Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Jupiter (Jupp) launched in October 2021 as an aggregator of Swap Solan, designed for the best prices for the consolidation of liquidity in fragmented AMM and order books through the focusing of the most effective paths. As Solana Definitely expanded, Jupiter became the most prevalent network interface, supporting hundreds of millions of replacements per quarter and integration with 100+ ecosystem partners. The protocol continued to develop a series of directing and transactions updates, including a methis direction engine, a priority of transaction fees and the recent introduction of “Ultra Mode”, which integrates real -time scoring assessment, dynamic priority fees and optimized landing in transaction to reduce the cost of executing behind the scene. In addition to these optimizations, the team has expanded its apartment to features such as average dollars, permanent trading, mobile applications and portfolio monitoring, positioning itself as a comprehensive platform Deam.

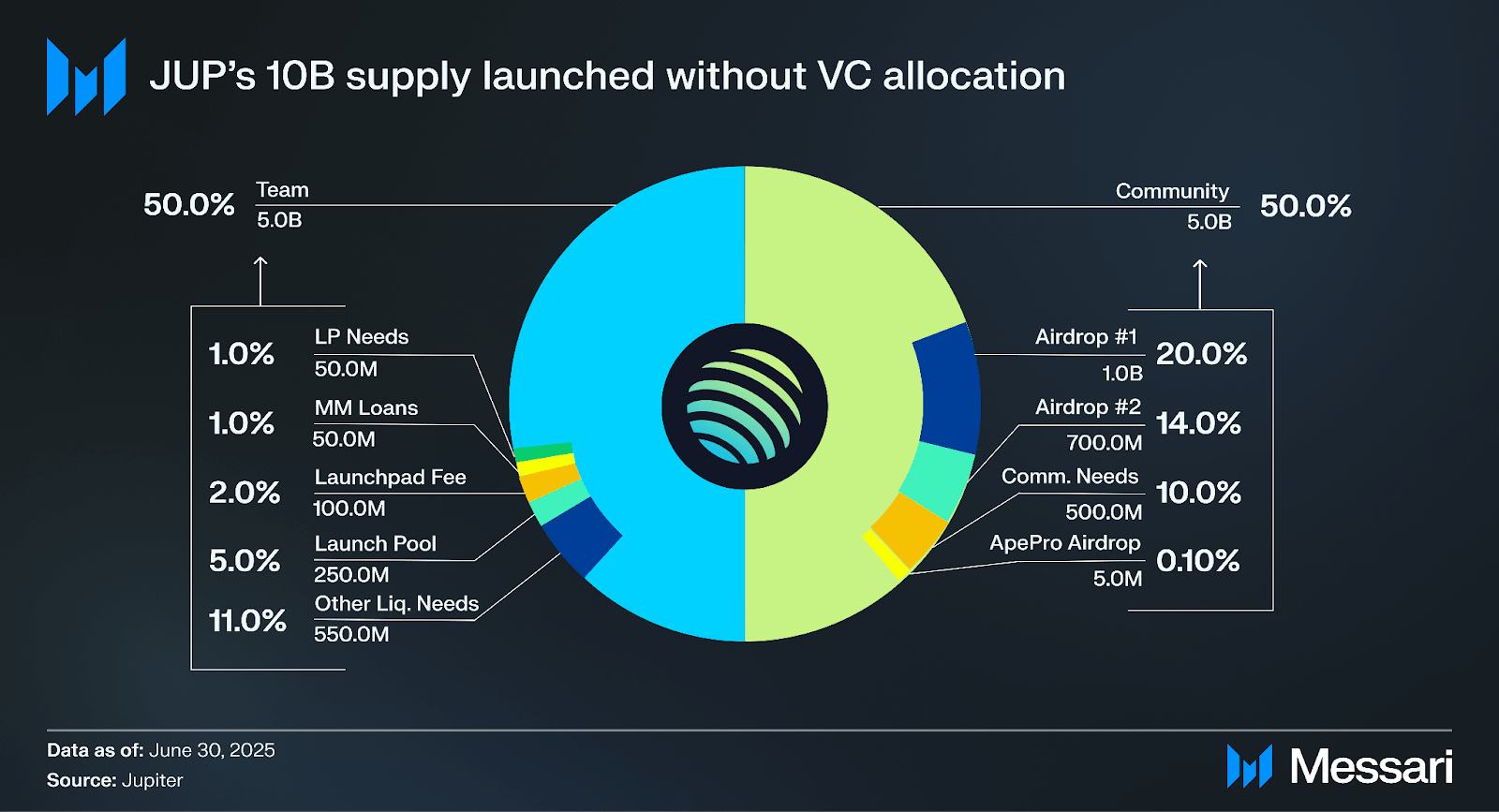

In January 2024, JUP, a project management token, was launched through an open pool of liquidity and aviation at over 600,000 wallets, avoiding the traditional VC Displays on OTC. Since July 2025. There are about 920,000 onchain carriers. A year later, the Protocol burned down 3.0 billion of JUP, representing 30.0% of the total supply, equally drawn from the community and team extracted, and committed 50.0% of redemption revenue redemption redemption fees, enhancing its model collection of values aimed at use.

Website / X (Twitter) / Disharmony

Jupiter was launched 2021 by the co -founder Miow (pseudonym) and Siong ong To resolve one of the biggest questions in the early defense solana: fragmented liquidity in the AMM -U order books. At that time, Solan’s Dex Landscape was a patchwork of isolated AMMS Order Books, each of which worked in its silo. Early the team focused on the combination of Dex like Serumwhich offered deep liquidity but lacked user experience. Jupiter merged them together, building an aggregate that directs orders at places and the optimal price area. While Solane users tried their best because of liquidity mimicked by confidence after FTX collapseJupiter quietly found an apartment on the product market and became the most commonly used aggregate to replace. From June 30, 2025. The project is first in quantity (seven -day, one -month and time frames of all time) among All blockchain dex aggregates.

