Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Uxlink is the Socialfi infrastructure project aimed at reducing the obstacles to the adoption of the web3 by simplifying boarding, identity management and interactions in all networks. It is designed to bridge the web2 and web3 by providing a layer of social coordination that provides incentives and users and the DAPPS -us communication. Unlike conventional social platforms that primarily support one-way social connections, such as likes or the following, the UXLINK Ecosystem is built around a two-way relationship that requires the mutual agreement of all parties participating.

The UXLINK -O’s social growth layer is a concise technical complexity and allows users to participate in onchain activities without deep technical knowledge. Includes UXLINK one chain, one account for one gas protocol and a social growth protocol package. This infrastructure complements the AI agent box for automation of tasks such as community engagement and support to users.

In January 2025. The UXLINK founded the Committee -a as part of its control structure. The Committee includes representatives and basic teams and community, and is responsible for managing the proposal and monitoring the distribution of the treasury.

UXLINK spreads beyond its Socialfi Foundation with the upcoming launch of Fujipay cards, debit cards that allows users to waste crypto currencies like UXLINK in daily purchases. The initiative aims to improve the utility of ecosystems and promote more friction interactions between the web3 and the traditional financial systems.

The UXLINK Token was launched on July 18, 2024, as well as as management and useful token Uxlink ecosystems. It coordinates economic activity at the entire platform, facilitating interactions between users, developers and services. UXLINK OWNERS EXTRACTS TO PARTICIPATION ASSEMBLY Recordingwhere one token is equated with one voice.

Token also plays a critical role in the ecosystem service program:

