Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

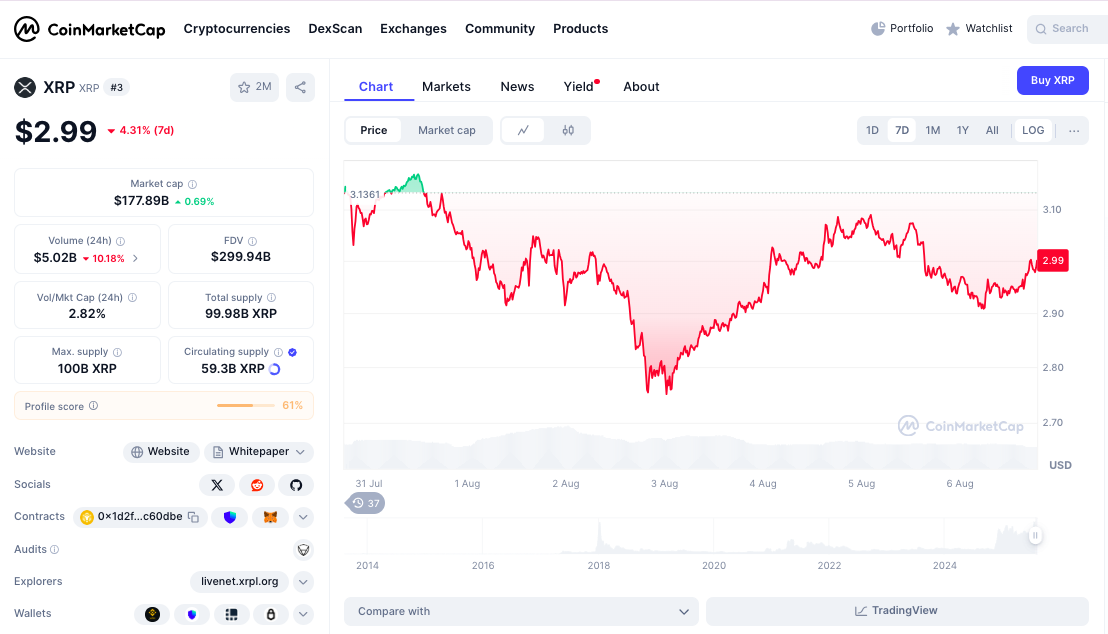

XRP XRP Analysis indicates the consolidation force to $ 2.98, marked by + 0.78% Earn, following the SBI Holding of Japan Faling for a $ 214 billion Bitcoin-xrp etf.

Commerce above the key 50 days, 100-dayand it 200-day EMAS, with only the 20 days Em $ 3.02 provide minor resistance, XRP demonstrates a bullish structure with a strong institutional foundation.

Summoning XRPT XRPT Analysis 20th one Real-Technical Technical Indicators, Japanese Etf Etf, Japanese decision timeline, and the Korean constitutional lunged to assess XRP’s 90 days Trajection of Trajectory Key Regulative Regulations between Consolidation Controllation and Explored Shared

The current price of XRP of $ 2.98 reflect a steady + 0.78% gain each day from the eagerness price of $ 2.96setting up a narrow trade narrow between $ 2.99 (high) and $ 2,90 (low).

This controlled 2.9% The intraday interval demonstrates the institutional accumulation typical pre-breakout consolidation phases.

The RSI to 50.61 If you are in the perfect neutral territory with the substantial room for upward movement without excessive condition.

The movement in motion reveal a strong position with XRP over the EMAS of the majority: 50 days at $ 2.81 (-5.9%), 100-day at $ 2.60 (-12.9%), and 200-day at $ 2,35 (-211%), with only the 20 days Em $ 3.02 (+ 1.0%) provide resistance. This structure indicates healthy consolidation in a stuproded.

Macd shows MY MIDS A -0.0557 Subject to zero but a positive historic to 0,1023 suggest the moment of the building toward a potential bullish crossover.

Volume analysis shows outstanding activity to 79.32 million XRP during the consolidation, indicates an institutional interest.

Atr to 2.20 Suggest a high volatility environment with the potential for strong movements such as regulatory catests.

August performance of XRP demonstrates the resistance with the current consolidation building on the Explosive Rally of the Xflulo $ 3.10 In spite of the wider market uncertainty.

The steady position above $ 2,90 Validate institutional confidence in regulatory resolution.

