Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin remains a focus singly and a toy trade and his volatility and macro sensitivity follows its grip. Since 2020, Bitcoin It was almost four times as main stock indicates, underestimating the risks that are poses also traditionally financial players.

While the new US legislation is the target of genius to stabilize the digital asset market, such movements do not make the expert market any less volatile. In fact, they may amplify risk, given as a cryptu intercomponsis and traditional markets become.

In spite of the narratives that ritra bitcoin as a hedge, it tried to a high altual, meaning more aggressive in the same ruler

When the searches fedge hikesate interest rates to fasten often as they suffer as liquities hepped as the safest assets as the safest assets.

Instead, rate sizes or even the speculation of ease typically trigger rallies, as a risk appetite again and capital in the speculative assets as crypto.

The approval of Bitcoin etfs Etfs in January 202 was a referral event, throw a massive income of institutional capital. These etfs offered traditional investors a fulfilling way, friction mode to acquire exposure to bitcoin.

When in the Blackrock and Fidder Institutions started to bitty behind their Etf products are supiled, strengthens in bullish, which in Turn Spinger are you higher.

The institutional pivot also changed the bitcoin market profile. Fishes are fishes financially now build robust infrastructure around bitcoin, by the constovers for duty plephphi. Even skeptic points pass like CEO LARRY CEO LARRY FLK have publicly hugged the assets.

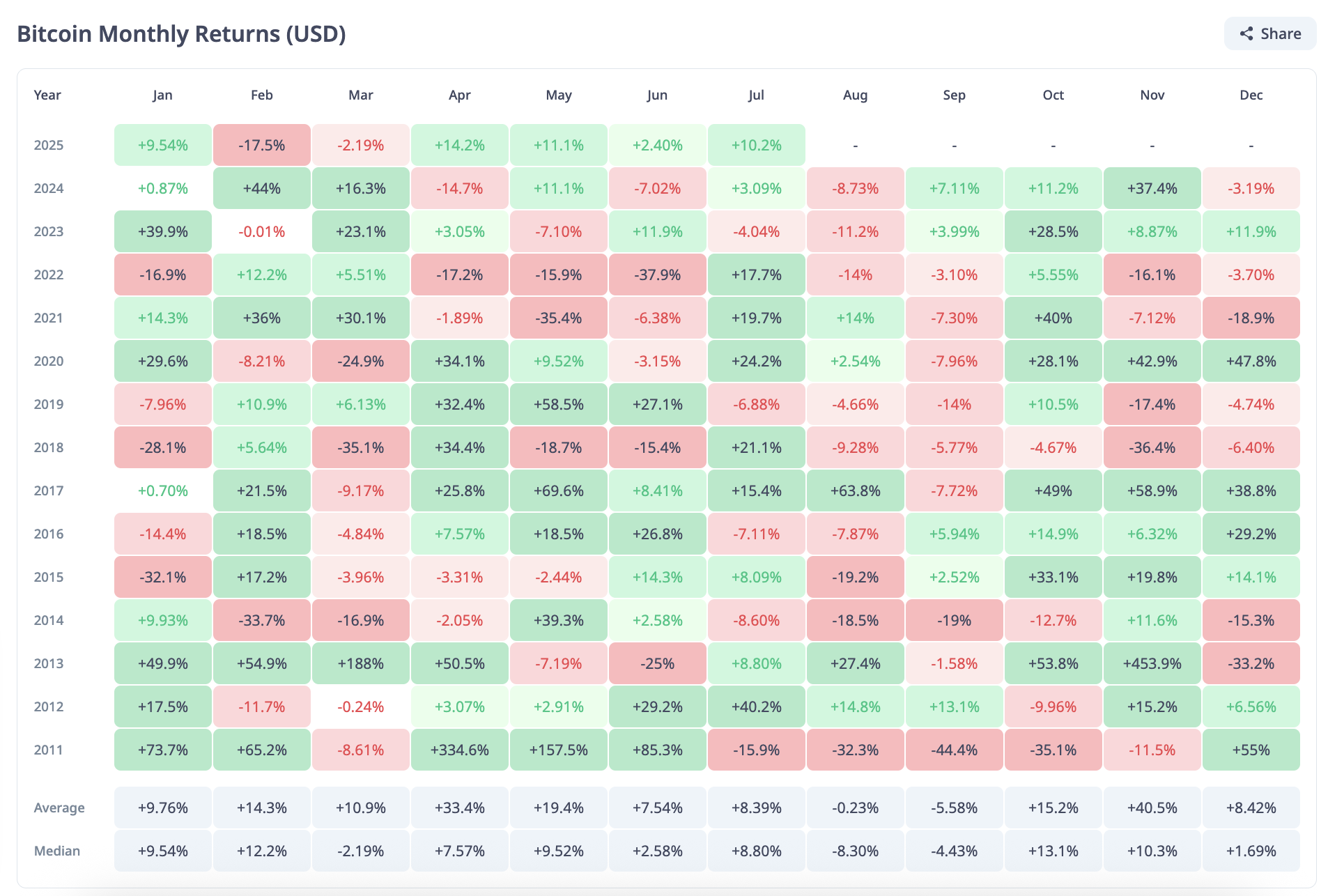

This muffler a bitcoin muffler as the investible asset, rather than not remove volatility, especially during historically weakly as august. August was often One of the most beautiful months realized Bitcoin, with average -8.3% losses and historic reflections in 2011, 2015, and 2015.

