Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

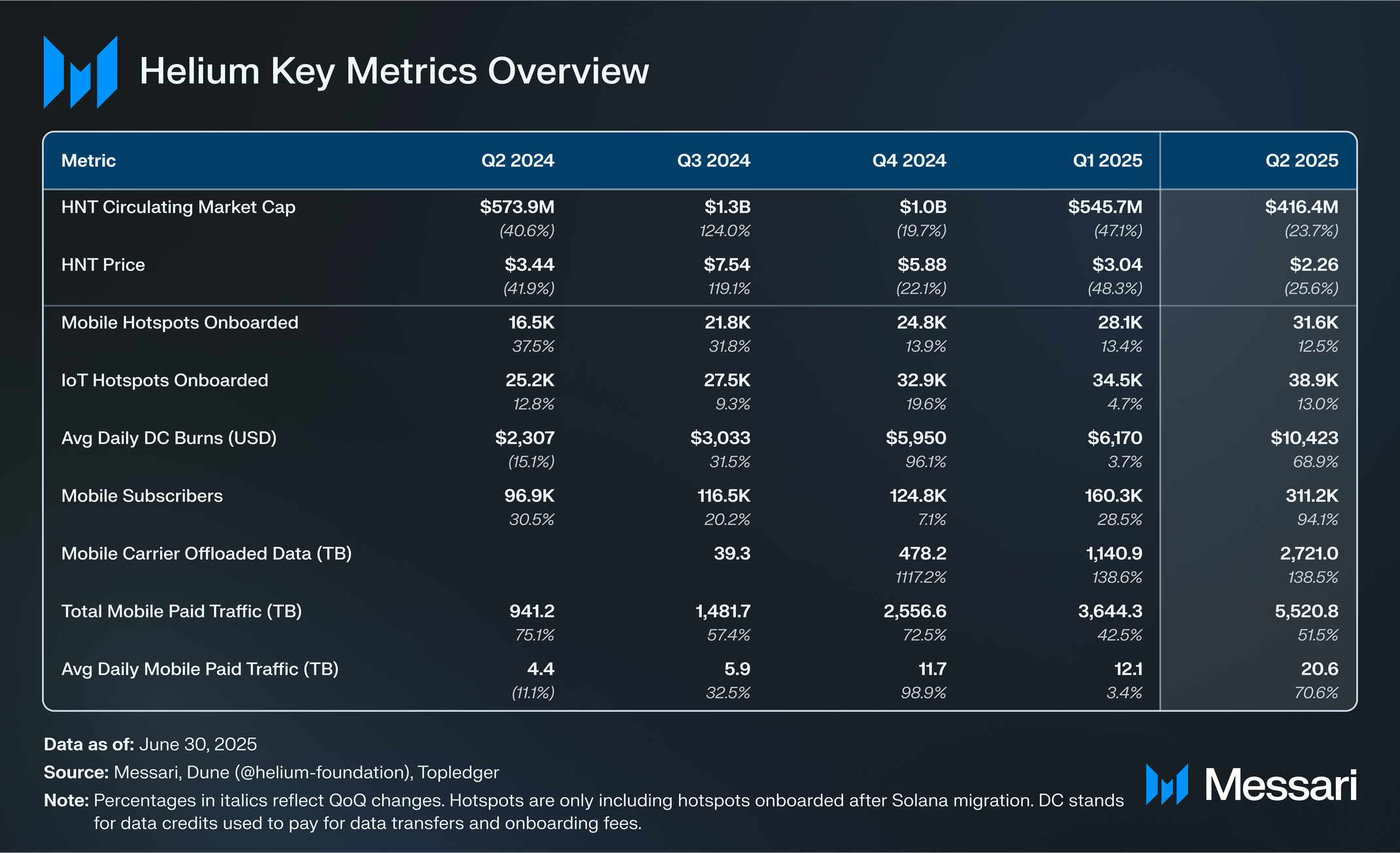

Helium (HNT) is a decentralized wireless network that provides both cellular (Mobile) and low-power Internet of Things (IoT) connectivity. The Helium Network is the world’s first “people-built” wireless network.

