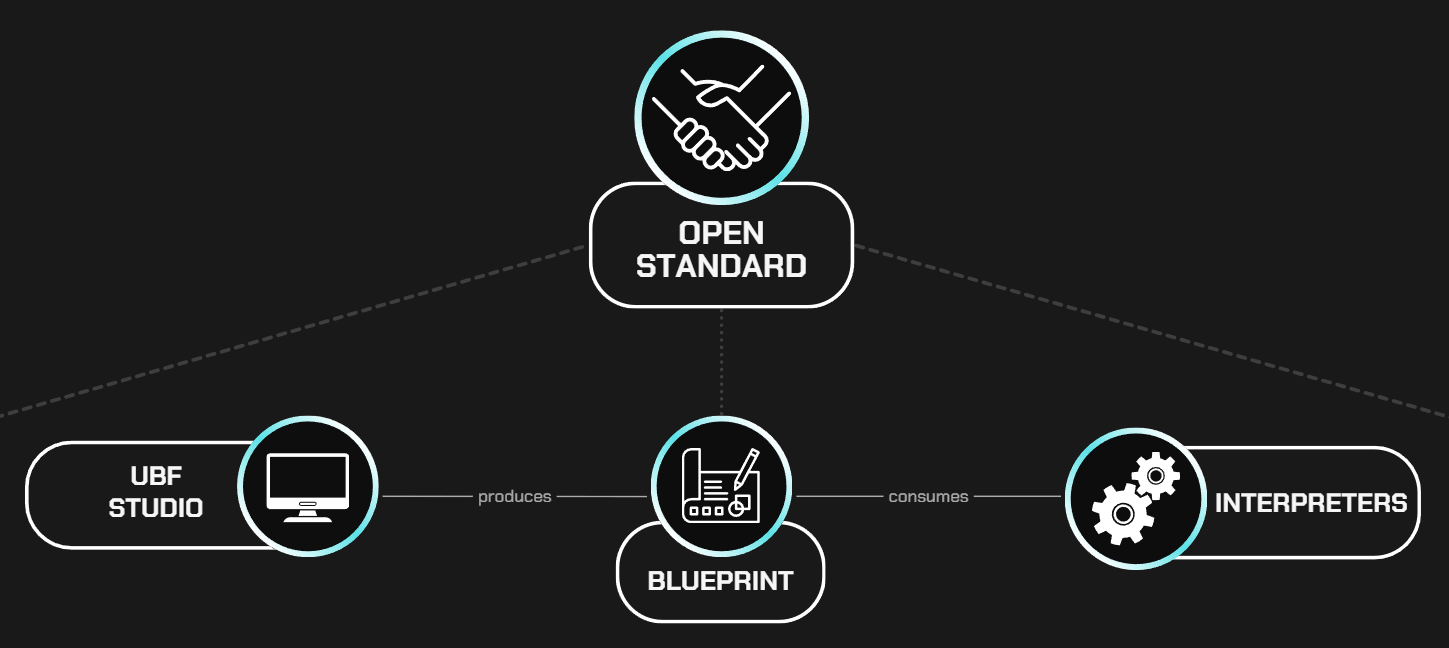

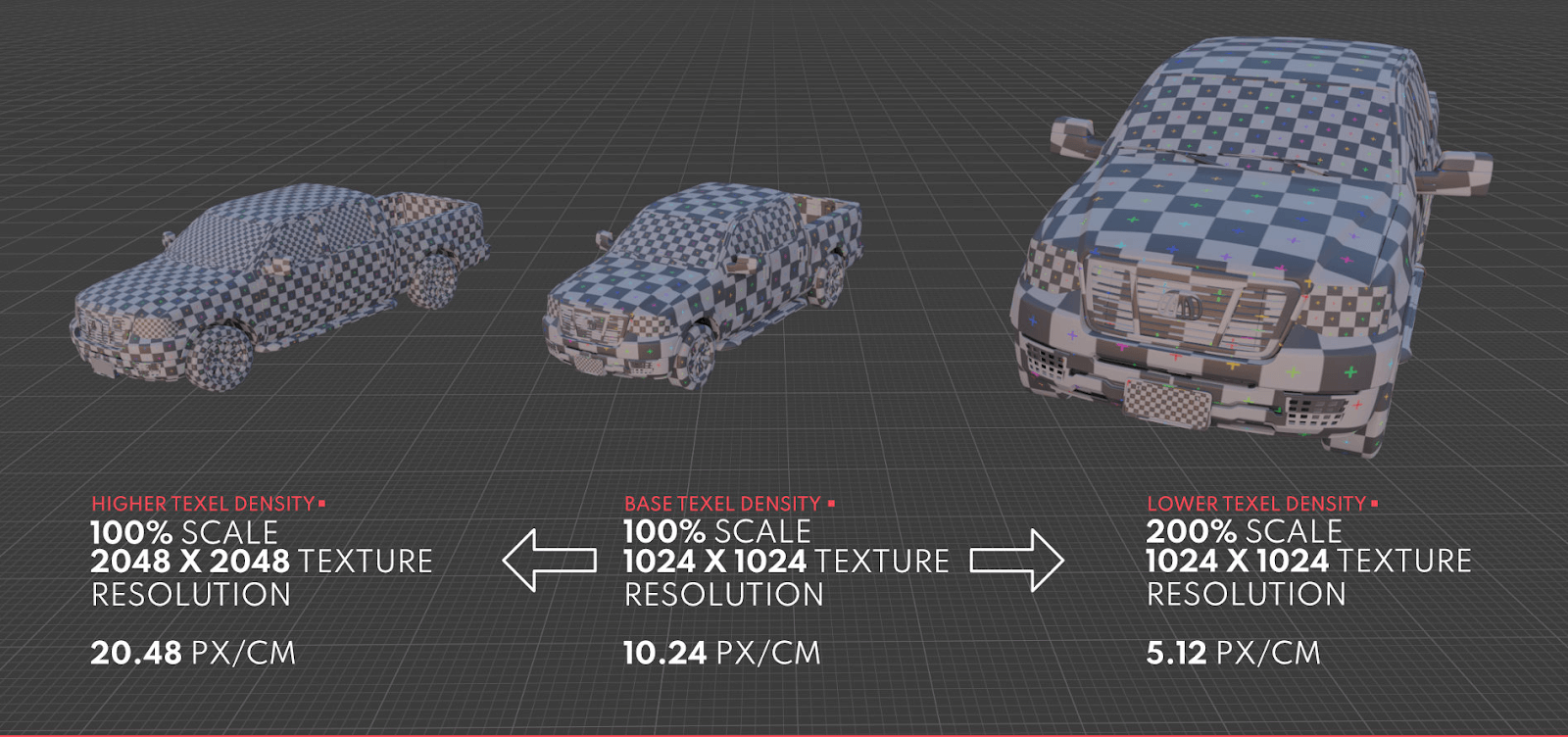

The Universal Blueprint Framework (UBF) is Futureverse’s protocol for creating and managing interoperable 3D assets. Designed to be platform-agnostic, UBF provides a standardized way to define, interpret, and deploy digital content across engines like Unity and Unreal (two of the most widely used real-time 3D engines for building interactive applications and virtual worlds), as well as within diverse metaverse environments. It decouples asset design from platform execution, allowing creators to design once and deploy across multiple applications without reconfiguration.

Source: Futureverse

UBF operates on a runtime-driven model that separates static asset files (e.g., models, textures, animations) from the logic that governs how those assets render. This logic is stored in JSON-based “blueprints,” authored using UBF Studio, a node-based visual editor. Blueprints can be previewed in real time with the UBF Previewer, allowing assets to be dynamically loaded into games without embedding them into builds.

