Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

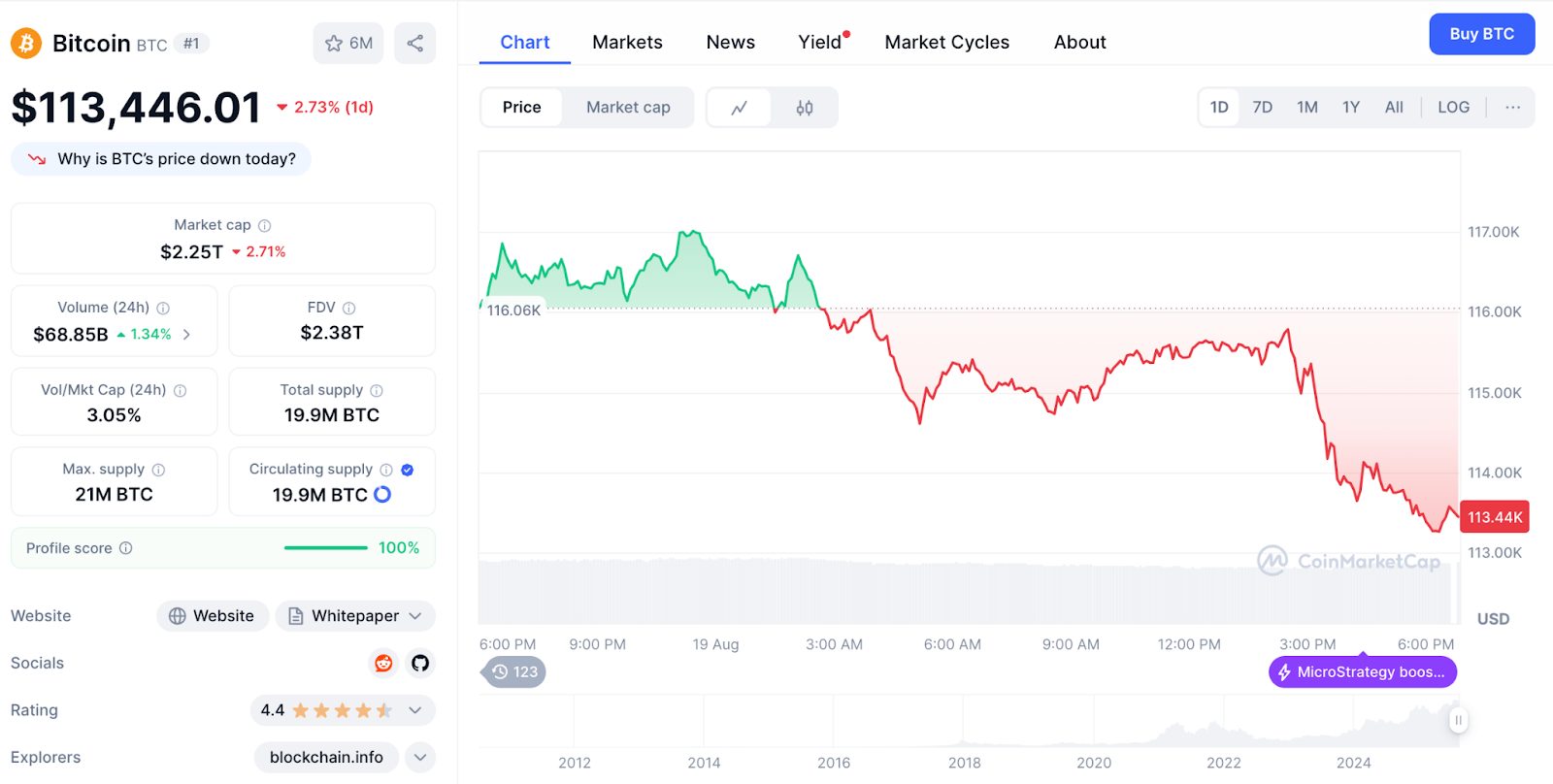

Chart Bitcoin analyzing revealed an important -2.05% break up to 113,912 $12Trial key support to $ 113.6Klike blackrock domains $ 548 million it’s worth btc and ark 21swares sells 559.85 It’s worth btc $ 64.4 million, range of the institutional profit of trigger.

The minced of the bitcoin to -444.13 and positive historic to 745.74 suggest the spell of the moment. Meanwhile, RSI to 42.15 approach the territory territory with extremely low 256 BTC volume indicating a distribution of institutional distribution of Amidid institution.

Summoning chartpt bitcoin analysis 24 Refresh-Time Technical Indicators Assessing Btc Support Pressure pressure and support of support from an overly recovery and a deeper correction.

The current bitcoin price of 113.912.912.47 reflect a strong -2.05% decline from the price of the opening of 116.311111.23establish a volatile trading masterpiece between 116 $, 797.66 (high) and 113.644444.18 (low).

This one 2.8% The intraday range demonstrates institutional pressure contained pressure after the distributions of the major bottom.

The RSI to 42.15 approaches the excess territory, provides potential conditions for the opposite positions.

The movement in motion reveal the head position with the right of the bitcoin below the 20 days Em 117.022222 (-2.7%) and the 50 days Em $ 11.97 (-0.9%), but keep the support over the 100-day Em 110,430 (+ 3.1%) and the 200-day Em $ 103.042 (+ 9.5%).

MacD shows the structure match to -444.13, Well under the zero, with the signal line to 301.61but a substantial positive historic 745.74 suggest that the moment is built toward a potential crossover.