However, bully the long-term predictions remain strong. Analysts as planb, known for the stock-to-flow-to-flow model (S2F), support that bitcoin is bottom of the gold. With the Bitcoin’s S2F report to 120 (double that gold), Planb suggest btc could be worth $ 1,18 million.

Meanwhile, bad cio Matt Hougan Bitcoin predict could come to $ 200,000 at the end of 2025, mentioning the institutional decline.

Bitcoin evangelist jerezes Go further awayPlanning a $ 500 $ 500 price and urges the long-term heads to borrow against his btc rather than selling.

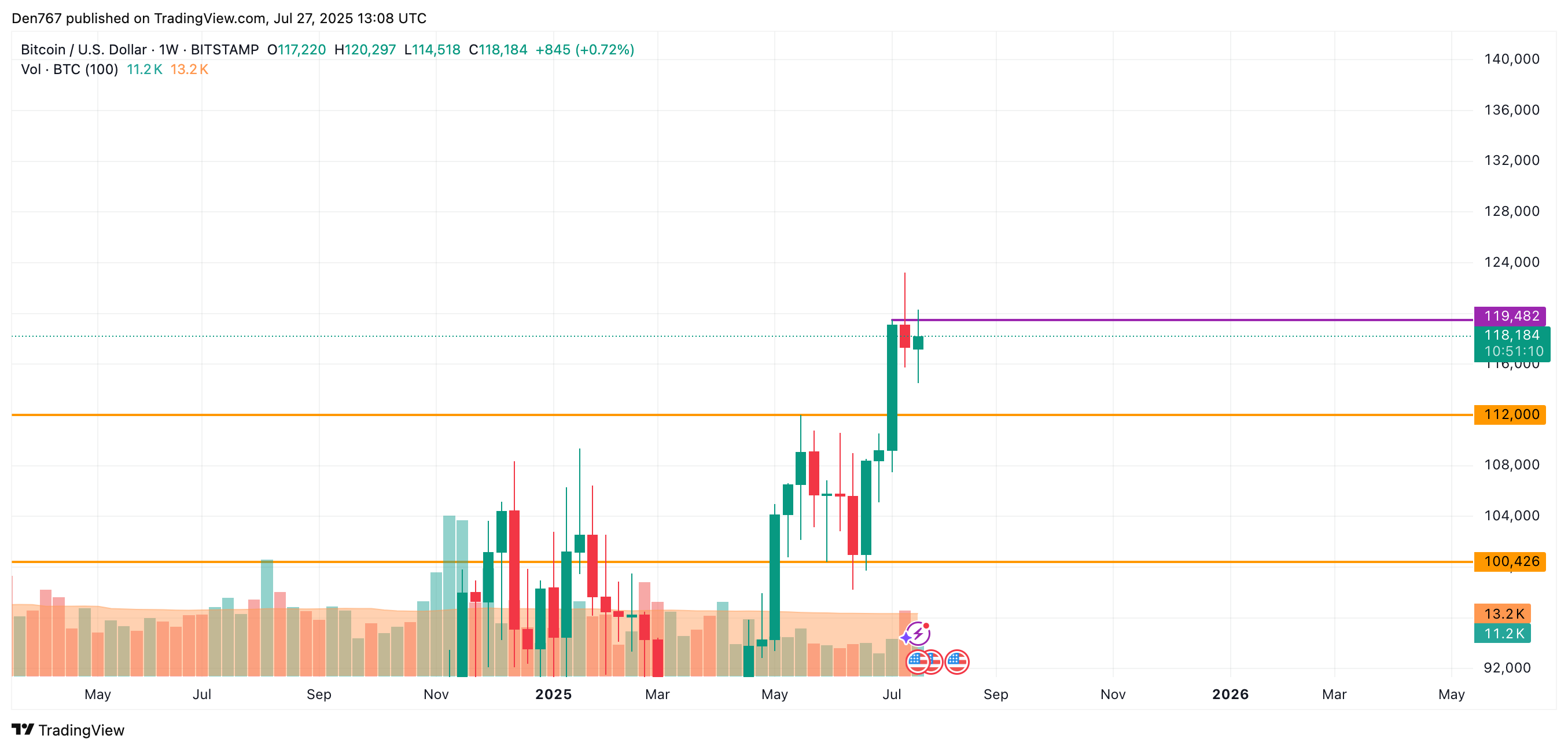

From a technical, bitcoin perspective is currently Trading Just over the key support in $ 117.888. If this level breaks, the traders see 117,500 as the next likely test.

On the side, a week Simane above $ 119.482 could reaffirm the moment of the moment. But the failure to keep these levels could open the door to a decline toward $ 112,000.