Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

U The Hong Kong Monetary Authority (HKMA)with analytical support from Deloitte, published its Phase 2 report of the e-HKD pilot program, which offers a look at how central bank digital currencies (CBDC) and other forms of digital money could strengthen the city’s financial ecosystem.

The report shows a pivotal transition – from physical cash to digital money powered by distributed ledger technology (DLT) – and outlines how Hong Kong positions itself as a global leader in digital finance, tokenization and next-generation payment infrastructure.

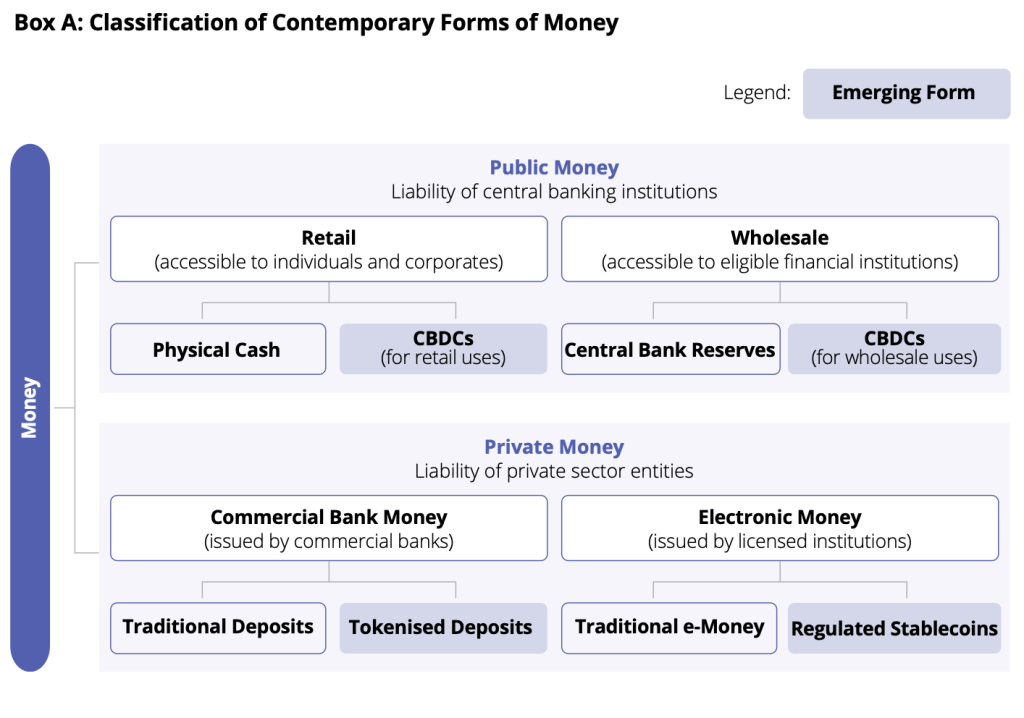

According to the HKMA report, the digital money landscape is evolving into two main categories: public money and private money. Public money includes central bank digital currencies such as e-HKD, while private money includes tokenized deposits and regulated stablecoins.

These innovations are building the foundations for tokenization in Hong Kong, enabling faster, more transparent and programmable transactions that connect traditional finance with the emerging Web3 ecosystem.

The HKMA has been studying e-HKD since 2017, conducting pilot studies and technical experiments to explore its potential in wholesale and retail settings.

With Phase 2, the focus expanded to include comparisons between e-HKD and private forms of digital money, evaluating their usability, scalability and commercial viability.

The Phase 2 pilots, conducted with 11 industry partners in the banking, payments and technology sectors, explored three central themes:

Settlement of Tokenised Assets: The pilots tested the use of a hypothetical e-HKD for the atomic settlement of tokenised assets, such as money market funds and bonds.

The results showed that DLT-based settlement could shorten cycles from T+2 to T+0, improving liquidity and reducing counterparty risk. However, banks indicated that tokenized deposits could offer similar efficiency with fewer infrastructure changes.

Programmability: The report examined the potential of programmable payments with smart contracts and target money (PBM). Pilot use cases include green reward vouchers, escrow-based prepayments, and supply chain financing.

While programmability increases automation and transparency, the HKMA found that commercial adoption models remain limited, with no clear business case for a large-scale rollout.

Offline payments; Offline e-HKD pilots explored Super SIM and NFC-based payments that operate without an Internet connection. Given Hong Kong’s robust digital infrastructure and existing offline payment systems, the HKMA concluded that an offline e-HKD could add limited incremental benefit at this time.

The HKMA, supported by Deloitte’s analysis, will prioritize wholesale use cases for e-HKD, particularly in the settlement of tokenized assets and interbank transactions.

The central bank will continue to evaluate retail applications while laying the political, legal and technical foundations to ensure readiness for 2026.

As the global race toward digital money intensifies, Hong Kong’s collaborative approach—combining public oversight with private innovation—puts it at the forefront of financial transformation. The e-HKD initiative reflects not only the city’s commitment to technological advancement, but also its strategic role in shaping the next era of money – connected, efficient and inclusive.