Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Key Takeaways:

October did not live up to “Uptober” expectations. The brutal market correction of October 10 is still weighing on sentiment. Investor pessimism was fueled by US-China tariff tensions, the Fed’s policy stance and weak economic data. But can November change the tone and restore optimism?

Throughout the month, the crypto community kept repeating “Uptober” and talking about an upcoming altseason. However Ethereum (ETH) underperformed, closing October without the expected breakout. Historically, however, Q4 has been a positive period for the asset. Despite the recent drawdown, November and December could also change the picture.

ETH dropped below $4,000 and is now holding close to $3,800. If the bearish scenario plays out, a deeper pullback towards $3,500 remains possible. This is a key psychological level that can determine the next direction of the market.

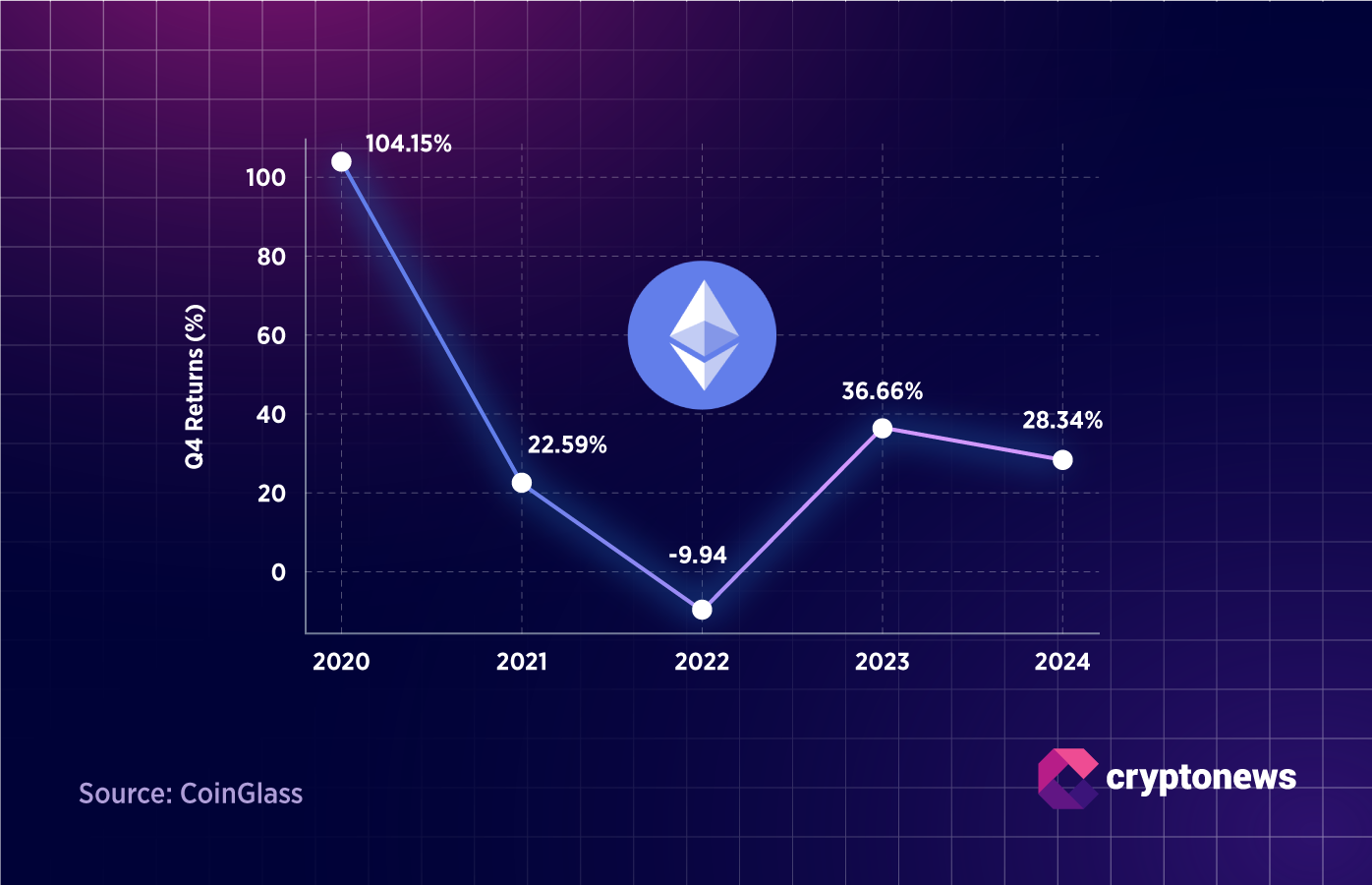

In 2024, Ethereum finished Q4 up 28.34%, and in 2023, 36.66%. Yet past performance does not guarantee future earnings. The stage of the market cycle remains uncertain. Some analysts believe that the altseason has peaked this summer, while others expect another wave.

Mary Carol, CEO of StealthExhe said Cryptonews that market risks remain high. Although the market appears stronger than in previous cycles, she warned that sudden shocks could still trigger a sharp decline:

Drawdowns remain possible. Since the market is now more liquid than during previous cycles, the frequency of extreme flash events is reduced, but systemic risk, such as the withdrawal of liquidity from large LPs, a surprise macro event, or a regulatory shock, can still trigger large moves. Worst-case scenarios are less likely than in thinner markets, but they are not impossible. In practice, the risk is now asymmetric, with the upside requiring lasting, deep liquidity and sustained flows, while the downside can be catalyzed by rapid deleveraging. Managing that asymmetry is what traders and institutional desks are focused on.

Talking with Cryptonews, Cais Mana, Co-Founder and Head of Product at TEN Protocolnoted that Ethereum’s recovery remains uncertain amid changing macro conditions. Market participants are waiting for a clear signal before committing to the next major trend:

The post-performance correction of ETH is clear, and the next move depends on the macro. If the Fed relents and risk appetite returns, we could see ETH recover $4,500 fast, especially with ETF inflows still healthy. But if $3,800 crack and macro remains sticky, the selloff will likely deepen. Now, the sentiment has become cautious, so it’s about who will blink first, the Fed or the market. So far, ETH is trading a lot relative to BTC.

