Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Circle has billions $ 1.25 billion (USDC) in the solan blockchain in only the seven days, lifting their total issuance in 2025.

The role of urge in the greeting of the greeting of the establishment of the Highlights Highlights as the issuer of cipher’s choice choices.

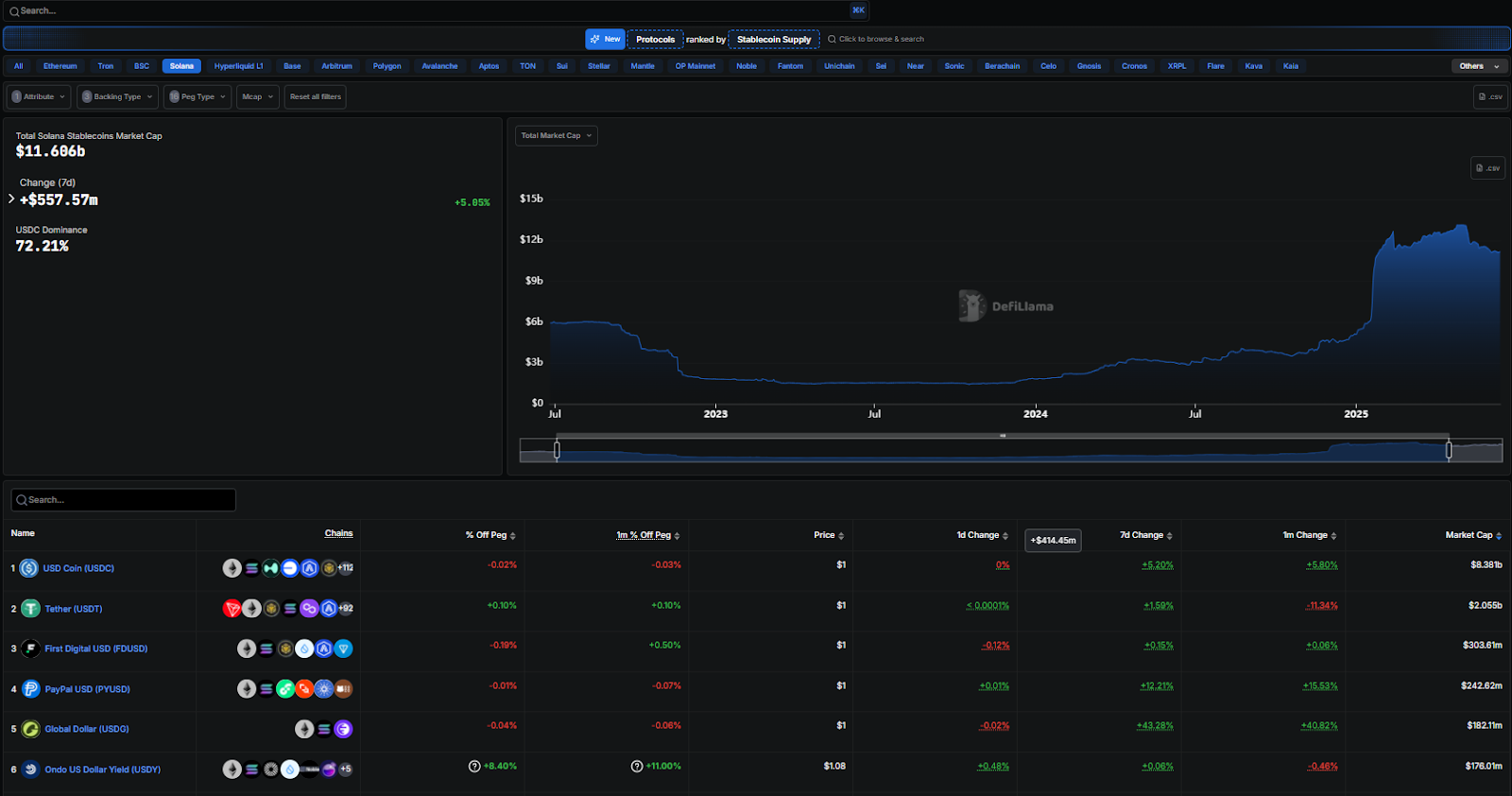

According to By Defillama data, the steady market covering in the solum has climbed $ 11.6 billion commanding an endearment 72.2% of $ 8.38 billion.

