Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Algorand (ALGO) is a smart contract platform using a Pure Proof-of-Stake (PPoS) consensus mechanism. The protocol was founded by Turing award-winning computer scientist Silvio Micali, also known for co-inventing zero-knowledge proofs, Verifiable Random Functions (VRF), and probabilistic encryption. Since the Algorand 4.0 upgrade in January 2025, validators holding at least 30,000 ALGO earn staking rewards. Algorand does not include a staking lockup or slashing mechanism. Similar to relying on stake weight in consensus, Algorand PPoS randomly selects consensus nodes based on their ALGO balances using a Verifiable Random Function (VRF), where having a larger balance increases the holder’s chance of selection. Algorand’s smart contract execution layer is powered by the Algorand Virtual Machine (AVM). Algorand supports smart contract development in Python, TypeScript, as well as other community-developed languages. Algorand Technologies leads development, while the Algorand Foundation, a not-for-profit, supports governance, ecosystem funding, and community-driven development.

Website / X (Twitter) / Discord

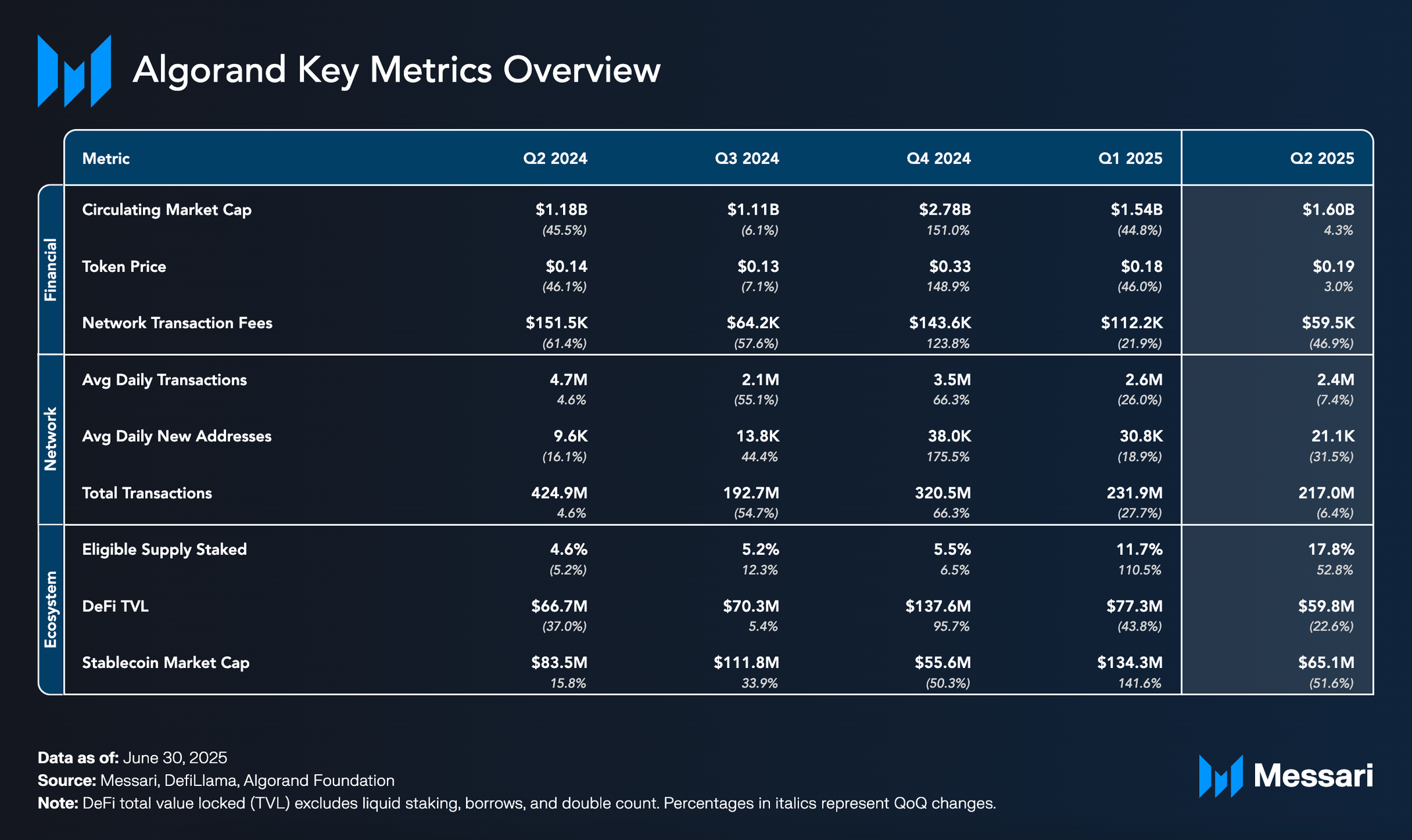

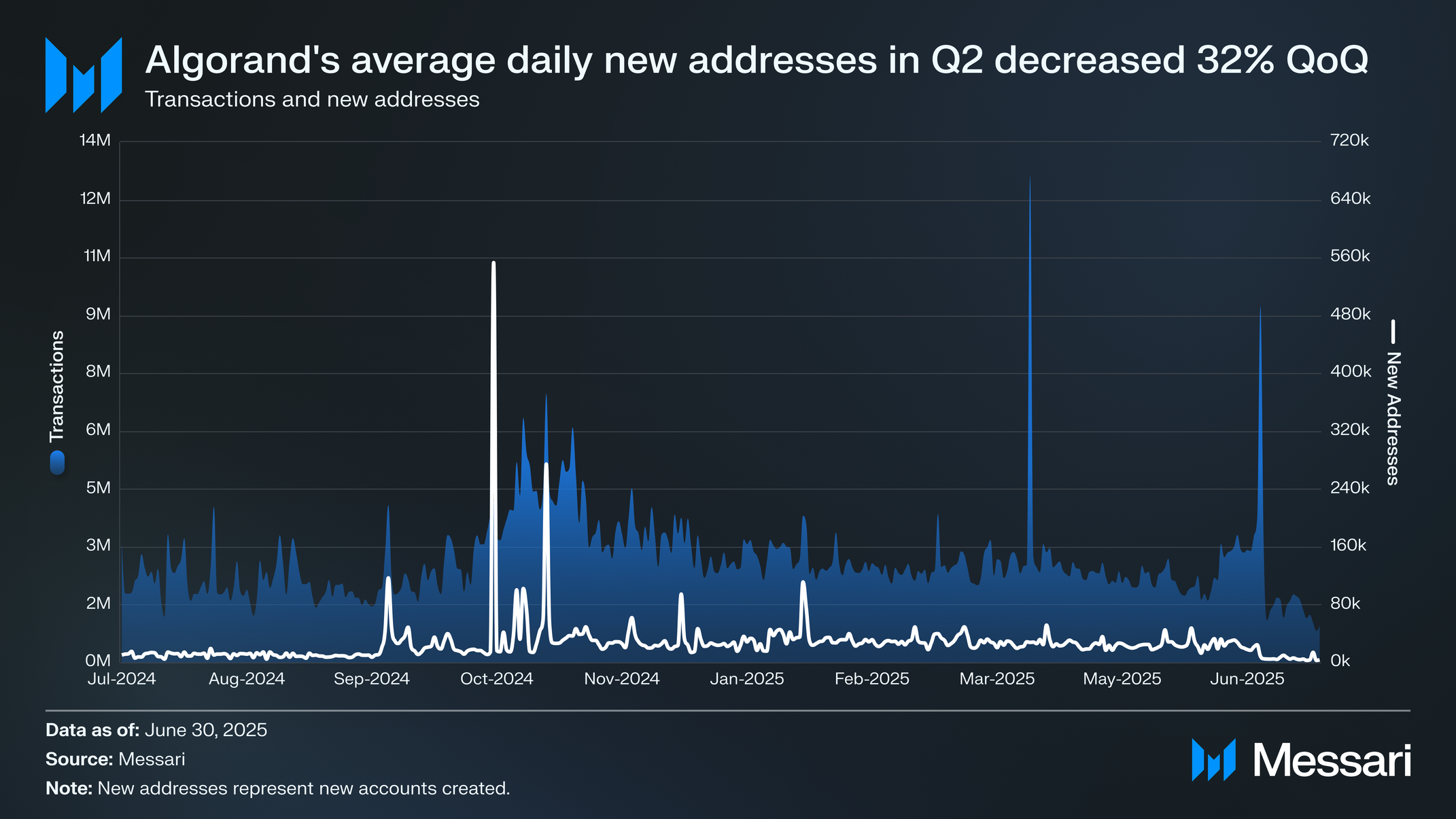

Algorand’s circulating market cap increased by 4% QoQ, rising from $1.54 billion at the end of Q1 2025 to $1.60 billion at the end of Q2 2025. ALGO’s price mirrored the rise, moving from $0.18 to $0.19. Circulating supply also ticked higher, up 1.0% QoQ, from 8.54 billion to 8.63 billion ALGO, as scheduled emissions and staking rewards continued.