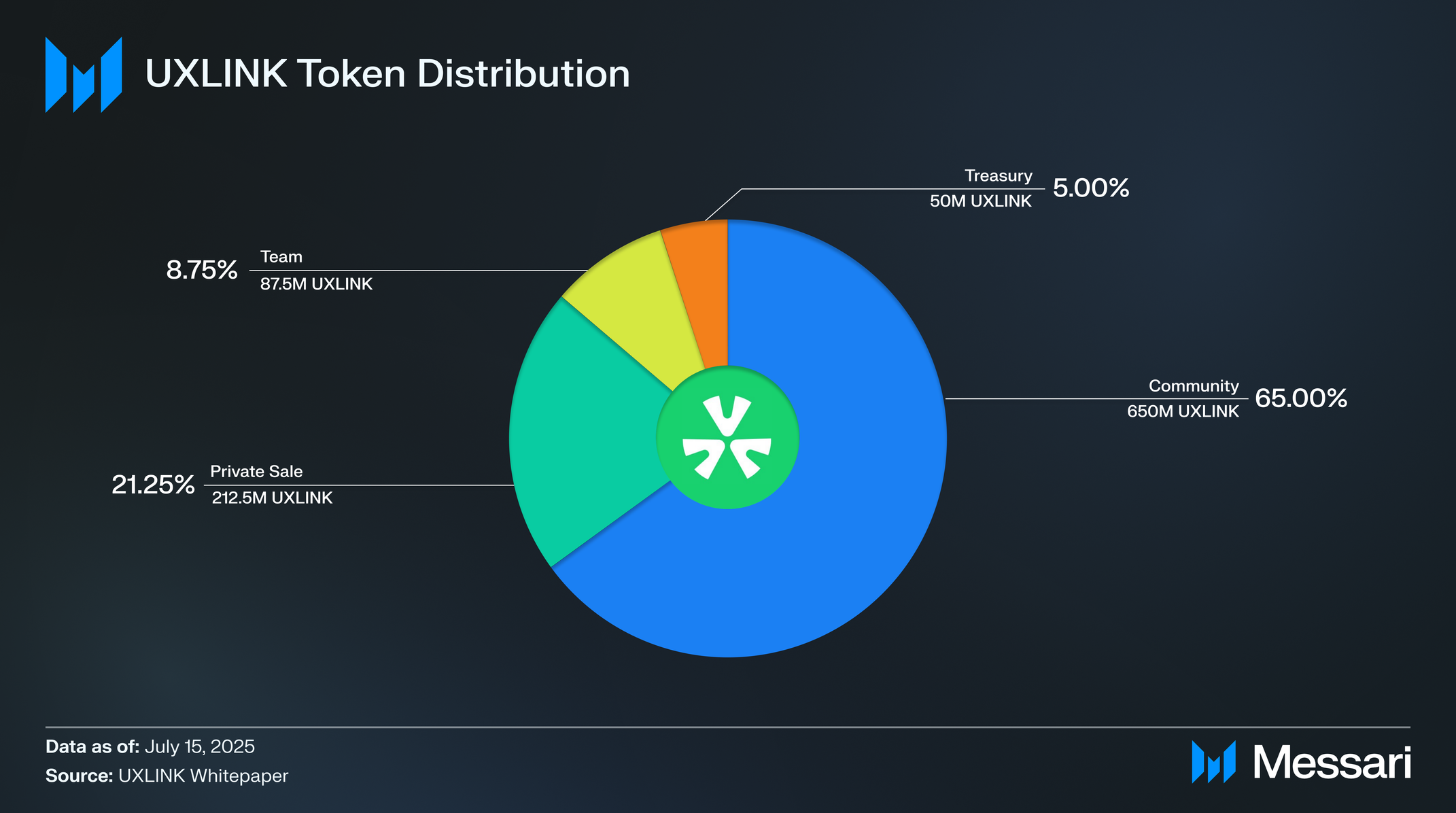

UXLINK has a maximum total supply Those billions of tokenWith about 479 million in traffic from July 18, 2025. The structure of the token distribution is designed to prioritize the priority of the user growth with the maintenance of long -term alignment between contributions and protocol development. Conditions of clearing and assignment are as follows:

Of the 65% of the community allocated, approximately 40% are reserved for UXLINK users, and the remaining 25% for developers, ecosystem partners and other associates such as centralized exchange. In addition, 1% of the community distribution is distributed to the Ufly Labs, an ecosystem fund, which will be used for initiatives for ecosystem growth.

Uxuy points are the mechanism through which users become eligible to receive Airdrops from the distribution of community tokens. These cannot be transferred through Proof of Connection (Pol) Activities, which include tasks such as user calling, participating in campaigns, use of products for ecosystem or cooperation with partnership initiatives such as Fujipay or NFTS.

When community tokens are unlocked according to the acquisition schedule, users can request UXLINK based on their Uxuy points. Once they are distributed, these tokens are not subject to any locking and can be freely used or transferred.

The release of the UXLINK token from the distribution of the community is regulated by a dual limit limit that limits distribution based on the growth of time and user:

This model is intended to reconcile token emissions with the use of the network, not to relieve only the unlock on the basis of time. If the net does not reach 100 million qualified users, a part of 65% of the community distribution will remain not issued, even after the full acquisition period has passed. In contrast, if the user’s turning point is achieved on the eve of the schedule, the shows will continue to monitor the established time tape of the quarter edition. According to writing, UXLINK Self-dispensation of more than 54 million users, and 35 months remain in the show schedule. Based on the current growth rate compared to the year, the project appears on the road to reach 100 million meters threshold within a four -year period. Adaptations of mechanics distribution or acceptability criteria can be proposed through community management as needed.