Which dominance do not show solely the solicit, where USDC has been involved during forgetful exchanges in all token and raydium, loan, and applications.

During the last week only, the supply of the steady steady raises more than $ 550 million, a 5% increases that opens to the fresh and confidence of capital inflaws.

The PEG of USDC is still restless, deviating only 0.02% by its $ 1 value, strengthening their reputation as one of the most affection in Crypto. This stability is particularly significant in an ecosystem where rivals show more mixed performance.

Tether, still the largest stable, maintain a 18% of the solan market in the circulation but its supply in the network has been from 11 past 11.

To counteract, PaySD Payush, the primune (FDUSD), and the most recent English (USDG) and performance performance

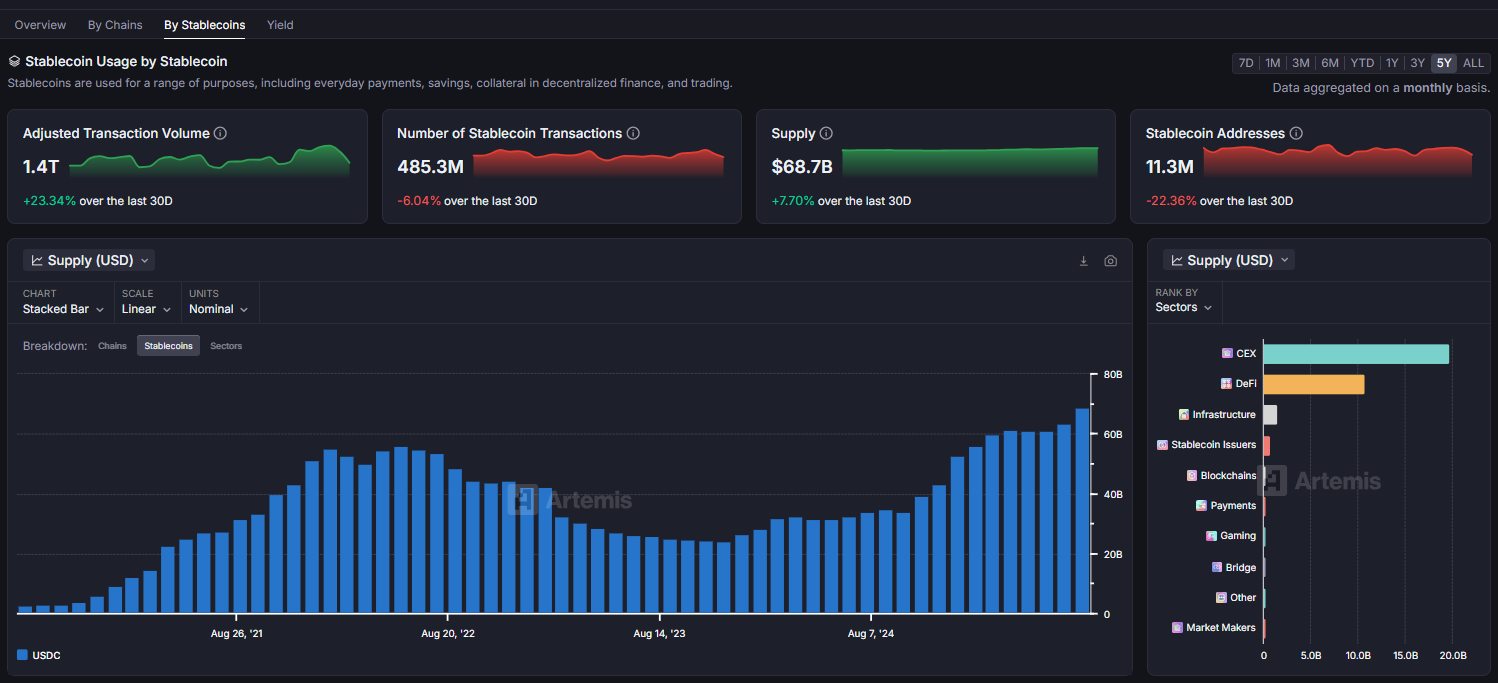

The wider context reveals because the minting of the circle of the circle. Data from Artemis Shows Using of Stablecoin on solane newly, with $ 1.4 Transaction in the previous transaction volume in the last 30 days, a 10% source surgeon economic activity.

Interesting, while the number of transactions were expensed by the average timile makes it brightly, suggestion that the institutional players are always more fun of solid steady.

This institution is also visible in unique attached stability drop, down 22.3 million, as consolidate funds in less than centralized flatness.

