Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Japan Exchange Group is exploring measures to limit listed digital asset treasury companies, citing investor protection issues as crypto-hoarding stocks suffer steep losses.

Tokyo Stock Exchange operator JPX is considering stricter backdoor listing rules and fresh audit requirements for companies pivoting to cryptocurrency accumulation, according to people familiar with the matter it spoke to. Bloomberg.

Three listed Japanese companies have abandoned plans to buy cryptocurrencies since September, after the JPX warned that their fundraising capabilities would be restricted if they pursued crypto strategies.

The exchange does not currently have a general regulation against corporate crypto hoarding but is “monitor companies that raise concerns from a risk and governance perspective, with a view to protecting shareholders and investors“, a JPX representative wrote in an email to Bloomberg.

Crypto treasury shares modeled after Michael Saylor’s Strategy Inc. have collapsed from previous highs, leaving retail investors with heavy losses.

Strategy shares are about half since mid-July despite the company holding a Bitcoin stack is worth more than $60 billion.

The potential crackdown was sparked by concerns that the recent decline in treasury stocks of local digital assets has hurt domestic investors.

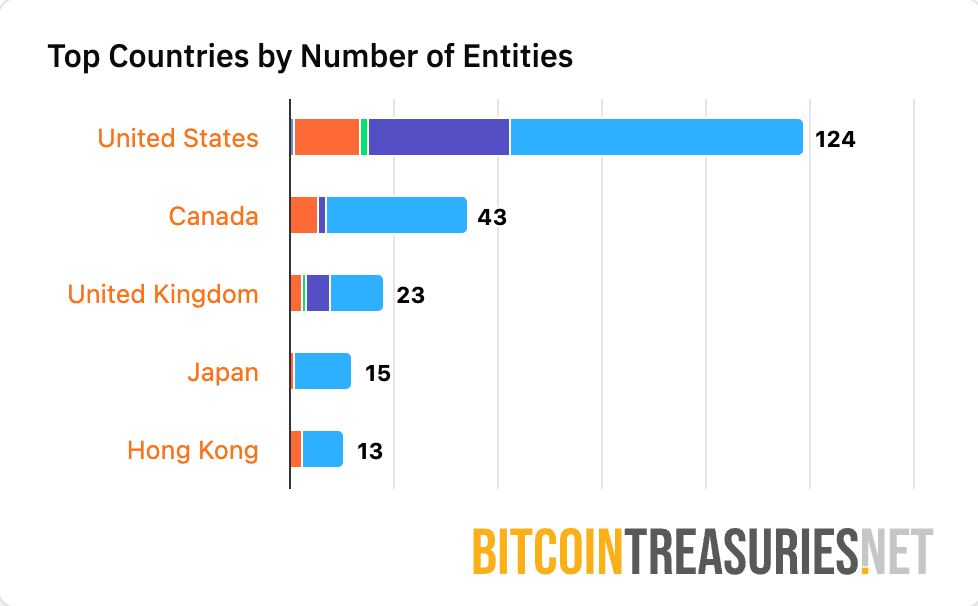

While Hong Kong and other Asia-Pacific exchanges have resisted new listings of the digital asset, Japan has 15 public buyers of Bitcoin, the most in Asia.

Metaplanet, Japan’s largest operator, listed in Tokyo, has plunged more than 75% from its mid-June peak after growing 420% earlier in the year. Nail salon operator Convano, which is targeting 21,000 Bitcoin, is down about 60% since late August.

Market analysis has signaled widespread dismay across the sector, with K33 research reporting that a quarter of all public companies holding Bitcoin are now trading at market values below their token holdings.

JPX is exploring whether to extend its existing backdoor listing ban to companies that change core operations to cryptocurrencies.

A backdoor listing typically involves a private company going public through a merger or acquisition, thus bypassing the normal initial public offering (IPO) process.

Simon Gerovich, CEO of Metaplanet pushed back against being grouped with companies that lack proper governance.

“Metaplanet held five general meetings of shareholders in the past two years (including four extraordinary general meetings of shareholders and one ordinary general meeting of shareholders), and proceeded with all important matters with the approval of shareholders.Gerovich said.

He emphasized that these processes “have always been carried out in accordance with the proper procedures under the management team that has continued since before the commercial transition.” Gerovich added.

Dylan LeClair, Head of Bitcoin Strategy at Metaplanet, noted parallels with recent shareholder approval requirements for crypto acquisitions from NASDAQ.

He said the Strategy quickly clarified that “the new NASDAQ policy on the formation of digital asset treasuries will not impact Strategy, our ATM program, or other capital market activities.“

LeClair explained that companies with an established governance framework that consult shareholders through appropriate procedures can continue operations without interruption.

“This regulation targets cases of rapid pivots without shareholder consent, and bitcoin treasury companies with well-functioning governance were exempt,“, he said.

Metaplanet pivoted from hotels in early 2024 and amassed over 30,000 Bitcoin, making it the fourth largest public Bitcoin holder in the world.

The company reported a dramatic financial turnaround in Q3 2025, posting a sales turnover of 4.517 million yen ($29 million), up 1.702% year-on-year, and an ordinary profit of 23.229 million yen ($150 million), after incurring a loss of 311 million yen ($2 million) the previous year.

Total assets reached 550,744 million yen ($3.56 billion) as of September 30, led by Bitcoin holdings valued at 516,360 million yen ($3.33 billion) in current and non-current accounts.

The equity ratio also improved to 96.7% from 55.9% at the end of 2024 after warrant exercises and overseas offerings that increased the capital by 247,462 million yen ($1.60B).

The company’s Bitcoin per fully diluted share reached 0.0214885 BTC, representing about a six-fold increase from the year-end 2024 figure.