Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Monthly (Glmr) is a layer-1 parachute on Polcadot. Provides implementation of Ethereum Virtual Machine (EVM) and Web3 API, allowing direct implementation of the strength agreement and protocol interfaces with minimal modifications. Moonbeam allows cross integration, using its functionality of liquidity aimed at Moonbeam and bridges networks. His Primary features Involve the integration of the cross chain, investment and management of Onchain. The network includes multiple implementation: Moonbeam on the polkadot (December 2021), Moonriver on Kusama (June 2021) and The database of the moon Alpha on the testnet (September 2020). This structure ensures safe and fast updates Mainnet Moonbeam.

In Q2 2025, The sea is given progressed his way with Own Launching a stagenet 20. May. This turning point provided an environment for compatibility testing with Eigenlayer Protocol and starting an initial test at storage primitives. As an autonomous service that can be checked (AVS) within the Eigenlayer Ecosystem for a validator, Datahaven applies Ethereum’s safety validator, using check methods such as Merkle Forests and Digital Fingerprints. Development also included work towards the incredible bridge between Moonbeam and Datahaven, along with cross -communication through General Message (GMP) Protocols for facilitating property storage, application application and certified interaction. In addition, Datahaven emphasized the tools for development developers and SDKs to alleviate the integration of their storage solutions to existing applications, while opening applications for companies and projects to become partners, promoting the expansion of ecosystems.

Moonbeam’s Technology Stack, built with rust and Substrateprovides a strong development environment. It boasts Ethereum compatibility, offering complete EVM implementation and web3 RPC API, which integrates existing Ethereum tools and apps. As a key player in the polqadot ecosystem, Moonbeam provides developers an affordable path to exploit the polkadot effects, using Ethereum tools and compatibility.