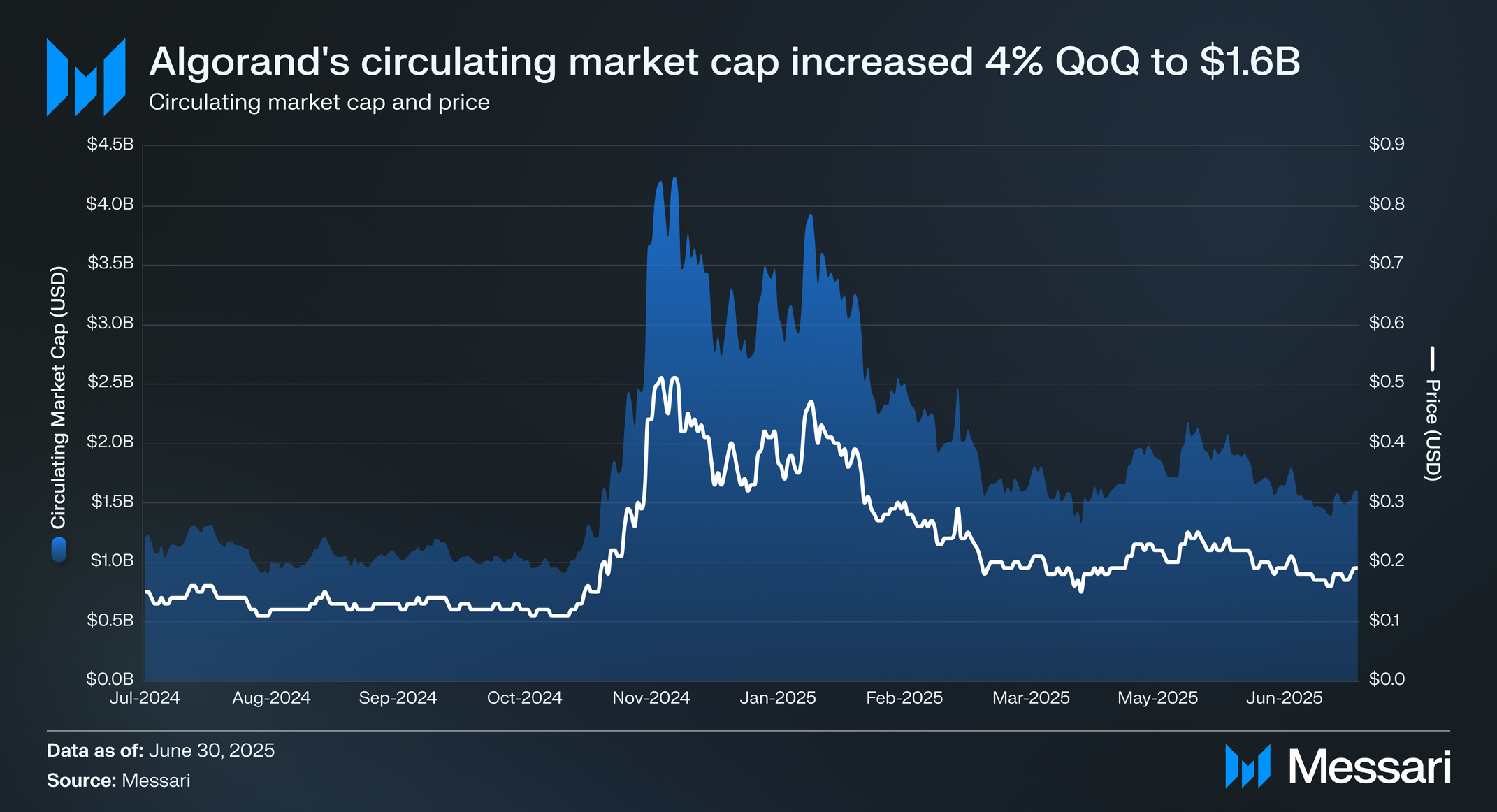

Total fees on Algorand, collected from network transactions, decreased by 46.9% QoQ, falling from $112,000 in Q1 to $59,500 in Q2. Over the same period, average daily transaction fees declined 47.5%, from $1,250 to $650. Additionally, average daily transactions declined 7.5% QoQ, from 1.3 million to 1.2 million, while total transactions fell from 232.0 million to 217.1 million.

