Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

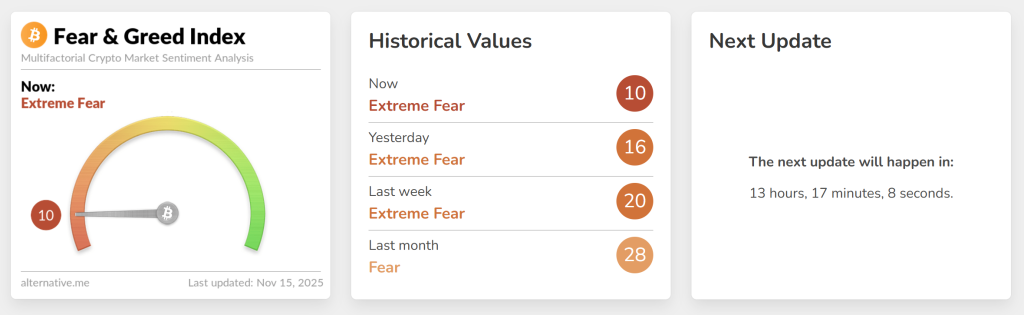

Bitcoin is trading around $95,775, up nearly 7% this week, as the broader crypto market goes through one of its most fragile sentiment phases of the year. The Crypto Fear & Greed Index collapsed to 10, marked “Extreme Fear” and the corresponding levels last seen in early March.

That turn alone is enough to give even long-term traders pause, especially as market capitalization has fallen to $1.91tn and momentum indicators continue to soften.

Historically, extreme fear has tended to act as a contrarian signal, often appearing near key accumulation areas, but this time the technical structure does not offer a clear verdict.

Bitcoin has fallen below its long-term uptrend line for the first time since the spring, signaling a break in the momentum that has carried the market for most of 2024 and 2025.

Bitcoin is stabilizing after a sharp decline that dragged the market into the $94,500-$92,000 support region, an area that served as a pivot throughout April and May. Thursday’s long wick lower suggests buyers have stepped in, but the follow-through has been timid.

The 20-EMA has turned, as dynamic resistance, while the RSI is near 33, above the oversold territory without forming a clear bullish divergence.

Behavior of candles reinforces uncertainty. This week’s pattern looks like a smaller version of a sequence of three black crows, followed by a single rejection candle, not enough to signal capitulation, but enough to slow the decline. The price is now squeezed between the broken trend line above and a mid-range floor below, an area where markets usually make quick decisions.

A change in momentum requires evidence. Traders watch:

A daily close above $99,000 will confirm a short-term reversal, especially if accompanied by an engulfing bullish candle and an RSI above 40.

Extreme fear can create opportunities, but it can also precede another wave of selling. With Bitcoin stuck between conflicting signals – oversold momentum versus broken structure, traders approach this area with caution. If buyers defend $92,000, this could evolve into a classic accumulation pocket. If not, the market may revisit deeper supports before stability returns.

Bitcoin Hyper ($ HYPER) brings a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what was always missing: Solana-level speed.

capabilities with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consultthe project emphasizes reliability and scalability as adoption develops. And the momentum is already strong. The presale exceeded $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity grows and the demand for efficient BTC-based applications increases, Bitcoin Hyper stands out as the bridge that connects two of the largest crypto ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it back fast, flexible and fun.

Click here to participate in the Presale