Website / X (Twitter) / Telegram

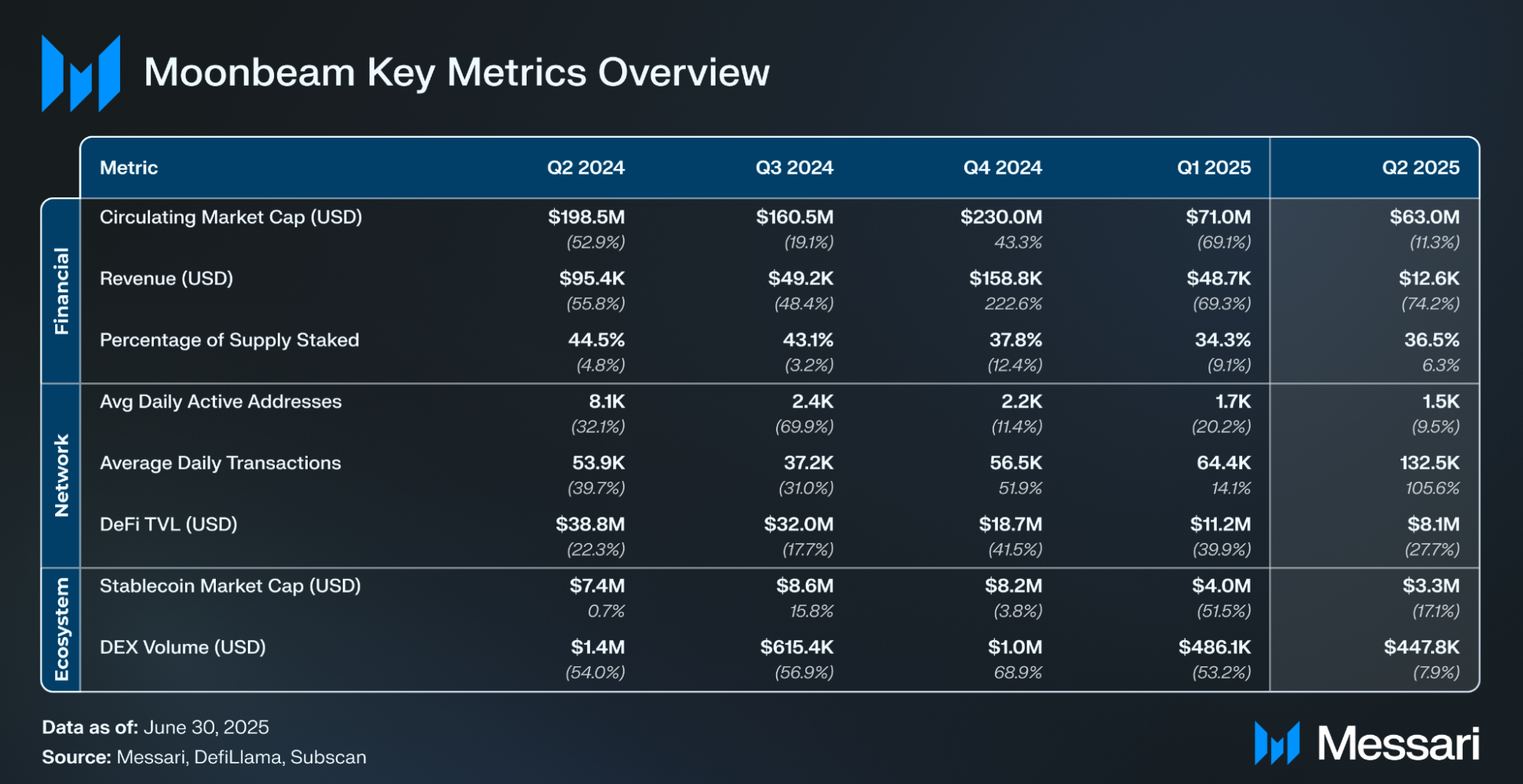

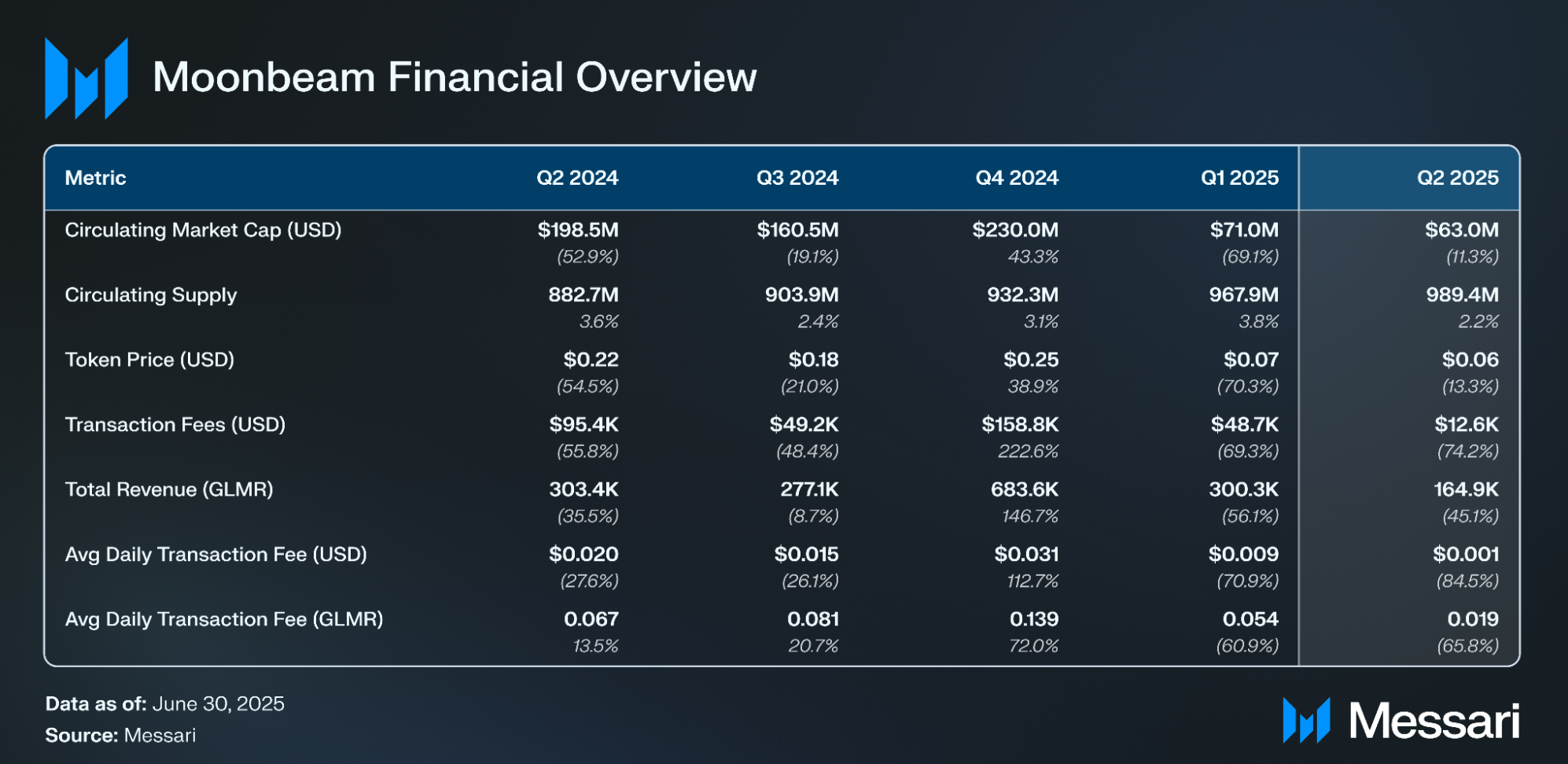

In the Q2 2025, the GLMR -LOD market cap was estimated at $ 63.0 million, which came to a fall of 11.3% QOQ with $ 71.0 million in Q1 2025.

GLMR is the original token of Moonbeam network. There are several roles, including the compensation of the block manufacturer to ensure the network, supporting participation in the management of Onchain and the settlement of transactions fees. Token follows a fixed annual arrangement of an inflation of 5.0%, without predefined maximum supply.