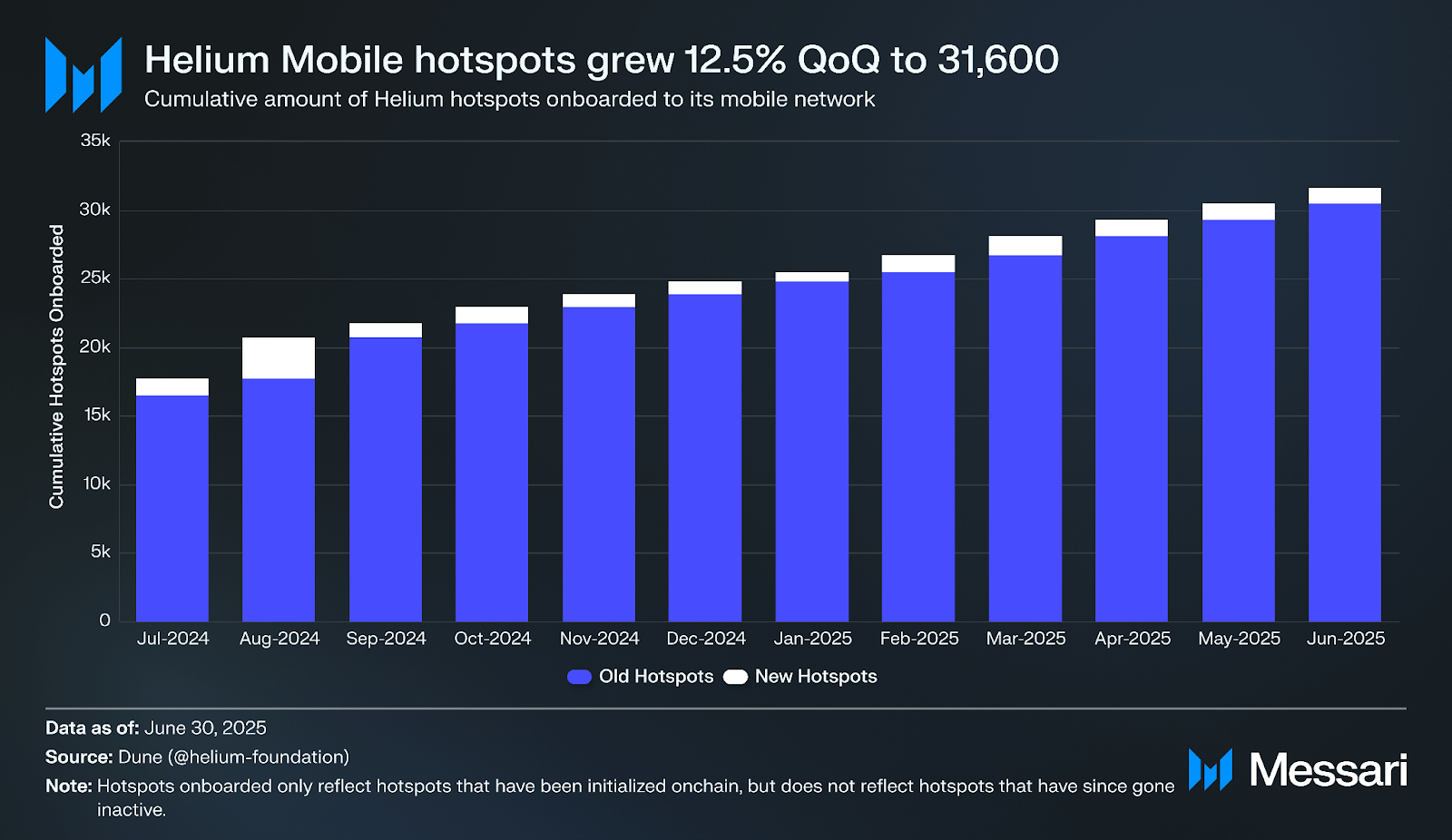

Helium Mobile is a Mobile Virtual Network Operator (MVNO), providing its service by blending two sources of coverage: T-Mobile’s nationwide 5G network and the community-powered network of Helium Mobile Hotspots. This unique model is driven by an incentive model where individuals who deploy Hotspots are rewarded with HNT tokens for expanding the network.

For the end user, a phone on the Helium Mobile plan seamlessly connects to either a nearby community-deployed Hotspot (which acts like a mini cell tower) or T-Mobile’s network, ensuring consistent coverage across the United States.

