Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In a search note, Blake Heimann, Associate Research Senior In Wisometree, Presents Bitcoin and gold as key “hard assets” meadow to enjoy continued expansion of the gloobal money supply.

With the economic economic mounts, I am always going to the craft they bought debt to power, and institutional risks, and trust institution institution.

Traditionally, gold was seen as the durable store of value. Now, bitcoin is emerging as a credibly, decentralized, the eyes of many institutional investors.

Warnamtree’s Warnamtree-based scenario’s expansion that in moderate expansion, the expansion of the evility and my growing modest

Analysis assuming bitcoin will continue their part of the basketball “total basketball” to the gold, driving the decentralized financial systems.

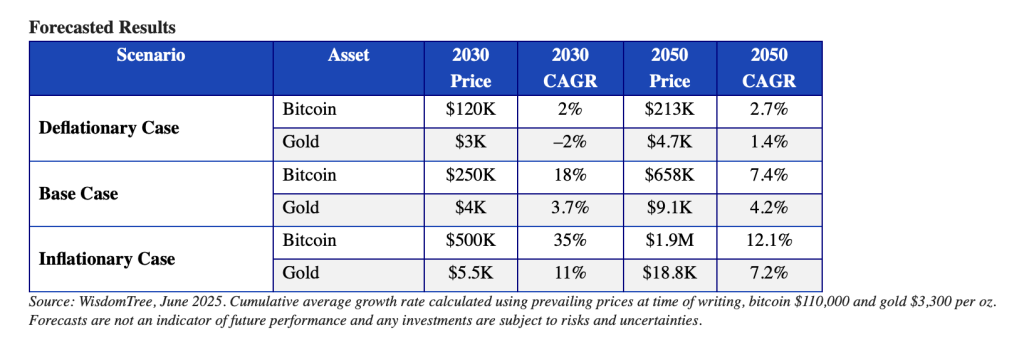

The three macroeconomic trajectories: Deflitary, basic case, and inflitary. In the case of deflaring, where tax riches of the money convenience, the bitcoin is expected to reach $ 120.000 for 2030 while the gold is released to $ 3,000.

In a swelling scenario characterized by an incinated inflation and mitcoin is the forecast to drive to $ 500,000 for 2030 and hit $ 150.

Gold could rise to $ 5.500 in 2030 and $ 18,800 in the middle of the middle of the century.

The rating pattern is found to the bitcoin prices and goldening of the glubal money supply, using historical money value of money for the future prices.

Combined with the assumptions around this cheese, the pattern provides along the potential panties of potential assets under several economic regiments.

According to the Heimann, the predictions that the grind, gold, gold can play in a diverse hazardous to a monetary resource.

The two absent, unreasonably to catch the value as the world attacks the persistent liquity, and tax return for tax alternatives to fiat tax.

Show príces don’t have futural guarantees, reflect a futurable consensus, reflect the bitcoin is no longer just a cumulative asset of modern strategy of modern strategy.

First today, Bitcoin wasted to a high register above $ 118.600 Friday, lifted by an instituting institutional question, ethflows and renewal the tail of the Trump’s tail.

The last rally catch of guard and enabled the highest wave of liquidations in years, reporting a powerful change in a moment. The last Spike Preview arrived as the market structure has bullish decisively, depending on 10x search.

The post WISDOMESTS BITCIN TO $ 250K and GOLD TO $ 4K by 2030 in the basic basic scenario it first appeared Criponews. I am