Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

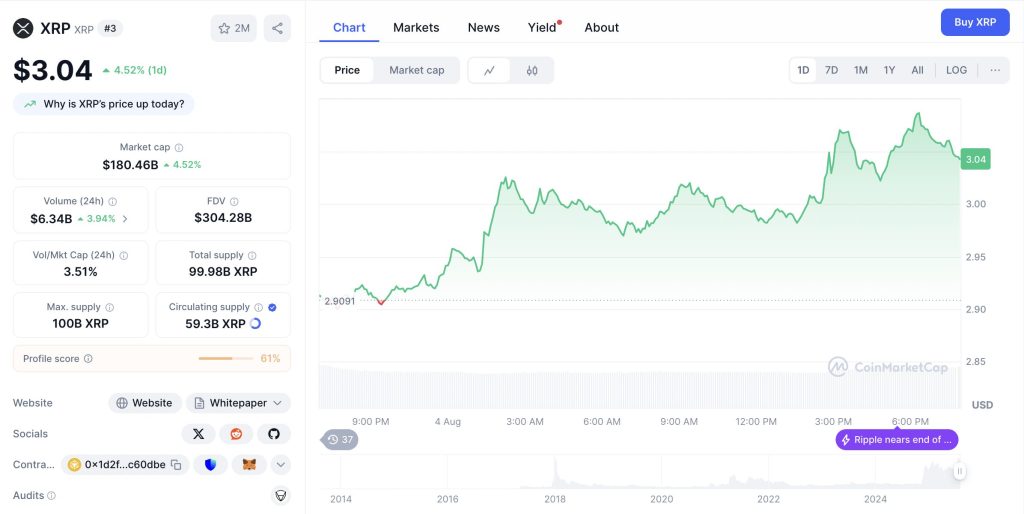

Chart XRp analyzing reveals a burlish breakout above $ 3.05 As the Ripple Banking Application Accelerate while 42 Banks reported to block approval, XRP position for a potential income toward $ 3.15 or consolidation above $ 3,00 Psychological support with a 3.57% displacements of the volume every day 130.77 million. I am

With neutral rsi to 53.55 and the macd histogam moment after desired line, the next direction movement could be significant as the accelerate bank license.

Summoning XRPT XRPT Analysis 24 Technique indicators, continuously, development developments, bance, pressure of menu grounds, and metaboration of institutionation for evaluating XRP 90 days The amidian trajectory concerned regulatory between continuing consolidation and a moment of the establishment of Explosive Institution.

The current price of XRP of $ 3.05 reflect an impressive + 3.57% chiru of everyday from the price of the opening of $ 2.95set a business interval between $ 3.08 (high) and $ 2,93 (low). This one 4.9% The range interday demonstrates typical controlled victulistic of bullish attempts.

The RSI to 53.55 If you are in healthy neutral territory with a substantial room for above movement above without conditions above.

The motion notice reveal the outstanding position with XRP over all EMAS: 20 days at $ 3.02 (+ 1.0%), 50 days at $ 2.79 (+ 8.5%), 100-day at $ 2.59 (+ 15.3%), and 200-day at $ 2,34 (+ 23.3%).

Volume analysis shows noticeable expansion to 130.77 million XRP, indicating massive participation during the discovered attempt.

Macd shows MY MIDS A -0.0668 Subject to zero but a positive historic to 0.1314 suggest the moment of the building toward a potential bullish crossover.

Atr to 2.23 Suggest a high-volatility feed with the potential for strong movements as regulatory catalyrs appear.

August performance XRP demonstrates the noticeable resistance with a strong recovery from recent consolidation, building the Explosive July rally $ 3.64.

Actual discovery attempt displays the enration of institutional confidence by the wider market confidence.

The January $ 3.40 Start, followed by the fix of spring to February $ 1,77 and the March $ 2.09, established a base of accumulation.

April June consolidation between $ 2.18- $ 2.21 created a foundation for the explosive of July 40% + rally toward $ 3.64. I am

The actual actuality of the august has by the strength of July with today + 3.57% Surgees demonstrate the institutional interest continued.

The current prices keep a 20.45% discount at the time of all the time while extraordinary assurance 108,000% + gain gain from 2014 Lows, showing both the rest of the appreciation of the institution’s prospective appreciation through the regulatory cycles.

Immediate support emerges to the lower $ 2,93enhanced by psychological $ 3,00 level and 20 days Em $ 3.02. I am

Key support demonstrate considerable depth with 50 days Em $ 2.79 (+ 8.5% buffer), 100-day Em $ 2.59 (+ 15.3% buffer), and 200-day Em $ 2,34 (+ 23.3% buffer).