In Q2, daily fees and daily transactions peaked on April 3, 2025, with transactions reaching 12.6 million and fees $2,500. The spike was driven by activity from a liquidation contract, which filled a large volume of orders over a sustained period, exceeding 5,000 transactions per second for more than 40 minutes and highlighting the performance capacity of Algorand. Fees and transactions also reached a secondary peak on June 12, with transactions reaching 9.2 million and fees $1,800. This spike was driven by TravelX, which completed its final onchain ticket minting batches before suspending onchain activity due to compliance requirements.

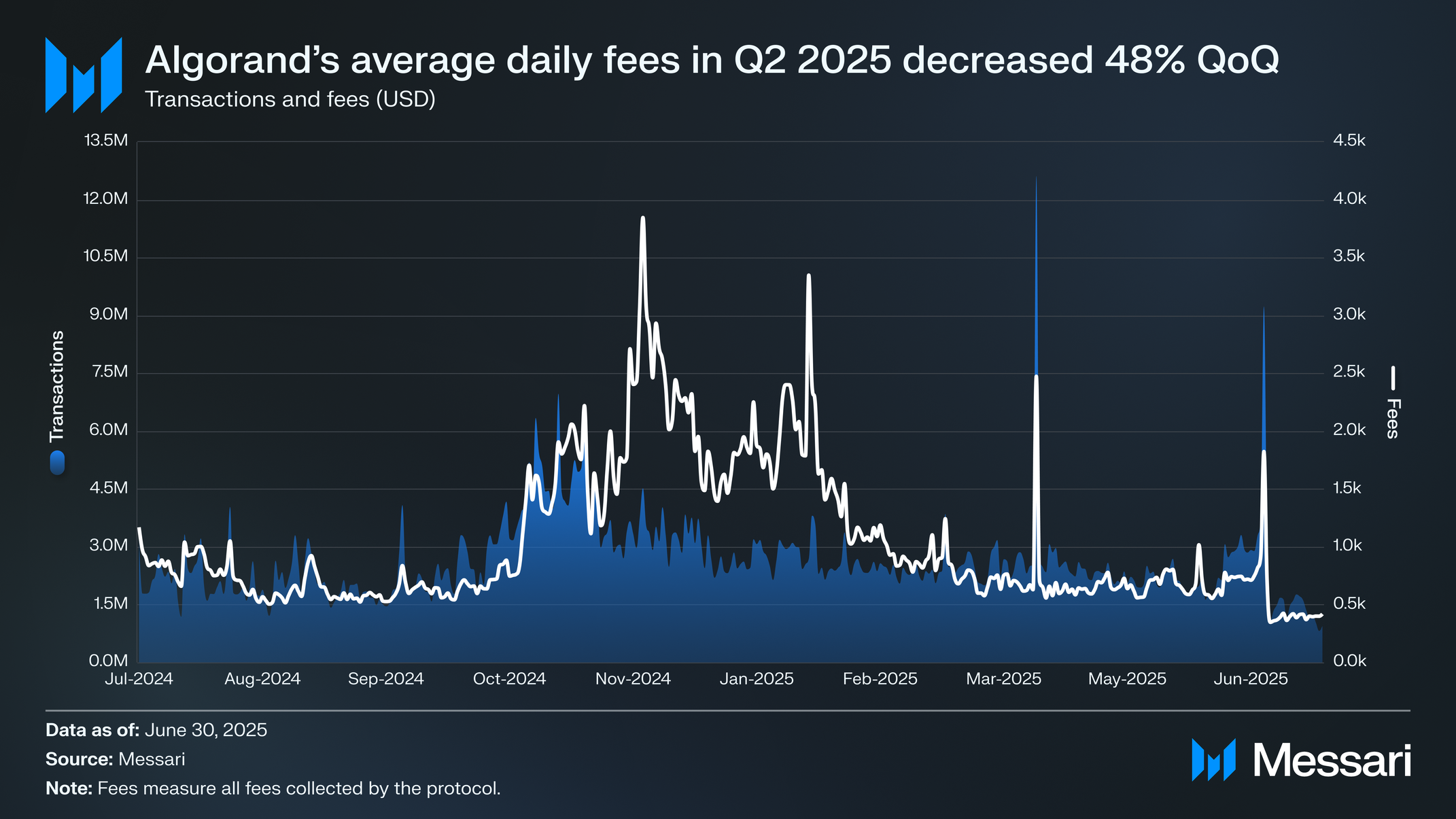

The number of average daily new addresses on Algorand decreased 31.5% QoQ from 31,000 in Q1 to 21,000 in Q2. Similarly, total new addresses created over the quarter decreased 30.7% QoQ, declining from 2.8 million in Q1 to 1.9 million in Q2.

