Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Aptos (APT) is a Layer-1 blockchain designed around the core tenets of scalability, safety, reliability, and upgradeability. Aptos was born out of Meta’s Diem and Novi projects, eventually launching in October 2022. Core developer Aptos Labs raised about $400 million in two 2022 private investor rounds.

Aptos’ technological stack features many novel aspects, including the AptosBFTv4 consensus mechanism, the Quorum Store mempool protocol, the Block-STM parallel execution engine, and the programming language Move. Aptos Move, which builds on the original Move language created by the Diem and Novi teams, offers enhanced flexibility and safety compared to other Web3 programming languages. Aptos Move is being co-developed by multiple protocols.

Other key features aim to improve user experience and safeguards, including accounts where private keys are decoupled from public keys, transaction pre-execution to explain the outcome of a transaction before a user signs it, and transaction expiration time and sequence numbers. Development of the Aptos network and growth of the Aptos ecosystem is primarily led by Aptos Labs and the Aptos Foundation. For a full primer on Aptos, refer to our Initiation of Coverage report.

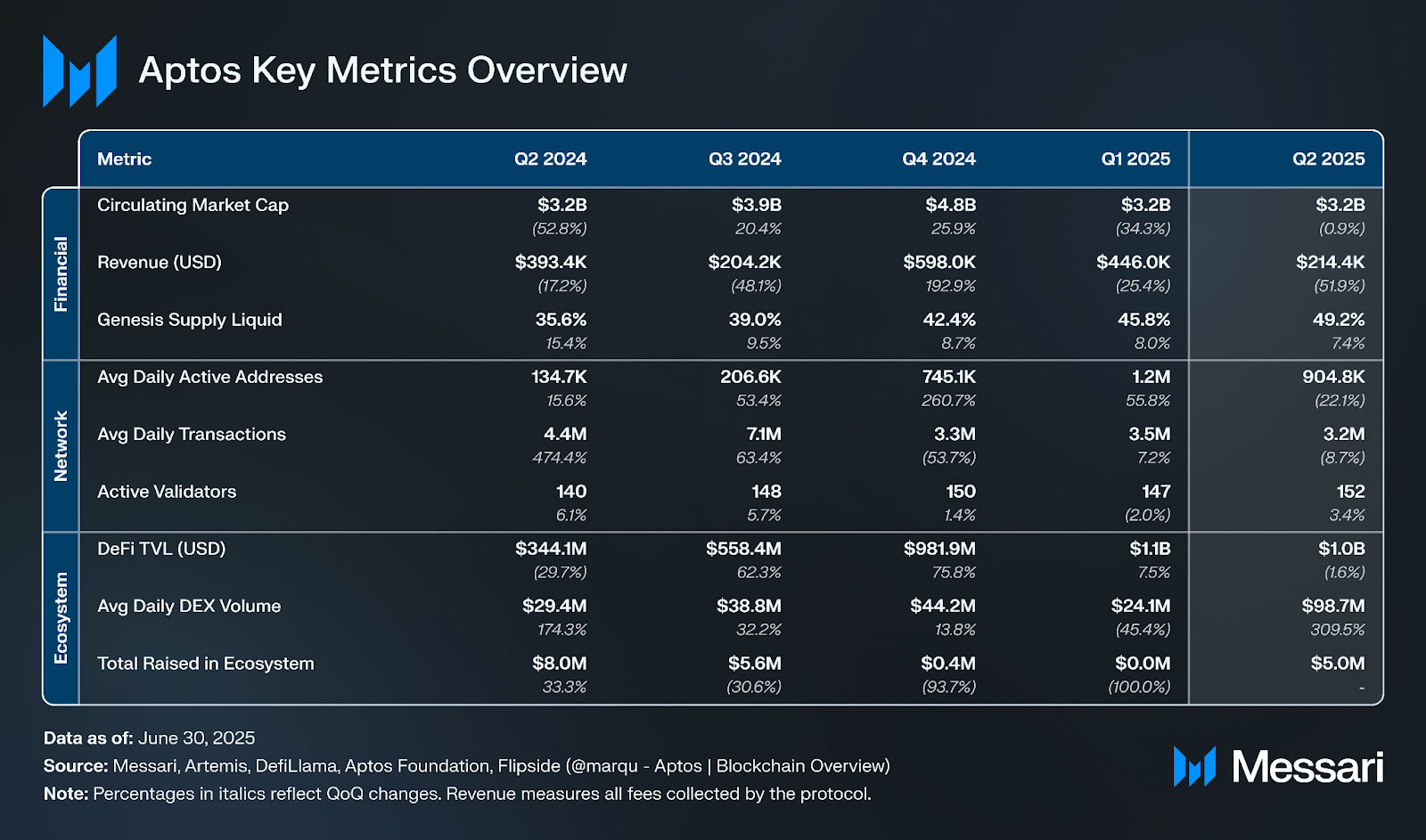

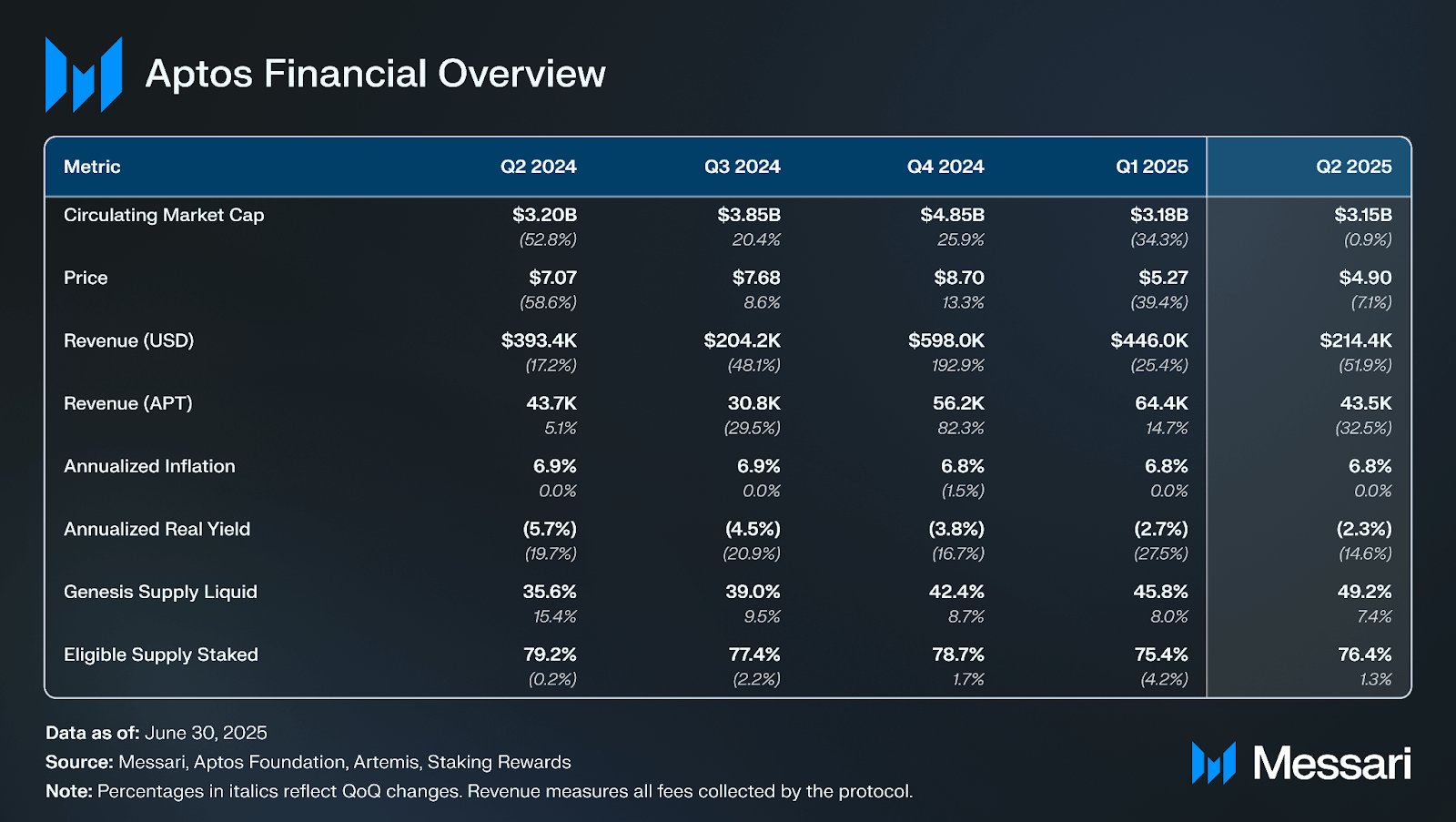

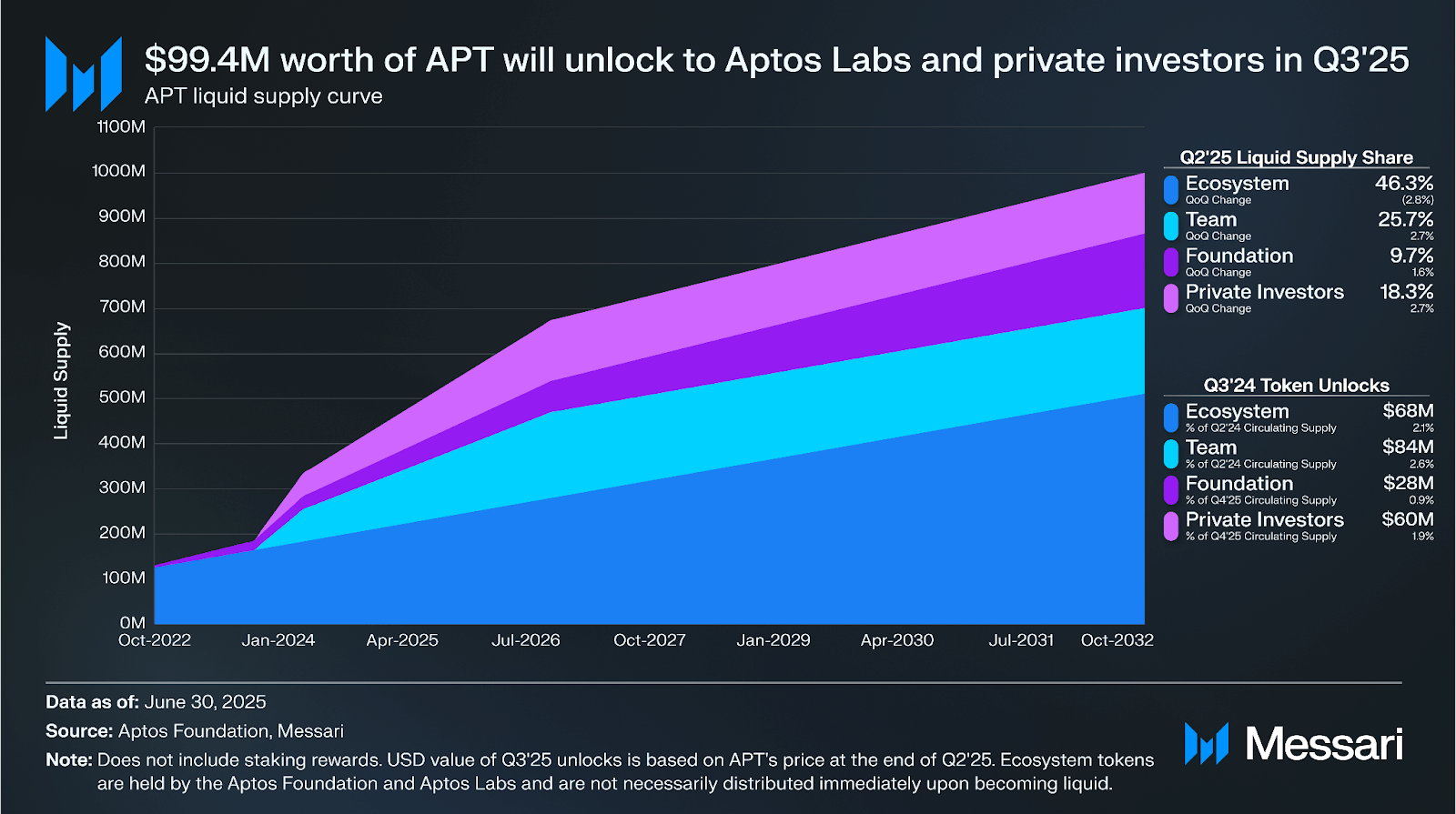

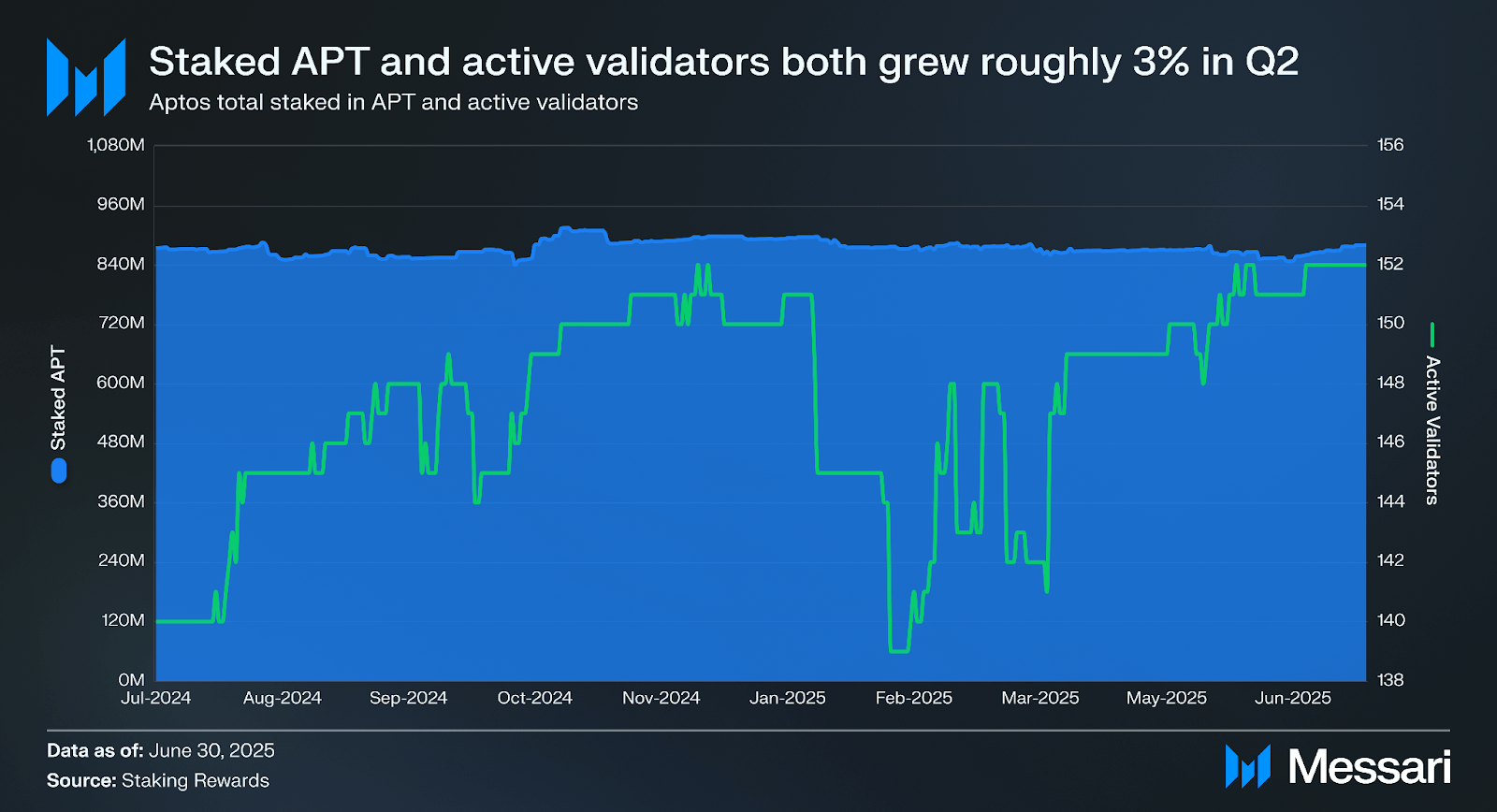

APT’s circulating market cap decreased by 34.9% in H1 to $3.2 billion, while its market cap rank dropped one spot to 31. APT’s price dropped 43.7% in H1 from $8.70 to $4.90, as token unlocks continued in H1, detailed further below. For comparison, other top networks had mixed results in H1, with BTC’s circulating market cap up 15.1%, while ETH and SOL declined 25.2% and 8.6% respectively. Notably, in March, Bitwise filed an S-1 with the SEC to register an APT ETF. APTB, Bitwise’s Aptos Staking Exchange-Traded Product (ETP), began trading on the Swiss exchange SIX in November 2024.

