Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

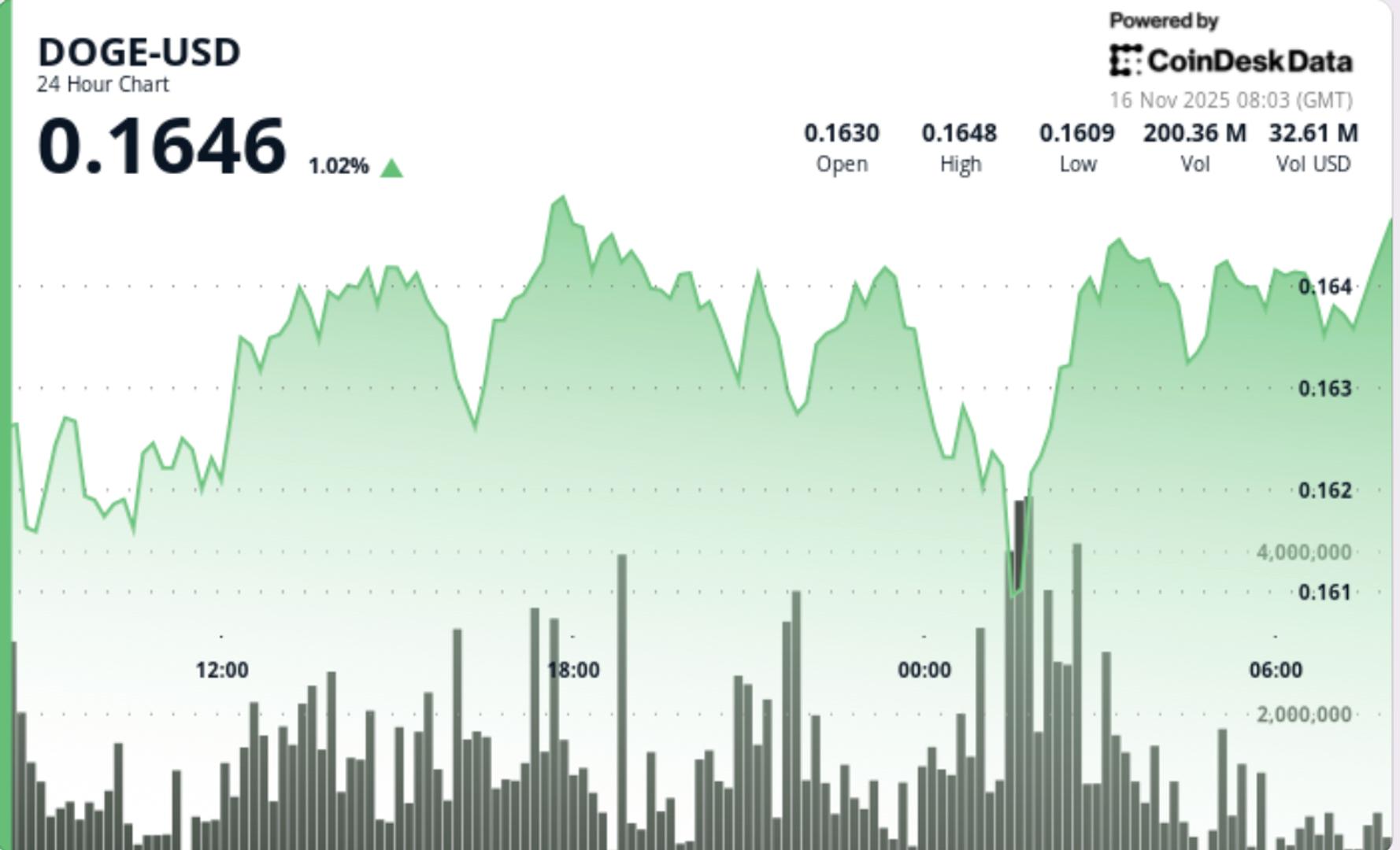

The two main meme assets traded through high-speed volatility windows, with Dogecoin rebounding sharply from a heavy volume flow while Shiba Inu broke key support before staging an aggressive intraday reversal.

The broader crypto markets continued their risk-on spin as sentiment remained weighed down by AI bubble concerns, $800M in Bitcoin ETF flows, and tightening liquidity in speculative assets. The weak macro backdrop left meme-coins particularly exposed to volatility shocks.

Despite this, the behavior of large holders diverges in DOGE and SHIB. Dogecoin saw an increase in institutional accumulation after two weeks of heavy whale positioning, while SHIB faced high retail-led selling before buyers aggressively entered intraday lows.

No specific catalyst for the tokens drove the session’s movements, although traders monitored continued discussions related to ETFs and whale positioning trends as key sentiment drivers.

DOGE climbed 3.0% to close at $0.1641, rebounding from a sharp decline in the first session that reached the price at $0.1551.

• Volume spiked to 613M during the support test – 186% above the 214M average

• Breakout above $0.1640 established an ascending intraday trend line

• End of session trading kept DOGE in a consolidation band of $0.1638 – $0.1643

The rebound produced a clear pattern higher, confirming the rotation of momentum despite the weakness of the broader market.

SHIB fell 2.0% from $0.000009233 to $0.000009045, breaking the daily support at $0.000009240.

• The heavy sale at 08:00 GMT reached 412.35B tokens – 67% above average

• Price dropped to $0.000008975 before violent reversal

• A V-shaped spike back to $0.000009082 printed on 32.34B hourly volume

The intraday rally recovered short-term resistance at $0.000009060, signaling stability despite the broader downtrend.

Support/Resistance:

• Major support validated at $0.1551

• New support: $0.1638 to $0.1640

• Resistance: $0.1650so what $0.1680

Volume:

• 613M peak confirms the institutional purchase

• Recovery maintained above the base, signaling sustained demand

Chart structure:

• Ascending trendline intact

• The higher-lower pattern reinforces the bullish momentum

Support/Resistance:

• Strong support: $0.000009020 (triple defense)

• Resistance: $0.000009240so what $0.000009307

Volume:

• Breaks: 412.35B (+67%)

• Recovery: consistent high flows through 02:10-02:12

Chart structure:

• Daily downward trend intact (lower highs)

• Hourly V-inversion suggests near stabilization