Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Revolut has removed all fees and spreads when converting between USD and two major stablecoins, USDT and USDCwhich allows its 65 million global users to exchange up to €500,000 every 30 rolling days at exact 1:1 rates.

The move removes traditional friction points in the movement between fiat and crypto, replicating the company’s decade-long approach to foreign exchange that made transparent currency conversion a standard expectation for digital banking users.

Leonid Bashlykov, Head of Product Crypto at Revolut, announced the feature on LinkedIn, emphasizing that users will receive exactly $1.00 in stablecoins for every $1.00 in cash and vice versa.

The service supports transfers on six blockchain networks, including Ethereum, Solana and Tron, providing fee-free ramp and off-ramp capabilities that eliminate the markup typically charged by exchanges and trading platforms.

Revolut’s wealth division, which includes cryptocurrency, commodities, trading and savings products, generated £506 million in 2024 while posting 298% year-on-year revenue growth.

The increase was primarily driven by an increase in crypto trading activity across the industry, as well as the successful May 2024 launch of Revolut X, the company’s standalone trading platform designed for professional traders.

Revolut X offers trading in more than 100 tokens with fixed fees of 0% for producers and 0.09% for takers, regardless of volume, placing it as a direct competitor to established crypto exchanges.

The platform has been extended to 30 other European countries in November 2024which provides real-time trading tools, advanced analytics and TradingView chart integration for users across the European Economic Area.

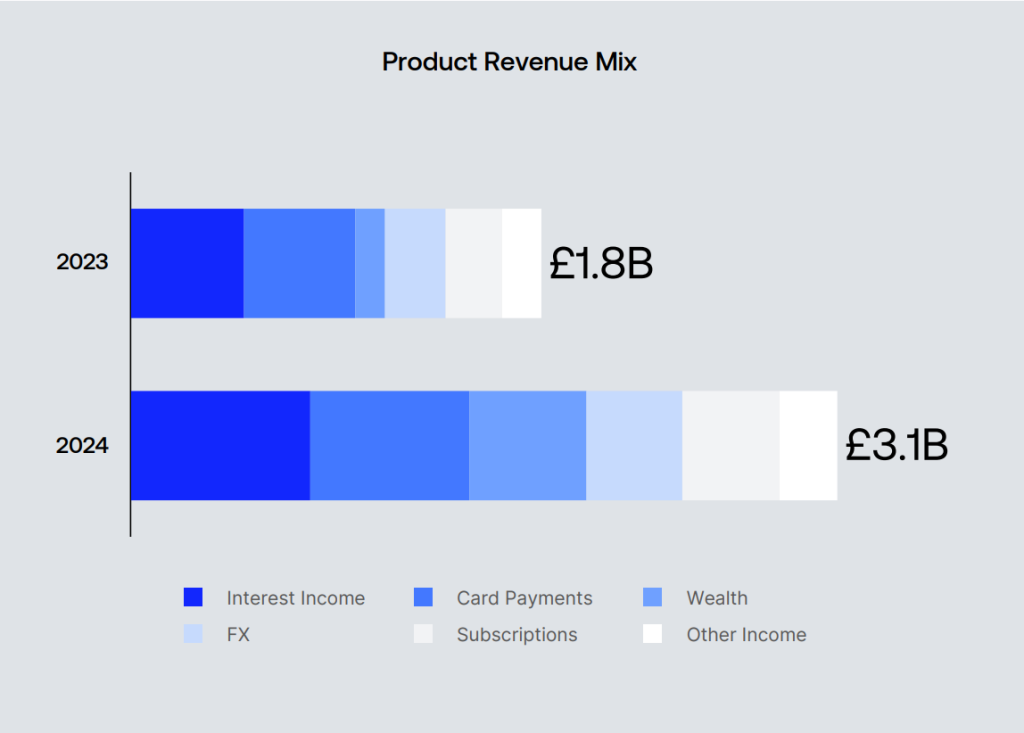

The fintech reported record financial results for 2024, surpassing $1 billion in annual profit for the first time with net income reaching £1.1 billion, an increase of 149% compared to the previous year.

Total revenue rose 72% to £3.1 billionwith subscription services increasing by 74% to £423m and the loan book expanding by 86% to £979m as the company prepared to launch full UK banking operations following its approval of a restricted banking license in July 2024.

The company launched Revolut Ramp in March 2024Partnered with MetaMask developer Consensys to allow users to buy crypto directly in their Web3 wallets.

August, Revolut has partnered with Ledgerwhich allows customers in many EEA countries to buy cryptocurrencies with their Revolut accounts or cards through Ledger Live.

Most customer funds are stored in cold storage with 24/7 encrypted chat support, while advanced risk monitoring tools prevent account takeovers.

The platform integrates a Crypto Learn tool to improve crypto knowledge for retail users, especially for first-time crypto buyers with educational resources alongside trading capabilities.

Revolut Digital Assets Europe Ltd has secured Crypto Asset Service Provider registration from the Bank of Spain and De Nederlandsche Bank in 2024 as the company works towards full MiCA authorization throughout the European Union.

Regulatory progress comes as Revolut is pursuing banking licenses in another 10 countries while they plan more than 1 billion euros in French investments until 2028, including the creation of a headquarters in Western Europe in Paris.

The company explores the the acquisition of a national bank of the United States to speed up its entry into the US market, eliminating the lengthy paper application process that can take years.

Revolut currently serves 60 million customers worldwide, with 12 million based in the UK, although crypto services will remain suspended in the US from October 2023 due to regulatory uncertainty.

Founder and CEO Nik Storonsky secured a new investment in 2024 through a secondary stock sale at an implied valuation of $45 billion.

Recently reports They also suggest that the company is in talks for a $1 billion fundraising round that would value the fintech at around $65 billion.

The company is also informed considering a dual listing in London and New Yorkwhich could sit among the first 15 most valuable companies in the London Stock Exchange and make it the first company to simultaneously join the FTSE 100 and list in New York.