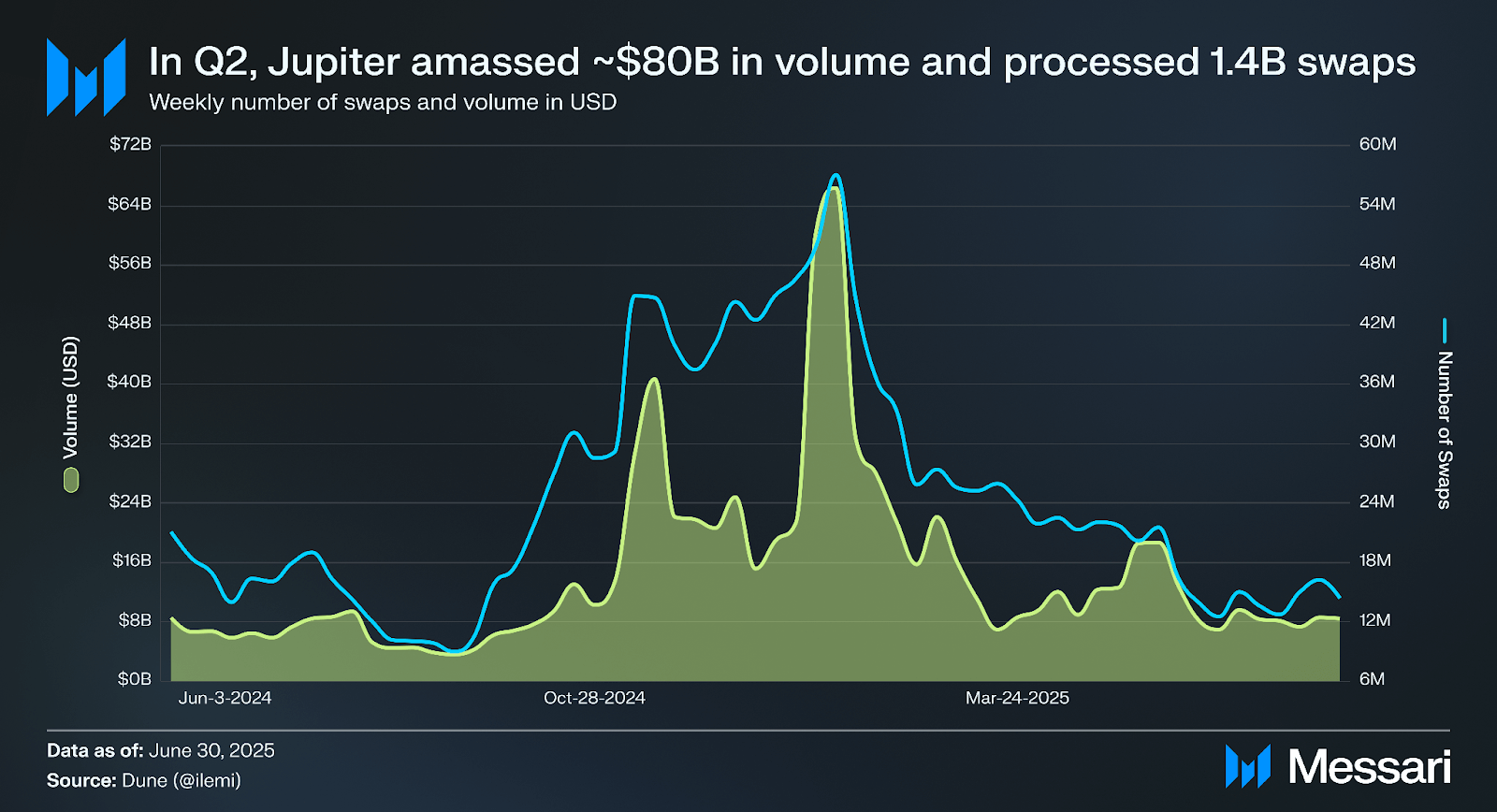

In Q2 alone, Jupiter facilitated over 1.4 billion replacements and collected a volume of ~ $ 80.0 billion. To put it in a perspective, which explained more 90.0% of all the activities of the aggregate on the solana and 50.0% total aggregate activities in all blockchains.

But only the combination was not the ultimate goal. Since then, Jupiter has grown into a platform with full layers, closer to the similarity of the operating system than the Swap user interface; Combining new optimization optimizations, a growing online package and selective acquisition package to expand their range in Solan’s ecosystem. For example, to improve the quality of execution, the team appeared Ultra mode In January 2025, the optimization layer that automates the assessment of slipping, dynamic fees and landing transactions and makes this logic of directing available partners through API.

