Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

TRON (TRX) is a public, open-source blockchain network that relies on a Delegated Proof-of-Stake (DPoS) consensus mechanism. An election process is used to determine which validators participate in consensus. All TRX stakers vote onchain for the candidates they want to become Super Representatives (SRs). In each epoch, the top 27 most voted-for candidates become SRs within the active set and take turns producing blocks. A new election occurs every six hours.

The TRON Virtual Machine (TVM) powers applications on the network and uses “Energy” and “Bandwidth” instead of gas, like its Ethereum Virtual Machine (EVM) counterpart. Bandwidth is gas spent on transactions, whereas Energy is gas spent on smart contract calls. Energy and Bandwidth can be acquired by staking TRX or burning TRX to pay for the Energy/Bandwidth required to execute a smart contract call or transaction. The TVM is EVM-compatible and offers developers affordable and fast smart contract execution.

TRON Portal / Website / X (Twitter) / Discord

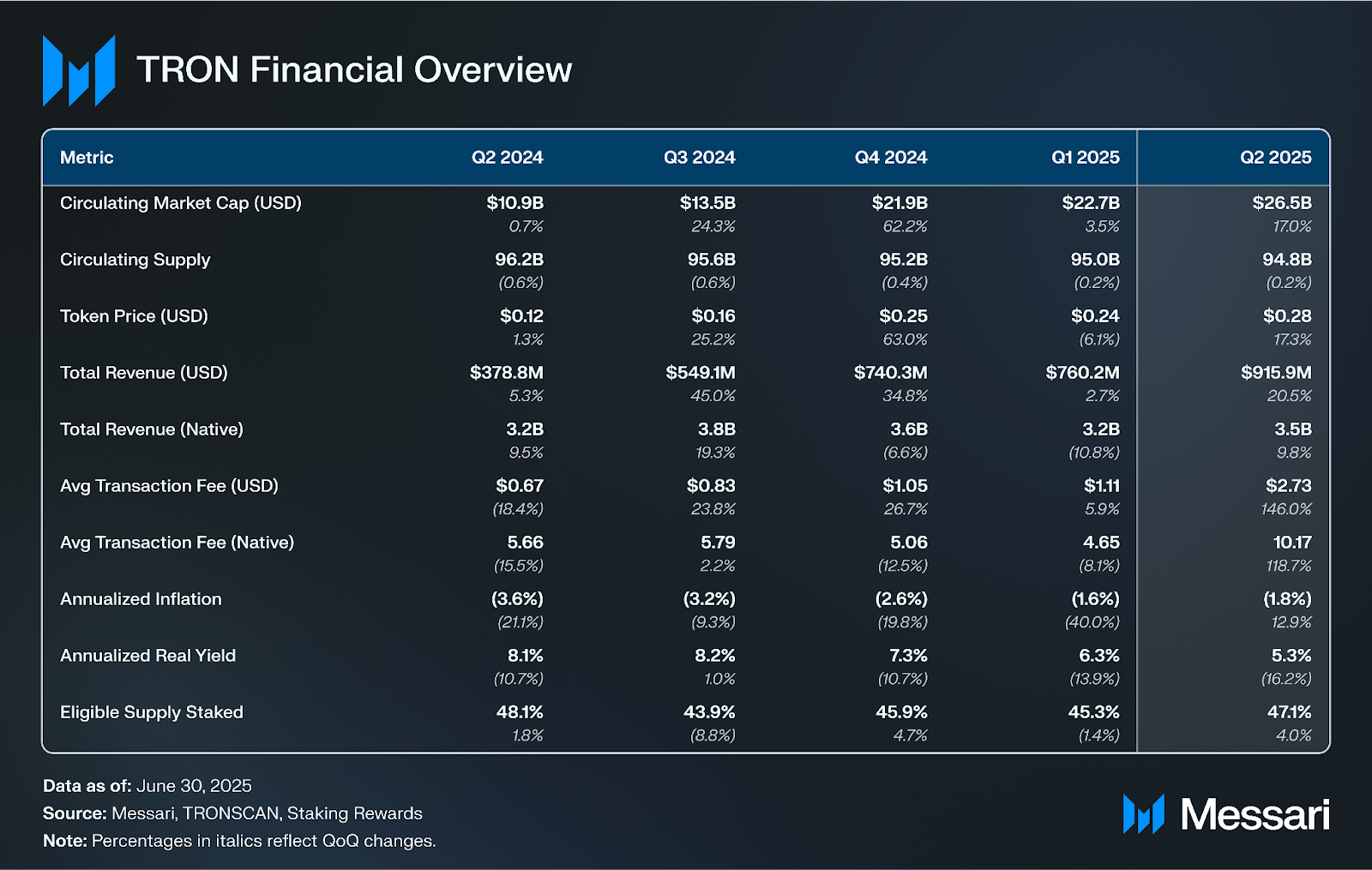

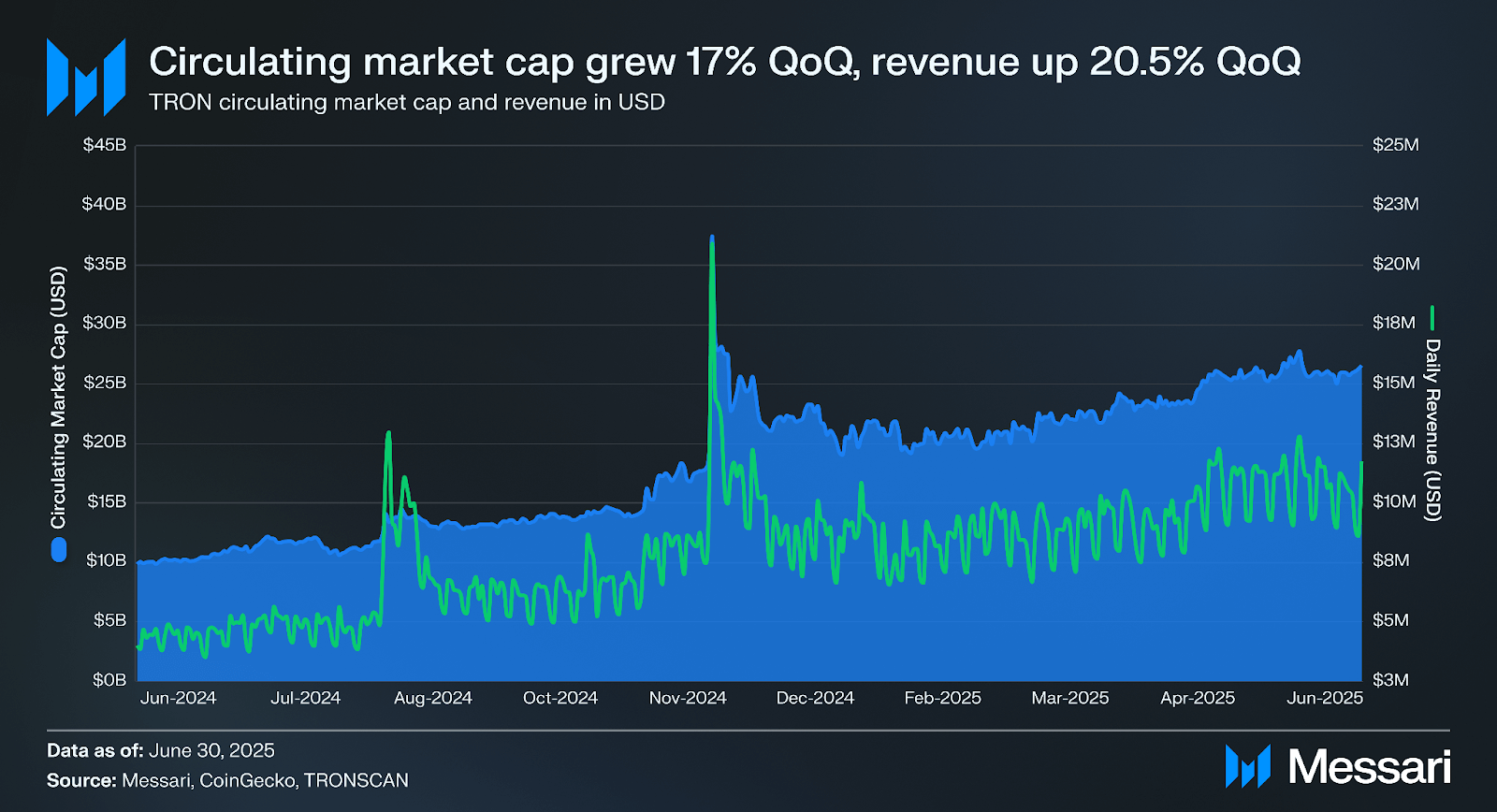

TRX’s circulating market cap increased for the tenth consecutive quarter in Q2, up 17% QoQ from $22.7 billion to $26.5 billion. Furthermore, TRX performed similarly to other large-cap cryptocurrencies as its market cap ranking amongst all tokens (excluding stablecoins) rose two spots from 10 to 8. Notably, TRX has maintained a deflationary trend for many quarters, and Q2 was no different, with a 0.2% decrease in circulating supply.