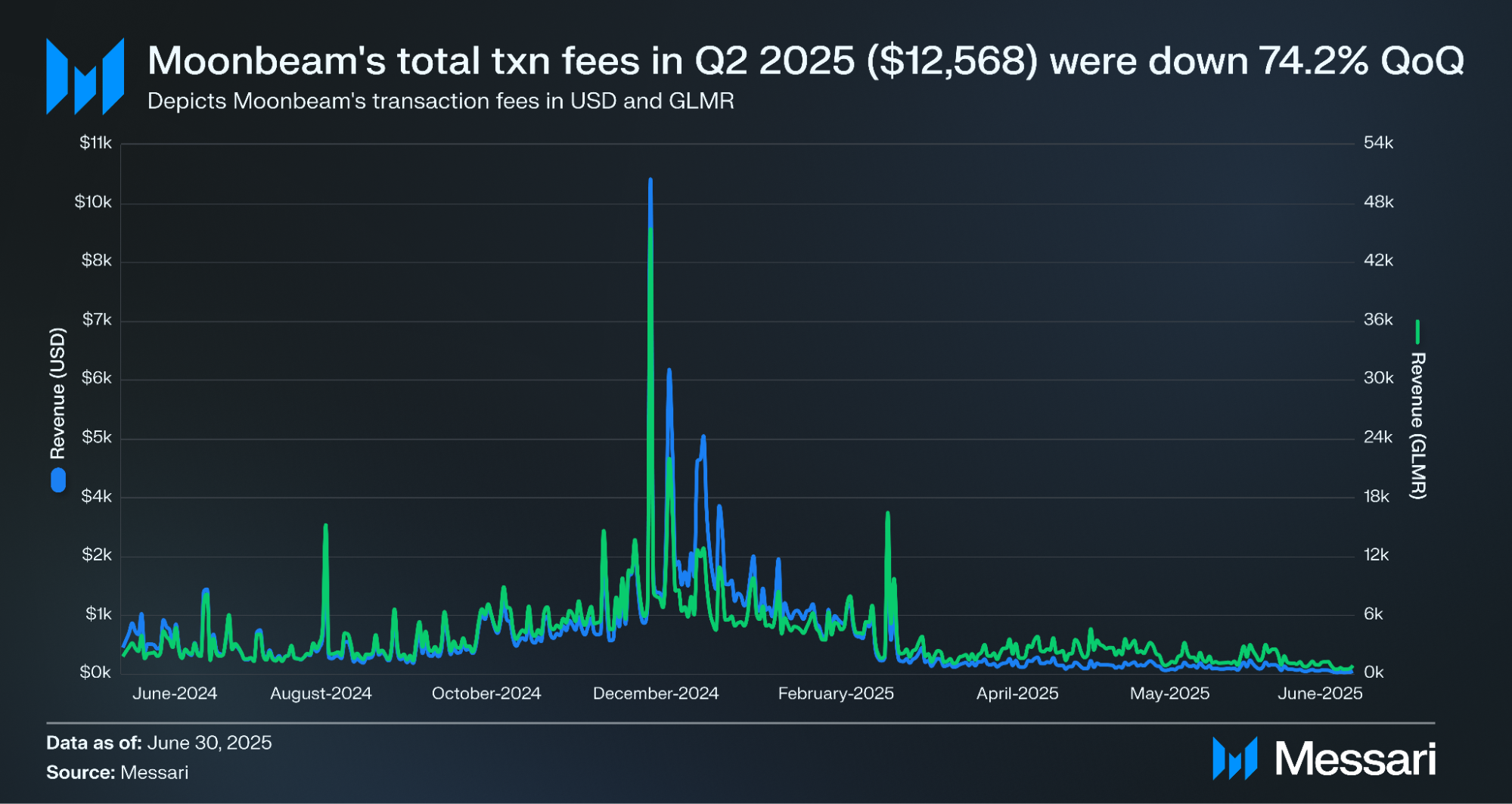

Total Moonbeam (USD) transactions (USD) fees were $ 12,568 in Q2 2025, experiencing 74.2% QOQ drop with $ 48,690 in Q1. Total average daily transactions (USD) fees were estimated at $ 138.0, which occurred a decrease of 74.47% compared to an average of $ 541.0 in Q1. Denominated in GLMR, the transaction fees were 164,854 GLMR in Q2 2025, experiencing a drop of 45.1% QOQ with 300.314 GLMR in Q1. The total average daily transactions (GLMR) fees were estimated at 1,811, which came to a decrease of 45.7% compared to the daily average of 3,336 in Q1.

These development continues to progress launched in Q1 and are partially under the influence results Referendum 91who upgraded the duration of Moonbeam V3400. This upgrade supported a reduction of 75.0% of the minimum gas price at all times. Furthermore, it also introduced improved errors to remove errors, improved smart contract management, lower transactions fees and implemented the gas refund mechanism for overrated evidence of evidence (POV).

From generated transaction fees, 100% were burnedin detail in Referendum 101.

