Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ethereum enters the new trading week at a fragile point, with the price hovering around $3,160 after a slight gain of 0.16% in the last 24 hours. As the second largest cryptocurrency with $381.6bn market capitalizationETH is now expressed in one of its most important technical structures of 2024-2025: a wide symmetrical triangle that was contracted from the August high.

What makes this moment pivotal is the convergence of two major trend lines. The long-term uptrend line that originated from the April breakout continues to act as structural support, while a firm downtrend line has rejected any rally for nearly three months. ETH is sitting right at this apex, a point where markets rarely stay neutral for long.

Recent candles reflect this uncertainty.

Long lower neighbors indicate that buyers are defending the $3,060 demand zone, while small body recoveries signal hesitation near the descending trend line. The 20-day EMA also turned lower, creating dynamic resistance that sellers continue to press.

The momentum profile of ETH leans bearish, with the RSI standing at 34, firmly below the median line, but not yet forming a bullish divergence. This means that price and momentum are aligned to the downside, they do not work against each other, a sign that sellers are still influencing the direction.

Historically, ETH has performed recoveries from similar RSI levels, but only when paired with a firm reaction to trend support.

Key technical levels in the near term include:

The positioning of ETH in the triangle suggests that a decisive move is near. If the buyers manage to hold $3,060 and print a bullish engulfing candle, the first upside target becomes the upper border of the triangle near $3,485, followed by the critical level of $3,653 that would formally reverse the bearish structure.

A breakout here would allow ETH to recapture the 20-day EMA, retest the trend line from above, and potentially accelerate towards $4,242 – a shelf of major resistance.

Ethereum price forecast seems neutral since the symmetrical triangle is in play. A clean break below $3,060 would snap the long-term rising trend line, exposing ETH to a deeper pullback at $2,632 and then $2,192, the next two pockets of liquidity on the daily chart.

Given how tightly ETH is currently compressed, any support breach could trigger a quick and impulsive move.

But if ETH regains $3,653, the narrative turns instantly. That level represents both a structural inversion and a psychological change in favor of buyers. A close above would confirm a bullish breakout from the triangle, setting the stage for a renewed uptrend.

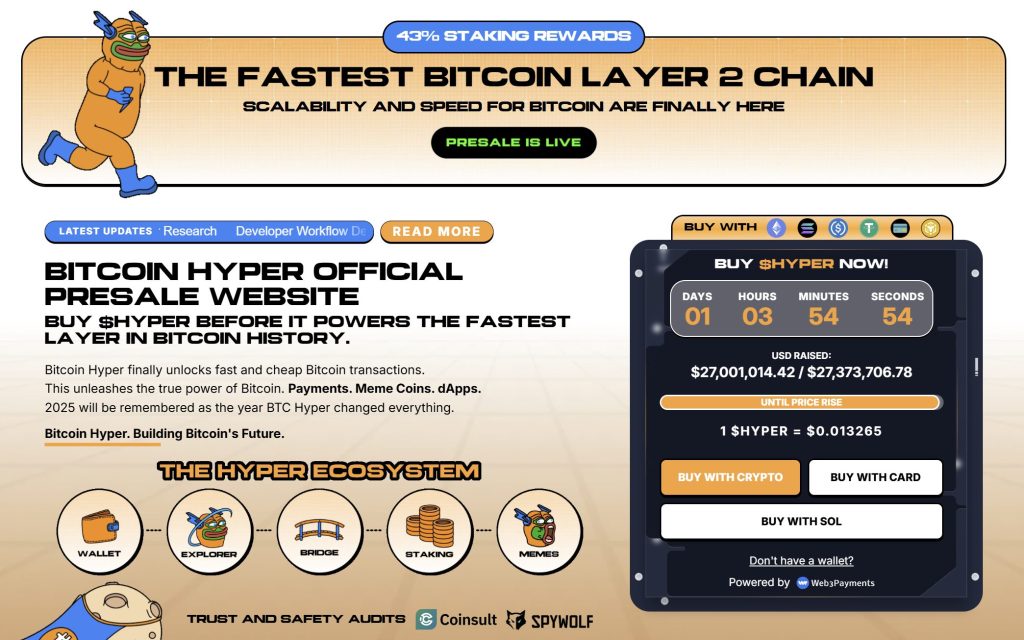

Bitcoin Hyper ($ HYPER) brings a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what was always missing: Solana-level speed. The result: fast, low-cost smart contracts, decentralized apps, and even meme currency creation, all secured by Bitcoin.

Audited by Consultthe project emphasizes reliability and scalability as adoption develops. And the momentum is already strong. The presale exceeded $27 million, with tokens priced at just $0.013265 before the next increase.

As Bitcoin activity grows and the demand for efficient BTC-based applications increases, Bitcoin Hyper stands out as the bridge that connects two of the largest crypto ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it back fast, flexible and fun.

Click here to participate in the Presale