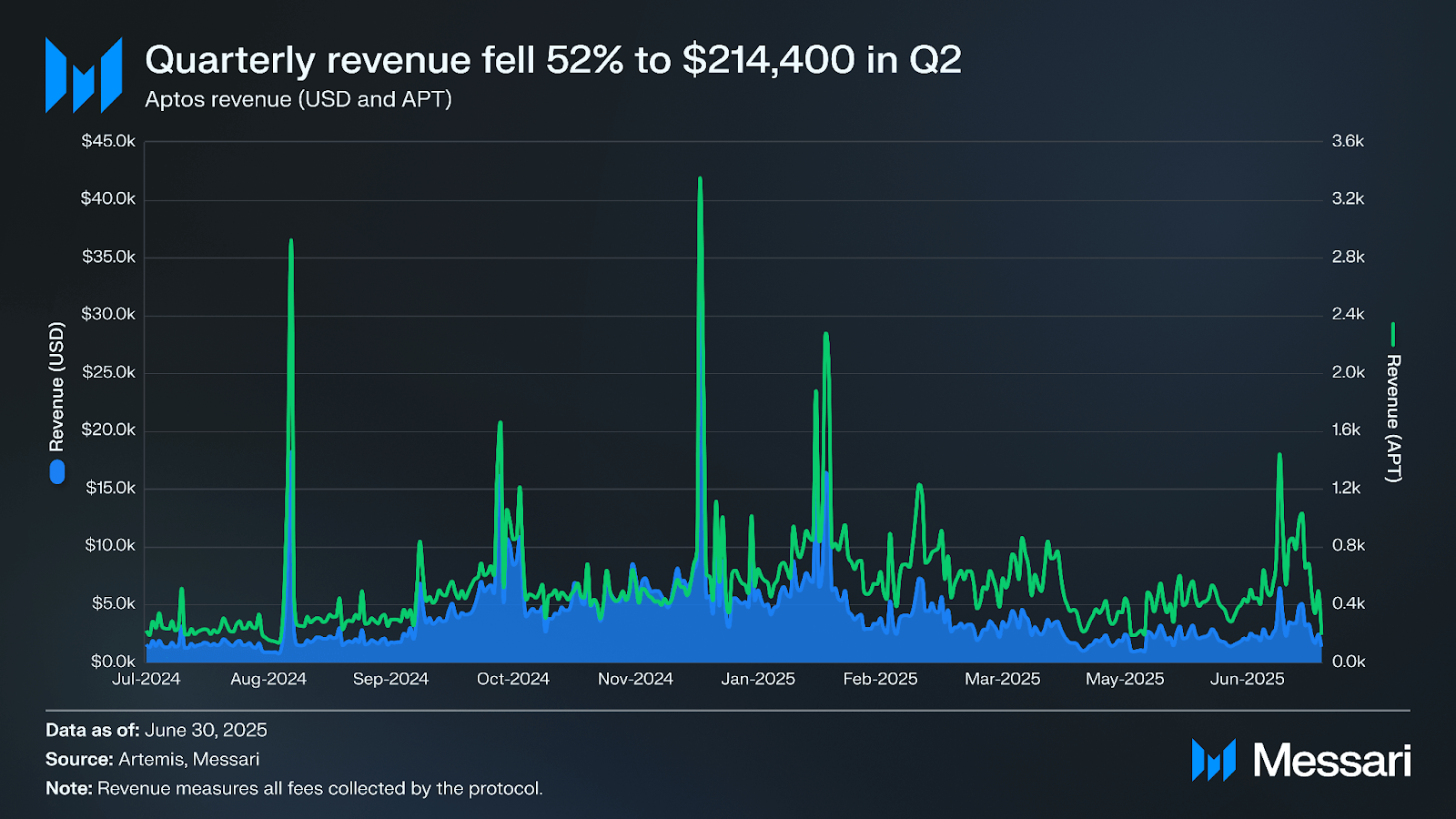

Aptos revenue, i.e., all fees collected by the protocol, fell by 51.9% QoQ to $214,400 in Q2. This followed a 25.4% QoQ decline from a peak of $598,000 in revenue in Q4 to $446,000 in Q1. Currently, Aptos burns all revenue generated, though these burned tokens have not significantly offset inflation.

Aptos’ genesis supply includes the 1 billion APT initially allocated but not staking rewards. At Q2 close, 49.2% of the genesis supply had unlocked, a 7.4% QoQ increase.

From April 2024 through September 2026, 11.31 million APT (1.1% of the genesis supply) unlock on the 12th day of each month as follows:

At the end of Q2, 76.4% of the eligible supply was staked (+1.3% QoQ). Because locked tokens can still be staked and earn liquid staking rewards, the supply eligible to be staked is APT’s total supply rather than its circulating supply.

In addition to APT supply unlocks, Aptos has inflationary APT staking rewards. These rewards began at a 7% annualized rate based on the initial total supply of 1 billion APT, and were initially set to decrease by 1.5% each year until reaching 3.5%.

However, on June 21, AIP-119 was executed, immediately lowering the staking reward rate APR by 0.25% to 6.54%, as part of the AIP’s seven-month schedule to reduce the reward rate to 5.26% over the next seven months. Motivations behind reducing the staking rewards rate include aligning the staking yield with other competitor L1s like Ethereum, incentivizing restaking and DeFi activities, and reducing token inflation.

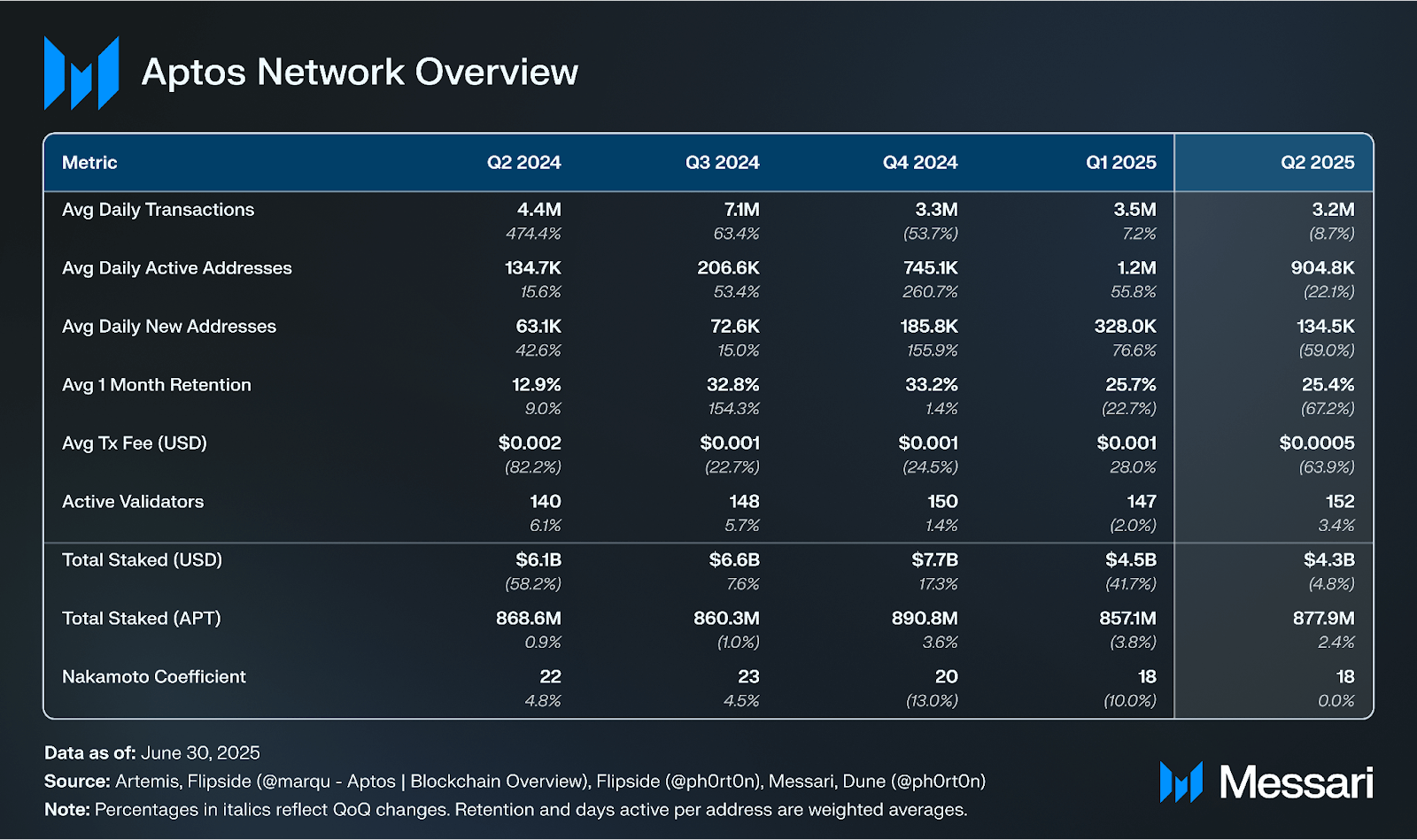

Network activity, measured by transactions and active addresses, declined in Q2 after increasing in Q1. In Q2, average daily transactions and active addresses declined QoQ by 8.7% to 3.2 million and 22.1% to 904,800, respectively. Prior to this, average daily active addresses peaked at 1.2 million in Q1 (+55.8% QoQ), while average daily transactions increased 7.2% QoQ to 3.5 million. Average daily transactions peaked at 7.1 million in Q3 2024, due to a record-breaking spike to 326.3 million transactions on Aug. 15, following the launch of Tapos Game #2, a tap-to-earn game where players click to make a cat jump. Aptos finished Q3 2024 with the third-highest daily average transactions among L1s, trailing only Solana and Tron. In July, Aptos surpassed 3 billion in lifetime transactions, with more than 3.1 billion to date.

Battle RPG game Defi Cattos led Aptos smart contracts activity in Q2, averaging 339,660 daily interactions, followed by the AptosFramework contract, which averaged 149,160, and Kratos Gamer Network (KGeN), which averaged 110,290.

In Q1 2025, the average transaction fee increased 111.3% QoQ to 0.00027 APT($0.0014). Thereafter in Q2 it decreased 61.1% QoQ to 0.00011 APT ($0.00052), roughly 10-100x cheaper than other top L1 blockchains like TRON, Solana, Ethereum, Avalanche, and BNB Smart Chain.

Monthly active users (MAU), defined as the number of unique sending or receiving addresses over a 30-day period, stayed above 10 million throughout the first half of 2025, maintaining the growth in H2 2024 when MAU steadily increased from 2.5 million in July 2024 to 10 million in December 2024.