TRON utilizes a resource model to execute transactions onchain. To summarize, the resource model is based on distributing Bandwidth and Energy to stakers. As long as stakers have acquired enough resources, they can use those resources to transfer tokens and execute smart contracts for free. Users must cover transaction fees with TRX if they utilize more computing power than their resources allow, all of which is burned. As such, revenues for TRON are derived from the TRX token burns coming from transaction fees. To track these numbers in real time, see the TRON Portal.

TRON had another solid quarter for revenue. Total revenue in USD was up 20.5% QoQ from $760.2 million to $915.9 million, and daily revenue was up 23.7% QoQ. Driven by a 17.3% increase in token price during Q2, total revenue in TRX rose by 9.8%, climbing from $3.2 billion to $3.5 billion, marking the first quarterly increase in the past two quarters.

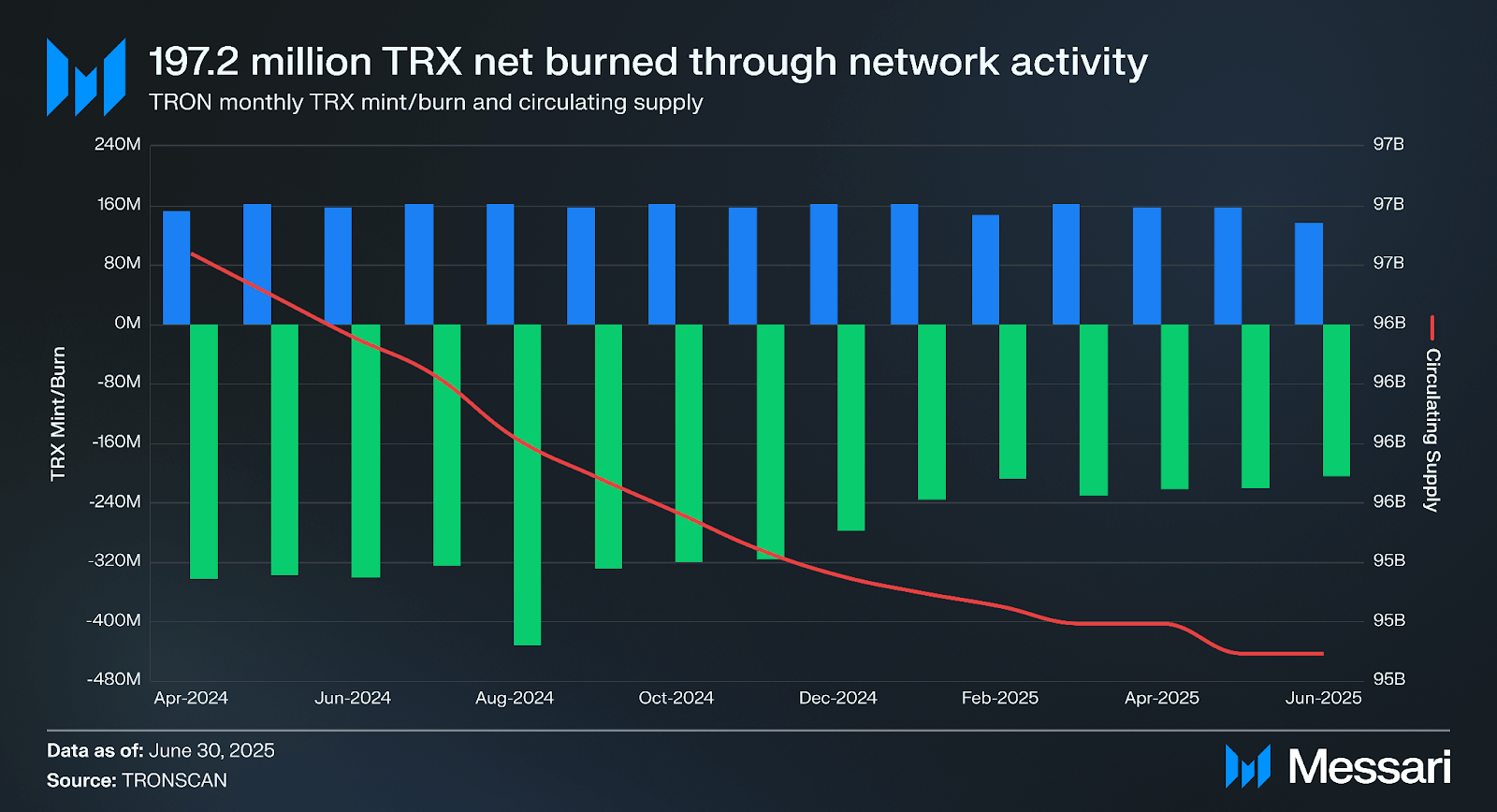

The circulating supply of TRX is primarily affected by two parameters: (i) tokens minted to reward stakers and block producers, and (ii) tokens burned due to network transaction fees. TRX rewards equate to 5.1 million tokens being minted per day. As such, the circulating token supply will decrease over time if more than 5.1 million TRX are burned daily, on average.