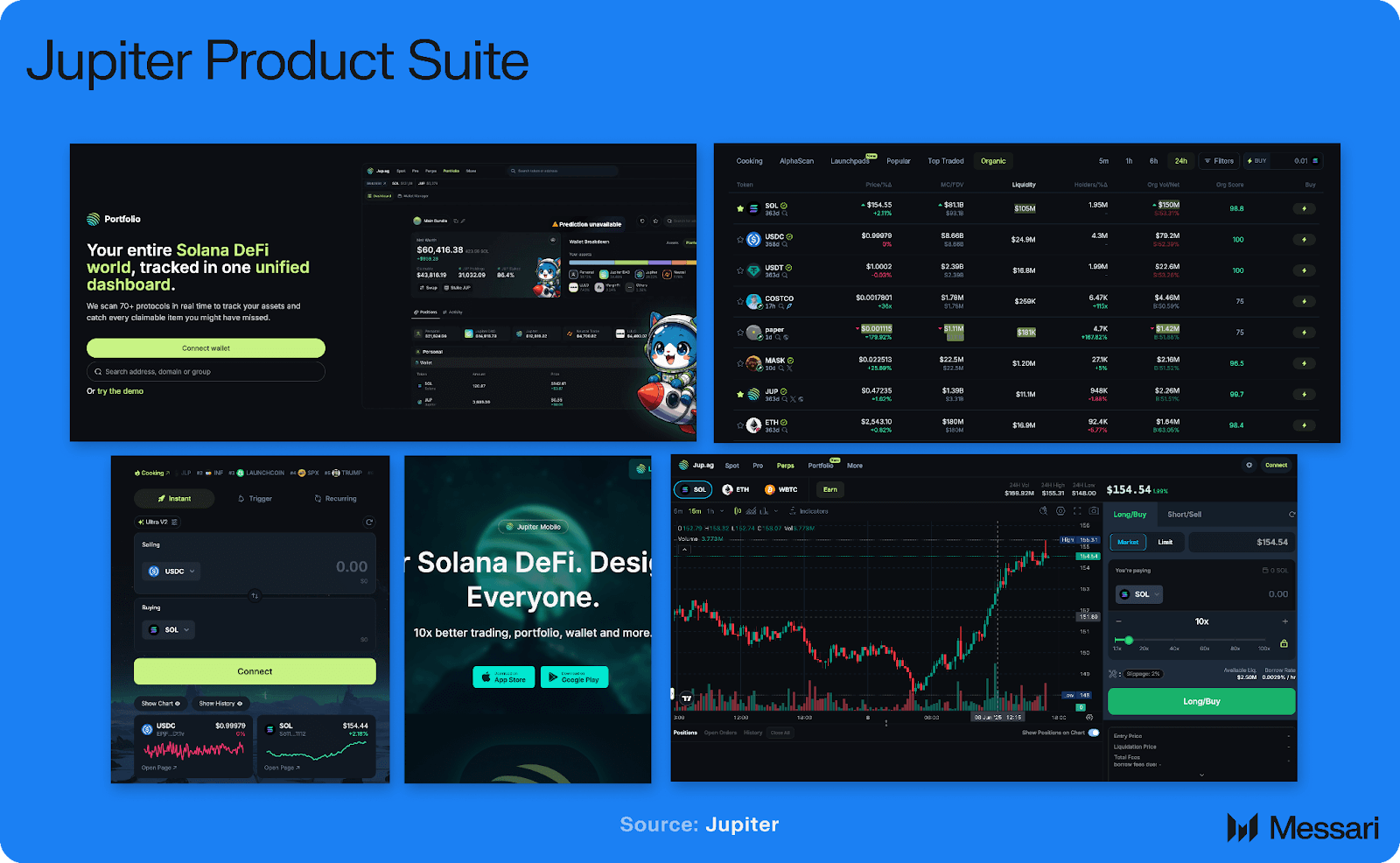

Today the team has various products including (i) a Portfolio tracker(ii) Pro trading terminal(III) Jupiter Mobile application and (iv) a Props dex. On top of all, they have also expanded by acquiring complementary projects, such as (I) DripNFT Platform; (ii) Moonshatmemecoin trading platform; (III) CoinhallCosmos aggregate; (iv) SolanafmBlock Explorer; (v) Sonarwatchmonitoring panel; and (you) UttermostMobile app for self -powers.