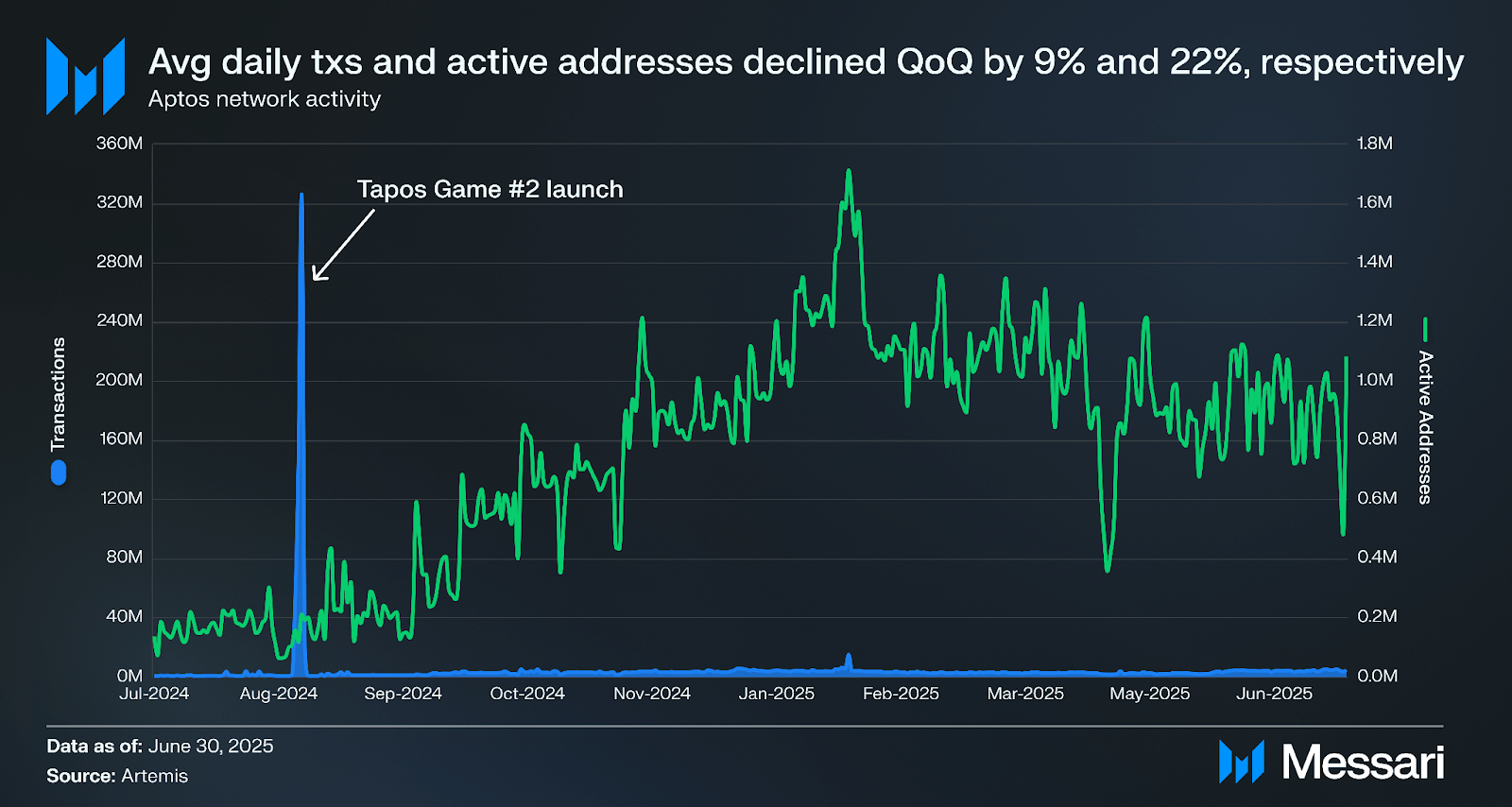

In Q1 2025, average daily new addresses increased 76.6% QoQ to 328,000 followed by a 59.0% QoQ decline in Q2 to 134,500. The retention rate is the percentage of addresses that remain active for a given time period after initially being active. In Q1 2025, the average one-month retention rate was 25.7%, down 7.5 percentage points from 33.2% in Q4 2024. In Q2 2025, the average one-month retention rate was 25.4%, only 0.3 percentage points lower than Q1 2025.

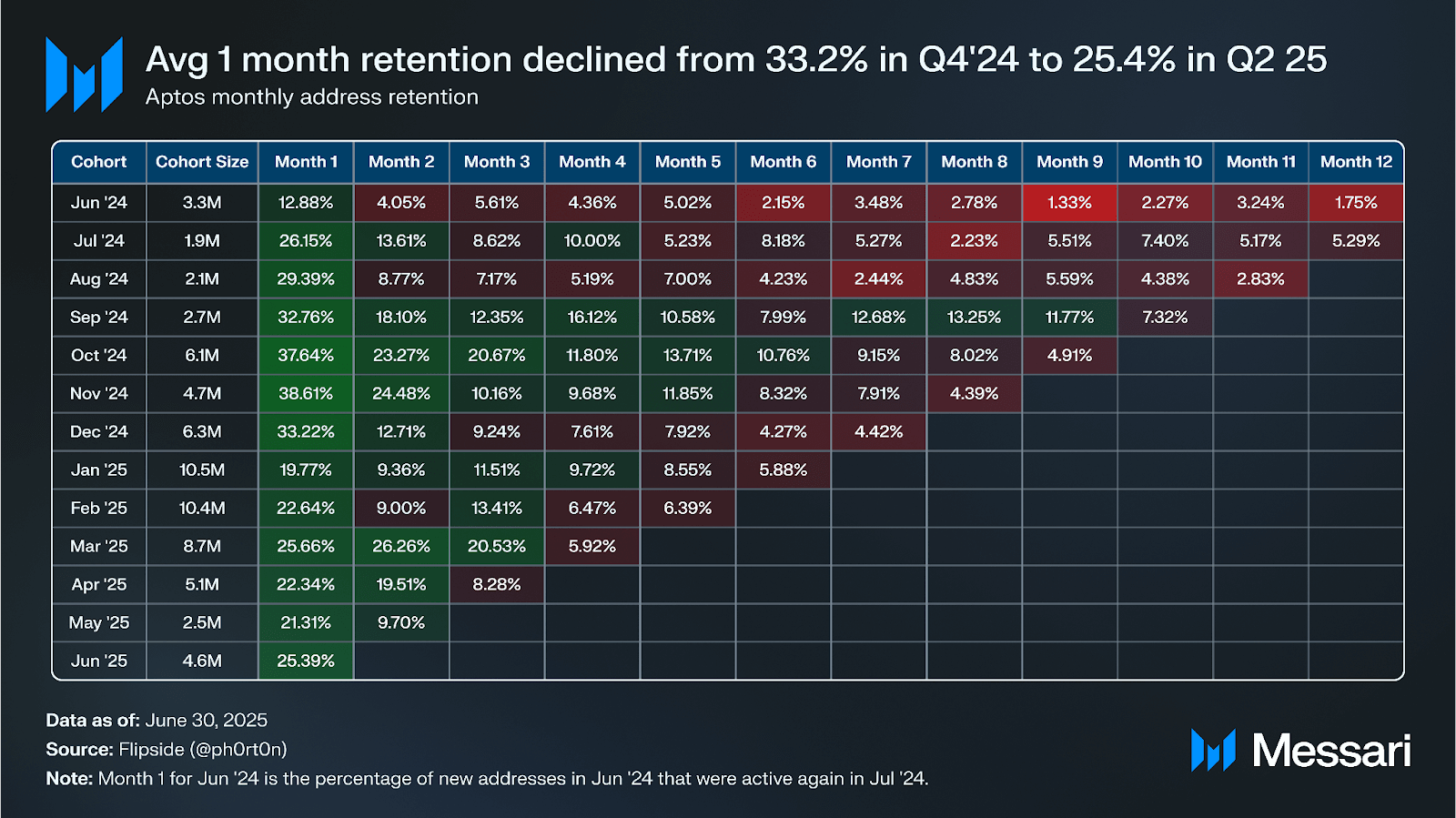

Aptos closed Q2 with 877.9 million in staked APT (+2.4% QoQ), though staked APT denominated in USD declined 4.8% QoQ to $4.3 billion. Still, Aptos closed Q2 as the ninth-largest network by staked market cap. Notably, Aptos does not have a slashing mechanism and allows locked tokens (currently ~50% of the genesis supply) to be staked to earn liquid rewards.

Active validators on Aptos continued to grow, up 3.4% QoQ to an all-time high quarterly close of 152 validators. About half of the validators accept in-protocol delegated stake, a feature that launched near the end of April 2023. The majority of stake for the other validators comes from out-of-protocol delegation from the Aptos Foundation and private investors’ locked tokens. The Aptos Foundation holds a majority of the total supply between its own allocation and the tokens on behalf of the Ecosystem allocation. As such, it can help distribute stake more equally among validators. As a result, Aptos has a Nakamoto coefficient of 18 (flat QoQ), which is above the median of other networks.

Aptos is designed to support frequent protocol upgrades. This ability stems from validator management occurring onchain, allowing validators to easily sync to a new upgrade. Parts of Aptos are also written in Move, which can improve the time-to-market for developers.

The Aptos protocol continued upgrading in H1 to 1.25.0 through to 1.30.2. These upgrade series implemented several Aptos Improvement Proposals (AIPs), as well as improvements to the Aptos blockchain, some of the most notable of which are detailed below:

With block times under 130ms and user finality of 650ms, Aptos is already one of the most performant Layer-1 blockchains as it scales towards its vision as the hub of global transactions supporting 1 million transactions per second (TPS).

In September 2024, Aptos Labs introduced Raptr, its next-generation BFT consensus protocol that implements the prefix consensus model to settle 260,000 transactions per second (TPS) with less than 800ms latency. Under this design, validators disseminate batches of data and leaders optimistically propose these batches before getting the corresponding proofs of availability. When a validator gets a block proposal, it can choose to vote only on a prefix of the batches it has received. As a result, and enabled by Raptr’s algorithmic innovations, validators can form quorum certificates and commit partial blocks for batches approved by a quorum of validators.

Baby Raptr, the first production-stage component of Raptr, went live on Aptos mainnet in June, with rollout to replace the AptofBFTv4 consensus mechanism in progress as of June 30. Baby Raptr (aka Optimistic Quorum Store) is a technique to reduce Quorum Store and Consensus (QS+Consensus) latency from six network hops to four, improving validator finality latency by 20% (100-150ms).

Further upgrades to reduce latency and boost throughput on Aptos include the Block-STM V2 upgrade of Aptos’ Block-STM parallel execution engine, as well as Zaptos and Shardines.

In a testing environment, Aptos Labs found Zaptos reduces latency by 40% under a load of 20,000 transactions per second.