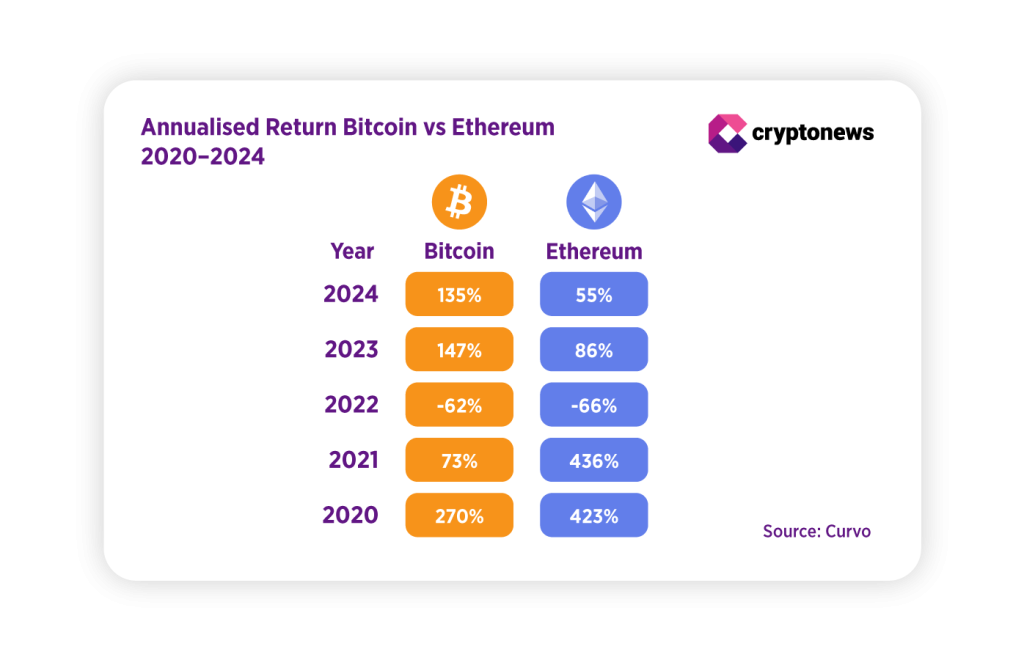

The performance of Ethereum is still closely related to Bitcoin. A strong Bitcoin (BTC) historically it has not been the best scenario for altcoins. According to Curvoin 2024 BTC increased 135%, while ETH gained 55%. By 2023, BTC advanced 147%, and ETH 86%. Interestingly, in 2021 and 2020, Ethereum surpassed Bitcoin with gains of 436% and 423%, respectively. It is also worth noting that in 2022, the two currencies corrected to almost the same level.

Will this pattern repeat itself in 2025? For Ethereum to rise, it is not enough for the price of Bitcoin or dominance to decrease. The asset still needs to remain resilient while moving quietly in the background. Carola explained that while Bitcoin’s slowdown may make room for ETH and other altcoinsdoes not automatically activate rotation:

A drop below a technical level like $3,800 would increase volatility and could deter rotation or create a hunt for value that sparks selective alt moves. Historically, alt seasons require more than an ETH dip. They need supportive BTC conditions and renewed funding streams. So an ETH breach alone is necessary but not sufficient.