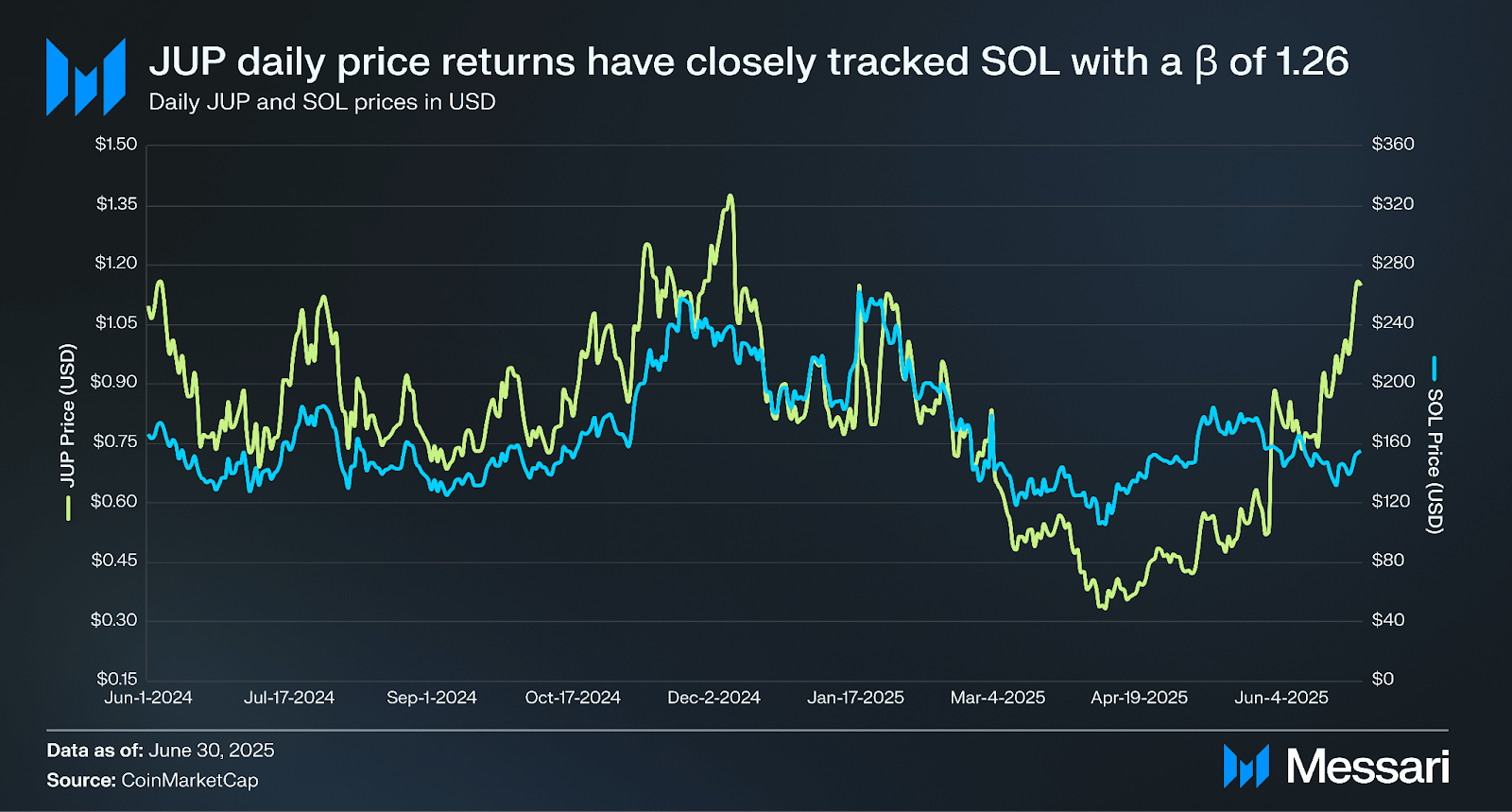

As the product ecosystem matured, so is his user base is to him, token. Early users were significantly awarded by Jupiter’s management token, JUP, which was initially Airdroped to over 600,000 wallets. Next “Wealth effect“The early adoption was expected, because JUP was now acting as an intermediary for exposing the growth of the ecosystem of Solana.

However, unlike most management tokens, JUP was launched without VC OTC offers. In addition, Jupiter burned 3.0 billion JUP tokens (30.0% of the total token supply), evenly divided between community and team extract. Also committed To extract 50.0% of the platform revenue in the permanent purchase of JUP -Open Market, which accumulates in “Litterbox”, a dedicated wallet to hold the redemption tokens that directly uses JUP owners. Users in this can check the burns, allocations and redemption Community audit.