On Aug. 5, Decibel, a permissionless trading engine built for speed, scale, and composability, launched on the Aptos blockchain. Developed by Aptos Labs in collaboration with the newly formed Decibel Foundation, Decibel supports both spot and perpetuals trading through a unified, cross-margin account and is powered by Aptos’ framework-level central limit order book (CLOB). Designed to deliver speed and performance on par with centralized exchanges, all matching and settlement occur entirely onchain. Decibel’s open and composable design enables anyone to participate in earning trading fees and supporting liquidations.

This launch represents a significant step forward for Aptos DeFi, introducing protocol-level infrastructure purpose-built for multicollateral support, real-world asset (RWA) trading, and capital-efficient strategies. Decibel is currently live on Devnet, with a Mainnet launch expected in early 2026.

On June 24, Shelby, a hot storage protocol for data availability co-developed by Aptos Labs and Jump Crypto, was announced. Shelby is designed to deliver Web2-grade low-latency with sub-second reads and high-throughput storage suitable for real-time, read-intensive Web3 applications. Shelby’s coordination and settlement is on Aptos, though the underlying storage functionality is chain-agnostic. The protocol runs via nodes connected by a fiber-optic network that will be rewarded in real-time for providing data. Shelby is chain-agnostic. Developers can request early access to Shelby by completing a form on the Shelby website. Shelby’s devnet is expected to go live in Q4 2025, with a public testnet released thereafter.

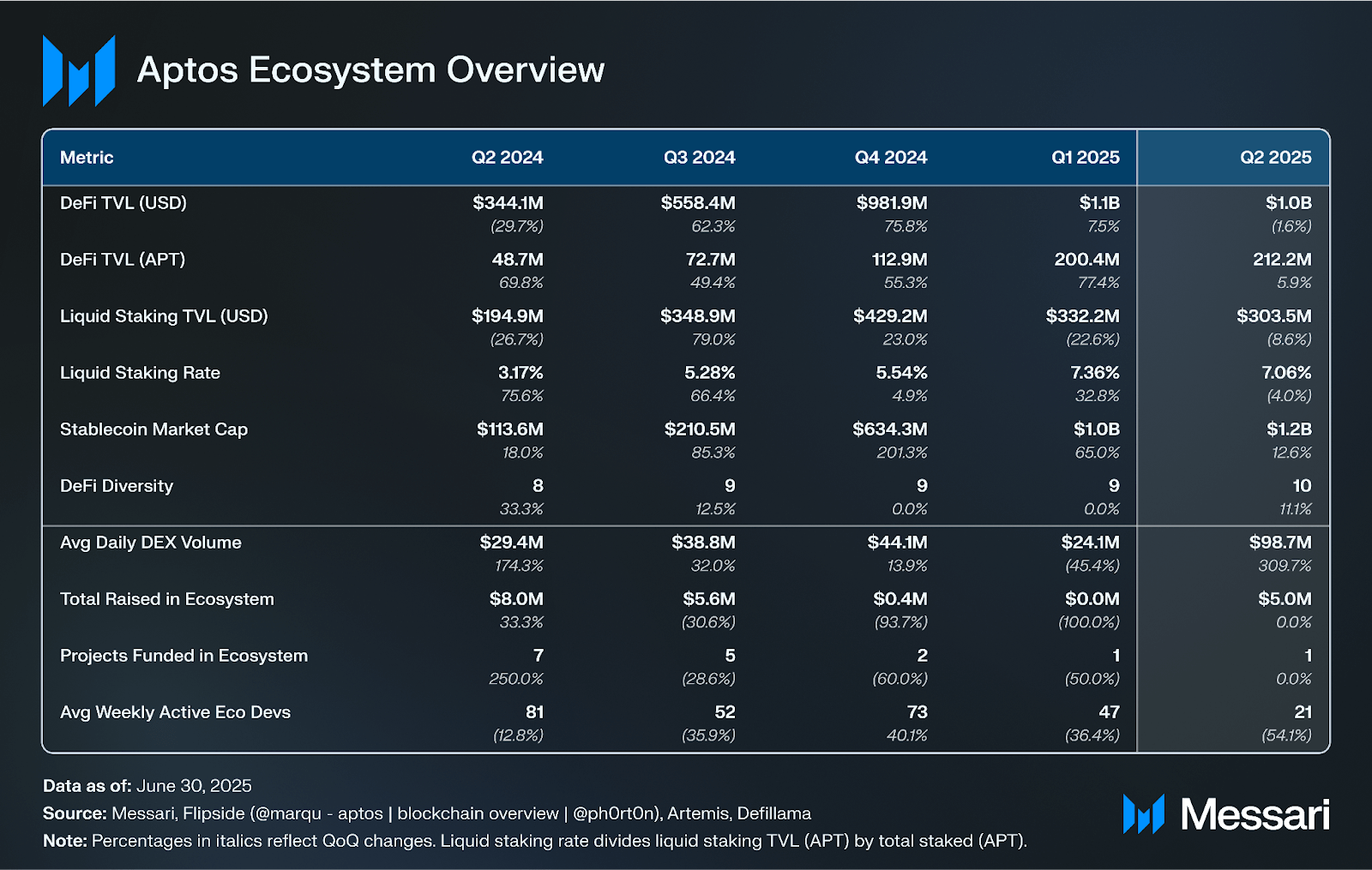

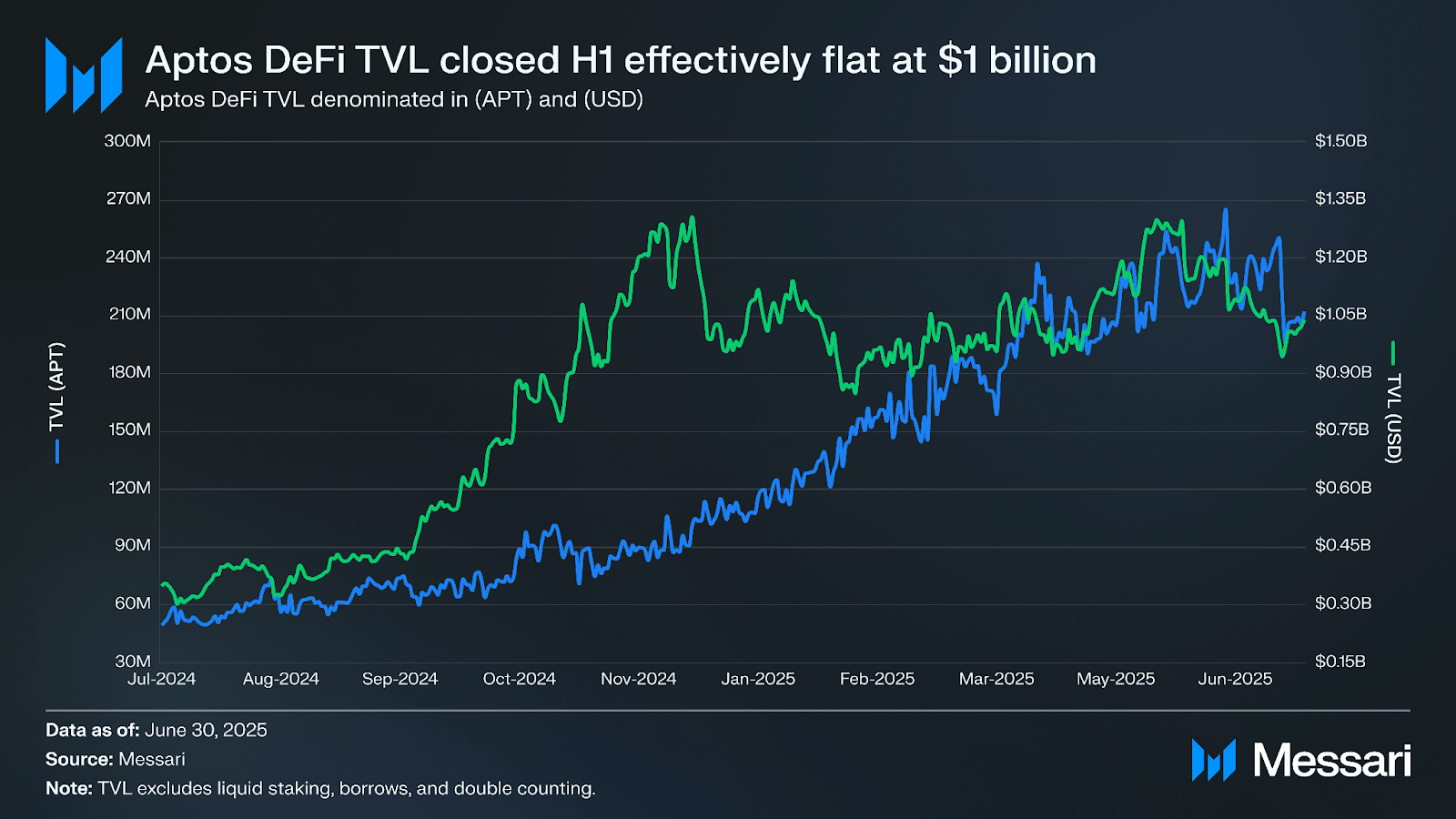

While Aptos’ DeFi TVL closed H1 effectively flat at $1 billion, it maintained the growth it had in Q4 2024 from its prior TVL range of $300-500 million, to $981.9 million at Q4 2024 close. In contrast, Aptos’ DeFi TVL in APT increased 87.9% in H1 from 112.9 million APT at Q4 2024 close to 212.2 million at Q2 2025 close. This reflects both the 44% decline in the price of APT in H1 2025 and the increasing share of stablecoins and other assets like BTC in Aptos DeFi TVL. marking sustained growth from the network’s prior TVL range of $300-500 million from late March to mid-September 2024