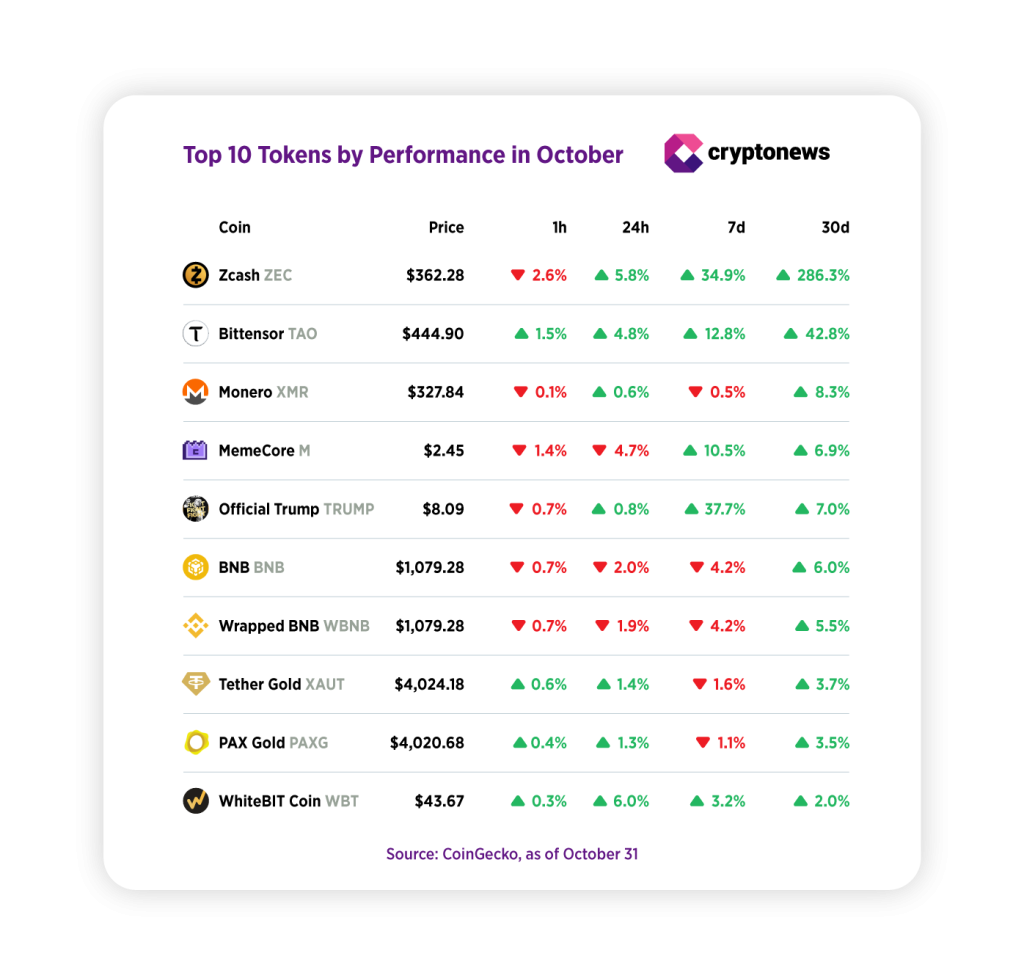

Among altcoins, Zcash (ZEC) stood out the most. The token ranked first in performance in the last 30 days, gaining almost 290%. That sudden look triggered a sense of FOMO among some traders, especially since most of the market is still correcting. But as we know, crypto narratives rarely last long. The key is to learn to see them first – not chase them to the top.

Carola noted, such demonstrations often bring a speculative advantage. He added that the RWA and AI sectors could also do well in the coming months. This trend is already visible in projects like Bittensor (TAO)which gained about 43% in October, and in the growing interest towards AI infrastructure tokens after the rise of x402:

We have to wait for a selective recovery. Some of the most attractive areas are privacy, both momentum and use cases in the chain, as shown in the move of Zcash that reflects speculative and utility interest. Next is the RWAs, which are tangible instruments of performance that attract institutional dialogue. When it comes to AI + Web3 infrastructure, developer activity and real product traction matter. Finally, exchange tokens and middleware, because as exchanges expand product groups, their native ecosystems can capture utility value.

Despite renewed activity in some niches, the broader altcoin market still lacks retail participation. According to Gavin Thomas, CEO of TEN Protocolcapital flows are mainly driven by experienced traders rotating between sectors rather than a new wave of sales:

Retail is waking up in pockets. Token sales and new names moving 5x are a good sign, but this is still a smart money spin, not a full-on craze. The next stage comes when new users come in, not just new tokens.

Capital may soon rotate from Bitcoin to Ethereum and its wider ecosystem, although other players, such as BNB and Solana, may also take the lead in the coming months. Maria Carola believes that rotation is possible, but it will be selective:

If the next phase of the market is quality altcoins, then ETH is the most likely beneficiary because of its infrastructure role. However, BNB or SOL could outperform in a narrative driven mini-cycle if chain-specific catalysts such as product launches, tokenomics upgrades, or ecosystem incentives materialize.