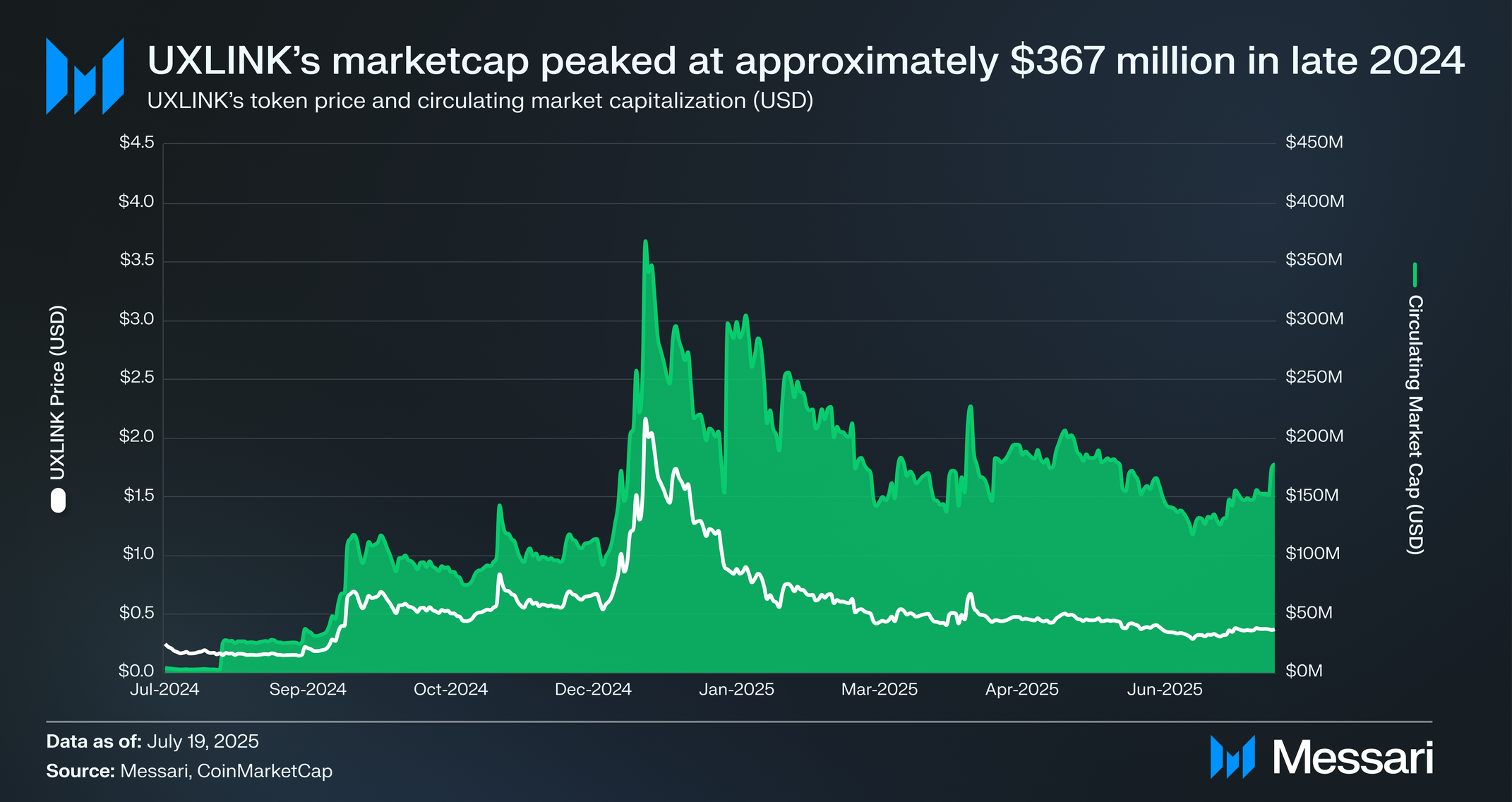

The UXLINK Token has been unstable in the last year, and market capitalization of prices and circulation at the end of 2024. Token scored its all the time, December 24, 2024, closing a day at about $ 2.16 with circular market capitalization of about $ 367 million. The rally was supported by favorable macro conditions, including the mitigation of monetary policy and improved liquidity, which launched the renewed capital flows into digital property. UXLINK has benefited from a limited short -term offer and increased demand from the market participants during this period of increased risk appetite. On July 18, 2025, Token traded in the amount of about $ 0.36, with market capitalization of about $ 175 million.