The UBF pipeline includes two core phases:

UBF supports a modular architecture that enables assets to be customized and recombined across collections. Core models, such as those used for NFT collections like Flufs, Party Bears, Raicers, Seekers, or Atem vehicles, can be extended with attachable traits like outfits, accessories, or animations. One-shot items, such as Reebok wearables, are also supported and can be reused across avatar types without modification. This composability enables efficient reuse and minimizes duplication across asset libraries.

Source: Futureverse

To ensure cross-engine compatibility and real-time performance, UBF enforces technical standards such as Level of Detail (LOD) optimization, ORM texture atlasing, standardized UV mapping, and ARP-compatible rigging. Projects are hosted on centralized repositories like Dropbox to support collaborative version control and consistent asset rendering across platforms.

Source: Futureverse

In Q2, Futureverse expanded UBF’s tooling ecosystem to streamline asset creation and deployment. The UBF Interpreter and an upgraded Creator Studio allow developers to test blueprints for cross-platform rendering. Altered State, Futureverse’s no-code avatar engine, now supports direct UBF export. The Open Alpha v2 release of Altered State introduced improved rigging, enhanced mesh detail, and stylization controls, lowering friction between AI-generated avatars and runtime integration.

Additionally, Futureverse launched Connectibles, a UBF-native asset management platform that allows IP owners to license, distribute, and monetize branded assets across multiple environments. Connectibles enforces digital rights and supports deployment independent of underlying game engines.

UBF-powered assets were integrated into multiple live environments in Q2. Avatars from The Next Legends could be ported into The Third Kingdom, Readyverse Showrooms, and other interoperable spaces, showcasing functional composability across experiences.

By standardizing asset behavior at runtime, UBF transforms NFTs from static collectibles into interoperable content primitives. This positions Futureverse not only as a content platform, but as a protocol-layer infrastructure provider for open metaverse applications.

Futureverse completed the acquisition of Candy Digital in April 2025, expanding its ecosystem with over 1.5 million user accounts and approximately 4 million digital collectibles. The acquisition strategically aligned with Futureverse’s goal of building an interoperable metaverse by integrating licensed entertainment IP into decentralized infrastructure.

Candy’s portfolio includes rights to content from Major League Baseball (MLB), Warner Bros., DC Comics, and Netflix. Since joining Futureverse, Candy has launched multiple campaigns on The Root Network, including:

These activations leverage Futureverse’s onchain infrastructure for licensing, royalties, and identity (via Pass), demonstrating how traditional IP can operate in Web3-native formats. Candy’s assets are also UBF-compatible, enabling deployment across games, storefronts, and immersive experiences within the Readyverse.

Futureverse expanded its ecosystem through a series of strategic partnerships targeting identity onboarding, branded content distribution, and interoperable IP infrastructure.

This integration demonstrates Futureverse’s ability to provide interoperable identity infrastructure for third-party ecosystems, reinforcing Pass’s relevance beyond its native applications.

Futureverse launched the RootRewards program to encourage sustained onchain engagement through a system of non-transferable loyalty points (Root Points) redeemable for ROOT. Since launch, the program has distributed over 5.2 billion Root Points and has contributed to a 7,000% increase in RootRewards-registered accounts. Daily active wallets rose from approximately 550 to over 10,600, and staked ROOT increased by 110%. By incentivizing actions such as staking, NFT ownership, and identity-linked participation, RootRewards has become a key mechanism for user activation and retention on The Root Network.

In parallel, the Universal Blueprint Framework (UBF) advanced Futureverse’s interoperability goals through improvements to its runtime architecture, authoring tools, and asset management systems. The Alpha v2 release of Altered State and the launch of Connectibles enhanced support for modular 3D assets and cross-platform deployment. Futureverse also expanded its ecosystem through strategic acquisitions and integrations. The acquisition of Candy Digital and partnerships with FC Barcelona, Rakuten Wallet, Glenn Maxwell, GameTree, and Story Protocol demonstrated scalable onboarding and cross-domain interoperability via the Pass identity system.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by FV Platform (BVI) Ltd. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.