Staking ALGO centers on network security rewards. Since the Algorand 4.0 upgrade, any account that keeps at least 30,000 ALGO online through a validator node is eligible to earn block rewards: 10 ALGO plus 50.0% of the block’s transaction fees. The 10 ALGO subsidy decays by 1.0% every million blocks and is underwritten by the Algorand Foundation for roughly two years. Rewards arrive instantly onchain, there is no lock-up or unbinding period, and the protocol still avoids slashing. Offline or malicious nodes are excluded from future committees.

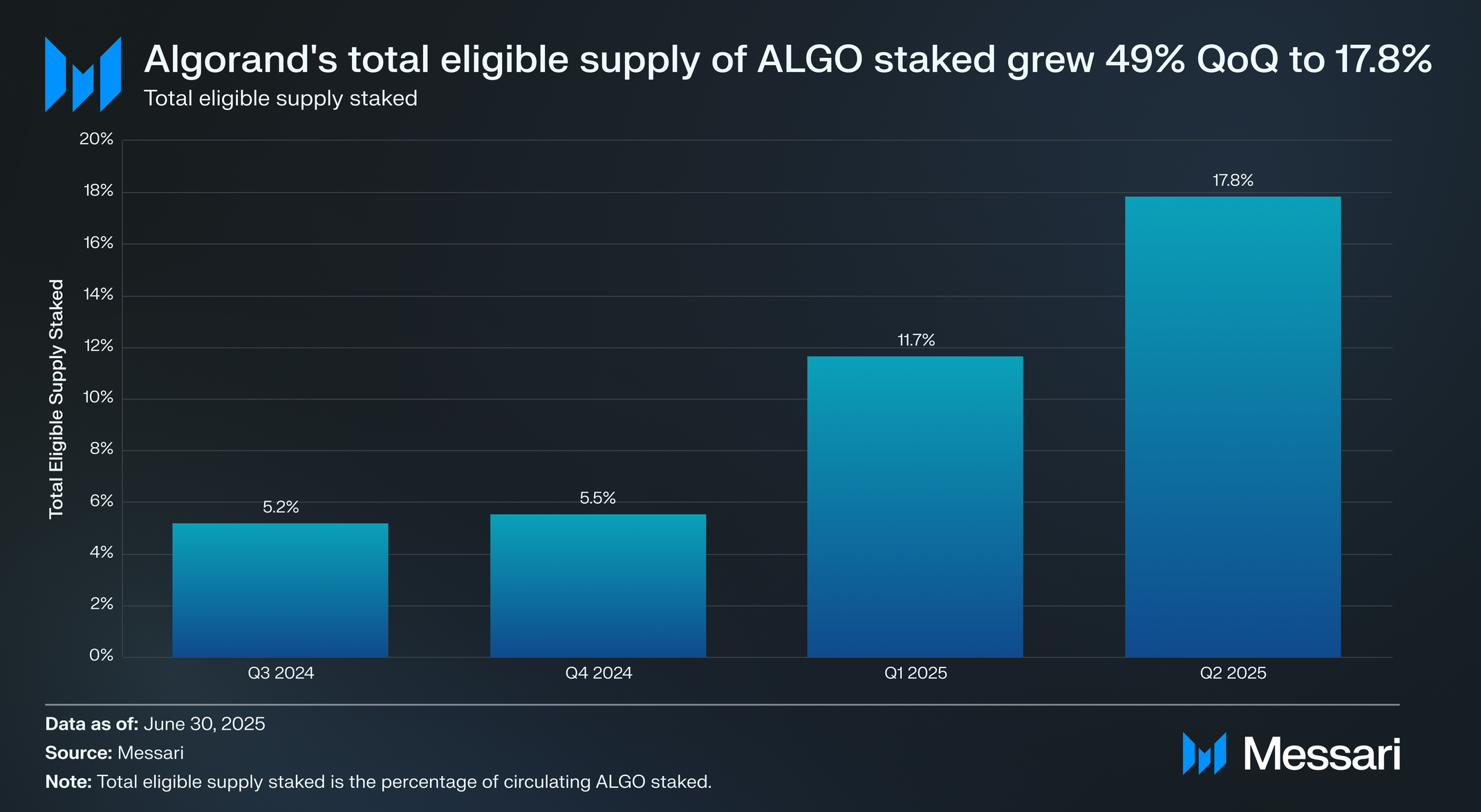

In Q2, staked ALGO increased to 1.95 billion, up 28.7% QoQ. With the phase-out of Governance Rewards in Q1 and the shift to continuous staking incentives, the sharp quarter-end uncommit cycles that previously drew down the staked supply have largely dissipated. The new model encourages sustained participation, gradually reducing Foundation dominance and broadening community representation.

By the end of Q2, community-held stake rose to 1.54 billion ALGO, a 51.1% QoQ increase. Concurrently, the Algorand Foundation’s stake fell 17.1% to 412.0 million ALGO. This shift aligns with Algorand’s pursuit of decentralization: while the Foundation once held nearly twice as much as the community, the community stake now accounts for 78.9% of all staked ALGO.

Total eligible supply staked, the percentage of circulating ALGO staked, rose to 17.8% in Q2, up 49.4% from 11.7% in Q1. The increase suggests that block-level incentives introduced in the Algorand 4.0.1 upgrade are beginning to take effect. As more node operators complete the upgrade path and staking rewards accrue continuously, participation appears to be stabilizing around these incentives rather than the legacy governance cycle.

