Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

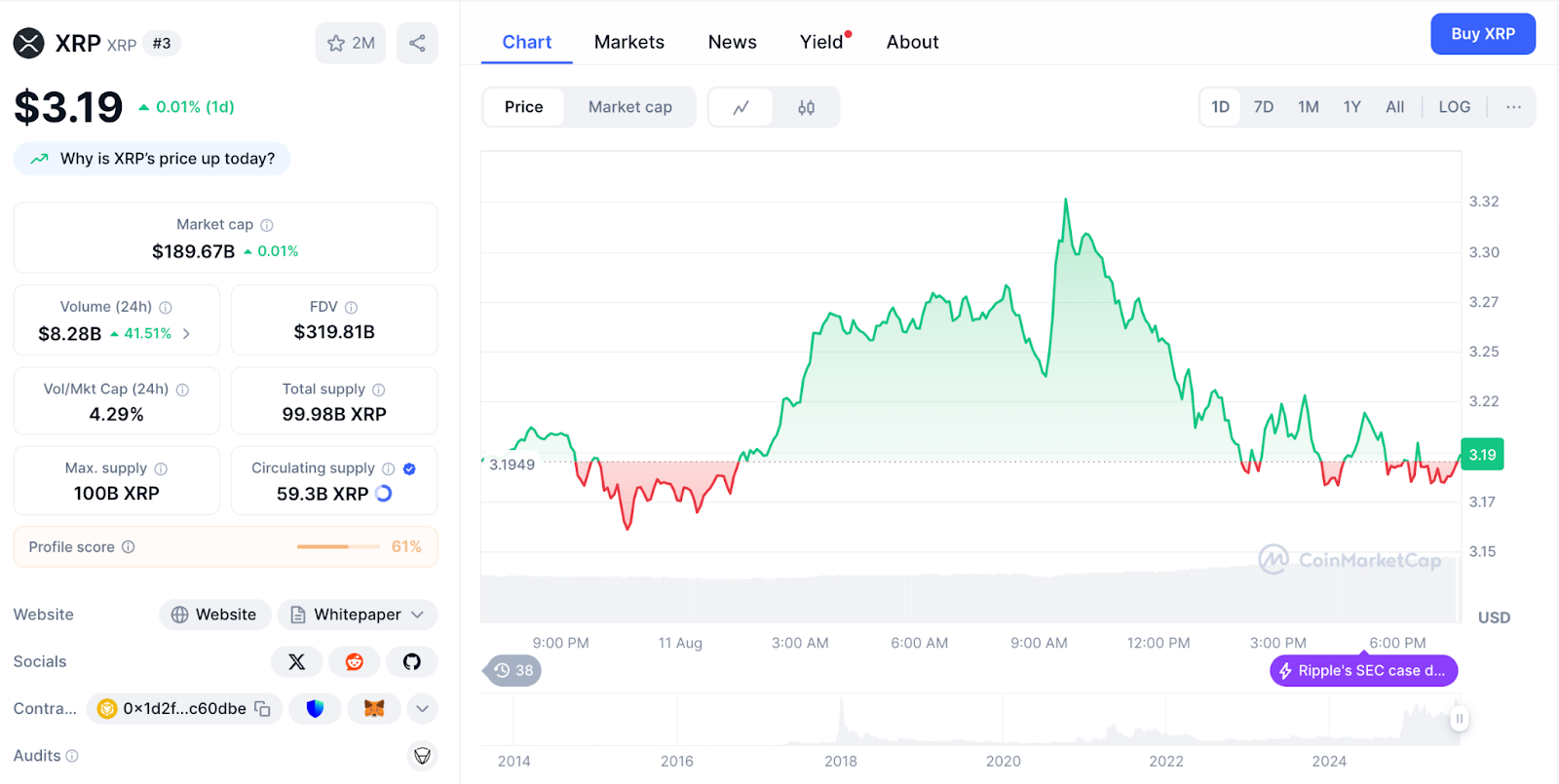

Chart XRp analyzing revealed a book-text model consolation 3.20 €, marked by minimum Move of -0.52%. I am This comes as secs grants ripples a new garment regulation dia, effectively effectively the impairment of important funding.

Meanwhile, the origin the origin of the Original Original Payment Post XRP XRP for a broken potential toward $ 3.33 or limited action to continued range above the $ 3,16 support.

Summoning XRPT XRPT Analysis 18th Indicators Technical Indicators-Fale-time, implications of wisps of wisporative corporate, and metrics of instupational position to evaluate xRp 90 days trajectory.

The current price of XRP of $ 3,20 reflect a minimum 0.52% decline every day from the opening price of $ 3.22setting up a narrow trade narrow between $ 3.2 (high) and $ 3.18 (low).

This controlled 1.8% The intraday range shows the classic classic consolidation typical preparation phases before major direction movements.

The RSI to 49.58 is found in a perfectly neutral territory with the substantial room for explosive movement in any extreme condition.

The movement in motion reveal a strong position with XRP over the EMAS of the majority: 50 days at $ 3,16 (-1.2%), 100-day at $ 3.12 (-2.5%), and 200-day at $ 3.07 (-4.1%), with only the 20 days Em $ 3.21 (+ 0.5%) provide minor resistance. This structure indicates healthy consolidation in a stuproded.

Macd shows MY MIDS A -0.0135 under zero, but a strong positive abutogram to 0.0344 suggest the moment of the building toward a potential bullish crossover.