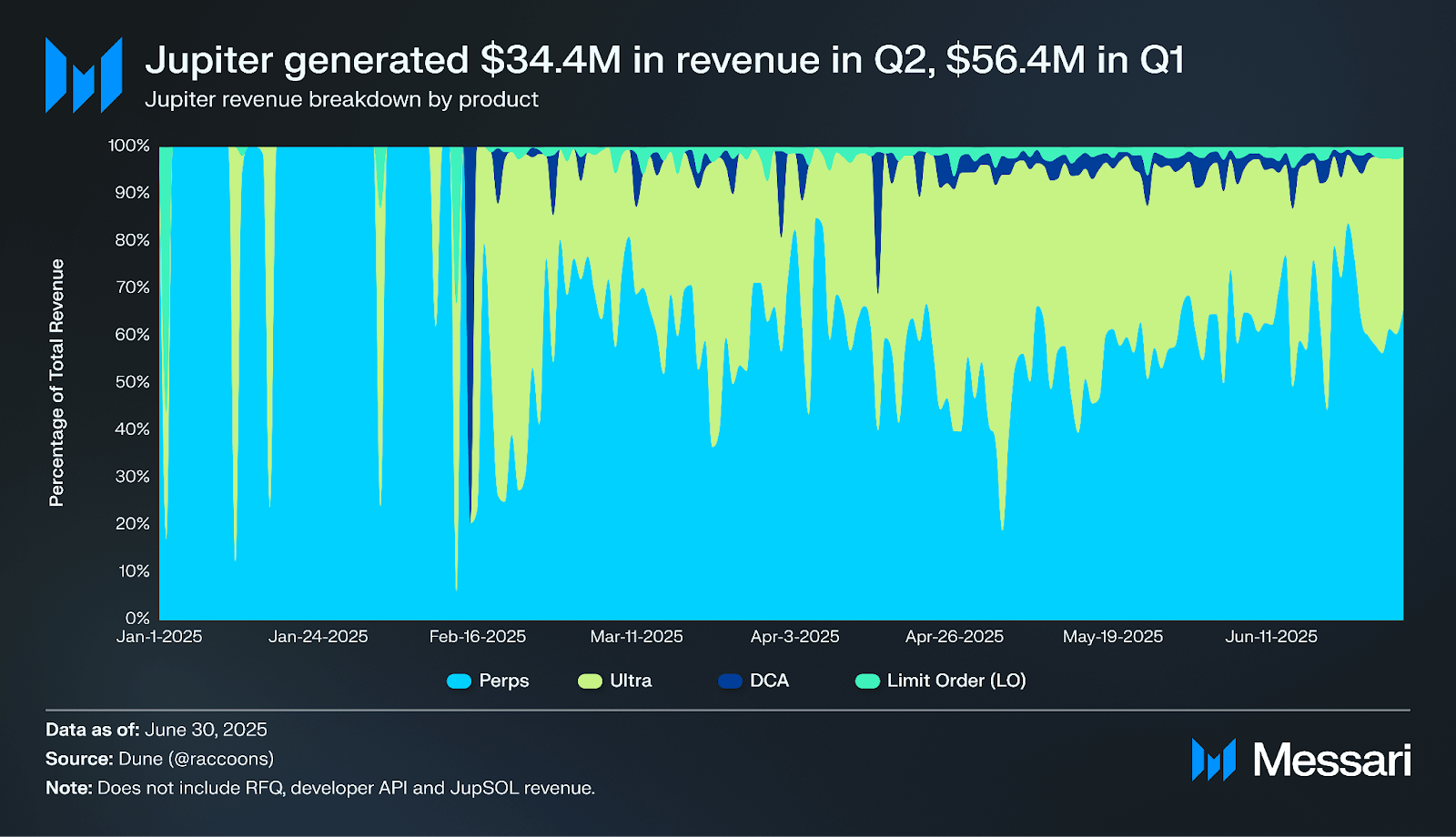

Recent data on the use and revenue from Q2 help contextualize the scale of activities in Jupiter products. Specifically, the protocol generated $ 38.4 million in total revenue, and most come from trade activity: Perpetuals ($ 20.9 million, 54.5%), Ultra mode ($ 11.8 million, 30.8%), DCA and repeating orders (996.4K, 2.6%) and limited orders (609.8K, 1.6%). Other revenue sources included RFQ ($ 3,4 million, 8.7%), APIs facing developers (393.6K, 1.0%) and Jupsol investing ($ 336.6.6K, 0.9%).

Other products and interfaces, like Jupiter Pro, drawn 4.4 million unique users in the last 30 days, while the mobile application has arrived approximately 825,000 lifelong downloads. Portfolio tools also saw a consistent engagement, with average out of 500,000 monthly users.

The question is now what the next stage of Jupiter’s growth will look like. So, where do they go?