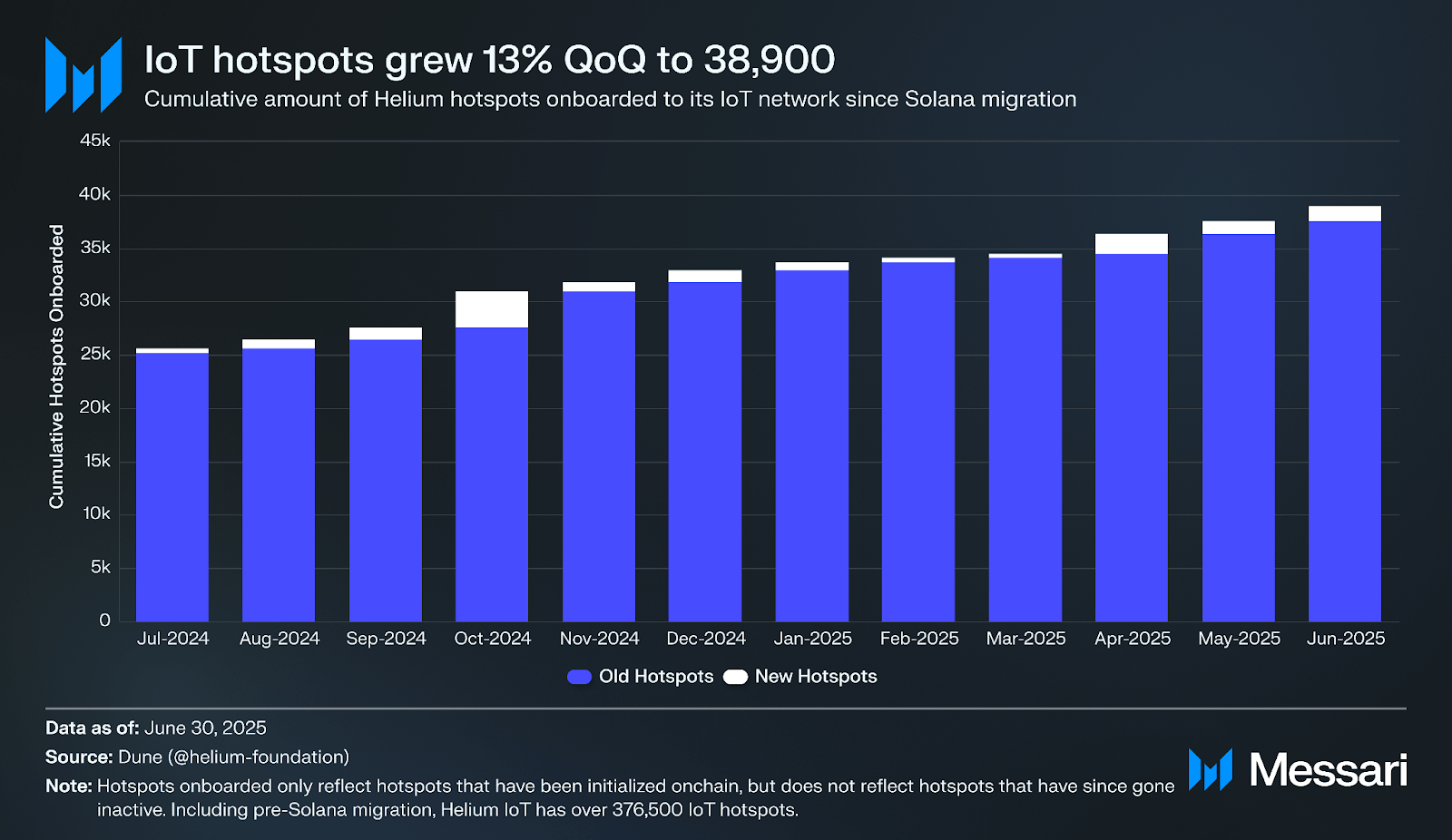

The Helium Network launched in 2019 with an IoT network on its purpose-built Layer-1 blockchain for peer-to-peer wireless infrastructure. Users could send data to and from the Internet, and protocol miners were rewarded with HNT tokens for providing wireless network coverage. What began as a purpose-built IoT network has since expanded into a broader wireless ecosystem, with Helium now supporting multiple types of decentralized infrastructure under a single protocol.

After the approval of a governance proposal (HIP-70) in August 2022, Helium sunset its Layer-1 blockchain and migrated operations to Solana on April 18, 2023. A primary growth driver for the Helium Mobile Network has been its Carrier Offload Program, which establishes partnerships with telecom companies. The program allows customers of legacy telecom companies such as AT&T and Telefónica’s Movistar to connect to Helium Hotspots in areas where the community network provides sufficient coverage, helping the carriers extend their service.

The Helium IoT Network has found traction in various use cases, with notable examples including its use in flood detection in Portugal and in monitoring humidity and temperature for museums. Helium’s founding team has raised over $360 million to date, including $200 million in its latest round in March 2022. For a full primer on the Helium Network, refer to our Initiation of Coverage report.

In Q1 2025, the number of new Helium Mobile Hotspots increased by 12.5% QoQ from 28,100 to 31,600. This does not include converted Hotspots; when included, the Network ended the quarter with 98,107 hotspots, a 53.8% QoQ increase.

Helium Mobile’s unlimited plan ($30/month) costs considerably less than the average three-figure plans that categorize American telecom. Subscribers can lower their bill further by earning Cloud Points.

Cloud Points are rewards Helium Mobile subscribers earn. They’re a way of paying users back for sharing anonymized location data. This crowdsourced data empowers the Helium community to identify coverage gaps, optimize Hotspot deployment, and guide strategic network expansion across the U.S.

Users’ location data is anonymized and shared with the network to understand where coverage is needed most. Cloud Points can be redeemed for eGift cards or donated to nonprofit organizations. In addition to its ability to attract network coverage suppliers via Hotspots, Helium Mobile seems primed to continue attracting new users to its telecom network, regardless of crypto-nativeness.

IoT Hotspots grew 13% QoQ, ending Q2’25 with 38,900 Hotspots onboarded since the Solana migration in April 2023. Before the migration, Helium had over 342,000 active Hotspots, bringing the network total to over 380,900.

To promote network growth in needed geographies, the IoT Network’s unique Proof-of-Coverage (PoC) model adjusts the rewards mechanism based on density to encourage more strategic deployments. As of June 30, 2025, coverage is strongest in major cities across North America, Europe, and Southeast Asia.