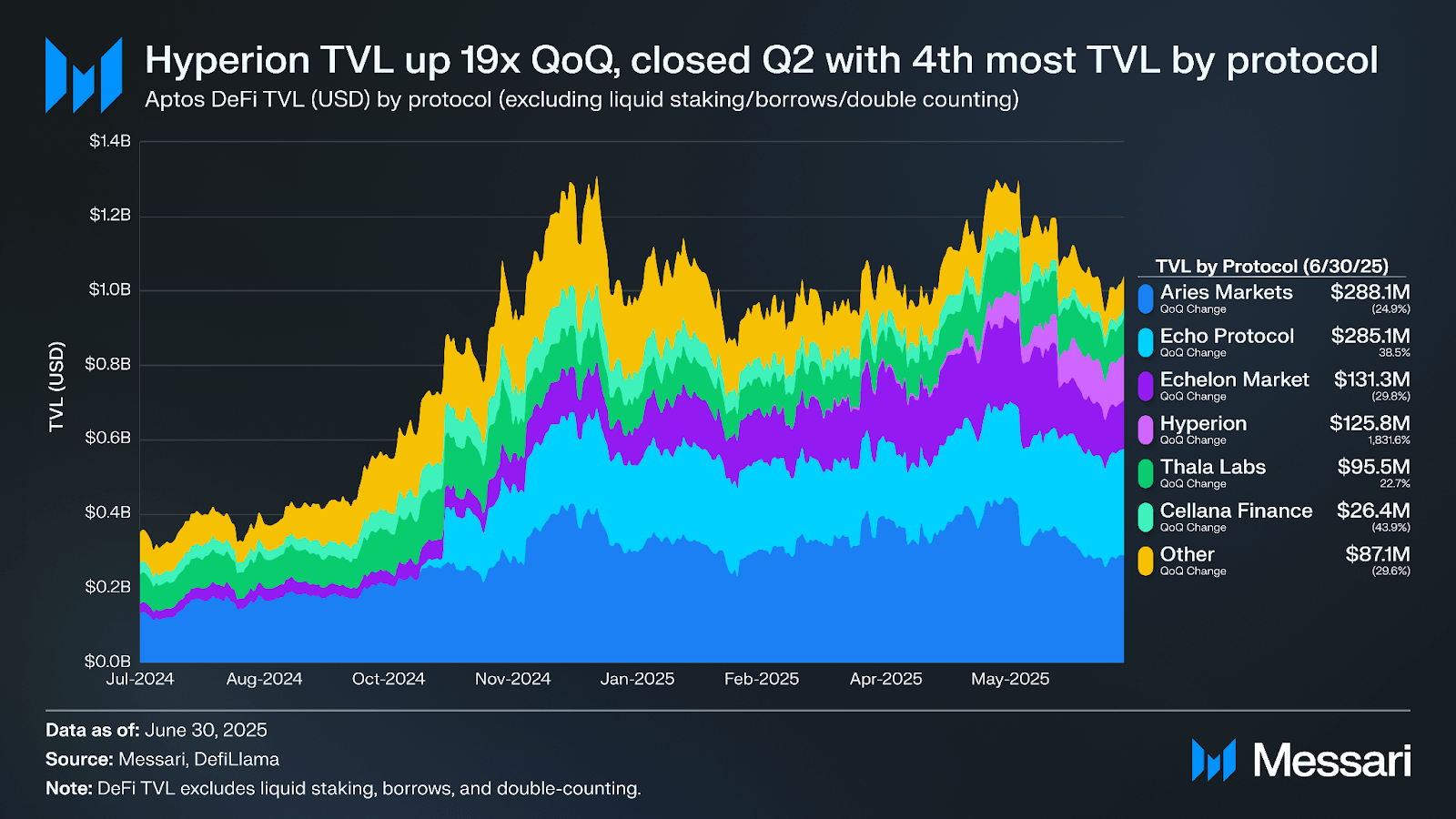

The TVL of Hyperion, a hybrid orderbook and concentrated liquidity AMM DEX, increased 19x QoQ from $6.5 million at Q1 close to $125.8 million at Q2 close, making it the 4th largest protocol by TVL on Aptos as of June 30. Hyperion launched in February and in July completed the token generation event (TGE) for its native token RION, the first exclusive bonding curve-based TGE in the Aptos ecosystem on Binance. RION can be staked for xRION, which is used to govern Hyperion.

The QoQ change in TVL of other top protocols was mixed, ranging from a 45% decline to 38.5% growth, reflecting multiple factors, including changes in asset prices, new incentive programs, new feature launches, and shifting user behavior.

All other protocols had $87.1 million in TVL at Q2 close, down 29.6% QoQ from $123.7 million. Some other notable protocols include:

Additionally, Ekiden is an upcoming orderbook-based hybrid exchange on Aptos. The protocol will use an offchain Central Limit Orderbook (CLOB) with deferred onchain settlement to maximize performance for both spot and perpetual futures trading.

On June 27, an Aave Improvement Proposal (AIP) approved deployment of lending and borrowing protocol Aave V3 on Aptos, which will be the first instance of Aave on a non-EVM blockchain. The initial deployment will support deposits and borrows for APT, USDC, USDT, and sUSDe.

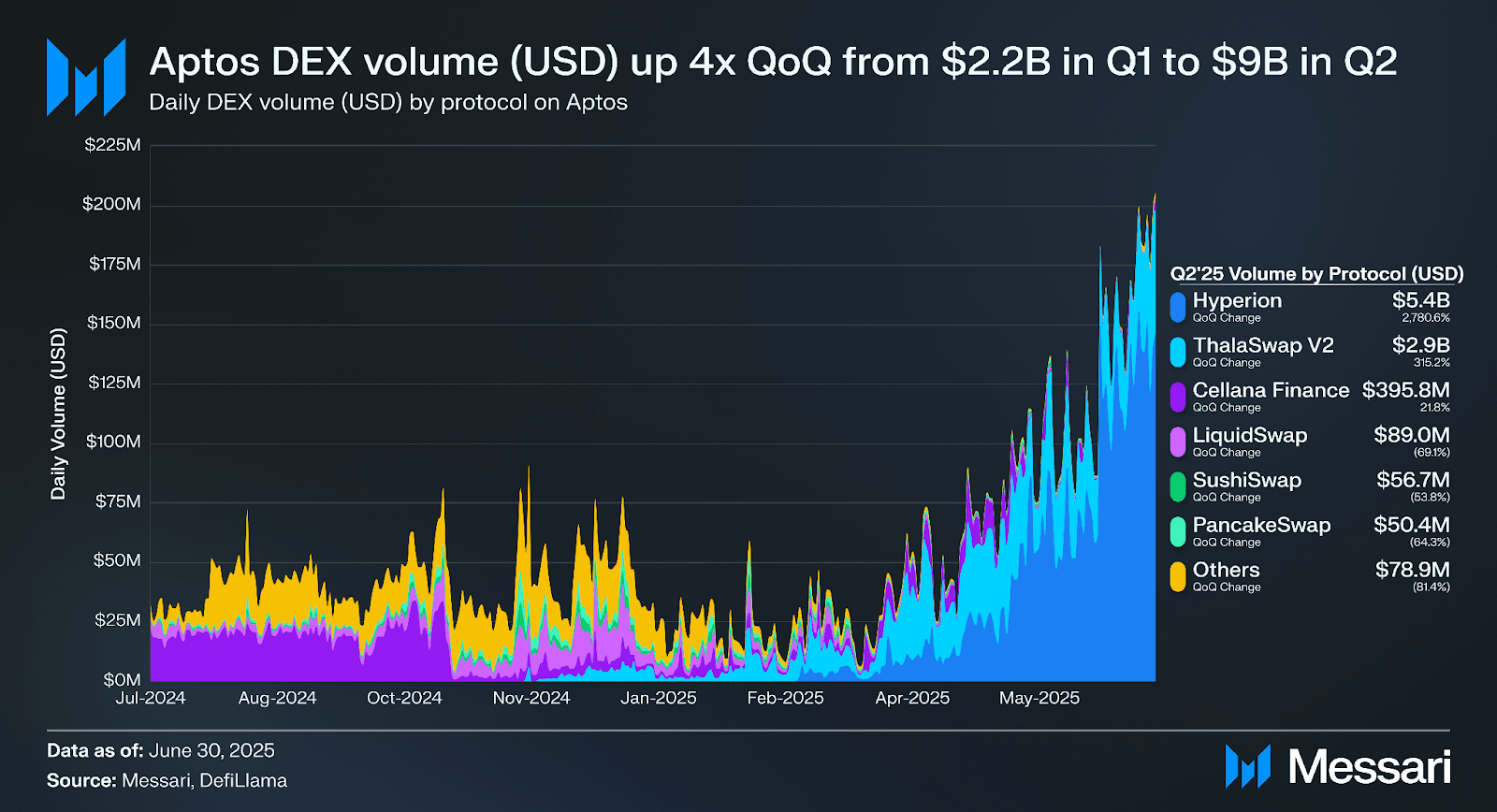

Though total quarterly DEX volume on Aptos declined 46.1% QoQ from $4.1 billion in Q4’24 to $2.2 billion in Q1’25, it then rose 310.3% QoQ to $9.0 billion in Q2’25. This growth was driven almost entirely by Hyperion and ThalaSwap V2. Launched in February, Hyperion’s quarterly volume grew 29x QoQ from $187.7 million to $5.4 billion, more than double Aptos’ total quarterly DEX volume for all protocols in Q2. Similarly, quarterly volume for ThalaSwap V2 grew 4x from $700.1 million in Q1’25 to $2.9 billion in Q2’25.

On a monthly basis, total DEX volume continues to accelerate. Aptos had $4.4 billion in total DEX volume in June ($147.1 million daily average), up 51.7% from $2.9 billion in May ($93.6 million daily average).

