Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Tron took the head as the dominant network for the USDT, Overting Ethereum in his liquidity and work transactions, according to a new report Criptomant.

With a USDT supply in 80,8 billion of $ 73.8 billion, Tron is turned the bolsain for the transfer block, by marking a early 2025.

The Tron’s USDT Transaction is of the trunk between 2.3 to 2.4 million – around 6.8 times higher than the volume of ethi. On a value basis, the network process more than $ 24.6 in the USDT per day, more than double that of their rival, cryptier reports.

The details that in the first half of 2025, 98% of the Top 10 token transfs in Tron were used, totals 384 million transacious. This dispreciation does not show you only scale but reliability hiring infrastructure of choice for a choice transaction.

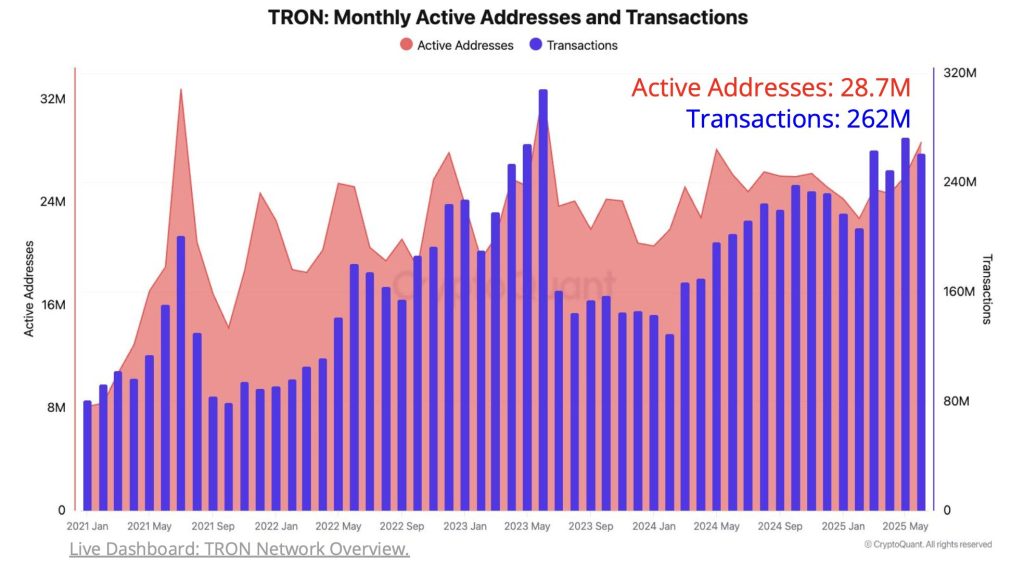

May 2025 saw the Tron Proccess 273 million transactions, its monthly second highest figure. June more traction with 28.7 million active addresses-the more than half of the 2023.

Molt of this growth is tron transactions, which accounts for 75% of all activities, up to 60% in the end of the usage to the onchain

Tron decentralized exchange, Sunswap, He also experienced consistent activity all over 2025, keeping exchange volumes on $ 3 billion per month and pea on $ 3.8 billion May.

The transactions number as well asked by 316,000 in 2024. Although wtx also sells with 98% at the platform and other attention to the platform.

The protocol of protective is even earning the moment. Both deposits and loans volumes are increased, with the USDT and USDD driving activity. Loans transactions are raised 23% compared to 2024 levels, undercover a loudest appetite for stable performance.

Despite the surge in free transactions, fee rate has made a new high 308 billion of the 2025 of June. This reflects the use of advanced services, through the detractralized network.

The capacity of scale a gelessed use and earn the higher network fees for a maturity ecosystem with layer activity beyond simple transfers.

The tron’s ascension loose their role in the female of the next utility and finance of onchain. With increased liquidity, volume of higher transactions, and expanse of DIFI services is placed as a volunteal of so incunoment in the global digital asset in the world’s asset asset.

The first half of 2025 marked a new phase for stablecoas their assumption of the total market by $ 204 billion $ 252 billion, with monthly payment volumes reaches $ 1.39 trillion Certik Reports.

USTT continue to drive the liquidity market, ascertive to the State of the Tron, while USDC has secured a mica’s license, and expanded the $ 61 billion of $ 61 billion.

The post Tron Tops Eteroum in USDT liquidity, driving a new wave of onchain activity: Cryptuquant it first appeared Criponews. I am