In Q2, the circulating supply of TRX decreased from 95.0 billion to 94.8 billion. Annualized, this equates to an inflation rate of approximately -1.8%. Annualized inflation was up QoQ, increasing 12.9% from -1.6%.

TRON incentivizes participation in its staking mechanism through a combination of the following:

The annualized real yield for staking decreased in Q2, down 16.2% QoQ from 6.3% to 5.3%. This decrease was due to less TRX being burned in Q2.

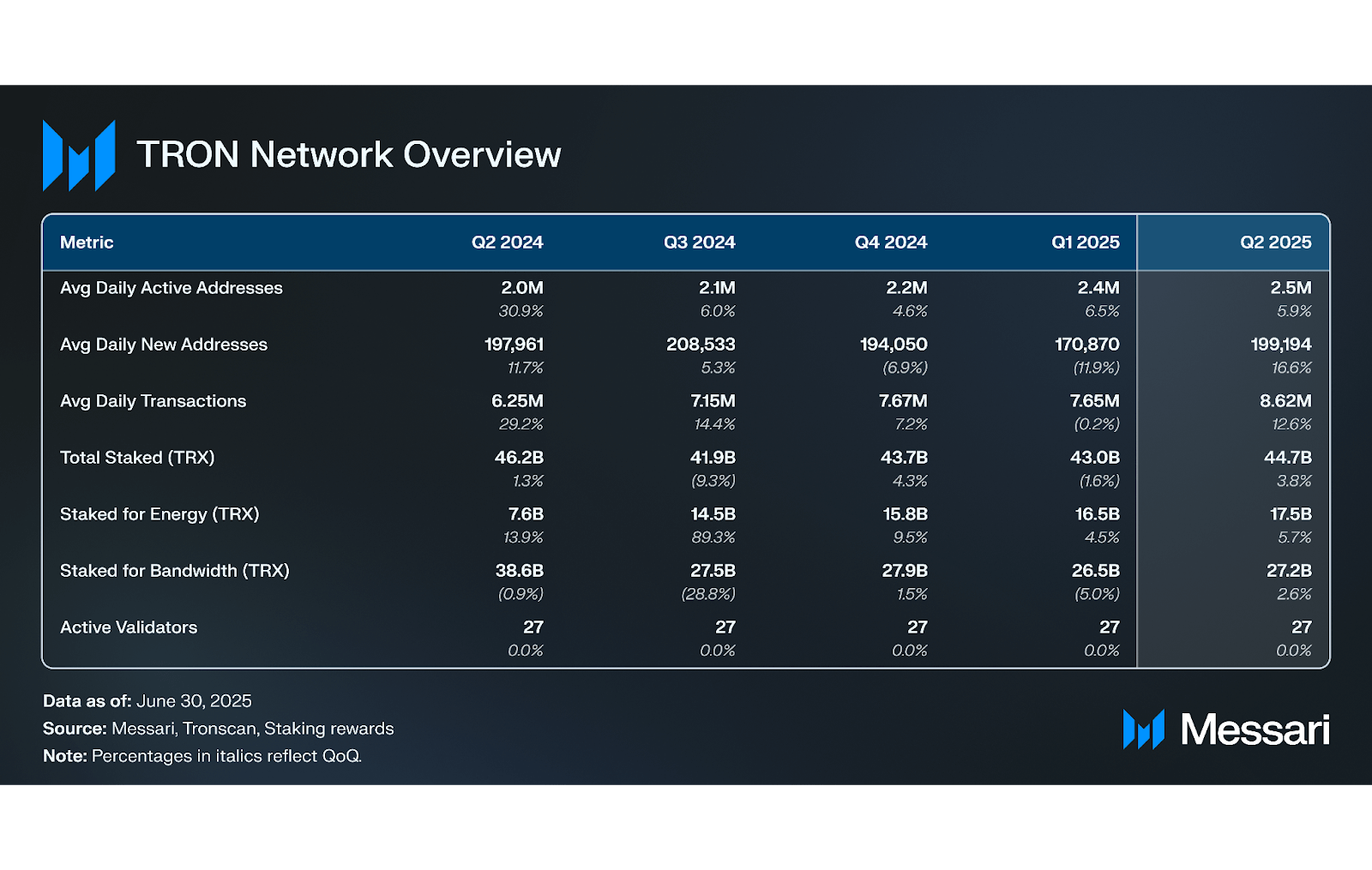

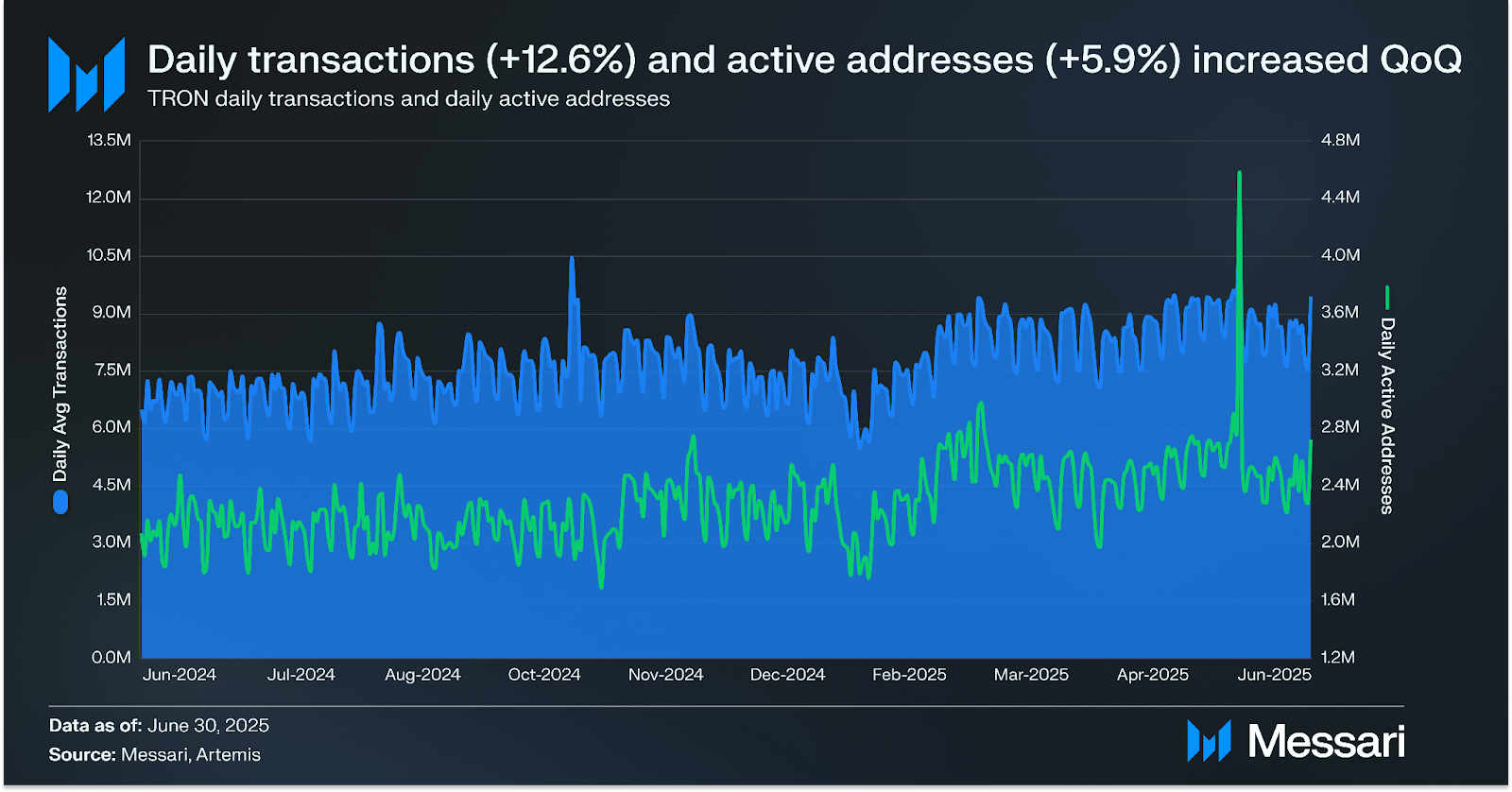

Q2 usage was positive for TRON, with increases in onchain activity metrics like daily transactions and daily active addresses. Daily average transactions increased 12.6% QoQ from 7.7 million to 8.6 million, and daily active addresses grew 5.9% QoQ from 2.4 million to 2.5 million.

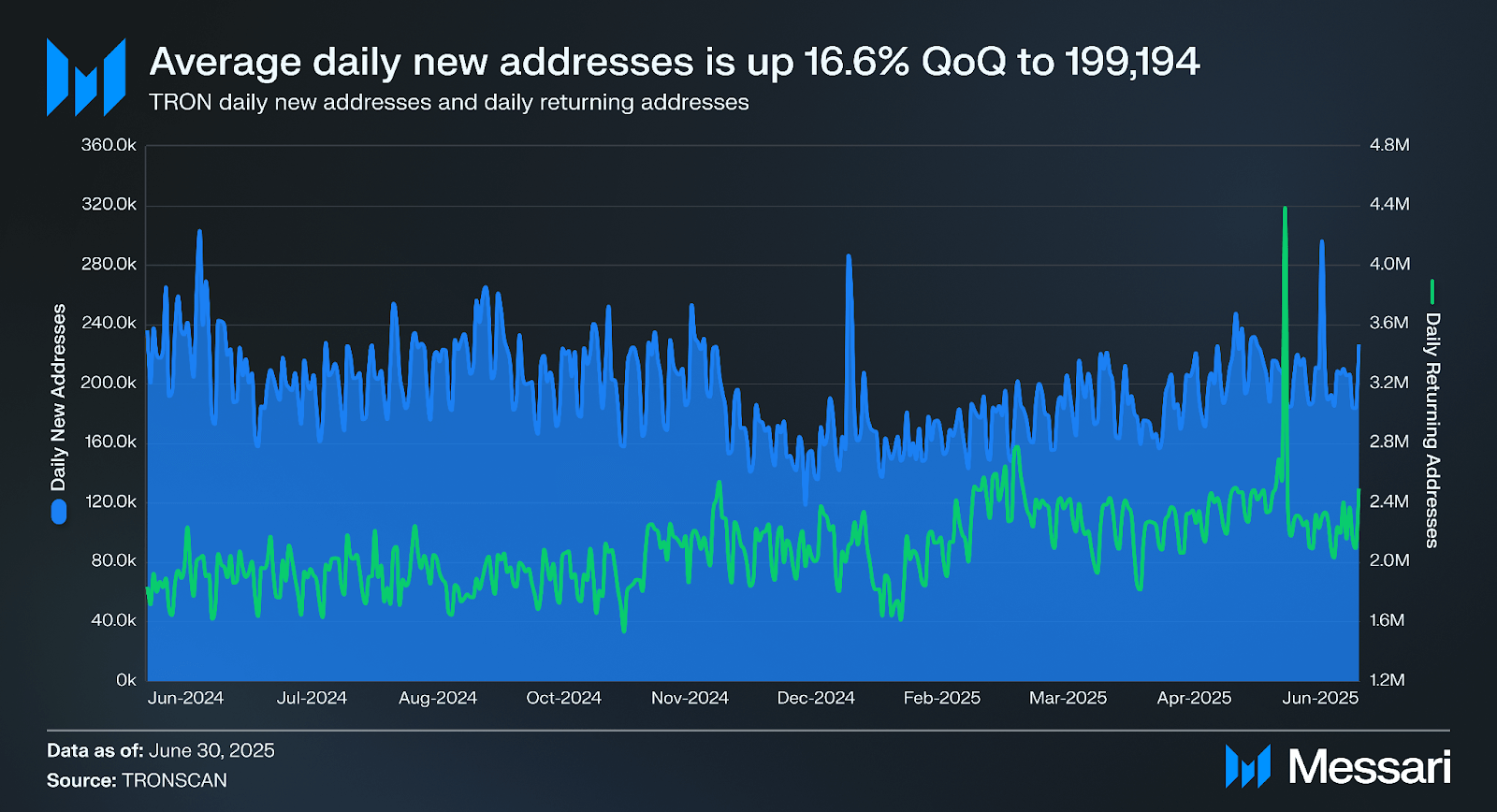

Average daily new addresses increased in Q2, up 16.6% QoQ from 170,870 to 199,194. Of Q2’s average daily active addresses, 7.96% were new addresses.

TRON uses a Delegated Proof-of-Stake (DPoS) consensus mechanism and the Practical Byzantine Fault Tolerance (PBFT) consensus algorithm to secure the network. A DPoS election occurs every six hours, in which 27 Super Representatives (SRs) take turns producing blocks. Those wishing to run a TRON node can pay 9,999 TRX to become an SR candidate.

While there may be centralization concerns regarding only 27 SRs participating in securing the network, at the end of Q2, over 393 SR candidates (down from 395 in Q1) received votes. This diversity of candidates helps mitigate centralization concerns and promotes a more distributed governance model, enhancing the network’s resilience and security. The number of SR candidates should challenge the voting population to distribute votes. Additionally, no singular entity received over 10% of all votes. The entity with the most votes was Poloniex, which received 2.9 billion (6.97%) of the 41 billion votes in the most recent election.