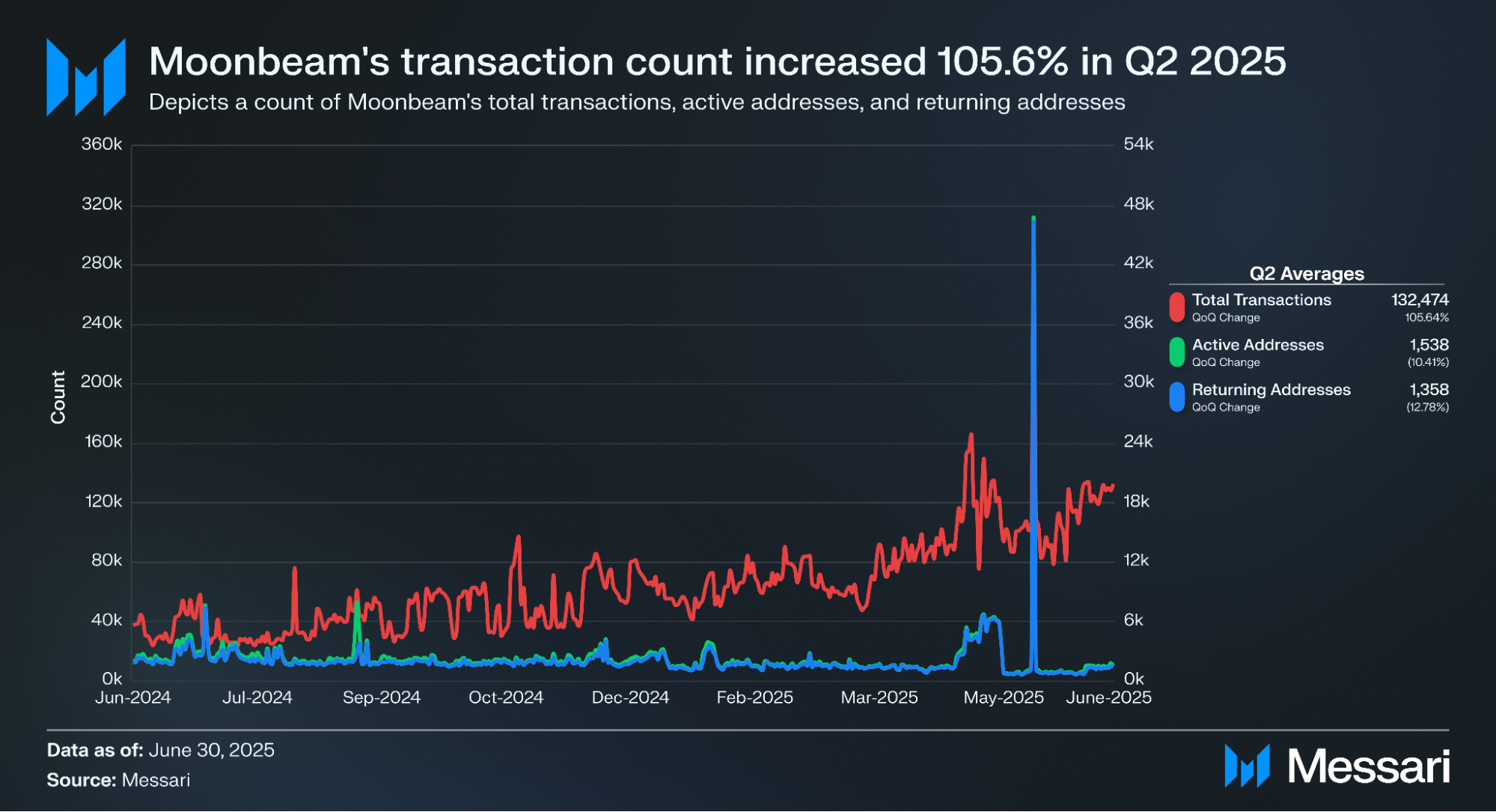

In Q2 2025, Moonbeam recorded an average of 132,474 daily transactions, which represents an increase of 105.6% with 64,419 in Q1. This rush was encouraged by an increased toy activity and network transition to compatibility with full EVM on May 29, 2025, which launched a jump in active activity. Average daily active addresses and addresses that are returned valued at 1,538 and 1,358, respectively. It is important to note that the real number of users on the Moonbeam protocol was greater due to the wide use of social applications and account abstractions at many Moonbeam games. These design choices darken the metrics at the level of wallets, as thousands of users can communicate through selected several visible addresses.

Moonbeam’s Defic TVL (USD) was estimated at $ 8.1 million in Q2 2025, experiencing a 27.7% QoQ drop with $ 11.2 million in Q1. The decline is primarily concentrated around Stelaswapa, a leading Dex on Moonbeam, which continues to take into account most onchain liquidity and trade activities. Despite the fall, Stelaswap remains anchor protocol within the definition of Moonbeam ecosystems.