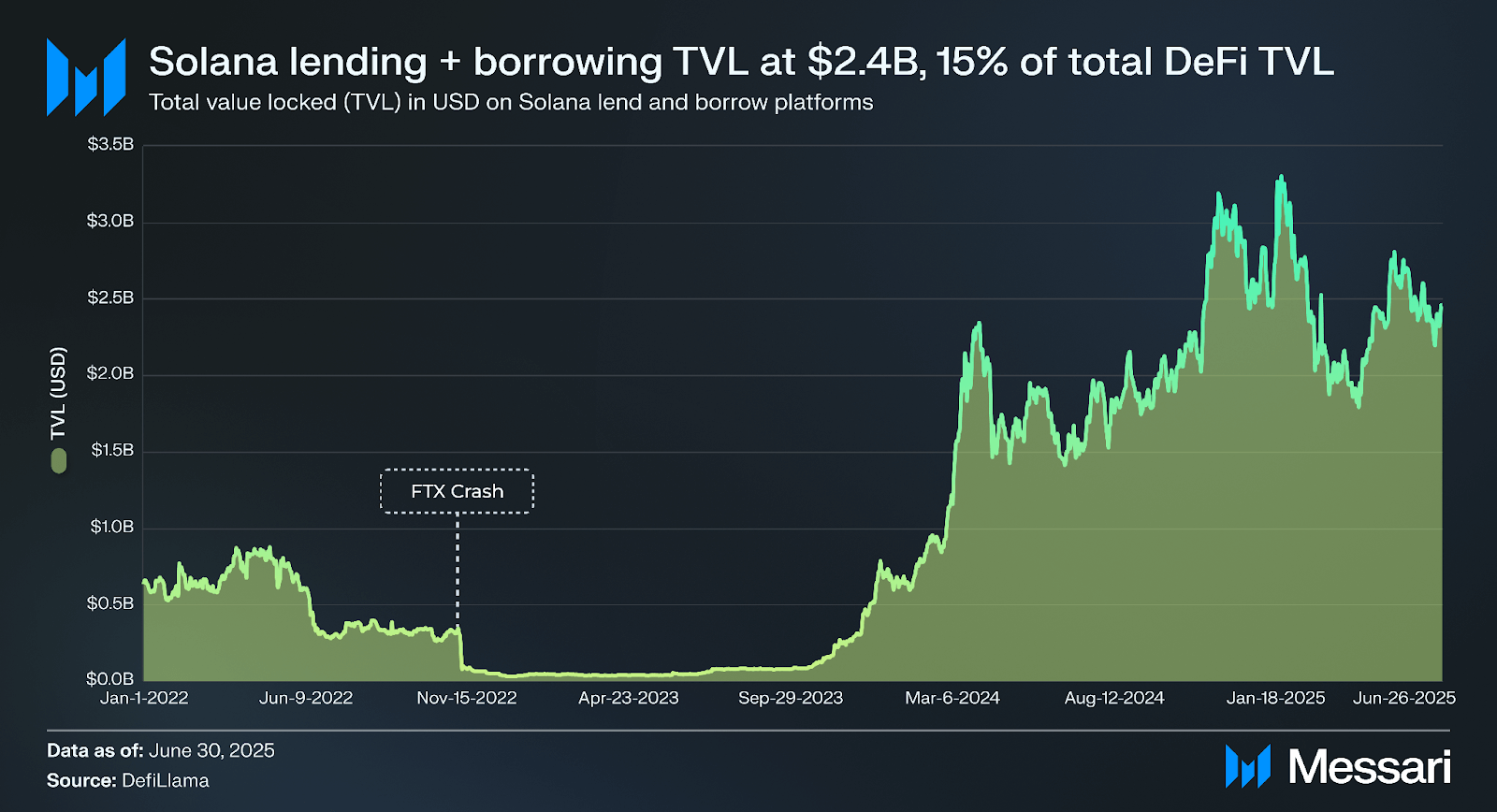

Jupiter built his Mark by attracting the most active crypto users through the leading aggregated interface to replace the Solana Token. Nevertheless lending and borrowing, activities that account for 15.0% of the total TVL of Solane (from the end of Q2 2025), led Chimney and Marginfiremained unused. Breaking and borrowing in Jupiter’s interface could unlock meaningfully annual incomewith a part that spread to JUP token.