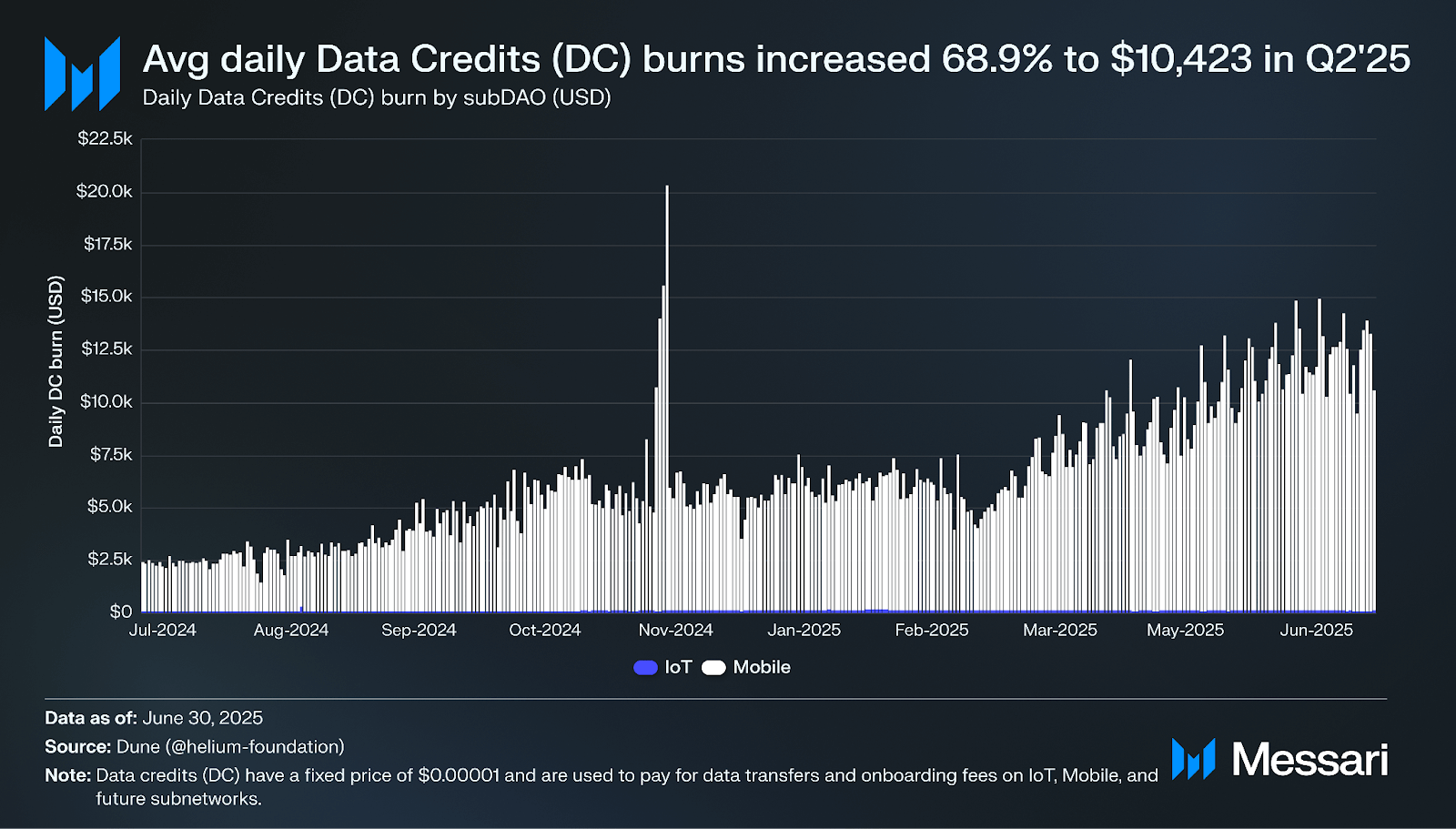

Data credits (DC) have a fixed price of $0.00001 and are used to pay for data transfers and onboarding fees on IoT, Mobile, and future subnetworks. The total DC burned at the end of Q2’25 was $3.1 million. Average daily DC burns increased 68.9% QoQ from $6,170 to $10,423. The Mobile Network accounted for $10,311 of the daily DC burns, representing 98.9% of the quarter’s total, while the IoT subDAO contributed $112.83.

