Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

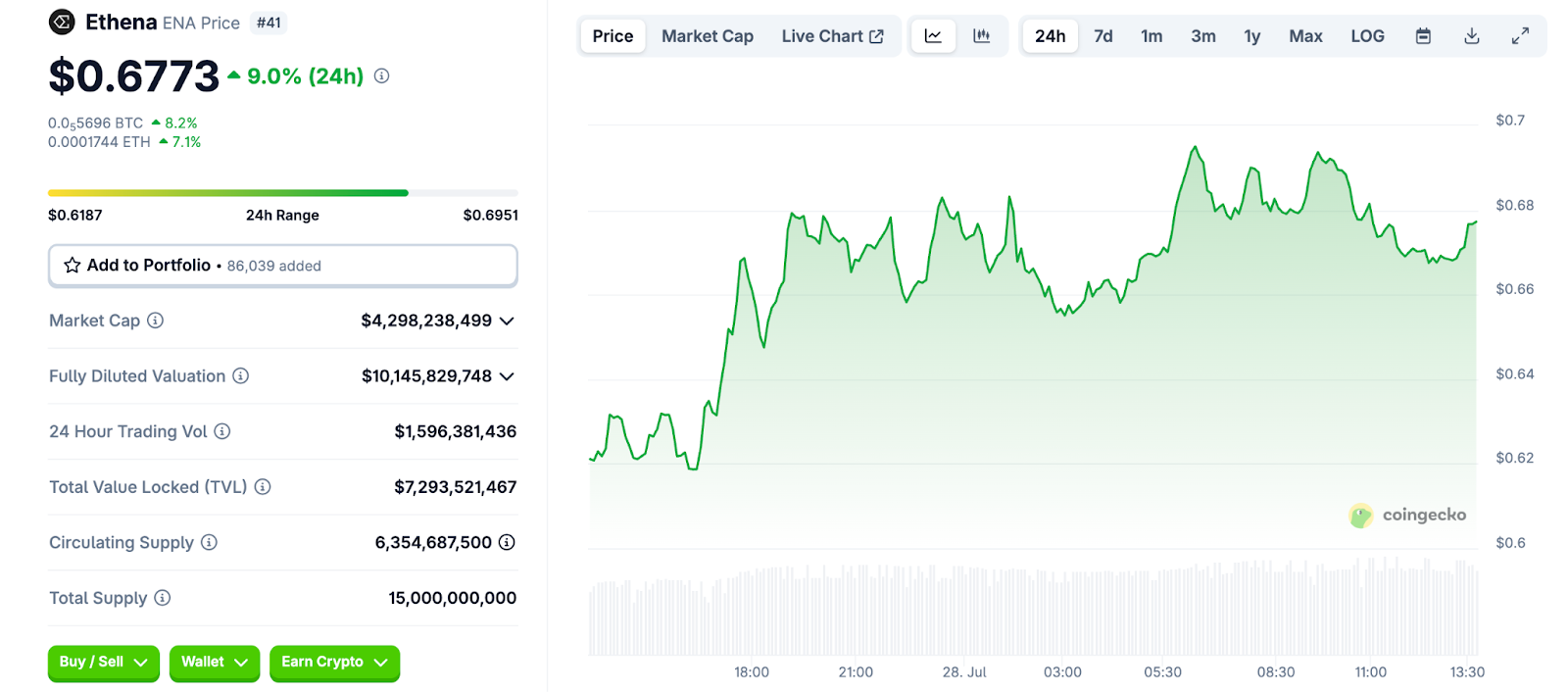

The Ethena $ The fresh-side defense stays with a week’s price relaxation this week – but the next movement of rally stops in the balance. After a breakup breakout, buyers are lost by resistance at a standing resistance standing, starting to commercial or quick revision.

The Thingen Things Aligned with the wider protruding growth, including expantities of major ecosystem and fresh capital. Yet technical indicators suggest the explosive movement may need renewed fuel to support their climb.

Ethen has integrated $ I guess in the Defi Ecosystem through partners with the blue chip protobsols such as Aaves, Financia curves, The habits without unlocking farm opportunity and yield farm opportunities that also aligns for token tests.

As well as Cryptic synthetic dollar protocol On Ethna, Ethna Compility the Minda of the Udte-Neutral Hedging strategies, provide scalping the dollar dollar that resistant to the historic

The unique offer of protocol is attracted to Total value shut (Tvl) of $ 7.726 billion and ton, reflecting a strong capital teaching and performance. These shoes solidify the protol position as one of the main networks of steady stable flaws.

He generated 433.33.32 million annual fees, translates to $ 97.8 million in yearly earnings for the treasure. In addition, $ ENE liquidity on UNISWAP v3 total 18.76 $ millionEnsuring the market depth for government token trade.

On July 22, 2025, Ethen Sent A $ 360 million tokens incoat, to strengthen the treasure resistance and protocol stability, together with the plans to list on the nashed.

Little after, the party’s bill with Digital Anchorage to launch USEDTB, a federally regulated 1.5 billion steady

Adding those Spanish Drough, Bitmex Co-founder Arthur Hayes Adding only 2.16 years, 7.06, certainly optimalage.

Analysts interpreted these activities across the protocol, as strategic pamper toward institutional integration and alignment of the lane ethena’s alignment,

With the Ethen’s market tap climbing the past 4.2 billion and the USDE itself Surpassing $ 7.5 billion In value to circulate, the bulky conversation sheets suggested $ ama remain well-placed to extend and sharing fees.

After weeks of methodical ascent in a parallel parallel channel, $ EAST / USDT has succeeded through the upper limit. But the breakout is not re-entered with the initially promised force.

What began as a clean move above resistance started to settle just under the handle of $ 0.69, raising the sustainability of this push.

At first, buyers were in control. The order flow has shown a strong question, with the cumulative volume blame 119m and deltas positive. But things have changed near $ 0.67- $ 0.69.

Two rights rights 4-hours printed (-5.69m and -5.17m), clear signs of sellers that occur. Volume also seems to be declined. This is not just hesitation; It seems to be real resistance.

At the cardboard level, price is still commercial above the channel but only right. Candles are now refugee, with long wicks indicating the refusal.

Meanwhile, the lives here on 70 per three sessions lasting, wearing the supbuted conditions for proses, as the macd lines started to converge near the top.

There is no invalidation. But the complexion has changed. That was now an explosive discovery as an act of levitations are maintaining the afloat price, but there is no increase in dialing a true change in the regime.

If the bulls cannot claim initiative with a strong release of the volume, this could turn corrective. A drift back in the channel exposes $ 0.63- $ 0.60 area, where the last cluster is reside.

The break can be valid but the lack of following suggests the market is already a second.

The post The enhna’s $ ena rockets 37% – the arthur hayes’ $ 1m bet keeps rally living? it first appeared Criponews. I am