In short

- Bitcoin miner TeraWulf said on Tuesday that it is expanding its partnership with Fluidstack.

- The company in August announced plans backed by Google to expand into the world of AI.

- Shares of TeraWulf climbed nearly 17% on Tuesday.

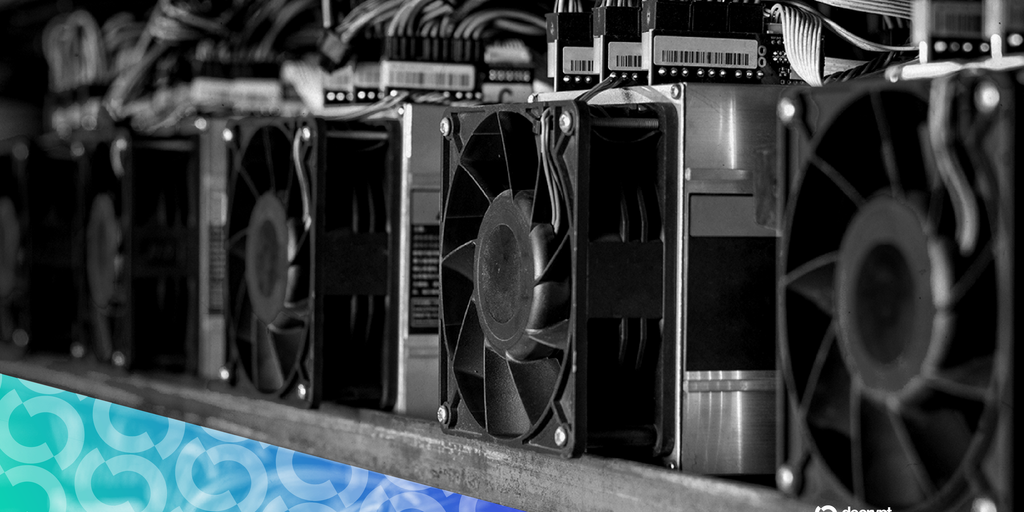

On a largely dark Tuesday for Bitcoin Mining stocks, TeraWulf’s share price rose almost 17% after the company listed on Nasdaq. he said was adding more artificial intelligence computing power through a Google-backed joint venture with AI cloud company Fluidstack.

TeraWulf stock (WULF) closed at $17 per share after the news. The shares have since fallen to $15.60 in after-hours trading.

The Easton, Maryland-based company said the two will develop 168 MW of critical IT load at a site in Abernathy, Texas in the second half of this year under a 25-year hosting commitment. TeraWulf will hold a 51% majority stake in the joint venture, an announcement said.

TeraWulf and Fluidstack in August already had signed an agreement to work together with the plan to build a new data center, supported by Google.

“This is exactly the evolution we have outlined: converting advantageous infrastructure positions into megawatt contracts with investment-grade counterparts and doing so at a strategic scale,” TeraWulf CEO Paul Prager said.

Among the other main miners on Tuesday, Riot Platforms fell 6.2%, while CleanSpark and MARA Holdings fell nearly 5.2% and nearly 3.5%, respectively, according to Yahoo Finance. IREN was off almost 4%.

Mining Bitcoin it became more challenging after last year half cut the amount of digital coins earned from 6,250 to 3,125.

Despite the rise in the price of Bitcoin, it has not risen as quickly as in previous cycles, but the difficulty of minting coins has become harder, prompting miners to look for new sources of income.

Hut 8 of the most publicly traded miner in August plans revealed to develop 1.53 gigawatts of new capacity at four US sites. Google last month announced a separate agreement to backstop an agreement between Fluidstack and Bitcoin miner Cipher, giving Google the right to buy a 5.4% stake in Cipher.

Bitcoin mining stocks this year have increased on the news of the initiatives of such companies that exploit the dramatic growth of artificial intelligence technology.

Bitcoin was recently traded below $113,000, a 1.6% drop in the last 24 hours. It has fallen about 10% since hitting an all-time high above $125,000 earlier this month, according to crypto data provider CoinGecko.

In a Myriad prediction market, about two in three respondents agree with crypto trader Mando that BTC’s next move will be to $120,000 instead of going down to $100,000 as entrepreneur KBM expects.

Debrief Daily Newsletter

Start each day with the latest news now, more original features, a podcast, videos and more.