Outside of AMM DEX volume, CLOB-based perp DEX volume continued to grow with the launch of new protocols like Kana Labs and Mirage Protocol, alongside longer-standing protocols like Merkle Trade. Merkle Trade has been used by more than 163,000 wallets and, on June 28, surpassed $24 billion in lifetime perps volume.

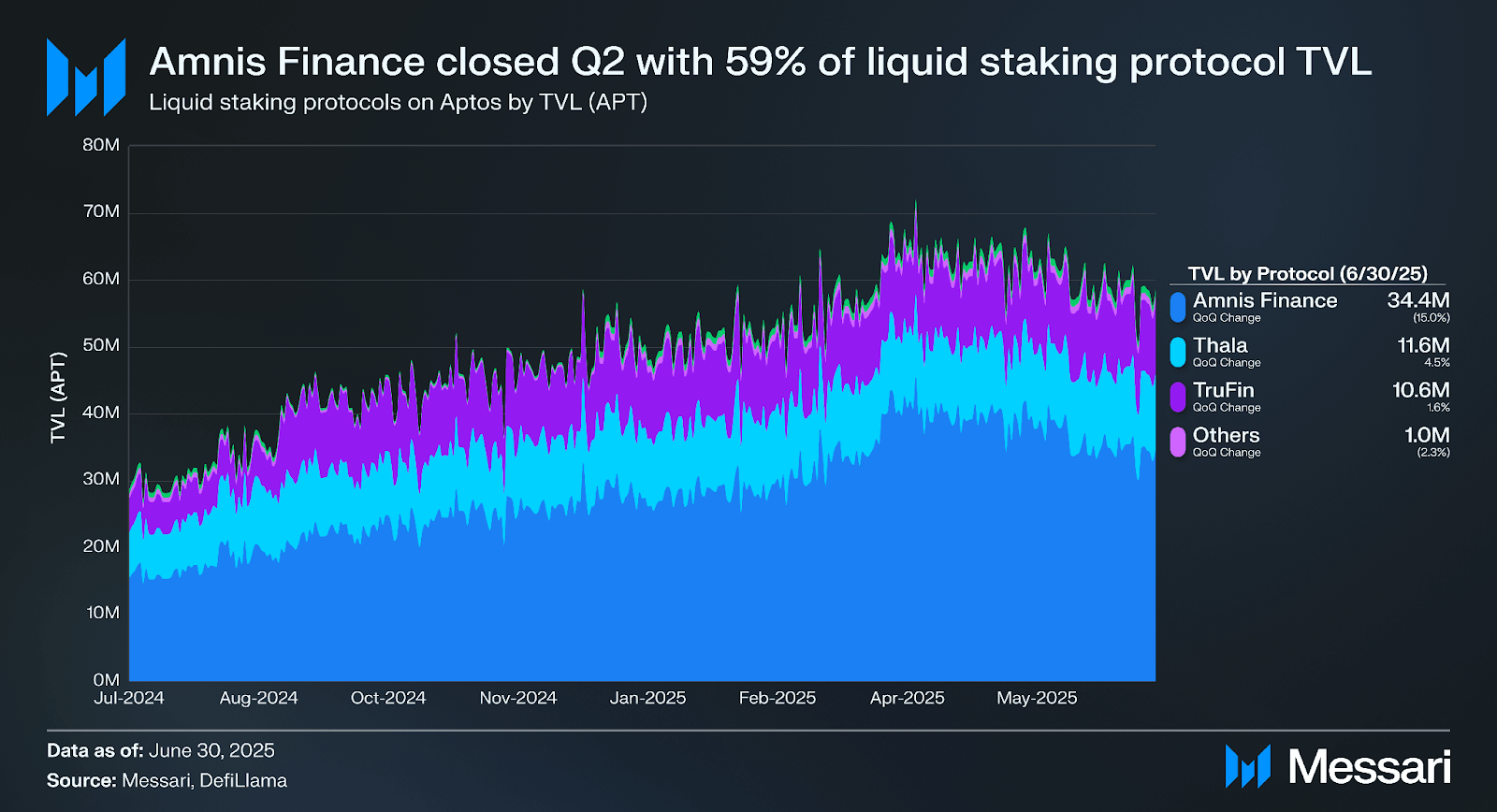

Amnis Finance continues to dominate APT liquid staking, closing Q2 with 58.7% (34.4 million APT) of liquid staking protocol TVL on Aptos. Upon staking APT, Amnis Finance users receive amAPT on a 1:1 basis. Users can then convert amAPT to stAPT, which earns 100% of stAPT validator rewards and 80% of amAPT’s validator rewards.

On March 26, Amnis Finance launched its governance and reward token AMI. Amnis Finance was the first project to participate in the Aptos Foundation’s Launch and Fundraising Module (LFM), designed to support leading Aptos-native projects preparing for their token generation event (TGE). Other projects in the LFM include Aries Markets, Echelon, and PACT Protocol, as well as Echo Protocol and Hyperion, which completed their respective TGEs in July. Other APT liquid staking providers on Aptos include Thala Labs, TruFin, and Kofi Finance.

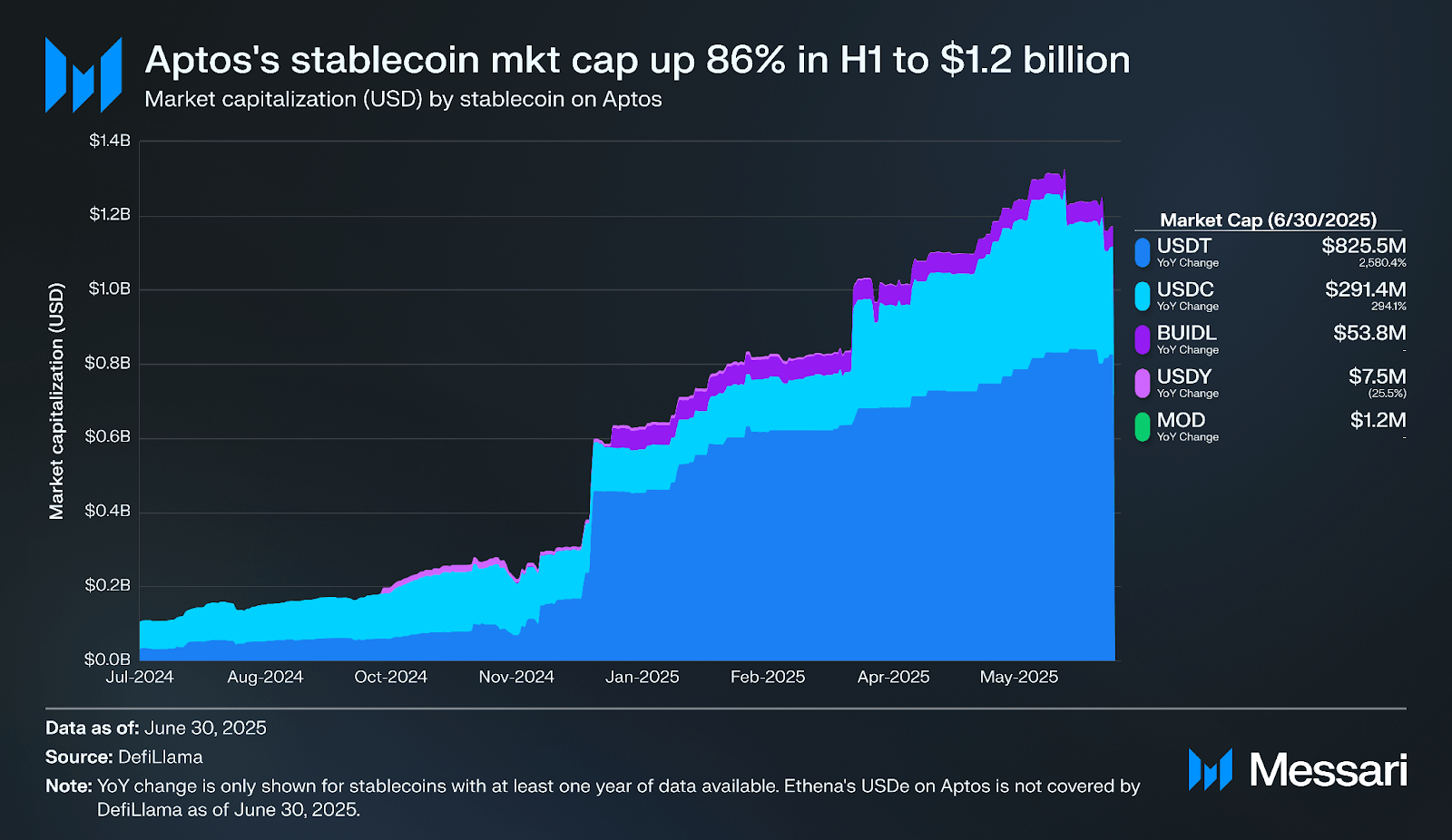

Aptos’ stablecoin market cap increased 85.9% in H1 from $648.9 million to $1.2 billion. This was driven almost entirely by market cap increases in Tether’s USDT and Circle’s USDC following their respective native contract deployments on Oct. 28, 2024, and Jan. 31, 2025. In H1, USDT’s market cap increased more than 81.3% from $455.4 million to $825.5 million while USDC’s market cap increased 148.2% from $117.0 million to $291.4 million.

On top of this, a bridged token contract for Ethena’s USDe, the third-largest stablecoin by market cap, launched on Aptos in late February, making Aptos home to the top three stablecoins by market cap (USDT, USDC, and USDe). Unlike USDT and USDC, which are fiat stablecoins backed by US Dollar and dollar equivalents, USDe is a synthetic dollar stablecoin, backed by crypto assets and corresponding short futures positions. USDe can be staked to receive an equivalent value of sUSDe. sUSDe tokenholders earn yield from USDe’s (1) underlying staked crypto assets and (2) the funding rate of short positions. sUSDe is the reward-bearing version of USDe and increases in value over time as value accrues through the yield USDe’s collateral generates.

