Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ethereum co-founder Vitalik Buterin says that decentralized finance (DeFi) has reached a turning point, one where on-chain savings is not only viable, but begins to rival traditional banks.

Speaking in a pre-recorded address at a Dromos Labs event on Wednesday, Buterin said he is “encouraged” by how far DeFi on Ethereum has come in terms of security, maturity and usability.

“We’re going to see, I think, a growth in more and more cases of people, institutions and all kinds of users around the world actually using this as their primary bank account,” he said. “DeFi as a form of savings is finally viable.”

Buterin’s remarks reflect a broader evolution in the sector that he believes is moving from speculation to stability.

Ethereum-based DeFi was previously associated with high-risk loans, complex performance strategies and frequent protocol exploits. But Buterin said the difference between 2025 and the first DeFi era of 2020 or 2019 is “night and day”.

Despite acknowledging the recent violations, including a multi-millionaire Balancer hack Earlier this month, he said that the security of the smart contract has improved substantially.

Blockchain analytics firm Elliptic noted that while crypto losses in 2025 technically “dwarf“Last year, much of that figure came from the historic Bybit hack in Februaryrather than the structural weaknesses of DeFi.

Buterin emphasized “proof walking,” a simple DeFi security measure that ensures users can always retrieve their funds independently.

He urged developers to keep the founding principles of Ethereum at the core: open-source code, interoperability and resistance to censorship.

He also asked developers to design applications with the Ethereum mainnet and Layer 2 networks in mind. With new tools like Lighter, which has reached more than 10,000 transactions per second, Buterin said that scalability is improving in L1 and L2.

“With the right kind of engineering, that level of scale is open to anyone to build today,” he added.

Ethereum’s DeFi ecosystem now processes more than $1.9 trillion in transactions per quarter, with a $77 billion market and more than 312 million active users by mid-2025.

Average returns on DeFi savings hover around 8.2%, compared to around 2.1% in traditional banking.

Although operating costs in DeFi remain lower, the sector still faces ongoing risks, including $1.1 billion in fraud and hacking reported in the first half of 2025.

By contrast, global banks manage about $370 trillion in assets and process $405 trillion per quarter, but their slow settlement times and higher fees make DeFi’s permissionless structure increasingly attractive to users looking for autonomy and speed.

Buterin’s optimism follows his September essay promoting it “Low-risk DeFi” as the sustainable economic backbone of Ethereuma form of decentralized banking that could support the network as Google Search funds the Google ecosystem.

He argued that stablecoin lending and flatcoins tied to inflation indexes or baskets of currencies could stabilize Ethereum’s economy while preserving its values.

Buterin wrote that blue-chip DeFi protocols like Aave, which offer around 5% stablecoin yields, provide Ethereum’s low-risk financial needs.

Earlier today, Buterin and the Ethereum Foundation published “The Trustless Manifesto,” warning developers against compromising decentralization for convenience.

The paper criticized trends such as sequencers centralized in Layer 2s and hosting RPC nodes, arguing that “decentralization is not destroyed by capture, but by convention”.

He proposed three “laws” for trustless design: no critical secrets, no irreplaceable intermediaries, and no unverifiable results.

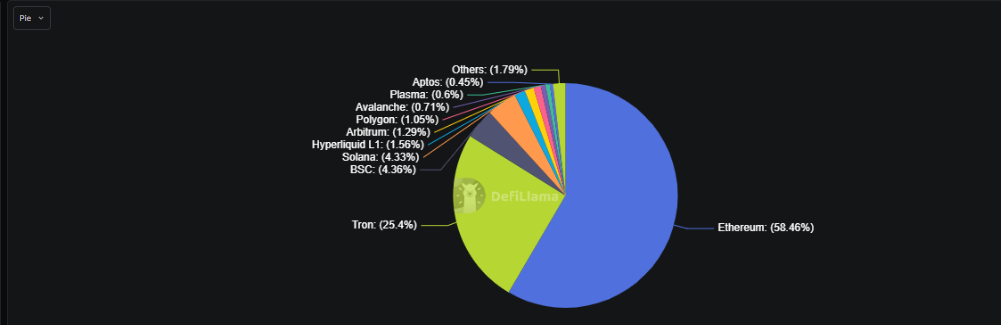

Meanwhile, Ethereum continues to strengthen its technical and institutional foundations. The network hosts more than 75% of real world tokenized assets and 58% of the global supplywith companies such as BlackRock, Securitize and Ondo Finance implementing tokenized Treasury products on the chain.

Its Layer 2 networks now secure more than $50 billion in value, while privacy and scale work is being accelerated through the Ethereum Foundation’s new 47-member Privacy Cluster.