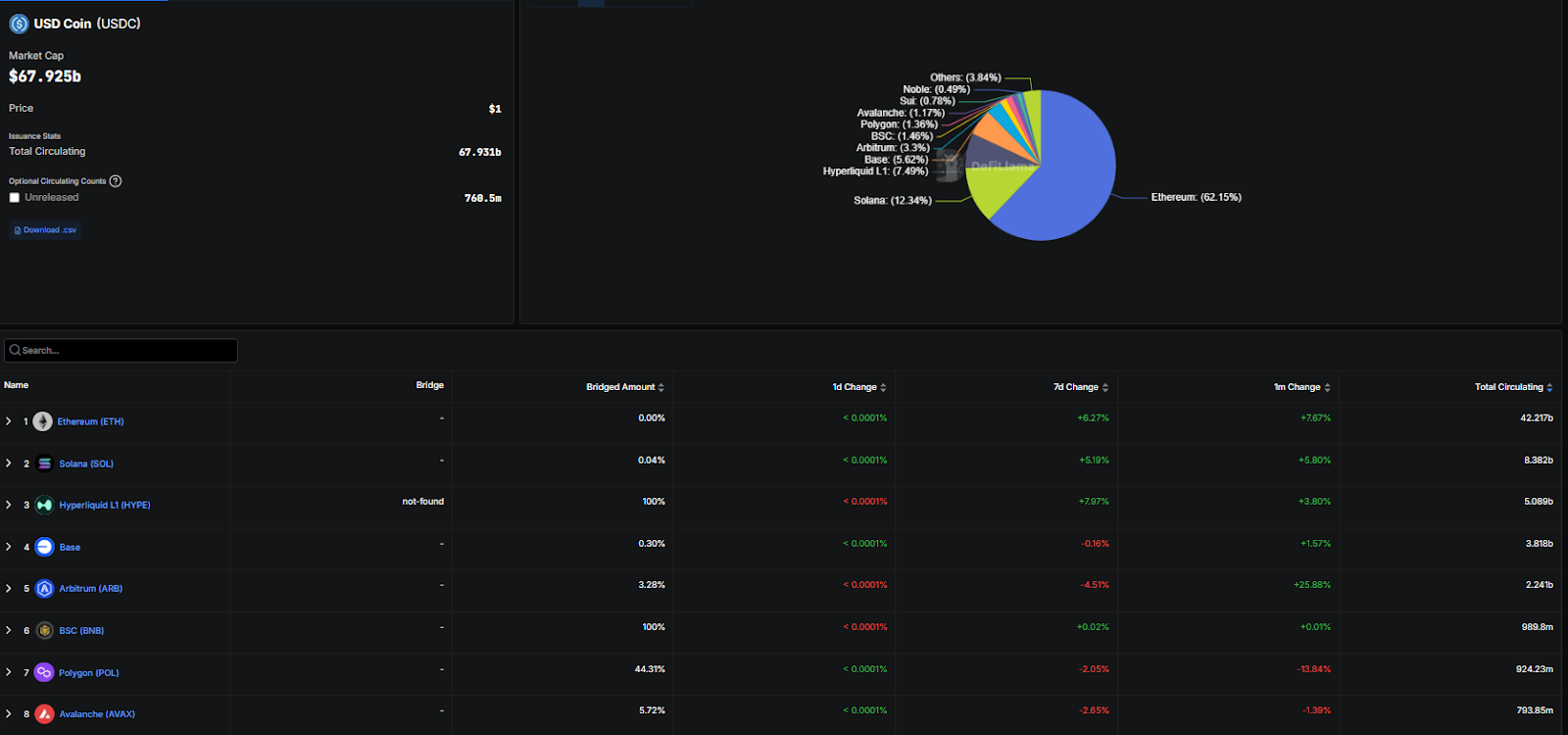

Circle USDC supply at $ 67,93 billion, with Ethereum Holding the greater part in 62.21 billion and $ 8.38 billion)

Notwillable, beat (5.62%), arbitrum (3.3%), bnb string (1,46%), park (77%) do more postculation

Expansion is part of a wider trend through the steady sector. In July, the capitalization of the steady global market Arrived at a high time of $ 261 billionMarking 22 Movies consecutive of growth. Trade volumes on centralized exchanges also cooked at $ 1.6 trillion, as stable as the role as the liquidity backbone in digital asset.

While Tether remains the sector’s giant with $ 164 billion, its dominance, the USD opening is $ 63.6 billion general and most recently.

By solane, numbers tell a convincing story. With the USDC accounting for almost three-quarters of all the steady steady on the network, circle has become the backbone of the solan difes and uneaf payment economy.

The bining has seen a bad $ 1,82 billion stable in recent days, one of the largest deposits of a single day in months.

Analysts Note Such a moves often precede market activities, suggested large investors could be prepared for accumulation or short term trades.

At the same time, The solan developers reported a new shot of crossing the weekendwith the network briefly dress 107.540 transactions per second on Mainnet during a trial of stress. The test, who used “noopweight” NOOP “mandified, highlighted theorist capabilities of 80,000-100,000 TPS in the living environments.

Despite the register, current usual use is remaining away. Through current Medium 3.600 tps, with most activity attached to the vowed validator. Really users transactions typically between 900 and 1,050 tps, largely driven by the memein trade on the pump.Fun.Funk and letbonk.

