Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Bitcoin Heavy Luncy Strage has launched a program $ 4.2 billion (ATM) of the preferred equity, by levy by the commitment to an aggressive acquisition strategy.

The filingSuccess to sc and advertised to the late, follow the most forthest performance of the company on price and comes in love a bitcoin treasure.

The LRC program, discidged by rate rate raie a perpetual extensual stock preferred with the flexibility to fold the time, according to the market conditions. Proceed by the offer are expected to be a loud or general corporate purposes, including the capital of work and dividends in actions preferred.

However, consistent with the stated objects of strategies, a principal part is anticipated to be attributed directly to Additional Bitcoin purchase. I am

The move build on the moment of four other ATM programs already in operation. Each strategy allowed to convert the investor in digital assets, strengthening the CEO niohiel’s CEO niohiel as a superior-bearing asset.

The trimship of the firm indicates its intention to continue lequity markets to support their espanding encrypting, which time spells several classes and structures you prefer.

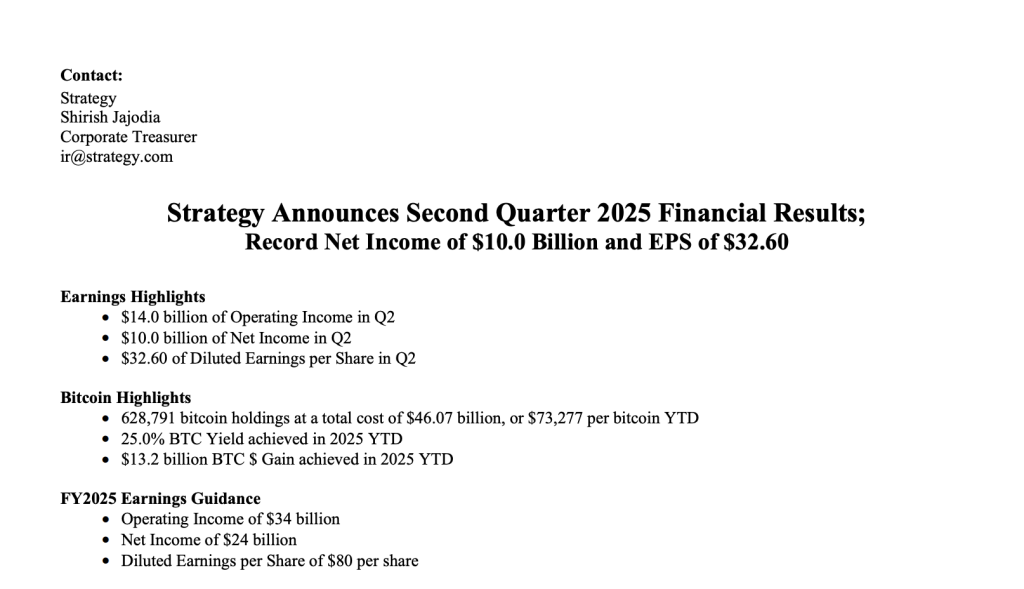

The Sistrollment Sistrollment Reportreleased right after the string of the str, showed a strong growing in the profitity. Net Getting Reply to more than $ 2,3 billion, driven by a non-performed gain on a fourth of bitcain when the price of BTC has from $ 110,000. This represented an increase nearly 140% of Q1, which indicates the material impact of the company’s asset on their bottom line.

Their bitcoin holdings, who were at 628.212 btc on July 29, are currently assessed at about $ 69.4 billion. This includes a recent 14.620 btc purchase first week, purchased using proceeding through the existing atm equity programs.

Filings S Sec shows that between July 14th and February 20, Strategy, Strategy has seen more than $ 740 million to sell half of half-common and preferred.

The time of strategy is visible in their capital markets, which generated more than $ 10.5 billion proceeds in large four months. Between April and the end of June, the company has secured 6.8 billion through many stock issuing programs.

A million additional 3.7 additional 3.7 has been raised between July 1 and 29th of July through the public offers and installations. A synable portion of that capital is already recycled in bitcoin.

The largest tranche has arrived at the Stock’s ATM Stock Program, which has carried the Stock Office Program after those sales, $ 17 Billion remains under their 2025 of 2025.

In addition to the common equity, strategy is the law of the preferred actions in many new products. Is it Tight atm program generated more than $ 518 million during the same period, while the ATM Stf program raised about $ 219 million. The Company May IPO’s IPO’s added $ 979 million, and its follow-up at the Lady ATM to the Lady has raised $ 17.9 million so far, with $ 47 billion.

Stract yourself you also saw a strong cash infusion before the ATM program has been announced. Strategy raised $ 2.5 billion in his initial trc tagsell more than 28 million share $ 90 each.

The favorite stock includes a monthly dividends, with the first $ 0.80 declared on July 31 and forecasted to be paid on August 31 to August 15.

The post Strategies Bets Bets: $ 4.2B Strc Offering Testing Massive Bitcoin Buy it first appeared Criponews. I am