This divergence of the moment during the price decay often precedes the reviewer issues such as overstated conditions develop.

Volume analysis shows exceptionally low activity to 256 BTC, indicating reduced retaliation participation and the shaustification potential after institutional distribution waves.

The ACT maintains extremely high readings in 104.703.20suggest the potential of massive volatility despite the current route phase.

Bitcoin breakup follows the extremal institutional sales with Blackrock Reportedly Dumping $ 548 million OK of BTC while Ark 21shares sold 559.85 It’s worth btc $ 64.4 million. I am

The one’s -2.05% The answer reflects the pressure of institutional distribution as the main funds reallocate the positions near the most historic.

Crypto’s Encryption Market is Start Fragile After $ 360 million in long liquid as a bitcoin initially fell below 116k $creating systemic sales pressure on approval positions.

The current position represents profit of the institutional continues after July’s peak near $ 122.054. I am

The one’s 2025 The trajectory shows the noticeable progression from the dibbile 81,975 low to current $ 113k levels, with the institutional distribution that occurs near tall loops.

The current pullback represents a natural fix after 39% appreciation from August to the low rather than a fundamental shot.

The market dominance of 58.25% (-0.17%) shows a light weak relative to the altooins during the institutional selling, while the -8.55% Distance from August 14th. All the high time of $ 124.457 Demonstrates proximity to recent distributing areas where decerence of institutional profit.

Bitcoin keeps the dominant position with a $ 2.27 trillion The pressure of the market distribution despite the institutional.

The market tap followed the ridden volume to $ 65,54 billion (-4.06%), indicating consolidation rather than the panic sells as institutions distributed.

The one’s 2.9% The chapter chapter report suggests the typical measured business activity of institutional distribution rather than sales caption.

A circulating supply of 19.9 million Btc represents 94.8% of the max 21 million Provide, with the disposing approaching the long-term value despite short term declibution pressure.

A fully diluted rating of $ 2,38 trigger reflects total value at the actual price, whereas the mechanism of a continuous controvers of the fundamental proposition.

The current prices keeps extraordinary 233.965.599% gain gain from 2010. lows, validate bitcoin institutional adoption despite temporary distribution phases.

Lunarcrush data reveals a decline in social performance, with the other bitcoin falls to 515 during institutional sales pressure periods.

Score of galaxy of 47 (+3) Reflect the sentiment mixed as participants processed main-distribution implications for market structure.

The metric of the engagement shows a substantial decline with 72.86 million total income (19.74M) while mentioned mention 231.88k (+ 87.828), showing attention height during institutional sales events.

Social dominance of 18.15% maintain visibility as feeling of feeling to 77% Positive distribution presentation.

Recent topics of focus themes in institutional sales points, with central community discussions on black $ 548 million distribution distribution and ark.

Movie’s major developments include Anthony Scarcar $ 180k–$ 200k The destinations of the year they want to despite the current weakness.

Prominent traders identify potential purchase opportunities, with some note accumulation of front of $ 52 million daily and massive long length total $ 28msuggest institutional confidence despite the distribution of the surface level that creates a short term pressure.

ChatCh’s bitcoin analysis reveal bitcoin to a proof of support of support of $ 113.6, following institutional distribution.

Support proof represents the validation of institutional confidence toward the work profit of work profit from the main funds looking strategic reallocation.

Immediate support emerges to the lower 113.644requires defense for continuation of structure in bullish.

The one’s 100-day Em 110,430 provide a major technical support, while the deeper support exists to the 200-day Em$ 103.042), creating the protection of substantial downside during distribution phases.

Resistance begins at the 50 days I am around $ 11.97followed by key resistance to the 20 days Em117.022222).

The technic Setup suggests key defense to $ 113.6K is necessary for the potential of the potential of obligatory, while a break below could activate a more deep fix toward the 110.4.4K–$ 103 Major support area as an institutional distribution accelerate before event stabilization.

Successful defense of $ 113.6k The combined support with the completion of the distribution of institutional could lead to recovery toward $ 118k–$ 122that represents a 4–7%. upside by actual levels.

This scenario requires the consignment counter of the discompers

Continue institutional profit can lead to consolidation between 110k $ 110k–$ 118kAllow the finalization of distribution while technical indicators reset for the next phase of accumulation.

A pause under $ 113.6k Support could enable sales to $ 110.4k- $ 103k support, which represents a 3!–10%. toward.

Recovery will depend on completing the great infense, and distribution and isstriting.

ChatCh’s bitcoin analysis that bitcoin is facing a distribution of distribution of amid institutional key support from important funds.

The discovery to $ 113.6k represents the validation of institutional profit versus the refund potential refund as the technical indicators for technical indicators.

Blust Target Target: $ 118k- $ 122k in 90 days

The immediate trajectory needs decisive defense of $ 113.6k Support to validate conditions of continuing distribution.

From here, institution institution could propose bitcoin toward $ 118k Psychological Resistance, with the convenience of supported distribution driving towards $ 122+ recovery levels.

However, failure to hold $ 113.6K would indicate a deeper fix to the 110.4.4K–$ 103 Range, creating an optimal accumulation opportunity before the next institutional wave which drive bitcoin towards the upper loops above $ 125k as complete distribution phases.

The post BitGPT BitCht Analysis: The $ 548m Blackrock’s exit tests $ 113K – Booce or Rowdown? it first appeared Criponews. I am