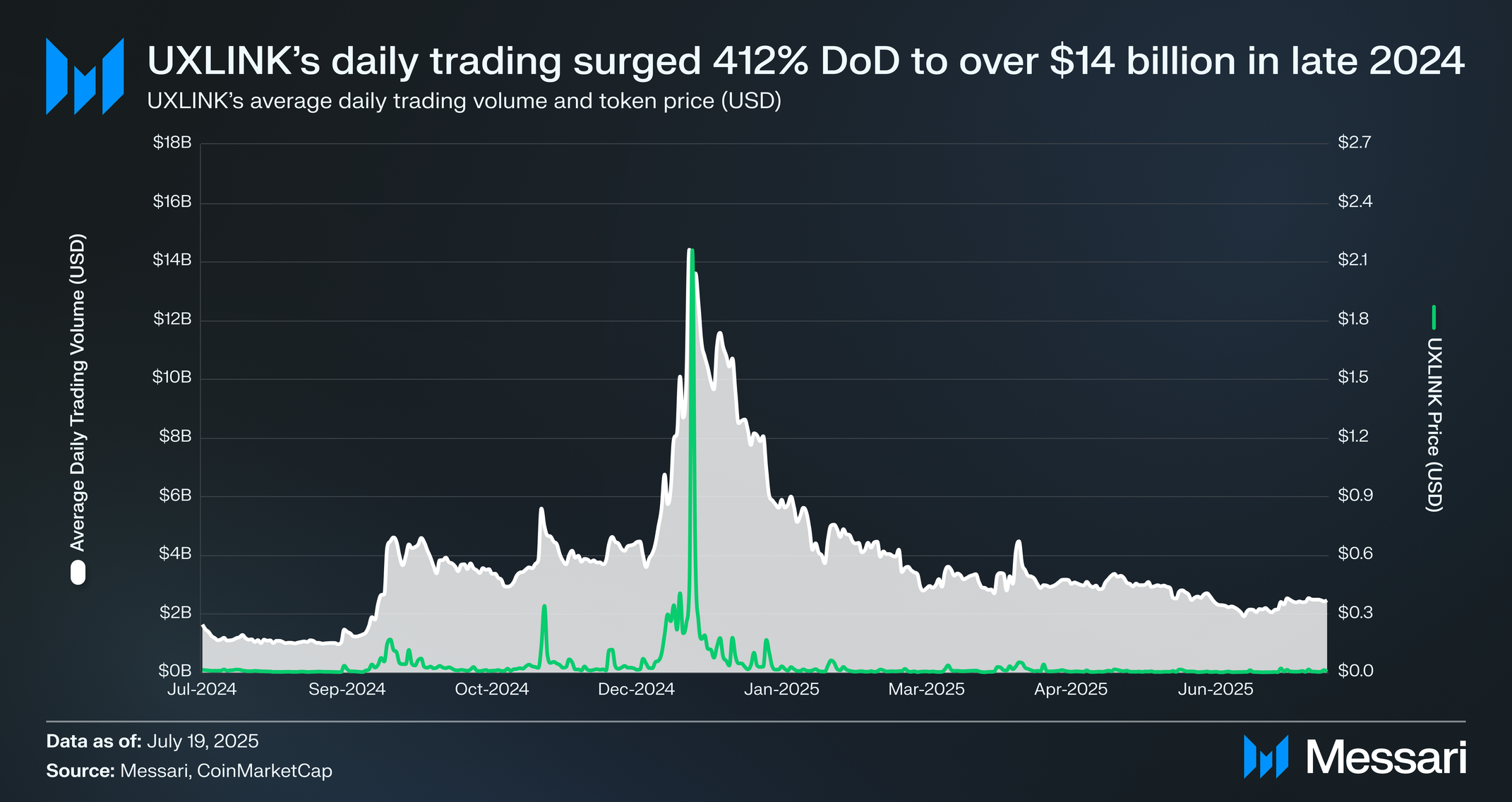

From TGE, the average daily trading volume of UXLINK is $ 240 million. The daily trading volume of UXLINK reached $ 14.4 billion high on December 25, 2024, increasing 412% compared to the previous day. The rush followed the price of the token and the top of the market and probably reflecting the increased participation of merchants who entered the market after the initial gathering. Time suggests a combination of delayed holiday trading activities, increased liquidity and rotational flows from other property. Uxlink’s trading volume spread by about 773% between 23 and 25 December, as its token became the focal point of short -term market activity. The trading scope fell to $ 1.73 billion in the next few days on December 27 and about $ 780 million to December 31. Of the one-year anniversary of the UXLINK TGE on July 18, 2025, the daily trade volume is $ 40.5 million.

The UXLINKO token model is structured around a fixed supply and a double-limit limit emission mechanism that connects the token distribution with time turning points and user adoption turningists. The use of Uxuy points as a criteria for acceptability for Airrops introduces a distribution process that requires a permanent engagement through the activities of the connection. The combination of payment of access to the developer, gas abstractions through one gas and the upcoming integration of offchain payments reflect access to the growth of ecosystems aimed at utility services. The ability of the protocol to reach 100 million qualified users will determine whether the entire distribution of the community is ultimately distributed.

UXLINK TOKEN has experienced significant volatility from launch, with prices and volume of trading largely concentrated during the period of the end of 2024. Market capitalization reached its peak in December before heading down with the wider Altcoin markets. Commercial activity has since stabilized, with smaller quantities of duration in the middle of 2025. These dynamics also reflect the effects of the limit of early supply and the positioning of the project in the current risk environment. Future performance will partly depend on the continuous growth of the user, the use of ecosystems and the ability of the protocol to reconcile incentives among the participants of their network.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

This report was ordered by Happy Fair PTE. Ltd. All content was produced independently by the author (s) and does not necessarily reflect the opinions of Messari, Inc. or an organization who requested a report. The release organization may contribute to the content of the report, but Messari maintains editorial control over the final report to retain the accuracy and objectivity of the data. The author (s) can hold the crypto currency named in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. The effect of any property so far does not indicate future results. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.