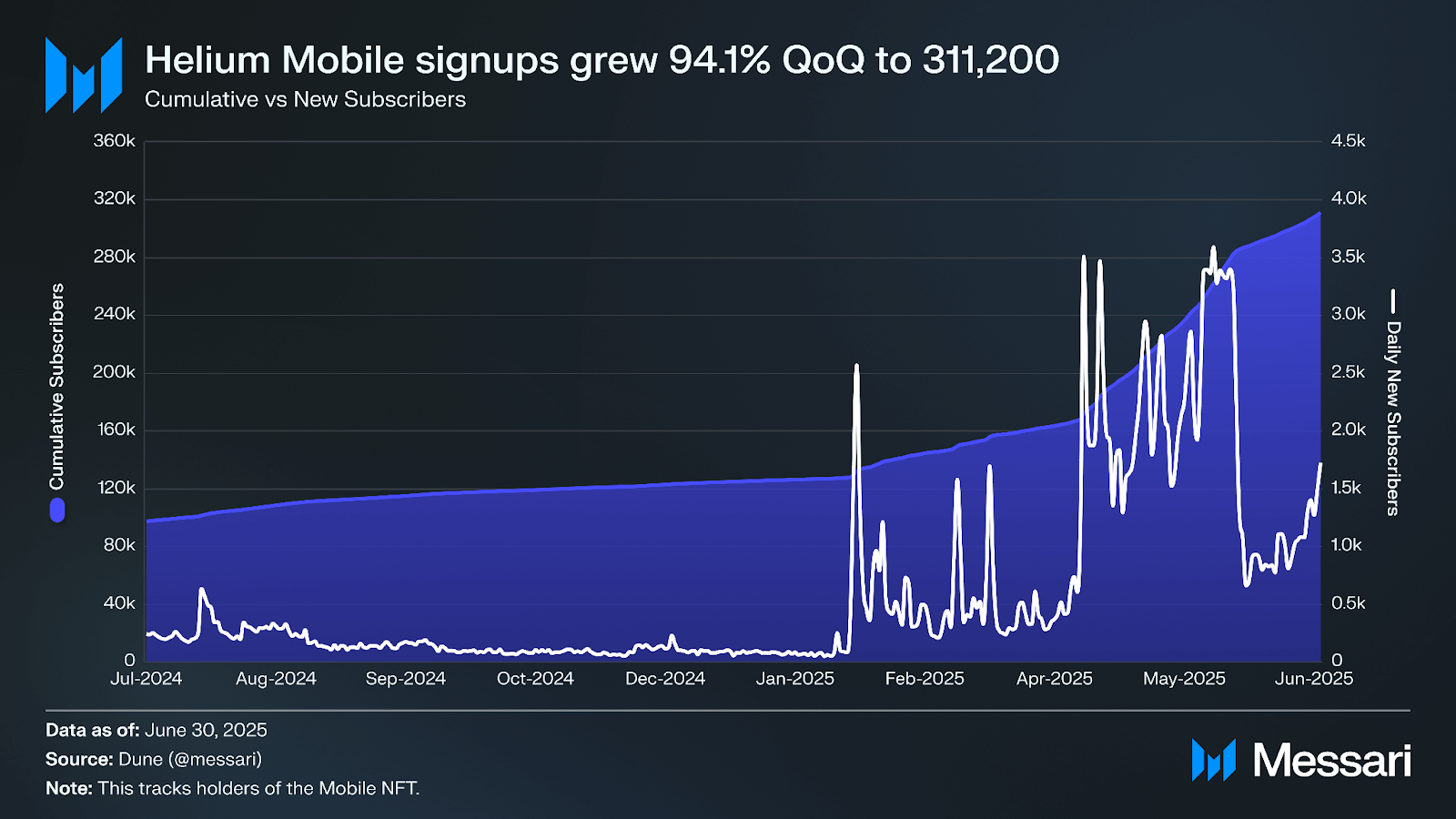

When onboarding to Helium Mobile, users are sent a Mobile NFT to their wallet, which is used to track Helium Mobile signups. In Q2, account signups grew 94.1% QoQ from 160,300 to 311,200.

Helium Mobile users automatically connect to Helium Hotspots when they are available and seamlessly switch to T-Mobile’s network when Hotspot coverage isn’t available.

In February 2025, Helium launched a free plan that allows users 3 GB of monthly data with the option to purchase additional data for $7.50/GB. Helium Mobile now offers three different tiers of plans:

All of these plans are eligible to earn Cloud Points from their plan. The free plan requires users to share their location data anonymously with the network. Air and Infinity users have the option to opt in to earn Cloud Points.

On June 10, 2025, Helium Mobile announced its “Sprout” Kids plan. The $5/month plan comes with 3GB of monthly data and unlimited talk and text. Parents or guardians manage the account, and subscribers of this plan will never be asked to share location data.