Although there may be some benefits to a democratic voting system for block production and a set of SR candidates, neither feature fully does away with centralization risks. Metrics such as the geographic diversity of nodes may also factor into a network’s level of centralization. At the end of Q2, there were 7,405 TRON nodes (down from 8,008 in Q1) distributed across 84 different geographic locations around the globe, with the highest concentration in the United States (21%). Geographic node concentration, while currently diverse, remains a factor to monitor given potential geopolitical risks, regulations, and acts of nature, among other reasons.

Since the introduction of the new staking mechanism, Stake 2.0 (TIP-467), in April 2023, it has become the default for all new staking activity. Any TRX staked after April 2023 is automatically assigned to Stake 2.0, while TRX previously staked under Stake 1.0 remains valid and unaffected. Stake 2.0 implemented a new layer to separate low-frequency staking operations and high-frequency resource delegating operations. It also introduced resource delegating without unstaking and improved resource utilization.

Across both options, the staking ratio (the proportion of TRX’s total supply actively staked) rose, increasing to 47.1% in Q2. This increase is mainly due to the small decrease in the circulating supply of TRX in Q2. Additionally, more users continued to switch to Stake 2.0 over 1.0 in Q2. Stake 2.0 ended the quarter with 25.2 billion TRX staked (+8.5% QoQ), whereas Stake 1.0 finished with 19.5 billion TRX staked (-1.7% QoQ). In sum, 44.7 billion TRX were staked at the end of Q2, an increase of 3.8% QoQ. Due to an increase in TRX’s price, the total stake in USD was up 21.5% QoQ from $10.3 billion to $12.5 billion. Compared to other PoS networks, TRON had the seventh-highest dollar value of funds staked by the end of Q2, dropping one position from the prior quarter.

It is worth noting that to take over the network through a two-thirds attack, a malicious actor would need to control 18 of the 27 SRs. At the end of Q2, this threshold was 33.5 billion TRX ($9.4 billion).

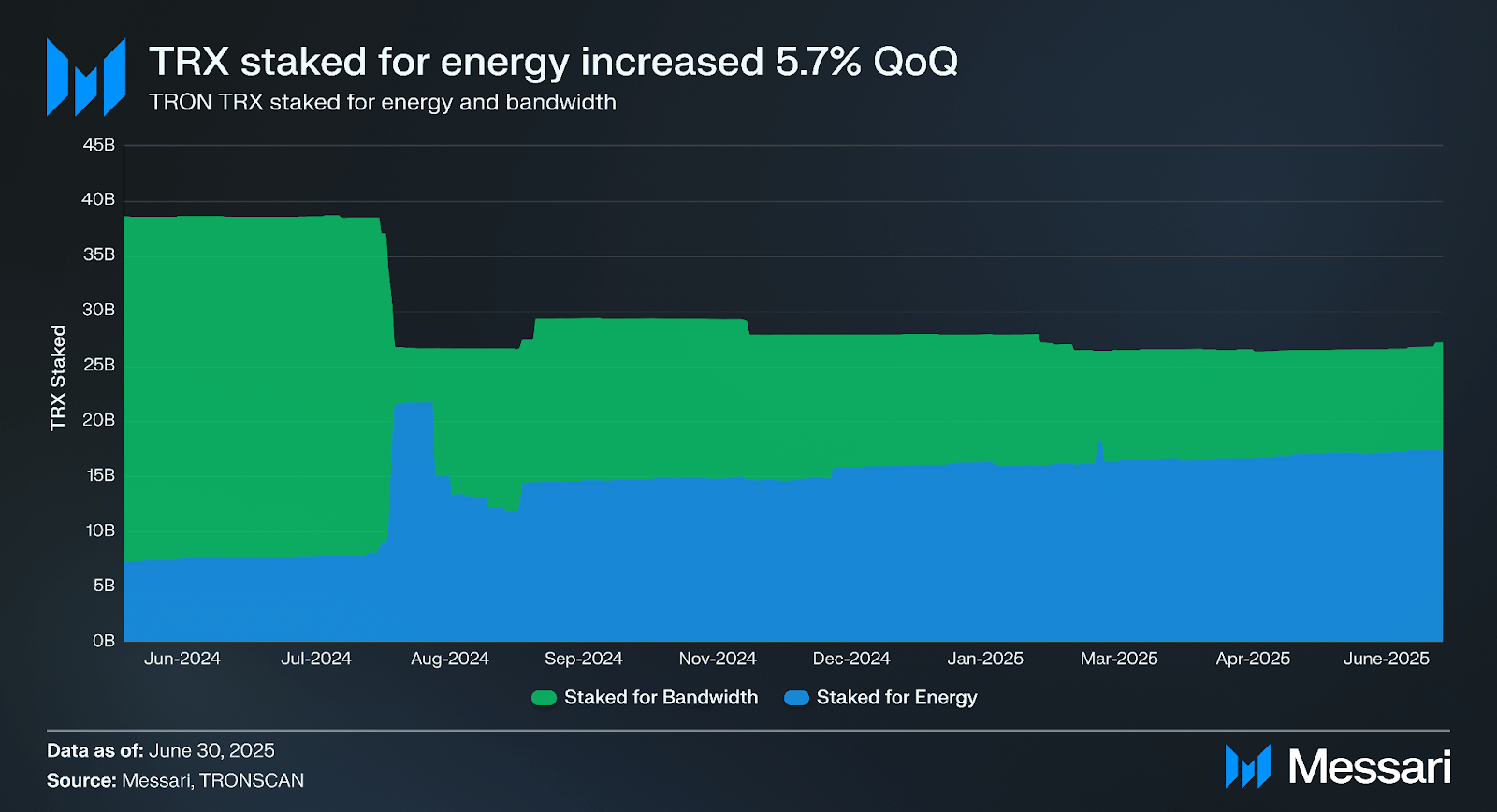

Bandwidth is the gas spent on transactions, while energy is the gas spent on contract calls. Users can stake TRX to acquire either resource accordingly:

Notably, the amount staked for bandwidth rose 2.6% QoQ from 26.5 billion to 27.2 billion. As for energy, staking increased 5.7% QoQ from 16.6 billion to 17.5 billion, in part due to overall higher gas fees. The amount staked for each resource is correlated with consumption.

In Q2, TRON passed two proposals to modify voting rewards and enable new features, as well as the Kant mainnet upgrade.