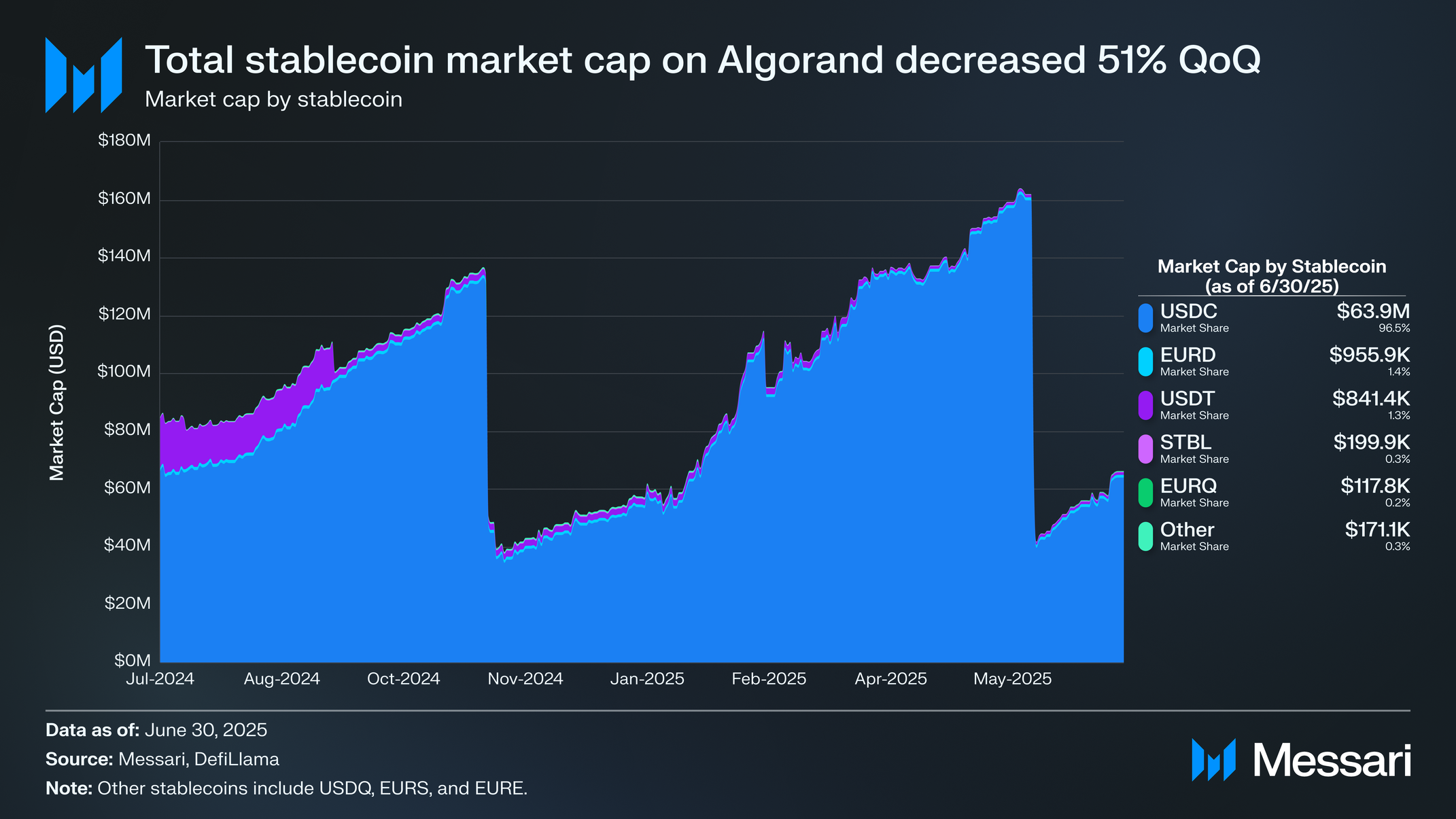

The total stablecoin market cap on Algorand fell 51.1% QoQ in Q2, dropping from $135.4 million to $66.2 million by quarter’s end. The decline was almost entirely driven by USDC, which dropped from $159.8 million market cap on May 26, 2025, to $64.7 million on May 27 and $39.6 million on May 28, a 75.2% decrease in two days. USDC eventually recovered to $63.9 million by June 30, but was still down 52.1% from the end of Q1. The drop was attributed to Binance reallocating funds between chains, a practice Circle described as operationally routine.

Other stablecoin results varied in Q2: EURD inched down 3.1% QoQ to $956,000, USDT remained unchanged as Tether wound down Algorand support, while smaller tokens such as STBL increased 0.5% QoQ. By quarter-end, USDC made up 96.5% of Algorand’s stablecoin supply, leaving EURD and USDT with around 1.0% share each.