In July, Circle approximated their global push with a partnership with OkxIntroducing direct 1: 1 US Widc conversed for the 6 million exchange. The movement is going to improve ramps in regions where access stability remained limited, while also enforce liquidity to the financial subject.

Around the same time, circumsted USDC and her Cross UpdadedThe chain transfer protocol (CCTP v2) on hyperlidActivate Seamless Transfers between the platform and other blockchains.

With hyperlid’s assets under handling of $ 5.5 billion, they seek that USDC has earned there will be completely reserved and redimable 1: 1 for US dollars.

The moment worn in August when the circle landed Bow, its own capa-1 blockchain designed for the steady finance. Located as the most ambitious infrastructure of the company’s archery, their gas token and the filling of sub-second, a integrated privacy motor.

Set to Public TestNet Launch this fall, Arc marks to the Ancient Job trailers through Payments, Foreign Congs, and Capital Walves. These announcements are matched with the surroundings The first reports of earning as a public company after its June IPOthat raised $ 1.2 billion.

In spite of a $ 482 million loads of the IPO loads, the circle reported different results at $ 65.2 to $ 65.2

With USDC now contracted 28% of the steady market and Wallet has to address 68% year, circle is underlined their ambition to make stability

The post Circle Mints $ 1.25b USDC on the solan in 7 days, Hits $ 24b in 2025 – This is why it first appeared Criponews. I am