The January $ 3.40 Start, followed by a spring fix to February $ 1,177 and consolidation extended to june to $ 2.18- $ 2.21, established a strong accumulation basis. The breakdown of july to $ 3.10 confirmed the recovery of structure in bullish.

Actual consolidation of august between $ 2.70- $ 3.00 represents healthy glass digestion while holding the elevation over historical resistance areas.

The current prices keep a 23.25% discount at the time of all the time while extraordinary assurance 106,000% + gain gain from 2014 Bows, showing both the rest of the potential and ability demonstration for the apprehension of institutional by regulatory cycles.

Immediate support emerges to the lower $ 2,90enhanced by psychological support and proximity to the 50 days Em $ 2.81. I am This confluence provides primary defense with the unsubstantial appoints layers below.

Resistance begins at the 20 days I am around $ 3.02followed by July high to $ 3.10 and important resistance to $ 3.4- $ 3.40. I am Breaking over $ 3.02 could agree to the acceleration of the moment for these highest objectives.

Technic Setup suggests the risk of the minimum in the support of loud emails as the above rifle $ 3.02 could activate quick appreciation toward $ 3.4- $ 3.40 Based on the moment Etf and the Required Charity.

The SBI’s SBI broken, run $ 214 billion In assets, Filed for a bitcoin-XRP etf launchedthat represents maximum institutional validation for XRP payment infrastructure.

Etf features demonstrate institutional recognition of cultivation of XRP wings of speculative trading.

The last development follows a The increasing tendency we’ve seen in 2025. I am

“Companies are always more diversifying [alternative cryptocurrencies]Treats as the strategic assets related to the finance of digital finance, “signal sign, understand the leader of the leader, exceptions.

Shared with criponews, affirming that “cubbean bull bull bull is not above but it is in phase where macro uncertainty is serious in time market.

XRP XRP analysis reveals key regulatory with the Sec scheduled vote For August 7, potentially ends the appeal decision before the August 15. “ Term.

Accessing Security Security Decision suggests internal pressure for resolution, favor optimistic resulting scenarios.

XRP keeps the position of the third largest $ 176,96 billion market tap, demonstrate institutional stability during market uncertainty. The modest 0.06% increase in the market tap accompany a 11.69% Volume has declined to $ 5.05 billion. I am

Supply of circle of 59.3 billion XRP represents 59.3% of the max 100 billion Token supply, with the release of the additional completion release.

The market dominance of 4.71% XRP positions such as a first institutional cryptocer with the exostoid recognition of the obsisther.

Lunarcrush data reveals to improve social performance with the other than XRP that if you get to 405indicating the commitment of the renewed commitment.

Score of galaxy of 55 reflects the building positively around the ethf developments and the record timeline.

Commitment mercy show substantial activities with 9.96 million ing total and 54.98K MENTIONS (+ 22.02k).

Social dominance of 3.8% demonstrates the attention sustained during the consolidation phase.

Feeling registrants in a robust 83% Positive obtimism, reflecting SBI Etf Etf Etf, Sec Vot, and the Launch of Korean Custody.

Recent topics focus on bull flag patterns, 7-14 price targets and acceleration of institutional adoption.

The security security combined with SBI approval Etf could drive explosive appreciation towards $ 7.00- $ 10.00that represents 135-235% upside by actual levels.

This scenario requires the volume sustained above 100 million everyday and a successful break over $ 3,42 resistance.

Retarded Regular Regular decisions could result in actual limits between $ 2.70- $ 3,20allowing technical indicators to reset while the institutional position continues.

The support to the EMA levels would provide accumulation opportunities.

Unexpected regulatory delays may activate the sale toward $ 260- $ 2.80 levels of support, representative 10-15% toward.

Recovery that depends on the institutional purchase in support EMA and a positive resolution.

XRP XRP analysis reveals the conjuvenation without regulatory resolution, adoption of institutional and technical consolidation force.

Prezi Bush: $ 7,00- $ 10.00 in 90 days

The immediate trajectory needs a decisive discovery above $ 3.02 Resistance in order to validate the moment of the institution continue on the consolidation.

From here, clarity acceleration reguladory could propose XRP toward $ 7.00 Psychological stern, with the adoption ethf sustained to drive toward $ 10.00 + that represented highest loop tall.

However, failure to break $ 3.02 indicates extended consolidation to $ 2.70- $ 2,90 The range like the adjustor timeline stretches, creating an optimal accumulation opportunity before the wave of regulatory victory.

The post XRP XRP Analysis: Sec vots looms, $ 214b Etf Add a Slowler Respage? it first appeared Criponews. I am