This multi-layer structure provides management of the risk of the risk of institutional.

Resistance begins at the tall today $ 3.08followed by psychological resistance key to $ 3.10- $ 3.15. I am

Large resistance emerge to $ 3,20- $ 3.30, where previous consolidation height creates the above pressure.

Setup suggests the guns will find the multiple support levels, while a discovery above $ 3.08 could activate quick appreciation toward $ 3.15- $ 3.25 Based on the bank position of bank and institutional position.

Ripple Banking Application Facial opposition earlier, with 42 traditional banks that block approval. However, today, 4 Aug, The application is live and publicly available.

This resistance valid XRP processing potential for global finances.

License purse allows quick fast competition with access to $ 150 trillion annual payment volume.

RIPLLE BLACKROCK COUPORATION FOR THE RICE ASSETTER TOKENCATION provides institutional validation despite bank resistance.

These partners suggest confidence in event of eventual license.

XRP XRP analysis reveals a key regulator of the key with the deadline secs the terms that approached and unresponsive.

The bully experts suggested the time Sot has the limited time, creating urgency for a resolution that could delete final regulations.

Regulatory environment shows the moment without previous with the previous and bank partnership validation.

Sec secness suggests potential potential or setting of the appealing, both scenarios are favorable by acceleration of institutional adoption.

The recent patent approval for infrastructure of payment infrastructure proves the Ripple Leuth Beon Resolution Starting position.

XRP keeps the position of the third largest 181.77 Billion Market cap, demonstrating institutional validation during the wider market uncertainty.

The one’s 5.35% The Contrast contrasting market carpet with the volume declining to 6.31 Billion. I am

The one’s 3.42% The head of the head of the head of the leader indicates the entire business activity, suggesting the continuous market institutional in spite of the market.

This moderate activity during positive price actions valid the underlying force.

Supply of circle of 59.3 billion XRP represents 59.3% of the max 100 billion Token supply, with a controlled release schedule supporting stability.

This tokenomic structure keeps scarcity while allowing ecostive expansion.

The market dominance of 4.81% XRP positions such as an encryption of the major institution with substantial recognition and $ 305.6 billion the fully diluted rating reflecting increasing expensive.

Lunarcrush data reveals to improve social performance with the otherwise else of XRP to 68by indicating a loud recovery of community commitment.

Score of galaxy of 64. reflect the positive feeling building around banking and regular banking.

Commitment mercy show substantial growth with 11.94 million total income (+ 159,34K), 52.84K MENTIONS (+ 20.64K), and 8.7K Creators contributed to discussions.

Social dominance of 4.25% demonstrates sustained attention during market consolidation.

Feeling registrants in a robust 81% Positive, reflected optimism of community around bangaria, banger’s resolution, resolution of stolution and institutional.

Recent themes focus on daily channel donators, bank resistance, and $ 6. price predictions.

The combined bank license approval with the resolution of houses if could drive explosive appreciation toward $ 6.00 – $ 8.00that represents 95-150% upside by actual levels.

This scenario requires the volume sustained above 100 million everyday and a successful break over $ 3.15 resistance.

Delayed bank approval could result in consolidation between $ 2.80- $ 3,20allowing technical indicators to reset while the institutional position continues.

Support to the EAL levels likely to hold with a volume normalizing around 80-90 million every day.

The major regulatory pretacks may activate the sale toward $ 260- $ 2.80 levels of support, representative 15-20% toward.

Recovery that depends on institutional purchase to the support of support.

XRP XRP analysis reveals key license’s key convergence, technical strength over the emas and resolution of regulating resolution.

The structure of the bulloles with a moment of every positive day creates the upside potential.

Blust Dester Dip: $ 6.00- $ 8.00 in 90 days

The immediate trajectory requires a decisive discovery above $ 3.08 Resistance in order to validate the moment of the institution continue on the consolidation.

From here, the acceleration of the bank license could propose XRP toward $ 6.00 psychological tapestones, with the institutional adoption supported by driving toward $ 8.00 +, that represented highest loop tall.

However, failure to break $ 3.08 indicates extended consolidation to $ 2.80- $ 3.00 The interruption of the reguladory timeline stretches, creating an optimal accumulation opportunity before the use of next bank approval $ 15 + Bietets, validate the icobal of replacement of the replacement thesis

The post XRP XRP analysis: Setup of setup above $ 3.05 despite 42-Bank blockade on Ripple it first appeared Criponews. I am