Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Galaxy Digital is exploring tokening their public trading coat as part of the bank-based finance and commission of the US (sec).

The move only gets weeks after the firm has finished his Listed listed On the NASDAQ under glxy ticker.

In the filming, Galaxy stated that Is “evaluate tokegetthing our class a common store” and has entered a transposing adjection with transposing services, a supercted agent on tokenszed

According to the company, this initiative could provide the investments with an alternative way to hold and of glxy-handed with block rails.

“If implemented, GLXY Tokenize provides a mechanism goodbyes to investors to hold and marketing in the company.” Galaxy said.

Business’s interest in the tokenized equity is not new. In May, Galaxy CEO Mike Novogratz I was able to publicly about the plans to turn the action of GLXY in tokens for use in decentral financial applications (dif) as a loan and business.

At the moment, Superstate has launched the opening bellA platform for commerred actions to the string in string, potentially placed work for the esperiment of galaxy.

In spite of growing unknown interest in tokented location, “MANNICLE for tokensis of tokensis who” market is not the polyber or a liquely tokend.

Talk to CryPonews, Ali Mahir Aksu, a founder of the assistance to their superstathevi this moment reso. Reflect a change in increasing where tokenation is not only liquidity; is of programability, access to property models

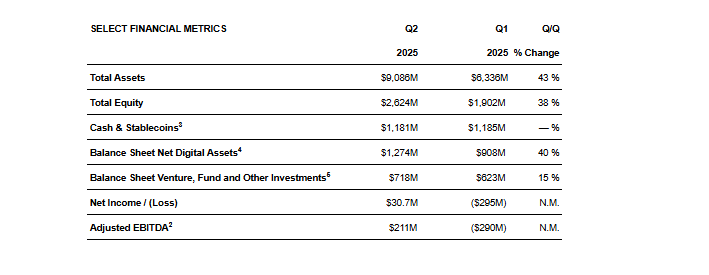

The announcement Follow a second turbulent second for the assets of digital assets. Galaxy reported $ 9.1 Billion in total goods for Q2 2025, a 43% increase by previous fourth, but also noted volatile financial.

Net income for the period reached $ 30.7 million 30 years, a Tornaro of $ 295 million of Q1. However, the gross entries adjusted 30% of fourth-over-over-fourth, and the total transaction expenses expires by one third.

The fourth sawn Galaxy Complete their corporate restructure and officially debut in NASDAQ on 16 May, opening $ 23.50 per part. The listed years followed years of retards than Novogratz discressed as “infuriating.”

Joël Valecuela, Marketing Director and BD, said, “L’S: Please be technique to their fullest power, the plan is massive.”

In spite of the axes of the assets of the assets of the asset published the strong results, with additional ebitty of $ 13 million and an object of 28% global market. The average loan size is up to $ 1,1 billion billion hunting the margin request

Their treasure and corporate division most earnings, while the profits from his unit of digital assets and management axis were more modester. Galaxy handle one of the greatest bitcoin sales in history, download more than 80,000 btc on behalf of a customer.

She’s firm was the glass that always for digital facilities, with growth in global markets and new activity in infrastructure. The firm also reported the sale of 80,000 Bitcoin on behalf of a client after the fourth closed, one of the largest national transactions of its type

Galaxy’s bombs’ asset has become, reaching $ 9 billion in assets on the deck from the end of June. However, the earnings from the stark has been declined 26% due to lower activity through blockchain networks.

Meanwhile, the fingers continue to build HELIOS Center campus. The company confirmed that Corewea has done in the full 800 Megawatts of the site approved to the site.

Ali Mahir Aksu, Founder of a Bondo. “As for the drop of Q2 Asset, part of the cycling data. Gallavorite, not riding.”

Galaxy also accurately a 160 land Arres of nearly, SAVING THE TAKE AFTER 1,500 HORD AND AGAINING THE POTAL POTALITY AT A 3.5 GigAWatt.

Novogatz told the wave of the crypo crypo’s waves of crypo on the buttons, can already be buekit.

Talking during Galaxy Q2’s call, Novongratz neight that while anticipated entrance to the michael’s bitcoin declor has carried the way, the most recent companies may fight for traction.

Pointed the focused focuses and key players sets for more growth, as they warn that future startups may find more difficulty. Galaxy Partner currently over 20 finger, handle approximately $ 2 Billion in axis and generating a steady fee income.

Al olà Treasury business, Galaxy is also building its institutional infrastructure. In July, it Integrated their edge platform with firebocksGiving more than 2,000 institutions of financial institutions to throw services directly for the foculocks custody system.

Meanwhile, Galaxy adventures, a black investment, hit the first external foundd in June, ensuring $ 175 millionAbove its initial target 150 million. The bottom fit in the first-scene projects in tokenation, stable, and blockchain Afrastructure. Since 2018, galaxy has invested in more than 120 start, including mond and ethna.

Novongratz said the BLOCKCHAIN markets remain the long-term vision, even the tokened liquidity is not lacking clear answers.

The post Galaxy Digital Tokened Glixy Eve after 43% of Asset Assets, 80K-BTC Mega-Trade it first appeared Criponews. I am