Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin

I Simed, the best investment in Crypto is his “cones and pale”, depending on the CEO of $ 1.6 Trillion Asset Franklin.

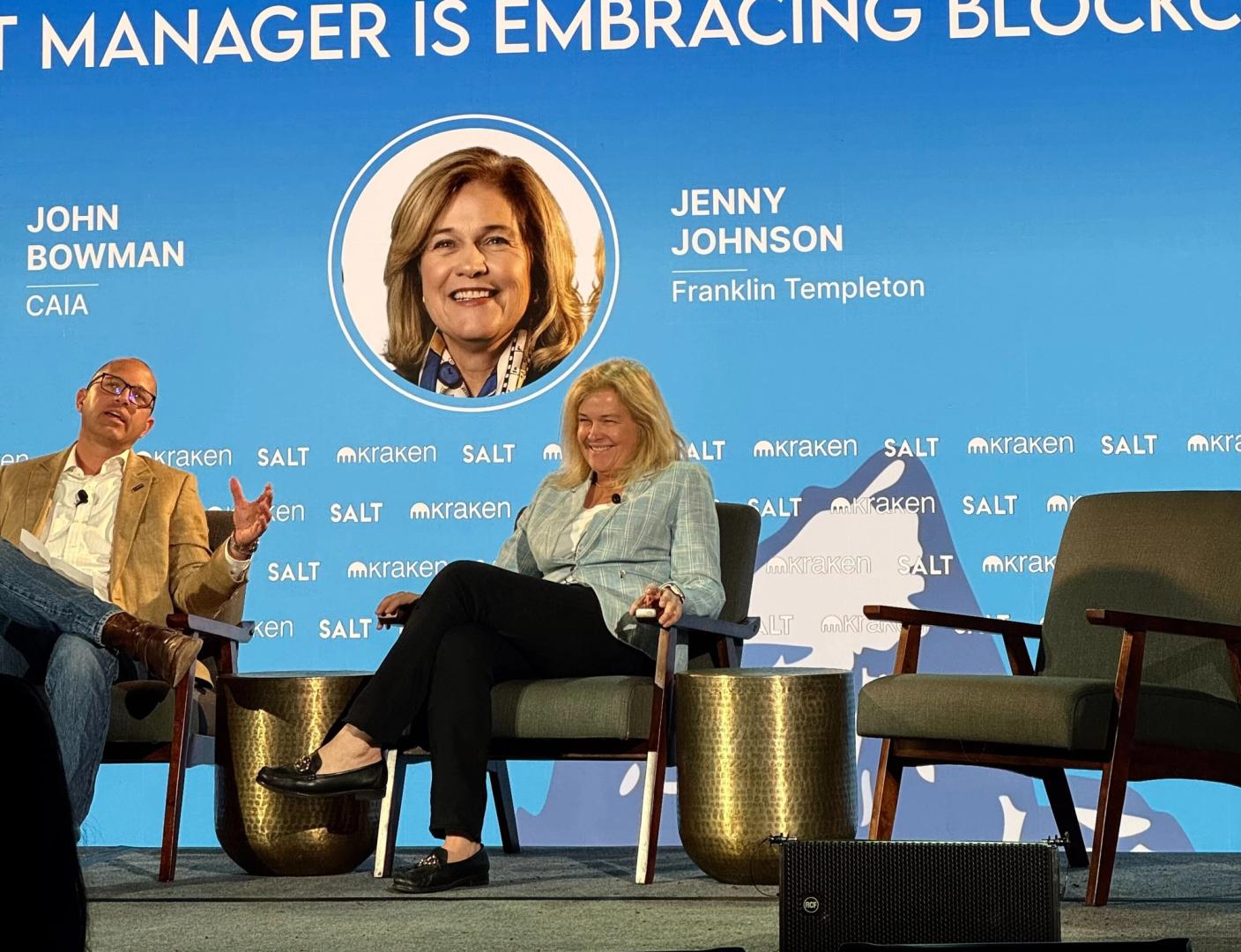

Jenny Johnson, the third gender’s head generation, spoke to the salt conference, has seen the bockchain technology and where investors is putting their money.

In their sight, bitcoin functions as a “foolishness of fear for people who governments can block access to the funds or where national curls lose time. But despite his appeal in those scenarios, see it as a distraction.

Bitcoin, commessa, it’s “most distraction for one of the greatest disruptions coming to financial services.”

This disruption, she said: They engage under the digital assets – not to tigital hogi, but in the systems that feel. It’s where you believe that the capital needs to be focused.

“The rocks and pals are the basis of the heavy app, layers:” Johnson said. “I like rails as a starting point,” added, refers to blockchain networks. “So there are some great consumer apps that goes out of that I think I’m really exciting.”

She also sees the Promise in the disvolerous role, the entity that in keeping blockchain network. For active investment managers, they could offer a new layer of transparency and are a “change of play.”

“Simpresent imagines you see the public equity all transactions that would like to be out of that company and how much information you told.

JUGGE government government government government government government’s government’s government’s government’s government leadership.

She is waiting for financial products such as mutual funds and ethphs to move to blocks, where they can operate more efficiently and the lowest cost. But for now, the regulate remains the “largest inhibitor” to that shift, he said.

Party of the hesitation, she added, it comes from the number of digital assets provide – a level of regulators and a level of level is not yet prepared to manage.