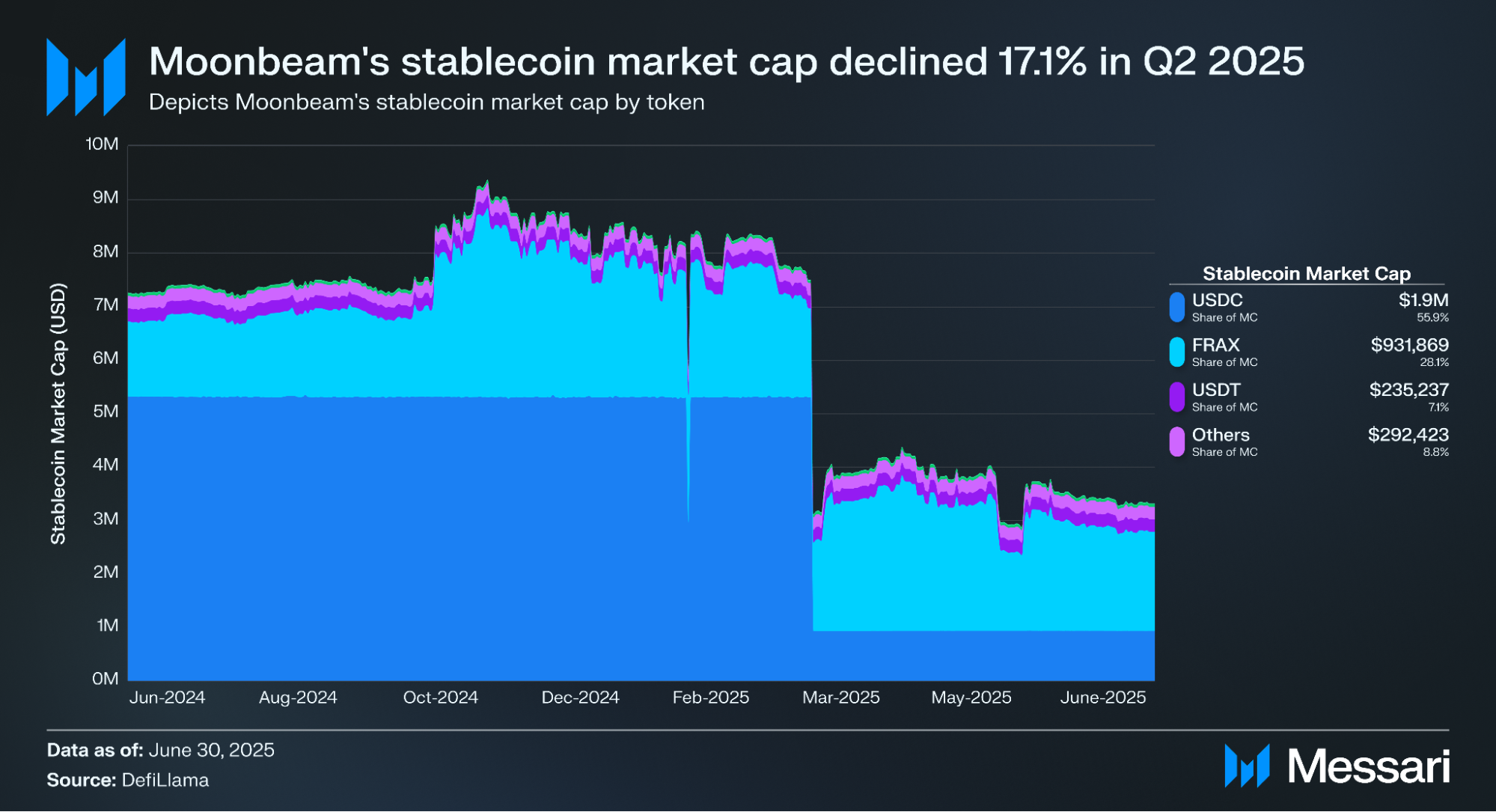

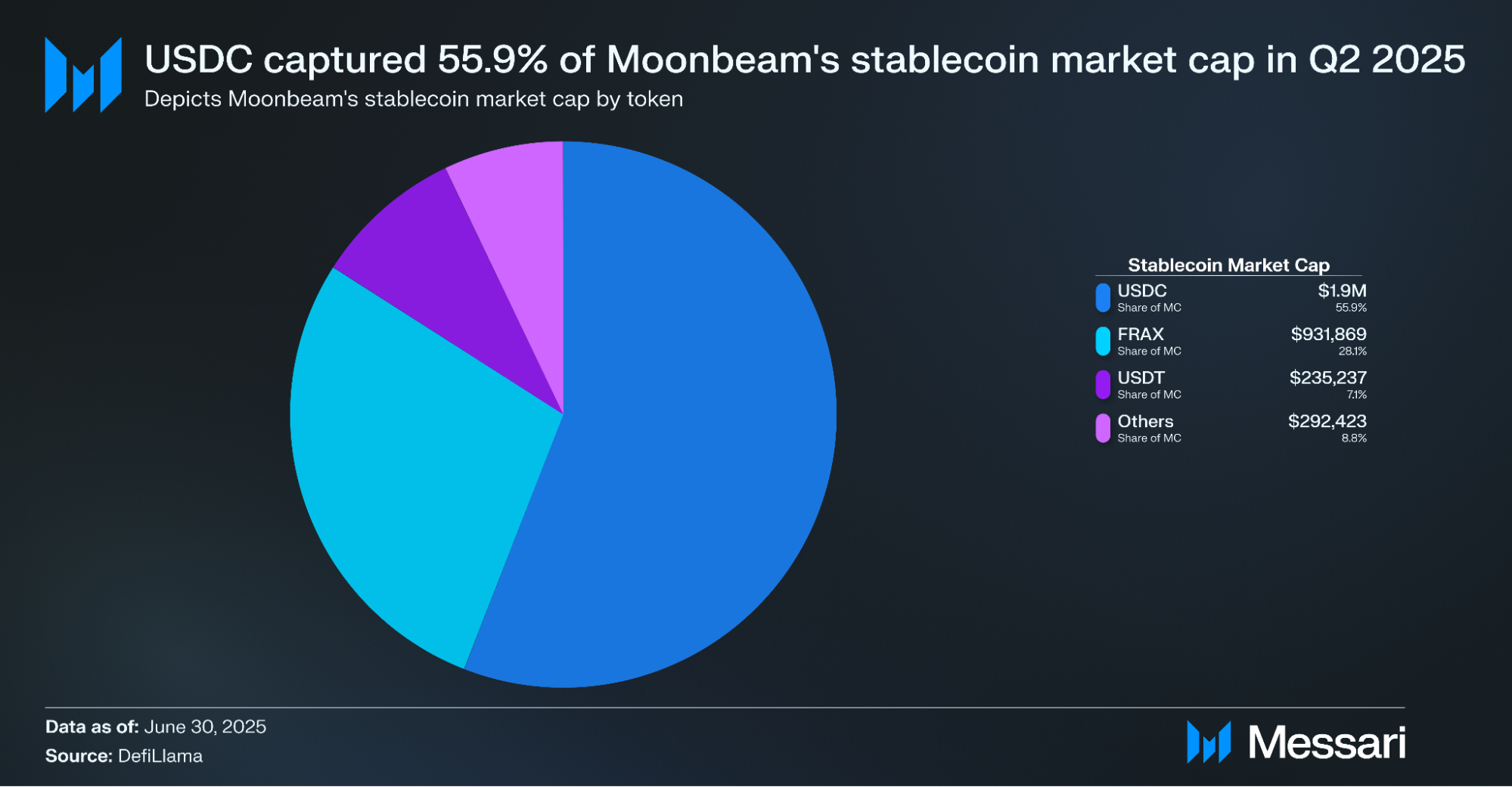

The total market cap of MoonBeam decreased from about $ 4.0 million to $ 3.3 million, reducing it by about 17.1%. This contraction mirrors expands a series of trends in defines online activities and reflects decaying liquidity in key applications like Stelaswap. From June 30, 2025. USDC remained dominant Stablecoin, which made up 55.9% of the total market limit of Stablecoin with $ 1.9 million in values. The USDC dominance enhances its continuous role as the primary medium of exchange and collateral assets in the moonlight.