As of June 30, 39.4 million in sUSDe has been bridged to Aptos via Stargate, while only 87 USDe exist on Aptos, indicating a strong user preference to earn sUSDe’s yield. Key use cases for both USDe and sUSDe on Aptos include depositing and borrowing from lending protocols such as Echelon, and providing liquidity to stable and non-stable pairs on DEXs like Thala.

Outside of USDT, USDC, and sUSDe/USDe, other notable stablecoins on Aptos include:

According to RWA.XYZ, Aptos had $13.2 billion in stablecoin transfer volume in April, $30.4 billion in May, and $48.6.2 billion in June ($5.7 billion adjusted according to Visa’s onchain analytics). Aptos’s June stablecoin transfer volume ranked sixth overall, trailing only Ethereum ($1.11 trillion), BNB Smart Chain ($680.1 billion), TRON ($624.4 billion), Solana ($134.1 billion), and Arbitrum ($56.5 billion).

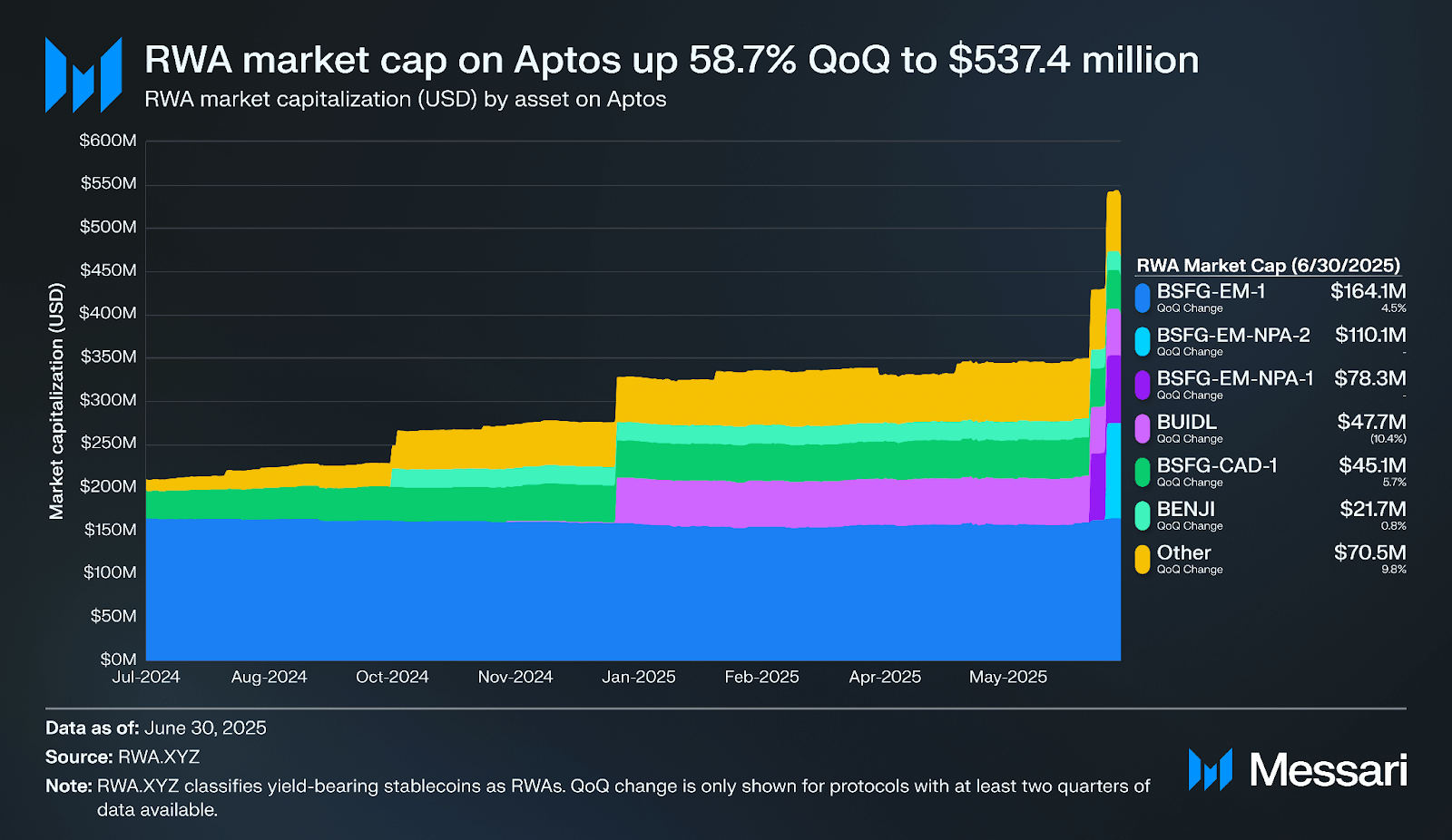

$419.9 million of the $537.4 million (78.1%) is issued by PACT, a consortium of regulated financial institutions and service providers dedicated to bridging micro-lending origination in emerging markets with capital access in developed markets.

To date, all six products issued by the consortium are via Berkley Square. These include three emerging market portfolios (BSFG-EM-1, BSFG-EM-NPA-1 and 2), a mortgage portfolio (BSFG-CAD-1), a portfolio of credit lines for small and medium enterprises in the UAE (BSFG-AD-1), and a Kenya retail portfolio (BSFG-KES-1).

In February, PACT announced the migration of its onchain credit infrastructure to Aptos, with more than $1 billion being migrated. PACT focuses on emerging markets where traditional banking remains out of reach of 85% of the world’s population and is the first participant in Aptos Foundation’s incubation pilot focused on supporting and scaling high-impact blockchain projects.

Other notable RWAs issued on Aptos include Apollo’s Diversified Credit Securitize Fund (ACRED), Libre Capital’s USD Money Market Fund (UMA) and Brevan Howard Master Fund (BHMA), and Franklin Templeton’s BENJI, each token of which represents one share of Franklin Templeton’s onchain US Government Money Fund (FOBXX).

Since the network’s inception, consumer applications have been a core focus for Aptos Labs and the Aptos Foundation. Notable developments in H1 2025 include:

Many Aptos-based projects announced funding rounds in the first half of 2025, including:

In February, the Aptos Foundation committed $200 million in grants and investments to expand Aptos DeFi. Following this in March, Movemaker, the Aptos Foundation’s community organization for advancing Aptos in Chinese-speaking regions, launched a $2 million grant program and co-working space for builders in Hong Kong. In June, Movemaker announced $200,000 in seed funding to create the Aptos Move Secure & General Purpose Base Library of smart contract modules in partnership with alcove. On July 31, Aptos Foundation announced a new Payments Grant program, a milestone-based funding program designed to support founders building next-generation payment infrastructure. Grants of up to $150,000 are available, along with hands-on support and ecosystem-wide amplification. To date, the Aptos Foundation has distributed more than 200 grants to ecosystem projects, through its grant programs, which include Ecosystem Grants, Registry Grants (funds contribution to existing pre-approved projects), Gas Station Grants (subsidizes gas fees for user transactions) and Security Credits Grants (covers the costs of security audits up to $25,000).

According to Artemis, Aptos averaged 74 weekly active ecosystem developers in Q2, a 31.7% QoQ decrease from 108 in Q1. As highlighted by Electric Capital’s Developer Report dashboard, Aptos has one of the top developer communities among non-EVM networks. Notable infrastructure and developer-related initiatives in H1 not mentioned elsewhere include:

Momentum across the Aptos ecosystem continues to advance the vision of a “Global Trading Engine,” supported by DeFi growth, protocol innovations, and new infrastructure, most recently Decibel, a fully onchain trading protocol built on Aptos. On the DeFi front, Aptos’s stablecoin market cap increased 85.9% in the first half of the year to $1.2 billion at Q2 close, driven by market cap increases in USDT and USDC. While Aptos’ DeFi TVL closed H1 effectively flat at $1 billion, it maintained the growth it had in Q4 2024 from its prior TVL range of $300-500 million. Additionally, Aptos closed Q2 with an RWA market cap of $537.4 million, the third largest behind Ethereum and ZKsync Era. Additionally, multiple upgrades were introduced to scale Aptos. Baby Raptr, the first production-stage component of Aptos’s next-generation BFT consensus protocol Raptr, went live in June and improves validator finality latency by 20% (100-150ms). The upcoming Block-STM V2 upgrade will further boost throughput, while Zaptos will reduce end-to-end transaction latency, and Shardines will apply sharding to Aptos’s execution engine.

Though Aptos’s vision to become the “Global Trading Engine” is quite forward-looking, the network’s results have already started to show. Monthly active users (MAU) stayed above 10 million throughout the first half of 2025, maintaining the growth in the second half of 2024 when MAU steadily increased from 2.5 million in July 2024 to 10 million in December 2024. Additionally, the average transaction fee on Aptos decreased 61.1% QoQ to 0.00011 APT ($0.00052) in Q2, roughly 10-100x cheaper than other top Layer-1 blockchains like TRON, Solana, Ethereum, Avalanche, and BNB Smart Chain. Finally, in June, co-developers Aptos Labs and Jump Crypto introduced Shelby, a hot storage protocol for data availability designed to deliver Web2-grade low-latency with sub-second reads and high-throughput storage suitable for real-time, read-intensive Web3 applications.

Aptos continues to reach new milestones, release new technologies, and sustain new baselines in usage, turning the Global Trading Engine vision into measurable momentum.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Matonee Inc. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.