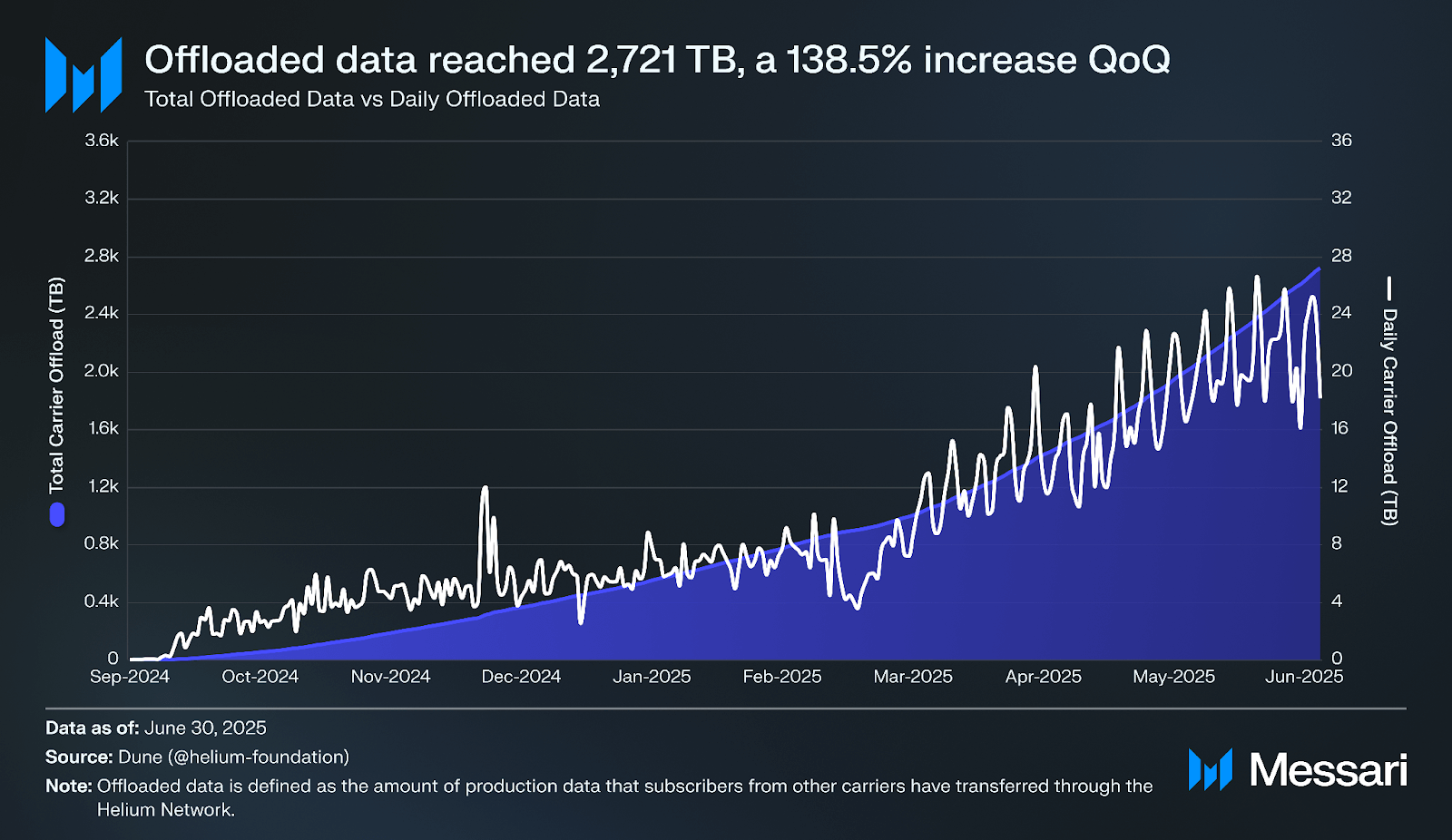

On June 18, 2024, Helium began allowing telecom companies to use the Helium Network to provide coverage for their users. Helium has partnered with several carriers to offload user data, including T-Mobile, Movistar, AT&T, Google Orion, and Wefi. In April 2025, Helium announced a partnership with AT&T, making it the latest carrier to join the offloading program.

Offloaded data is the amount of production data users from other carriers have transferred through the Helium Network. In Q2’25, cumulative all-time data offloaded (TB) grew 138.5% from 1,140.9 TB to 2,721 TB. Up-to-date statistics can be viewed here.