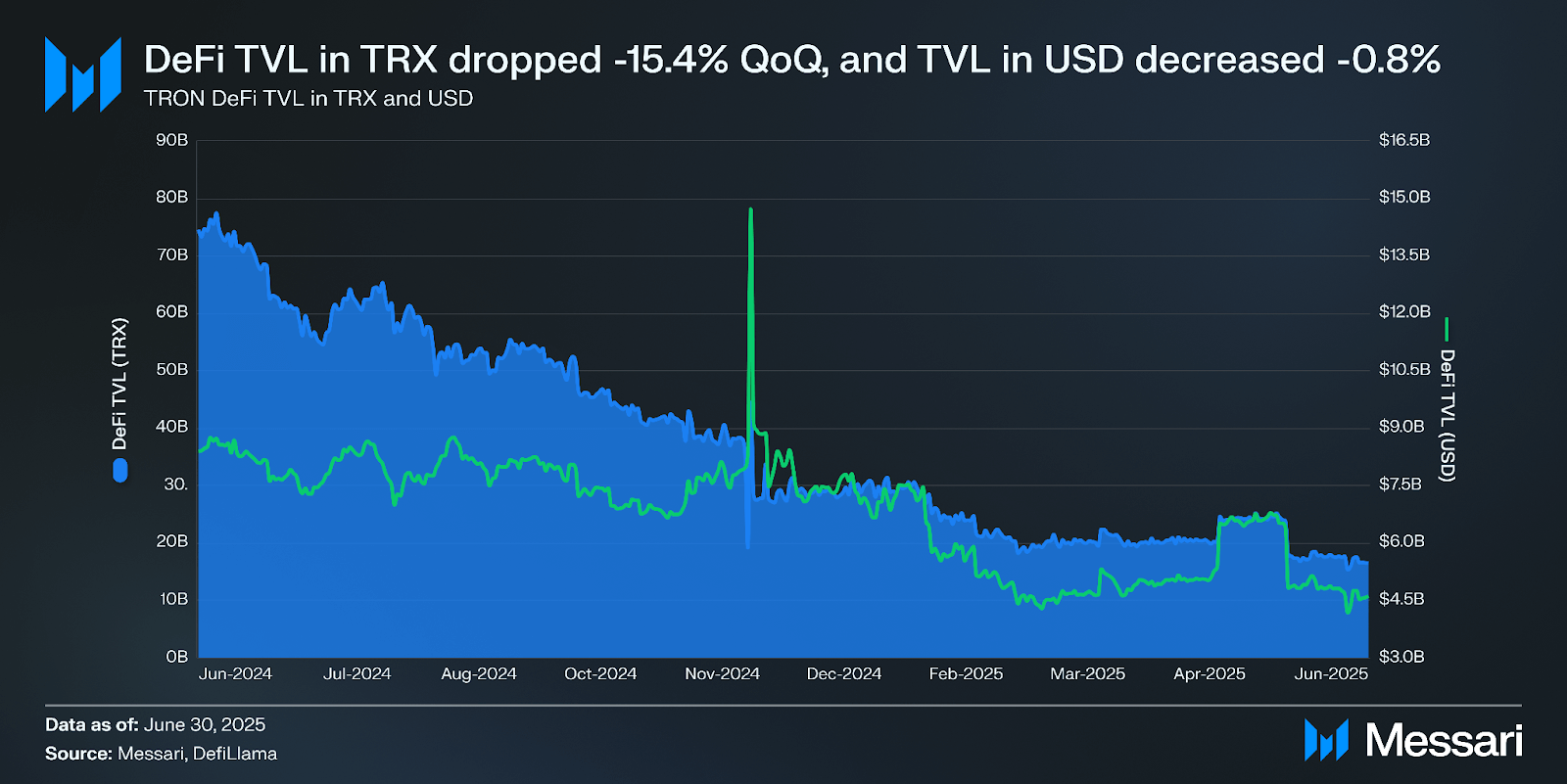

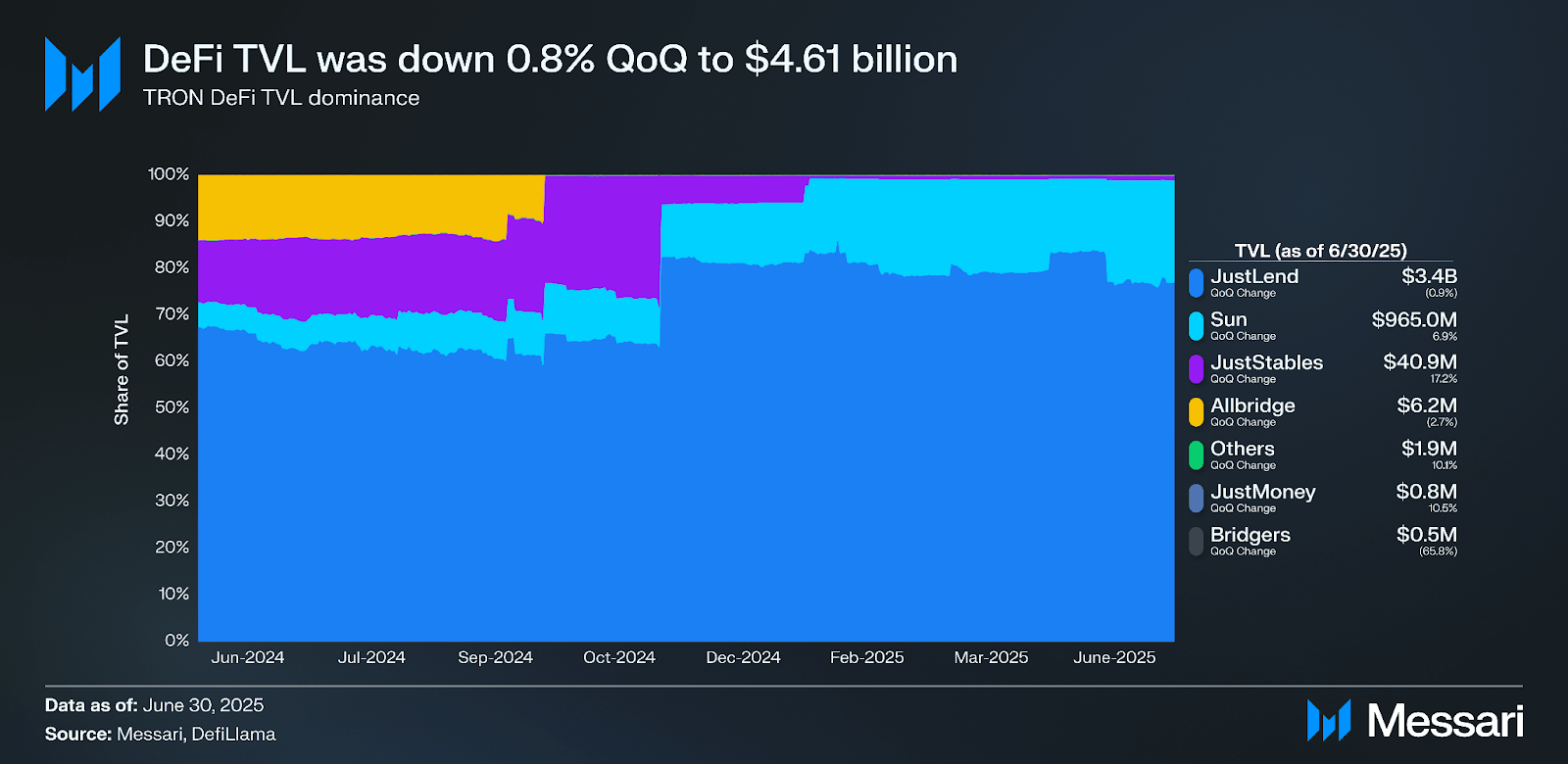

DeFi TVL on TRON denominated in TRX fell 15.4% QoQ from 19.5 billion to 16.5 billion. The TVL denominated in USD also decreased, down 0.8% QoQ from $4.64 billion to $4.60 billion. Compared to other networks, TRON maintained its rank as the fifth-highest network by TVL at $4.6 billion, getting beaten by fourth-place BNB Chain ($6 billion), third-place Bitcoin ($6.3 billion), second-place Solana ($8.6 billion), and first-place Ethereum ($63 billion). Notably, the large spike in DeFi TVL in terms of USD in Q4’24 was due to a sudden rise in TRX’s price and subsequent drop in Q1’25.

The top three protocols by TVL on TRON are JustLend, SUN, and JustStables.

JustLend, the largest protocol by TVL, saw its TVL decrease 0.9% QoQ from $3.43 billion to $3.40 billion. Total borrow volume on JustLend decreased -6.5% QoQ from $171.7 million to $160.5 million.

SUN saw an increase in its TVL, up 6.9% QoQ from $897.3 million to $965.0 million. The protocol consists of three different AMMs (V1, V2, and V3). By the end of Q2, V1 TVL was $464.1 million (48.4% of TVL), V2 