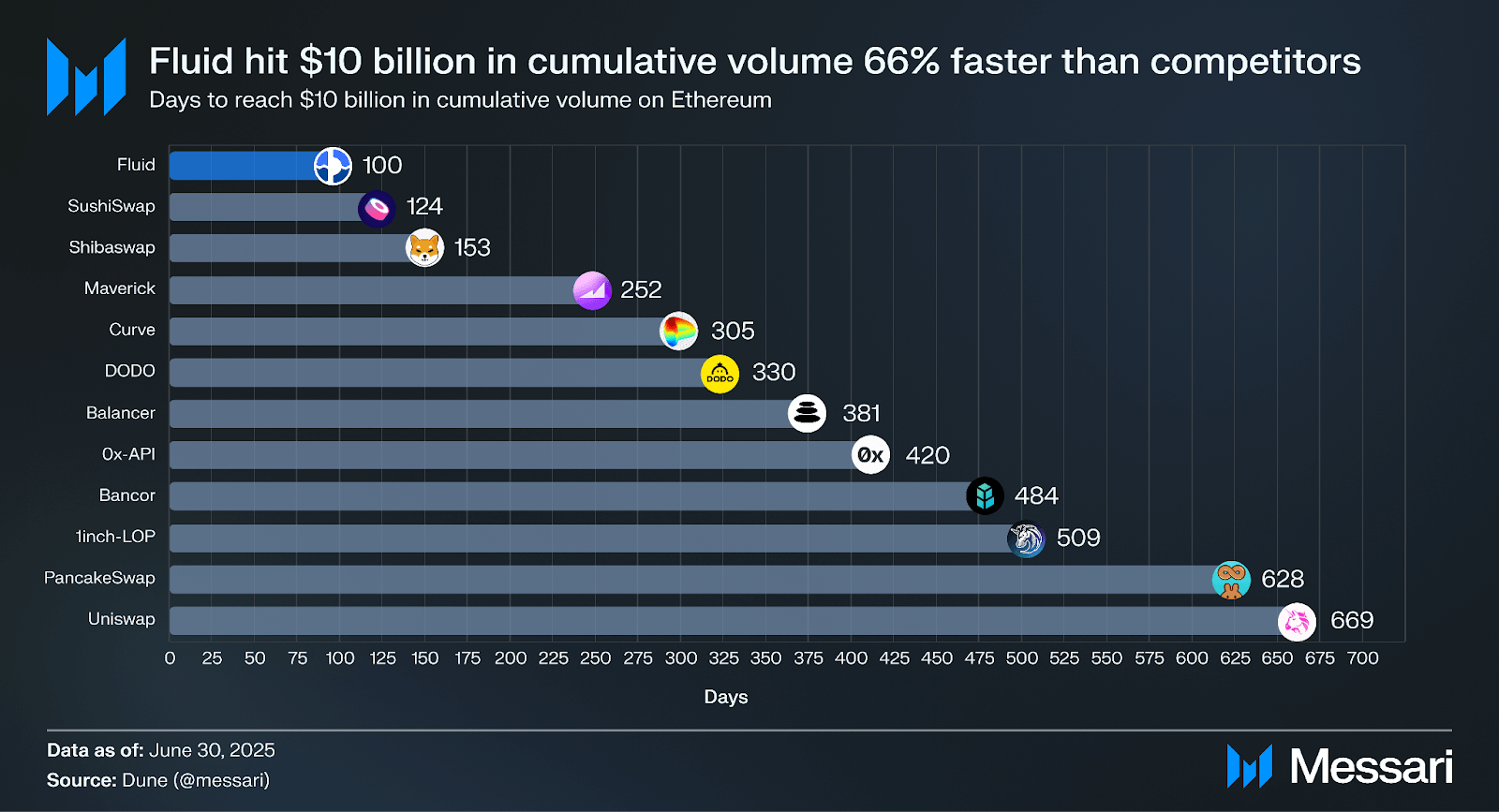

As such, Jupiter announced Jupiter Lend, a money market on the market in collaboration with Fluid, one of the fastest growing Ethereum protocol protocols on June 6, 2024. In particular, Jupiter will direct the transactions and borrow transactions through the Fluid Liquinity. For a comprehensive examination of fluid and its unique technology (ie liquidation engine, smart debt and more), read our comprehensive examination here.

Jupiter Lend should launch in mid -August 2025. With over $ 1.0 million incentives; waiting list here.

Jupiter does not stop in definition; Tim also recently announced JUPnet, infrastructure layer consolidating layers of liquidity and identity in one environment.

Similarly, Jupiter assumes that the industry is moving towards the world of millions of chains, billions of people and trillion tokens. JUPnet will combine this spread, so that users no longer need to think of how to bridge the property, manage gas fees or juggle dozens of wallets. Instead, JUPnet will work through a system based on accounts, a similarly known experience of a brokerage account, ultimately changing the current landscape of Kripto UI and UX.

To do it, Jupnet technology It will consist of three pillars:

JUPnet is currently in an internal testnet, and a public testnet is expected in early Q4.

Jupiter began with a narrow problem: effectively directing token through the fragmented liquidity of the salt pans. SOLUTION: AGREGATION engine was wrapped in a nocean interface that quickly determined that it was placed on the product market and now directs most Swap activities in Solana. It amounts to over 90% of the aggregate traffic on the salt pans and 50% on all blockchains, making it a leading Dex aggregate by quantity.

But it was the first phase. Since then, Jupiter has continued to expand his scope, first horizontally, with new features like Perps, Launchpads -Ai mobile tools, then vertically, with Jupiter Lend. Now, with the upcoming launch of Jupnet, the project changes its focus inwards, diverting the challenge not only to be only one of the user experience, but also the basic infrastructure. In the future, which is multihain and trends according to fragmentation, JUPnet will integrate the execution, the state of the book and the user identity into one system designed to hide complexity from users without rejection.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

This report was ordered by Jupiter. All content was produced independently by the author (s) and does not necessarily reflect the opinions of Messari, Inc. or an organization who requested a report. The release organization may contribute to the content of the report, but Messari maintains editorial control over the final report to retain the accuracy and objectivity of the data. The author (s) can hold the crypto currency named in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. The effect of any property so far does not indicate future results. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.