Frax followed with $ 931,869, which made up 28.1%of the market, while USDT and other Stablecoins contributed $ 235,237 ($ 7.1%) and $ 292,423 (8.8%). The visible slope towards the USDC -Ui Frax suggests limited diversity in stabiblecoin liquidity and emphasizes the challenges of spread beyond the two main publishers.

On the front of the management, Moonbeam launched Guilt of the Management Board 2 term 2establishing a structured approach to decentralized participation. The Protocol has delegated 5 million GLMR -AI 50,000 MOVR -U 10 selected community delegates, which marked a step towards the wider decentralization of management. This model is designed to increase transparency and harmonize decisions with wide associates, a dynamics that could echo with communities attracted to open financial systems anchored with stable use and fair participation.

The game was the primary contribution of the Moonbeam activity in Q2 2025. Transactions for Games rose 154.8% QOQ up to 1.6 million, while unique active wallets are increased 76.1% to 8,500. A large part of this activity came from the launch of Moonbeam Gaming HUB, the continued N3MUS tournaments and new implementation. N3mus tournaments surpassed 600,000 games played during the quarter, providing a permanent source of activities and boarding.

17. June 2025, launching Tableau illustrated this trend, recording 67,700 transactions and 2,007 unique active wallets in the first two weeks. Tubbly has become a leading game from Moonbeam by the number of transactions and counts of wallets by the end of June. And other new titles taken Increased activity, including older fall, with 250,000 transactions, Wegainst with 128,000 and Data2073 with 87,000.

Tokeniza is the largest single application in the amount of transactions in the moonlight. Ever since he launched in January 2025, he has held a monthly increase in activity, surpassing 8.5 million transactions by the end of H1 2025. More specifically, Tokeniza 2.9 million transactions were added to Q2, which is 104.8% compared to Q1. The project also progressed through its integration with PIX funding.

AND Moonbeam gaming hubdeveloped with n3mus and sequence, was introduced Simplify the implementation of games on games and reduce related costs for developers. Community partnerships have added visibility, including collaboration with Flamengo Esports, which targeting mainstream audiences with competitive games.

In the Q2 2025, the activity of the Moonbeam was anchored with games, which appeared as the largest vertical online. Transactions for games increased by 154.8% to 1.6 million, and unique active wallets increased 76.1% to 8,500, guided by Moonbeam Gaming HUB, N3MUS tournaments and publishing new titles such as Tubbly, Older and Data2073. Tokeniza also continued to play the central role, doublement of the QOQ transaction volume and exceeding 8.5 million cumulative transactions by the end of H1 2025.

While the financial metrics (GLMR market border decreased by $ 11.3% to $ 63.0 million, Defin TVL fell $ 27.7% to $ 8.1 million, and the market limit of Stablecoin decreased by $ 17.1% to $ 3.3 million), the wider ecosystem recorded progress. Datahaven progressed with the launch of the Stagenet, and the management programs distributed awards and delegated tokens to strengthen their participation in the community.

Looking in advance, the ability to Moonbeam to maintain a traction toy, and to improve the protocol upgrades and management programs will dictate long -term resistance to the ecosystem.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

This report was ordered by Moonbeam Foundation. All content was produced independently by the author (s) and does not necessarily reflect the opinions of Messari, Inc. or an organization who requested a report. The release organization may contribute to the content of the report, but Messari maintains editorial control over the final report to retain the accuracy and objectivity of the data. The author (s) can hold the crypto currency named in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. The effect of any property so far does not indicate future results. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.