TVL was $253.9 million (26.5% of TVL), and V3 TVL was $241.7 million (25.2% of TVL). After a successful Q1, Bridgers saw the most significant decrease in Q2 of 65.8% ending with a TVL of less than $500,000.

In sum, JustLend and SUN represent 99% of DeFi TVL on TRON.

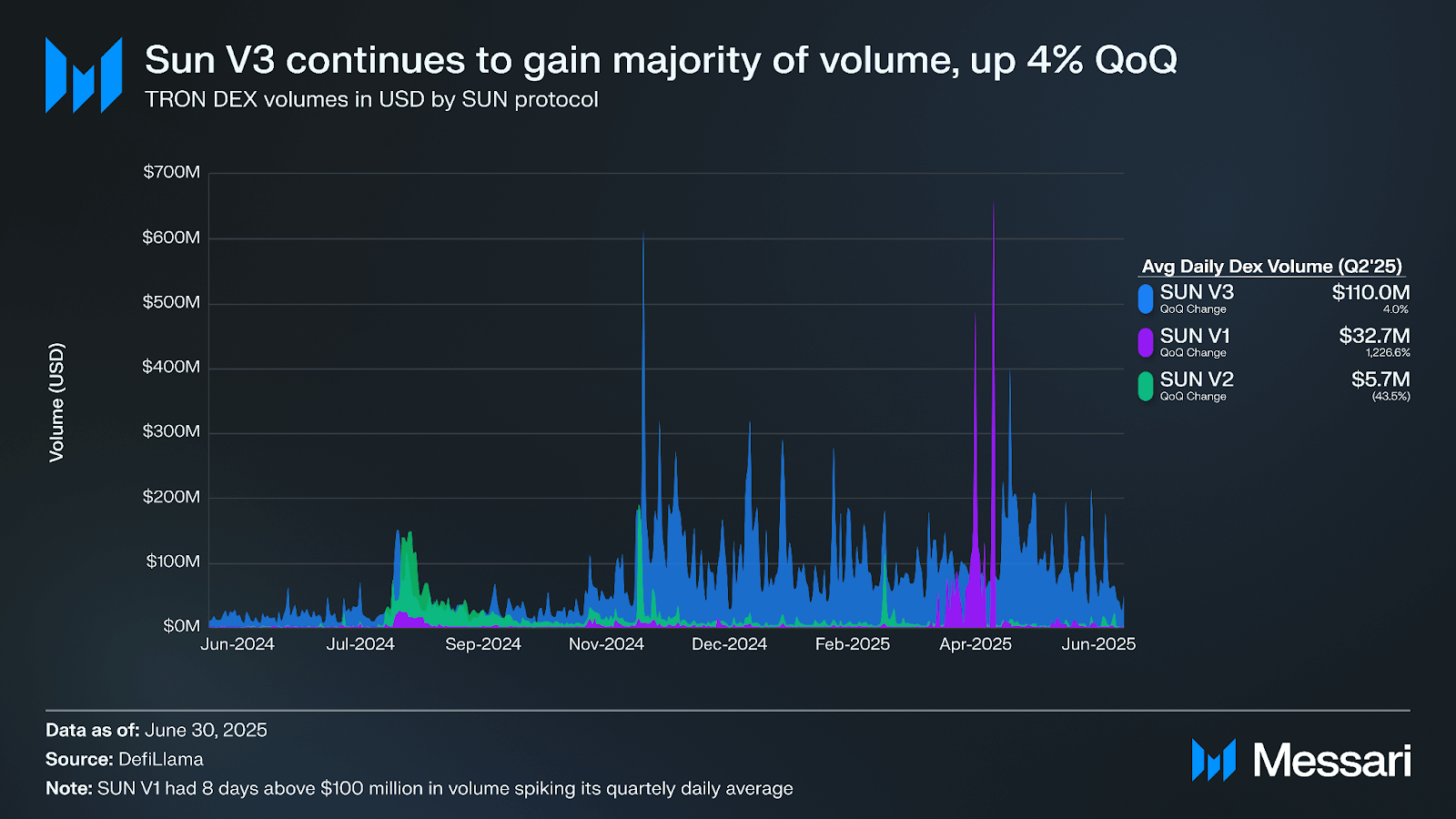

Overall DEX activity on TRON in Q2 was up, with average daily DEX volumes increasing 25.2% QoQ. Zooming in on SunPump, its slowdown is most evident through the decrease in volume routed through SUN V2, which hosts liquidity pools for bonded memecoins from SunPump. The average daily DEX volume on SUN V2 was down 43.5% QoQ. In Q2, specifically parts of April and May, SUN V1 experienced periodic surges in volume, bringing its daily average volume up over 1,200% QOQ.

Essentially, all DEX volumes on TRON occur on SUN. In June 2023, SUN introduced a concentrated liquidity (CL) AMM to its product suite (SunSwap V3). Q1’24 marked the first time since SunSwap V3’s introduction that the majority of volume on SUN was routed through the V3 AMM. SUN V3 accounted for 74.1% of all volume on TRON in Q2’25 due to the surge of volume in SUN V1.