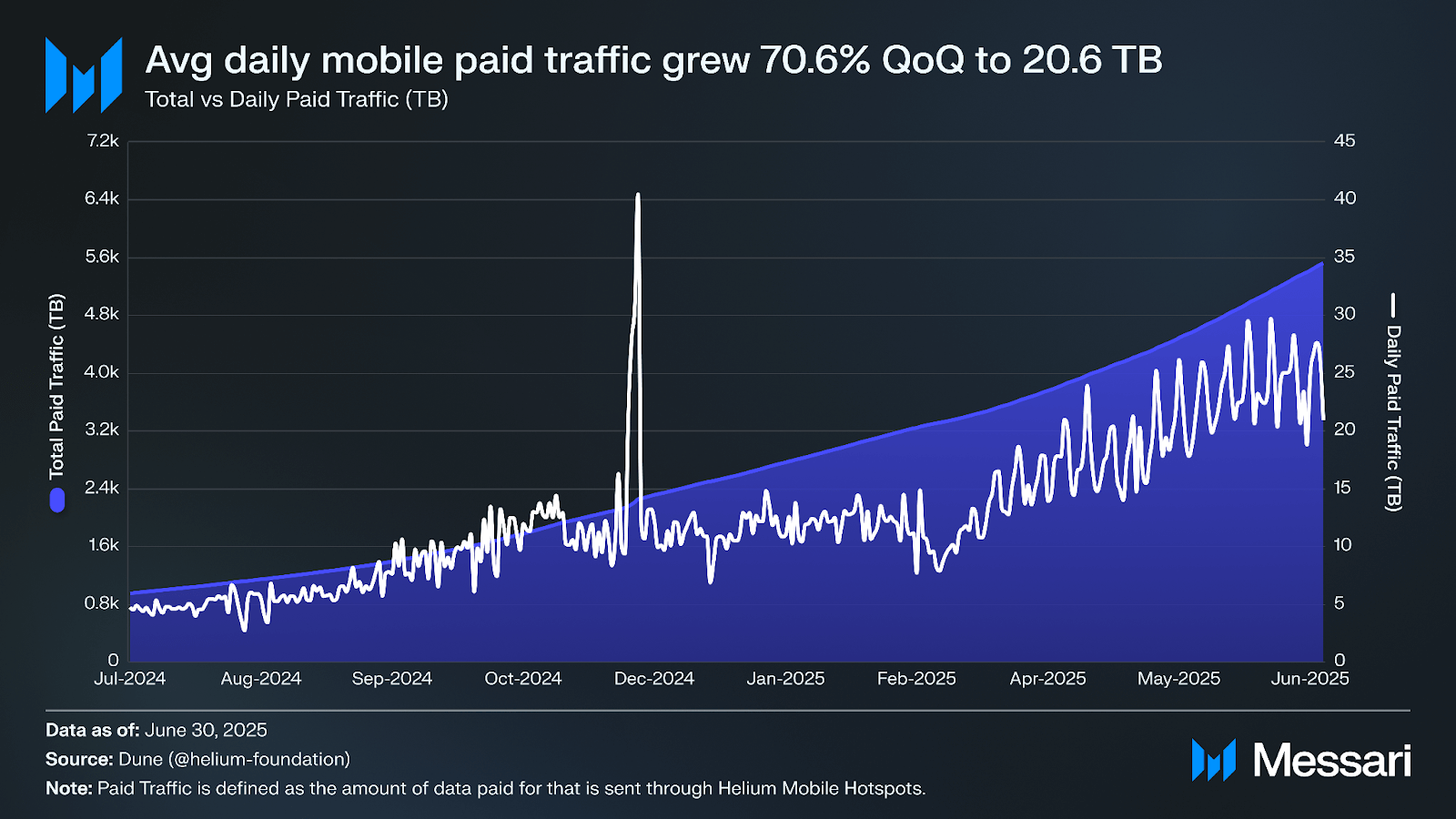

Paid traffic is the amount of paid data sent through Helium Hotspots. In Q1’25, average daily mobile paid traffic grew 70.6% QoQ from 12.1 TB to 20.6 TB. This growth brought the cumulative all-time paid traffic to 5,520.8 TB of data sent through Hotspots, a 51.5% QoQ increase. As one of the main revenue drivers for the Helium Network, this metric is expected to continue growing as more users join the network and partnerships for carrier offloading expand.

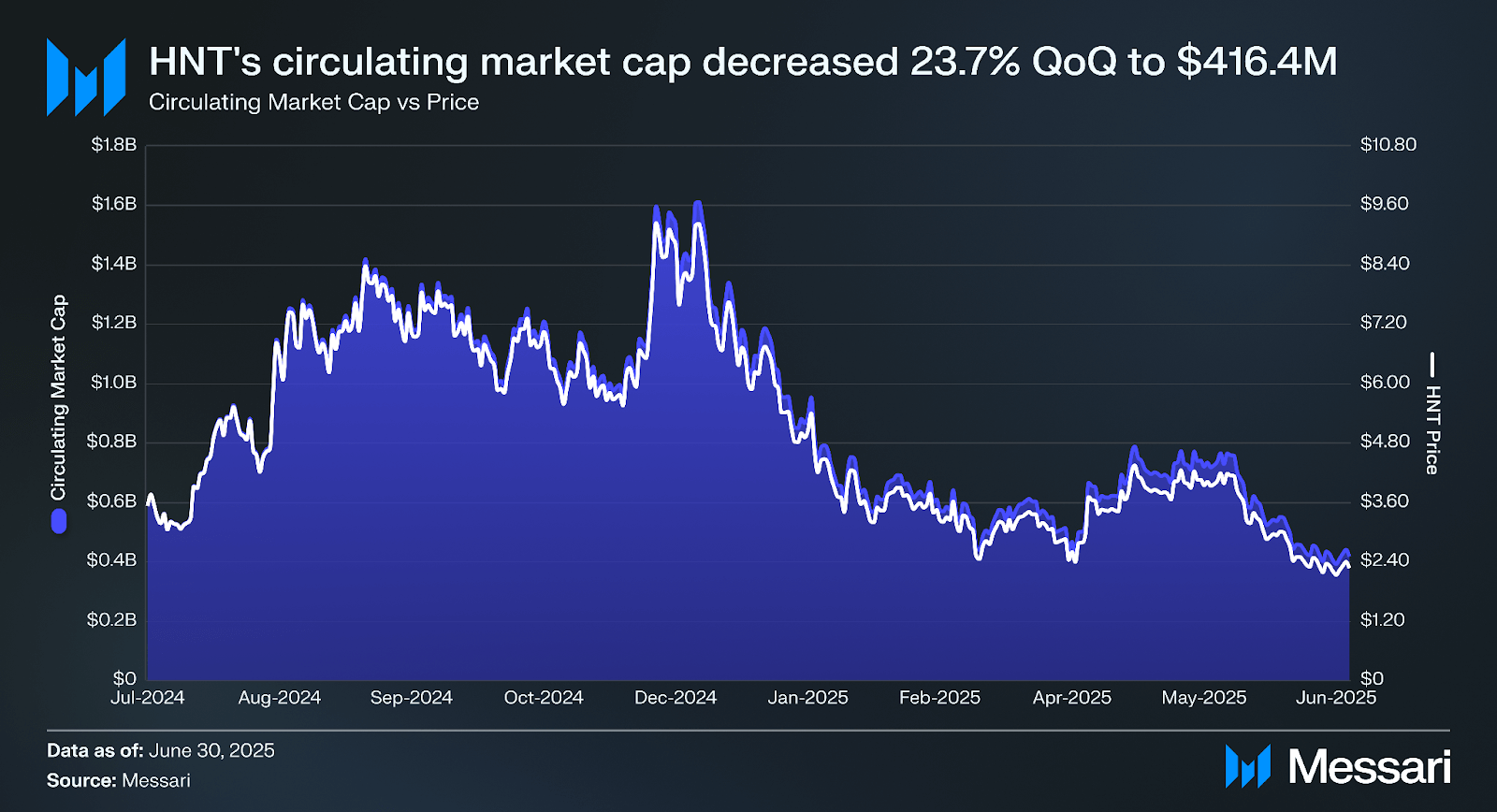

In Q2 2025, HNT’s circulating market cap decreased 23.7% QoQ from $545.7 million to $416.4 million, as its market cap rank fell from 96th to 122nd. HNT’s price fell 25.6% to $2.26 from $3.04. The Helium Network token (HNT) is the network’s primary token. It is distributed from the Helium DAO, minted through inflationary emissions, then distributed to subDAOs based on performance and engagement (i.e., Utility Score). There are two main functionalities for HNT:

