Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Belarusian President Aleksandr Lukashenko was installed crypto mining as a strategic path towards reducing global dependence on the dollar, announcing aggressive expansion plans during a government meeting on energy policy.

The directive builds on previous commitments to turn the country’s surplus nuclear capacity into a competitive advantage for digital asset production. At the same time, broader geopolitical trends are accelerating de-dollarization across many continents.

According to a local reportLukashenko dismissed concerns about market volatility during the November 14 meeting in Minsk, framing crypto as an inevitable component of international efforts to establish monetary alternatives.

“Our entire world is now faced with a global problem, namely moving away from dependence on a single currency, the dollar,“He told the officials gathered to discuss strategies for electricity consumption and development of nuclear capabilities.

“This process will intensify. Cryptocurrency is probably one of the options.“

The president’s approval follows months of groundwork aimed at positioning Belarus as an attractive destination for international mining operations.

Lukashenko in March ordered the Minister of Energy Alexei Kushnarenko to use the nation’s electricity surplus for crypto production, explicitly referring to developments in Washington, where President Donald Trump announced plans for a national country. Bitcoin reserve

“We can see the direction of the world, especially the world’s largest economy,” Lukashenko stated while suggesting that Belarus could eventually establish its own national crypto reserve rather than just attracting foreign investors.

Belarus has anchored its mining ambitions on the Belarusian Nuclear Power Plant, which has reached full operational capacity of 2,400 megawatts after the activation of its second unit in November 2023.

The infrastructure upgrade solved previous power shortage problems that had prevented previous attempts to court mining companies at the Minsk Hi-Tech Park.

Russian and Chinese investors are said to have expressed interest in Belarus-based projects, drawn by incentivized electricity tariffs now possible through expanded nuclear production.

Beyond the mine, Belarus is preparing to launch its Central Bank digital currency at the end of 2026.

The National Bank planned to onboard companies before extending access to government agencies and citizens in 2027.

The digital ruble initiative closely coordinates with Russia’s parallel CBDC development as both nations face sanctions pressure and seek alternative settlement mechanisms.

However, Russia has delayed its own launch to mid-2026 due to technical challenges.

Lukashenko’s strategic pivot coincides with documented changes in international trade settlement practices that extend far beyond Eastern Europe.

Investment company VanEck said in April that China and Russia have started to settle some energy transactions with Bitcoin and other digital assets, while Bolivia announced plans to import electricity using cryptocurrencies.

These developments gained momentum during the time when the Trump administration increased trade tensions by announcing a 125% tariff on Chinese imports, which triggered immediate market responses, with Bitcoin jumping 5.6% to $81,636 within an hour of the announcement.

At that time, China backed off from raising tariffs on US goods from 34% to 84% on April 9. However, a diplomatic breakthrough on May 12 led to an easing of tariffs, with the United States reducing duties to 30% and China reducing taxes to 10%.

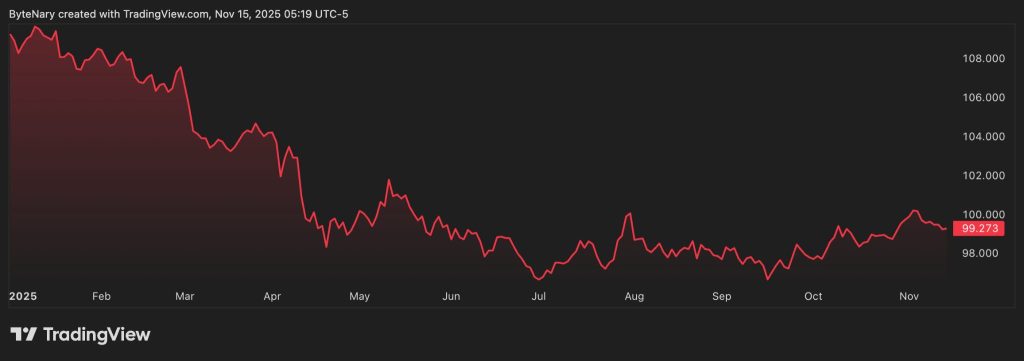

The US Dollar Index has fallen more than 9% year-to-date to 99, amplifying what VanEck describes as Bitcoin’s emerging role as a hedge against fiat degradation and geopolitical risk.

Asia’s billionaires have also responded decisively to these macroeconomic changes, according to UBS executive Amy Lo, who revealed at a Bloomberg event in Hong Kong that the region’s wealthiest investors are redistributing assets from US dollars into the Bitcoin, gold and Chinese markets.

Asia’s affluent investors now hold more than 15% of their wealth in cryptocurrencies and gold, a marked departure from traditional dollar-denominated portfolios.

According to the Cryptonews report76% of Asia’s family offices and high net worth investors hold digital assets, up from 58% in 2022, with multiple crypto allocations growing from less than 5% to more than 10% of total holdings.

Singapore is leading this transformation, with 57% of wealthy investors planning to expand their cryptocurrency positions over the next two years. The region’s affluent class is expected to see its wealth grow from $2.7 trillion in 2021 to $3.5 trillion by 2026.