Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

XRP price forecast took center stage this week after the first US Spot XRP ETF officially went live, opening for trading below Canary Capital’s XRPC ticker and attract strong initial demand from investors.

According to Bloomberg ETF analyst Eric Balchunas, the fund recorded 26 million dollars in trading volume in its first 30 minutes, which marks one of the most active ETF debuts of the year.

Balchunas said the XRPC “has a good chance to beat BSOL’s $57 million as the largest first-day volume of any ETF launched this year,” hinting at the growing appetite for regulated exposure to XRP among institutional traders.

On November 13 placeCanary Capital described the XRPC as a product designed to provide exposure to XRP, the native token of the XRP Ledger, which reflects the performance of the network in payment and liquidity protocols.

After the announcement, XRP he jumped 3% to reach $2.40, with daily trading volume climbing to $6.24 billion, a 34% increase since the ETF opened for trading.

Bitwise CIO Matt applaud the launch, calling it a bold step for crypto ETFs and a sign of how sentiment is evolving.

“The median opinion of a crypto asset does not determine the success of the ETF,” he said. “You’d rather have 20% of people love an asset than 80% of people vaguely like it.”

His comment explains the polarized reputation of XRP, often criticized by segments of the crypto community, but consistently supported by a loyal base of investors and developers.

Meanwhile, CryptoQuant data shows that large investors and whales were already positioned ahead of the ETF announcement.

“Prior to the XRP Spot ETF news, futures data showed a clear increase in whale-sized orders while prices were still compressed,“The firm’s analysts observed.

This “whales-first, retail-last“The pattern is a familiar sight in crypto markets and often signals a shift towards more aggressive price action.

“Once retail enters late, the market typically becomes more volatile and driven by sentiment,“CryptoQuant noticed.

Now many market analysts predicts XRP could end 2025 above $3.50with the potential to reach $5 by 2026 if institutional inflows sustain the momentum.

The XRP/USD chart shows an Elliott Wave analysis projecting a dramatic bullish scenario.

The chart shows that XRP completed a five-wave impulse structure from 2013 to 2018 (Wave 1), followed by a prolonged correction Wave 2 that peaked in 2023.

Analysis indicates that XRP is now in the early stages of Wave 3, historically the most powerful momentum wave.

The projection shows a potential rally towards the $5-6 range, which represents more than 150% gains from current levels around $2.40

Key Fibonacci extension levels are marked, with the 0.786 extension around $2.20 (already achieved) and the 1.00 extension near $3.5 serving as the next target before the 1.618 extension near $5.5.

As institutional money floods into ETFs, retail traders are turning to presale projects that offer better entry points and strong staking incentives.

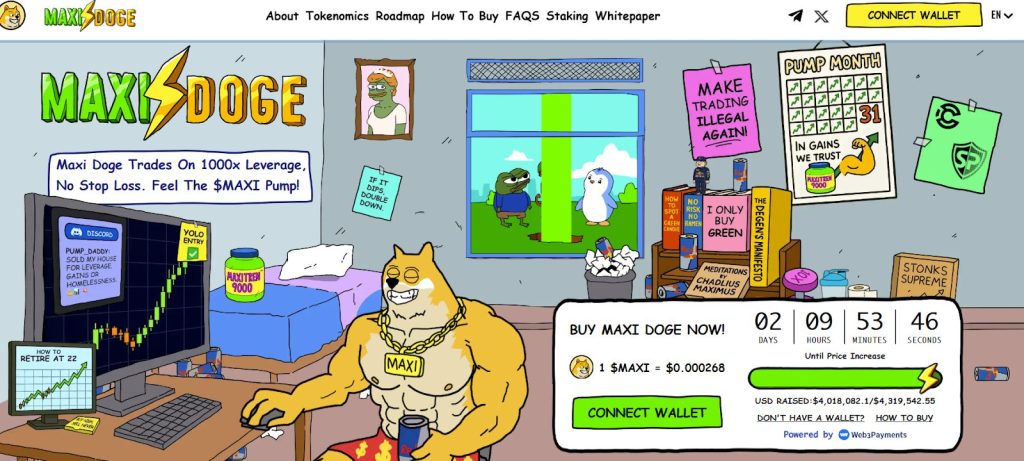

A standout is Maxi Doge (MAXI)a meme coin with muscle that has already raised more than $4 million in its ongoing presale.

Unlike typical dog tokens, Maxi Doge combines meme culture with real staking utility.

The presale runs in rounds on stage, with the current price at $0.000268 and small increments between stages, giving early buyers a clear advantage over their DEX listing.

Investors can buy $MAXI using ETH, BNB, USDT, USDC, or a bank card, with no minimum investment, and can stake immediately for an estimated annual return of 78%.

Visit the official website here