Volume analysis shows the activity remains to 42.33 million XRP during the consolidation, indicates an institutional interest.

In addition, att 2.97 Suggests a volatility food with potential for important movements, especially as regulatory developers accurring.

The August XRPs Demontrition, Iuitional patience follows the CURRENT market marker confidence despise the postal of the postal of typical victims.

The above position $ 3,16 The support keeps lift from the discovery of regulatory region.

The journey of the long year by the dibbile $ 1,72 low through the extended consolidation of spring to $ 2.18–$ 2.2 to the break of july to $ 3.10 has established a strong institutional funding.

The actual consolidation represents the whole digestion of victory gains.

August action of August $ 2.72–$ 3,38 Displays the institutional position controlled in front of the next wave cataly

The current prices keep a 14.89% discount at the time of all the time while extraordinary assurance 113,000%+ gain from 2014 low.

Immediate support emerges to the lower $ 3.18supported by the key 50 days Em $ 3,16. I am

This combination provides primary defense for a continued bullish structure with additional apple support below.

Key support demonstrates a solid foundation with 100-day Em $ 3.12 (-2.5% buffer) and 200-day Em $ 3.07 (-4.1% buffer).

This multi-layer structure provides the downturing protection of the institution in the consolidation phases.

Resistance begins at the 20 days I am around $ 3.21followed by the tall today $ 3.2 and important resistance to $ 3.33–$ 3.40. I am Break over the current narrow range could activate the time acceleration toward these highest.

The technical setup suggests the minimal downside rise to a strong support cluster, while the flag of the flag of the flag could produce the rapid movement toward $ 3.40–$ 3.50 Based on the moment of institutional adoption.

The security grant is To a new regulation of regulation regulment for Ripple, allow non-unlimited capital that grows from an incredids without redness without red ribbon.

Removal of the Waiver Enable Growing Initiatives, Product Development, and of Regulatory Limit

The timing after the Dry resolution sec Create an optimal environment for the institutional capital capital and strategic partners.

XRP XRP analysis reveals corporate adoption with Blue origin has bored Conception of XRP payment, representing the flower industry validation for infrastructure the infrastructure of XRP.

The adoption expansion of the action proves XRP, the practical utility of XRP EVERTROCUTIAL, with companies recognize payment and costs.

The recently developed development and institutional destition of institutional infrastrieting in the position of the main financial integration.

Talking to CryPtonews, Ray Yousef, CEO of Noones, emphasis that “The projects as a solicit and ripple have a bad stick to their market lids several times, potentially in the “altcoin ‘category and out of the shadow of the etony.‘

This assessment that is aligned perfectly with the current position of XRP, as the combination of Second payment of Seconds, and regulative Normands creates the perfect condition of conditions.

The opposite of the world’s work tokens, the world of the world’s sustainable world to survive the market cycles and achieve the status of the institutional.

XRP maintains the larger third position with a $ 189.76 billion Market cap, show institutional stability during consolidation phase.

The modest 0.2% Market Caper’s fire accompanies a healthy 25,41% disappear the volume $ 7,61 billion. I am

The one’s 4.0% Volume head report indicates moderate business activity, suggest institutional location rather than speculative activity.

A circulating supply of 59.3 billion XRP represents 59.3% of the max 100 billion Token supply, with the release of the additional completion release.

The market dominance of 4.74% XRP positions as a property an institutional criptury with a regular advantage.

Lunarcrush data reveals stable social performance with the otherwise of XRP to 143indicating a sustained committed commitment during consolidation.

Aa galaxy puncture of 53 reflects the construction time around institutional developments and corporate adoption.

Commitment mercy show substantial activities with 13.02 million ing total and 62.8k MENTIONS (+ 21.98k).

Social dominance of 4.45% demonstrates continued attention during a narrow trade rank.

Also, the feeling shows a sturdy 80% Forward the consolidability, reflecting the community confidence in a long time prospects after regulative clarity.

Recent topics focus on flag patterns, $ 4.–11 price targets and acceleration of institutional adoption.

A successful break above $ 3.2 Resisted combined with continued corporate adoption could drive appreciation toward $ 4.00–$ 5.00that represents 25–55% upside by actual levels.

This scenario requires the volume sustained above 60 million momentary of partnership daily and institutional.

The institutional position continues could result in extended consolidation between $ 3.10–$ 3.30Allow technical indicators to reset while developments of adoption they continue.

This scenario will provide the opportunity of no major risk accumulation.

The weakness of the wider market could activate the sale toward $ 3.07–$ 3.12 levels of support, representative 4–8% toward.

Recovery that depends on institutional purchase to support ie and the moment of continued adoption.

XRP XRP analysis reveal the optimal analysis of ruling normalization, acceleration of the adoption of corporate activity, and the consolidation of the technical flag.

Blust Targ dele: $ 4.00- $ 5.00 in 90 days

The immediate trajectory needs a decisive discovery above $ 3.2 Resistance to validate the breakout flag from the consolidation basis.

From here, the acceleration of corporate adoption might propel XRP toward $ 4.00 psychological titestone, with institutional integration sustained toward $ 5.00+, that represented strong appreciation.

However, failure to break $ 3.2 indicates extended consolidation to $ 3.10–$ 3,16 range while digested market developments, creating an optimal accumulation opportunity before the next wave wave $ 11.+ targets, validate global payment payment domenruction with full and operational regulatory normalization.

The post The XRP Analysis to see a perfect flag seat – the secs Security could trigger monshot it first appeared Criponews. I am