Gavin Thomas agrees that the next phase of the market is not yet here and that the turning point will depend on new use cases:

Cycles end with chaos, not calm. We are nowhere near that. The next wave of excitement will come when users experience what on-chain privacy and AI-driven applications can really do. It is the inflection point that the market has not priced.

Note also that Ethereum remains central to the market structure:

Ethereum is still the default risk asset in crypto. It doesn’t lose relevance, it’s just being forced to evolve. The builders are still there, and the shift towards encrypted execution and stronger data control is what keeps the story alive.

The coming month is unlikely to raise the entire market, but it can reveal which stories and assets still have the strength to move forward. Investors should keep an eye on markets where volatility remains high, as this is where trading volumes are concentrated. Looking at which projects are recovering most quickly after recent drawdowns can offer the best clues about where capital will rotate next.

Holders and early participants will be able to claim their MON tokens as the project launches its long-awaited airdrop. Market attention will likely focus on the token’s initial liquidity and price stability.

Sonic’s upcoming mainnet upgrade is expected to improve transaction throughput and overall network stability. The update may influence investor confidence and on-chain activity around S.

The launch of Polkadot Hub aims to unify the network’s ecosystem tools and governance modules. The update may boost developer engagement and visibility for DOT within the multichain space.

The Jupiter team will host an AMA focused on its new prediction market initiative. Community insights and roadmap details could spark renewed interest in JUP’s utility and ecosystem growth.

Lido will share its latest governance and staking performance updates with token holders. The session may outline protocol growth metrics and plans for expanding liquid staking adoption.

The Starknet V0.14.1 upgrade will go live on mainnet, introducing performance optimisations and improved transaction efficiency.

Disclaimer: Crypto is a high risk asset class. This article is provided for informational purposes and does not constitute investment advice.