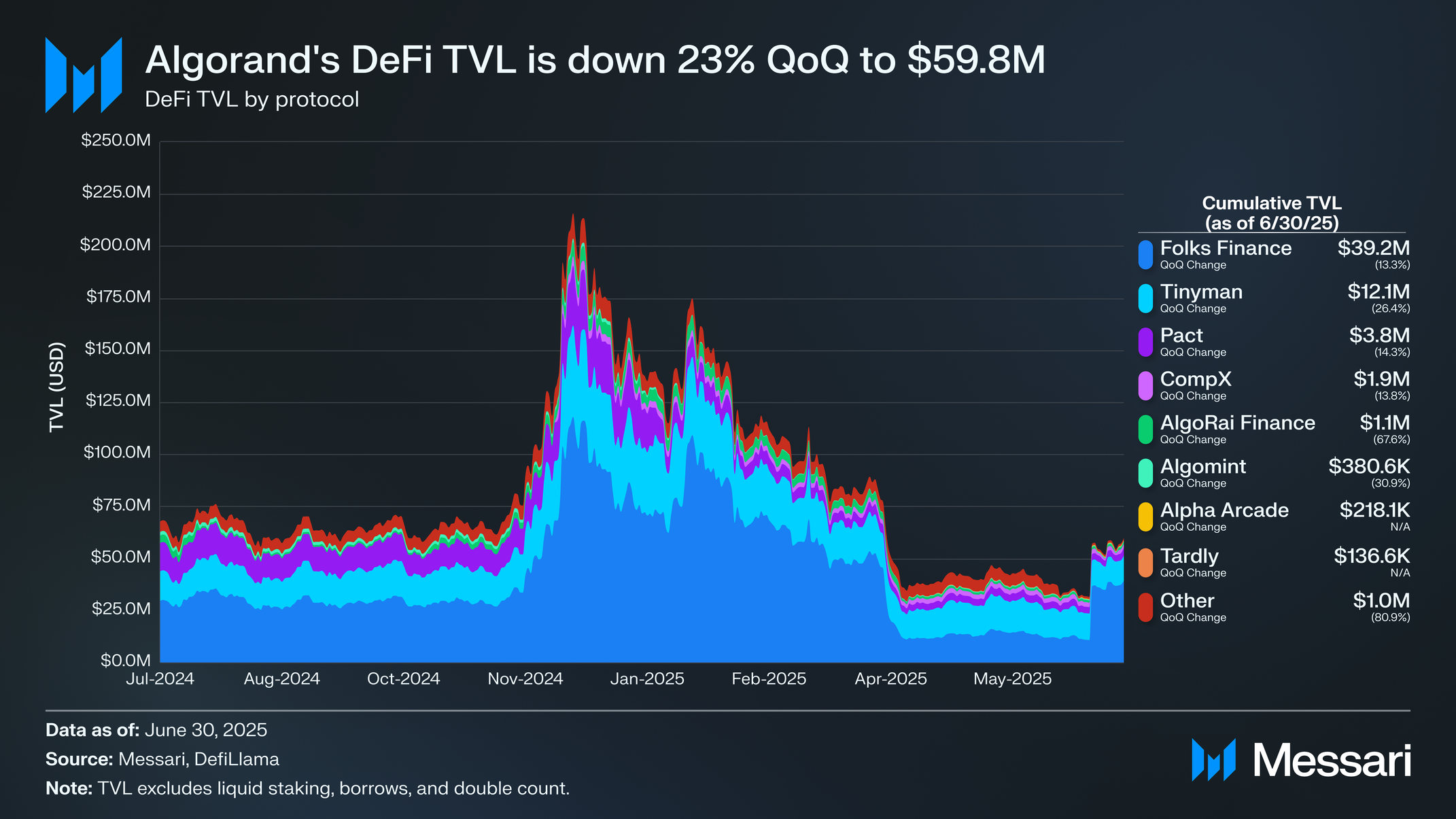

DeFi total value locked (TVL) declined 22.6% QoQ to $59.8 million in Q2. Algorand DeFi products in the top six by TVL decreased, with Folks Finance dropping 13.3% QoQ to $39.2 million, Tinyman to $12.1 million (-26.4% QoQ), Pact to $3.8 million (-14.3% QoQ), CompX to $1.9 million (-13.8% QoQ), AlgoRai Finance to $1.1 million (-67.6% QoQ), and Algomint to $380,600 (-30.9% QoQ). Alpha Arcade and Tardly were launched in Q2 and held $218,100 and $136,600 in TVL, respectively.

The Algorand Foundation concluded its incentivized Governance Rewards program at the end of Q1 2025, following 14 rounds across 3.5 years that distributed 687.5 million ALGO. Of this, 526.8 million ALGO went to governors, while 160.7 million supported ecosystem initiatives, including DeFi rewards, NFT rewards, and the xGov pilot grants.

With the end of reward-driven governance, Algorand now centers its governance model on three pillars: node decentralization with staking for rewards, xGov for expert-driven decisions, and non-incentivized Community Governance for referendum-style input. Future governance votes will occur through shorter, event-driven cycles.

The first xGov council will be elected in Q3, via a referendum, with voting beginning on July 7, 2025, and ending on July 15. Any ALGO holder with onchain governance experience may run. Councilors will be lightly compensated and held publicly accountable. The coming quarters will test two conditions: whether staking can retain more ALGO online compared to quarterly lockups, and whether an expert, vote-approved council can independently manage the xGov program grants with minimal Foundation oversight.

Algorand ended Q2 2025 with a broader staking base, greater community participation, and continued real-world integrations. Total staked ALGO rose 28.7% QoQ to 1.95 billion, with community-held stake increasing 51.1% and reaching 78.9% of the total. The transition from governance rewards to continuous staking incentives contributed to more consistent participation and a reduced share of Foundation-controlled stake.

DeFi TVL declined 22.6% QoQ to $59.8 million, while the stablecoin market cap declined 51.1%, primarily due to volatility in USDC balances. Transaction activity and fee revenue declined across the board, with daily fees down 47.5% and new address creation falling 30.7% QoQ. Despite these declines, development continued with the release of Algorand 4.1.1, which introduced network and API optimizations. The launch of MiCA-compliant stablecoins, mTBILL’s first non-EVM deployment, and integrations with AEON, Paycode, and Pera’s non-custodial Mastercard debit card supported ecosystem expansion.

Governance entered a new phase as the network prepared to elect its first xGov Council. With new tools for developers, expanded staking access, and policy engagement through the Blockchain Association, Algorand closed the quarter with a more decentralized infrastructure and a growing base of ecosystem participants.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Algorand Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.