Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

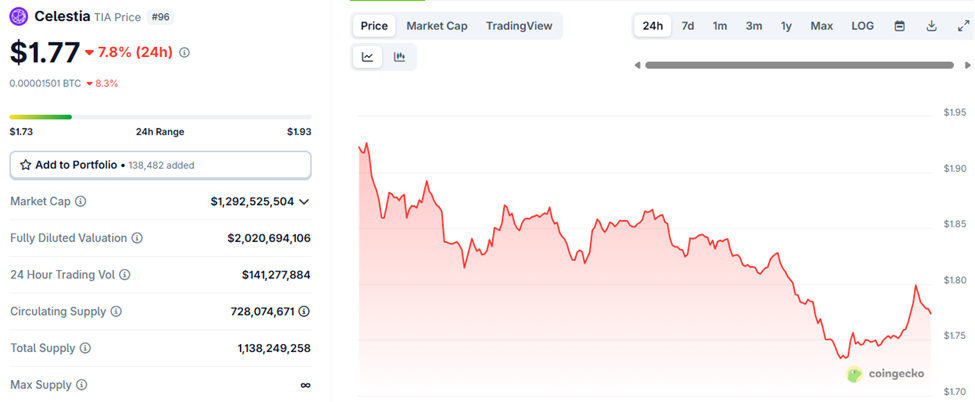

Celesti ($ TIA) token Fell 8% to $ 1.77 Amid market settback with the $ 144 million in the volume of daily trade and a market of the $ 1.2 billion, the fundamental fundamental tap

What is more, many strategic network updates and strategic strategic are placed landwork for future growth. While the action of short to short-bill, the project is continuing to attract serious interest by the main players in space.

Celestia has quickly set as a foundable player in the modular mode of availability of innovative data more with lapaurants and heads.

The network fire on the scalability and interoperation has fed the two anticipate and market confidence Native $ Tai token to new high. I am

A key development in the Celestia Trajector was its recent $ 625 million tokens of $ Tokens by Polychain, an early investor. The transaction, executed at about $ 1,44 per token, align with market prices from early 2025 July.

The repaired tokens will be redistributed to new investors under a rolling unlock calendar between August 16 and 14 November.

This buyers is part of a wider strategy, the louss “, which intrude a reduction of the Network, which intrude a 33%, disabling the integration of use for smoothly.

In the technical, held, Celestia frontage represents a major resigning commitment, 128 mb blocks-16 times larger than 8 MB of 8 MB. This update provides an impressive 21.33 MB / s of Celestia positions such as a backbone of high performance for the next bolsain’s rop.

Always Advancements, Celestia, sewing tangible adoption, as an arborous of the noble’s noble development of the Fulesty Food Aprastructure.

Institutional interest in celestia is also increasing. Eg the global investment society has extended their form of European crypto to launch a Exchange-traded Exchange Note (Etn) Attached $ TIA. I am

While the $ chicken price can be in the Red Topper, the technical developments, strategic, extinct adctions and increasing indicated hectic that $ Tia can rise above $ 2 in the middle of the long run.

However, the current market conditions say a different story in immediate time.

The recent seller in $ TAI / $ USDT seems to be a continuation of the observed debilit structure last week.

After setting up under the price area of $ 2.30, Crypto Asset failed to claim higher land, instead Rolling in a dot of 4 hours chart. The calendar brought token price back to $ 1.75, that if we have to strat, it’s a level that watches until the end of the late console. To this level, spectacine pressures are accelering through successive candles.

This picture was not sudden. Rather, developed over a series of bonfire synthes.

The most recent low leg confirms that buyers lost the short-term trend check.

The rally of the previous week to the $ 2.30 stole the enthusiasm quickly, marked by an increase in red volume bars or green candles or consistency. This bullish conviction erosion with the momentum indicators, and both the RSI and Macd now broken under the balance.

The RSI is currently attached by 34, a reading of the bearing reinforce the conditions of short term terms.

More important, the Macd confirmed a signal of the sign under the signal line, with two medi moving in disguise. These indicators suggest that the moment is not just absent but pulling the price, especially as the histogram has now entered a more deep negative phase.

It’s not everything. The red bars is also increased in the frequency and amplitude who start July 27, with the clearance of clearance visible in the displayed data. A particularly aggressive barbage 4-hours recorded a delta of -562.3k in the volume, confirming active sales in active areas.

While the short-rilie’s short moments is 481k delta currently-they have been camed and rapid selected with reneverable offers.

Sellers actively dominating this area and absorb any attempts to reverse. The buyer’s response has been reactive and short of conviction.

County, this pullback turns mirrors the wider feeling of feeling

The refusal to $ 2.30, combined with no new from last week, positioned $ TAI for a rollover. The current area around $ 1.70- $ 1.75 becomes pivotal. You should volume lifted without any important refund, a drop versus $ 1.60 or even $ 1.52 can materialize quickly.

For now, the market does not catch the knife. $ Ai remain under pressure, and any recovery required a distinct change in both structure and participation.

The post Celestia (tia) dips to $ 1,77: Is a refund come after strategic purchase and updates? it first appeared Criponews. I am