Notably, due to the implementation of HIP-138, the HNT token’s value is now directly tied to Network utility. Instead of being exchangeable for IOT or MOBILE tokens, HNT is essential for using the Network. Anyone needing to transfer data must buy HNT and “burn” it to get Data Credits (the network’s payment method), which creates constant demand. This token emission design, called burn and mint equilibrium, ensures that the network usage is aligned with the amount of HNT in circulation. Since IOT and MOBILE subDAOs no longer receive any more HNT, and no more IOT and MOBILE will be minted, the swap ratios for HNT remain fixed. The MOBILE to HNT swap rate is fixed at 7,473.58 MOBILE for one HNT. The IOT to HNT swap rate is fixed at 6,608.32 IOT for one HNT.

On August 1, 2025, HNT emissions were cut by half. This is the third halving laid out in HIP-20, which cuts emissions by half every two years. Annual emissions will decrease from 15 million HNT to 7.5 million HNT, or 20,548 HNT per day. Hotspot owners’ data rewards will not be affected, as they are rewarded based on the amount of data their hotspot handles. Subscribers who provided coverage data, however, will see their rewards cut in half.

Q1’25 began with a significant shift in Helium’s governance approach through the introduction of HIP-141: Single-Token Governance and Helium Release Proposals, which was implemented in Q2’25. HIP-141 passed with 98.6% of votes in favor, and was a major step toward simplifying and strengthening the network’s decision-making processes. The proposal restructured Helium’s multi-token governance into a unified framework and introduced several changes to improve transparency, efficiency, and stakeholder alignment.

One of the most impactful changes implemented by HIP-141 is the consolidation of Helium governance under a single-token system. This move retired the IOT and MOBILE subnetwork tokens as mechanisms for governance participation. Instead, all governance activities will now be carried out exclusively through HNT, reinforcing HNT’s role as the core asset of the Helium ecosystem and simplifying participation across network stakeholders.

The proposal also reintroduced veHNT (voting-escrowed HNT) as the sole governance mechanism. While veHNT has existed since the Helium Network’s migration to Solana, HIP-141 formalizes it as the single, unified approach to voting. Users must lock their HNT to obtain veHNT, which grants them voting rights on proposals and network upgrades. The locking mechanism is designed to encourage long-term commitment, as the amount of veHNT a participant receives is proportional to the amount and duration of their HNT lockup.

These changes created a more streamlined governance structure, encouraging long-term commitment from stakeholders and aligning incentives with the network’s overall health.

A significant development at the end of Q1’25 and beginning of Q2’25 was Helium’s partnerships with Telefonica subsidiary Movistar Mexico and AT&T. The partnership with Movistar aims to improve connectivity in Mexico by leveraging community-driven infrastructure to enhance network coverage and reliability, particularly in underserved areas. This model reduces infrastructure costs for Movistar while potentially improving service quality for users.

To support this expansion, Movistar is selling Helium Mobile Hotspots in its retail stores and online channels, encouraging public participation in building and expanding the network across over 300 target locations. This initiative accelerates network growth and aligns with Helium’s philosophy of community-driven infrastructure development.

The AT&T partnership brings one of the U.S.’s biggest mobile carriers to the Helium network. AT&T subscribers are now leveraging the network in areas of sufficient coverage. These partnerships drove the network to experience multiple days of over 1 million daily users.

The Helium Foundation launched a $50 million Coverage Grant Program to support network deployment and accessibility. This initiative aims to make Helium’s decentralized wireless network more accessible and affordable, with the goal of connecting more communities worldwide. New York City was selected as the initial focus for the first wave of the Coverage Grant Program, and is now available nationwide in the U.S. as well as Mexico. To facilitate this expansion, the Helium Foundation has introduced new features on its Helium World platform, including ‘Observed Demand’ and ‘Expansion Zones’. These tools allow potential deployers to identify locations for network expansion by visualizing areas of high demand and strategic growth opportunities.

On April 10, 2025, the SEC dismissed its lawsuit against Helium Network with prejudice. The ruling established that Helium’s tokens (HNT, MOBILE, and IOT) and hotspot devices connected to its blockchain are not considered securities. This dismissal prevents the SEC from refiling similar charges against Helium in the future and may influence the broader DePIN sector.

Q2 2025 demonstrated the Helium Network’s accelerated growth and increasing integration with the mainstream telecommunications industry. The network achieved a landmark 2,721 TB in cumulative carrier data offloaded, a 138.5% increase QoQ, driven by new partnerships, most notably with AT&T. This expansion was mirrored in user adoption, with Helium Mobile sign-ups growing by 94.1% to over 311,200.

This quarter also brought wins that strengthen the network’s foundation. The dismissal of the SEC lawsuit provided regulatory clarity for Helium and the broader DePIN sector. On the governance front, the implementation of HIP-141 successfully unified the governance model under HNT and the veHNT framework, streamlining decision-making and encouraging long-term stakeholder alignment. The launch of the “Sprout” kids plan expanded Helium’s product offerings to a new market segment.

Despite a broader market downturn that saw HNT’s market cap decrease, the network’s operational performance, partnerships, and legal and governance advancements position it for sustained growth and maturation as a viable, decentralized alternative in the global wireless market.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Helium Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.