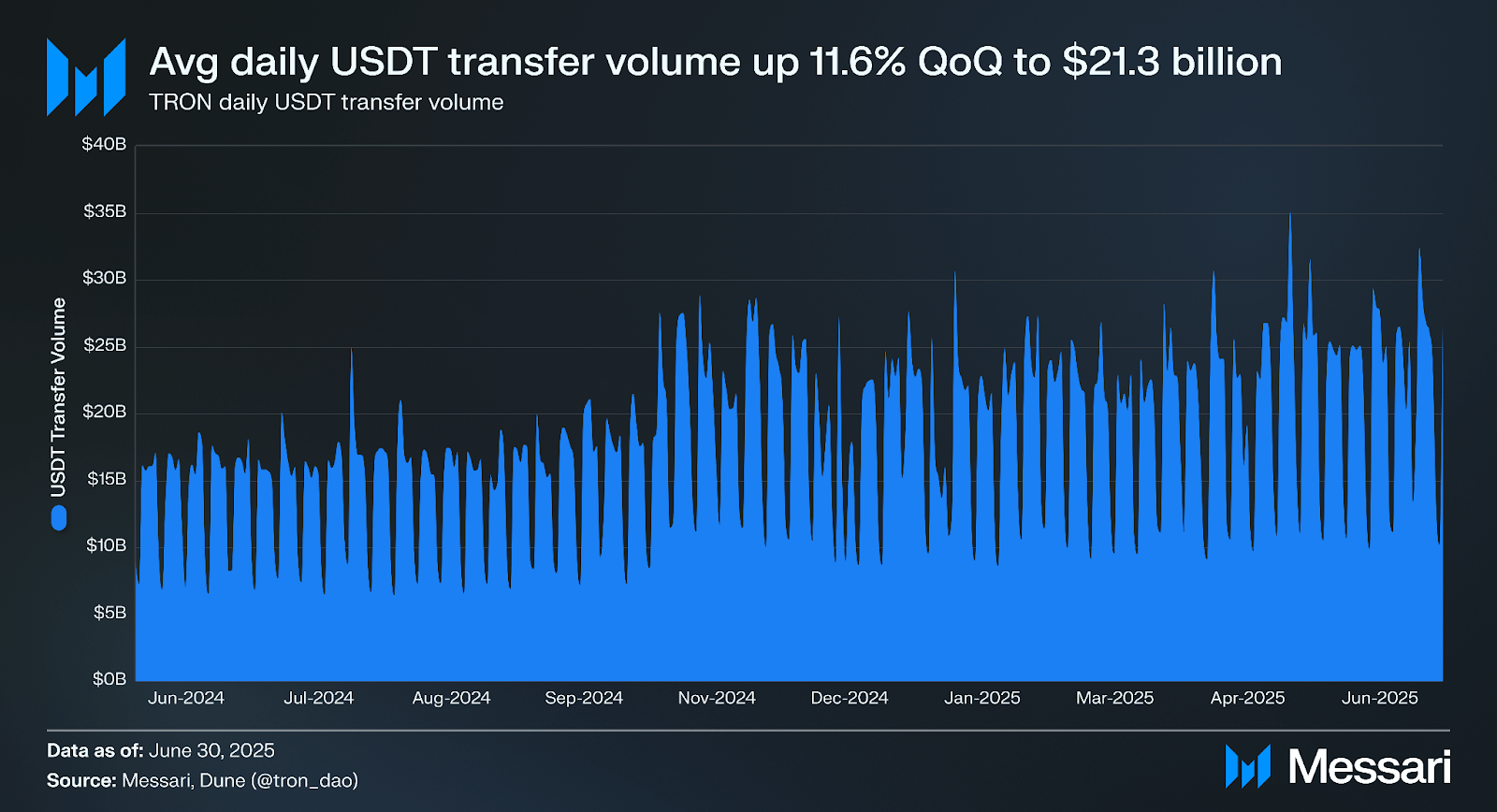

The stablecoin market cap on TRON has been steadily trending up over the past year, reaching an all-time high again in Q2. Stablecoin market cap increased by 22.2% QoQ from $66.2 billion to $80.9 billion. USDT accounts for the vast majority of stablecoins on TRON, boasting a market share of 99.2% (-0.1% QoQ). The market cap of USDT on TRON ended the quarter at $80.3 billion (+22.2% QoQ). Notably, 50.6% of all USDT in circulation is on TRON.

Other stablecoins on TRON also had QoQ increases in Q2. The second-largest stablecoin, USDD, was up 71.2% QoQ from $252.8 million to $432.8 million. USDD reached a milestone of over 409,000 accounts (+269,000 holders in Q2) that hold the stablecoin.

Another useful metric for evaluating stablecoins is transfer volume. This metric measures the dollar value of stablecoins moving onchain, not just when interacting with DEX-based smart contracts. The average daily USDT onchain transfer volume maintained its upward growth in Q2, increasing by 11.6% QoQ from $19 billion to $21.3 billion.

TRON continues to partner with leading companies in the blockchain space, with over 139 projects building on TRON with $20+ million market caps. A few notable partnerships and ecosystem upgrades that were announced in Q2 included:

TRON continues implementing strategies to grow its ecosystem beyond stablecoins, with initiatives such as the TRON Builders League, an incubator program with a $10 million fund, designed to support builders on TRON.

In 2025, TRON will focus on enhancing network stability by increasing the P2P topology robustness. Economic model improvements, such as dynamic transaction fee adjustments, aim to strengthen the ecosystem’s sustainability. In the long term, TRON plans to explore other areas like account abstraction and state data expiration to ensure robust infrastructure and future adaptability.

In Q2 2025, TRON maintained steady growth across key metrics, with continued increases in market cap, total revenue, and ecosystem engagement. The network continued to be deflationary in Q2 and delivered another strong quarter, supported by stablecoin dominance, DeFi activity, and enhanced infrastructure. Stablecoin activity continued to be a core pillar of the TRON ecosystem, with USDT maintaining a 99.2% share of stablecoin supply and average daily transfer volumes rising 11.6% QoQ to $21.3 billion. DeFi usage remained concentrated in protocols like JustLend and SUN, while TRON’s staking ratio grew to 47.1% amid broader adoption of Stake 2.0. Ecosystem expansion accelerated through integrations with partners such as SRM Entertainment, Privy, Bridge (a Stripe company), AEON Pay, and the rollout of USD1 on TRON. With continued technical upgrades and increasing network usage, TRON remains a leading force in the stablecoin and onchain finance landscape.

Looking ahead, TRON’s 2025 roadmap, coupled with initiatives like the $100 million AI development fund, the $10 million builder fund, and the many technical upgrades, positions the network for sustained innovation and ecosystem expansion. To stay up-to-date with all things TRON, visit the TRON Portal.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Tron Network Limited. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.