Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

5th June 2025, Plum (Tinsel) officially launched Plum Genesis, public mainnet designed for real finance of property (RWAFI). Plum is a network with complete layers and an ecosystem intended to allow interaction between token assets in the real world (RWAS) and definite protocol. When starting, Plum has already had integrated With traditional financial titanium (eg Blackstone and Invesco) and defined volume (eg curve and morpho), they are on board $ 150 million in the RWAS used. Plumo’s series A was subject of the main investors (Brevan Howard, Apollo, Galaxy, etc.), and the network went live with more than 70 projects live or in development.

Since the launch, Plum has surpassed Ethereum to become the highest network of the total number of RWA owners. According to rwa.xyzThe number of addresses held by RWAS on Pluma jumped over 103,000 within a few weeks of launch, which is approximately 50% of all RWA owners in public networks. Is currently over 200,000. Through PortalCustomers can bridge the property in the showers, replace the tokens and explore protocols like Nest, Rooster and Soller. Ascapstraing off of complexity, the portal helps to feel RWA as the original cryptocurrency, making them immediately replaceable, composite and accessible.

Website / X / Disharmony

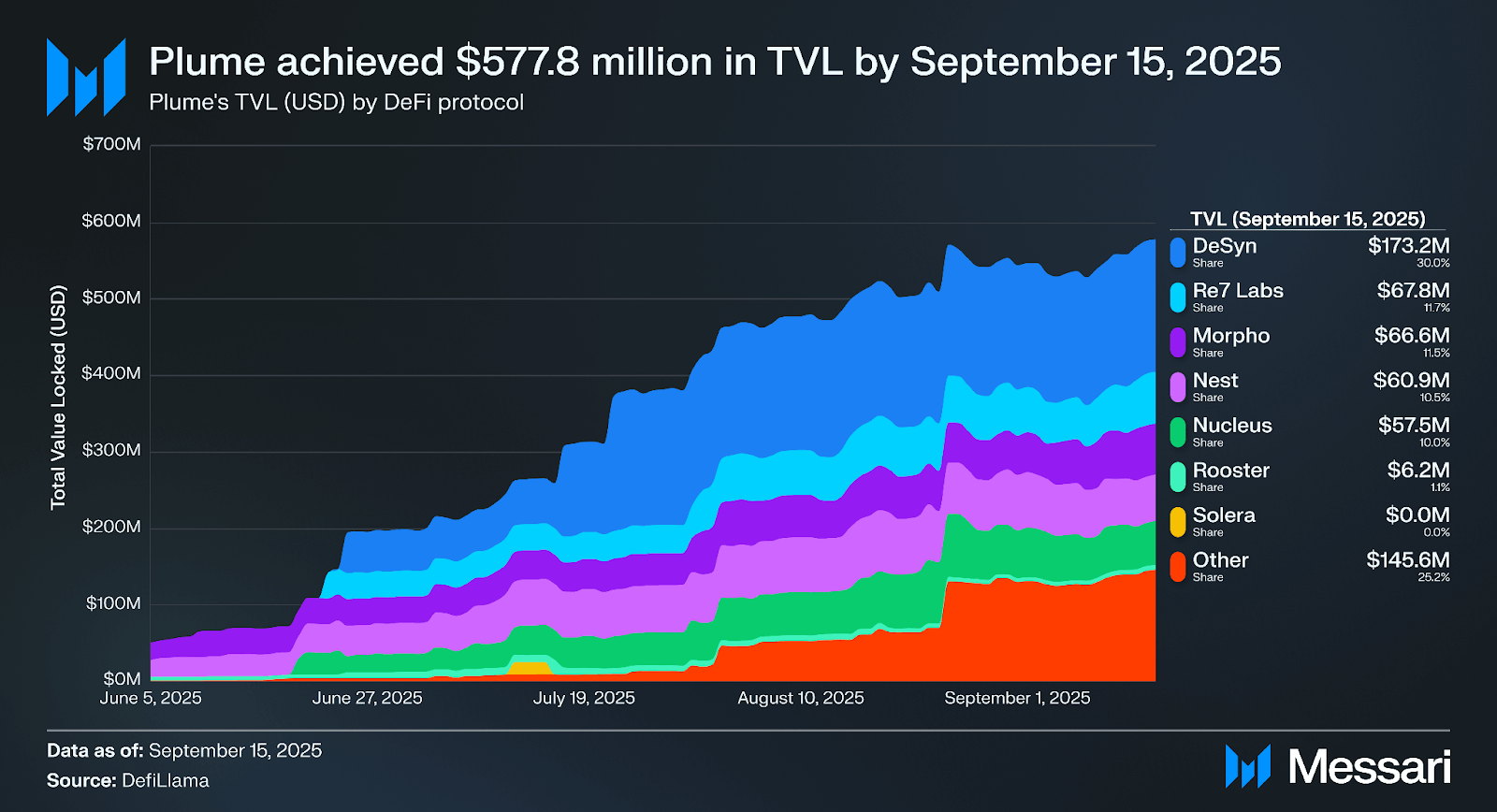

Definine Plow activity is strong since its launch of the mainnet in June 2025 to 15 September, reached the total value locked (TVL) $ 577.8 million in USD conditions and 4.9 billion showers. Dinyin He made up the highest share of $ 173.2 million, or 30% of TVL.

Nest is the leading protocol to put RWA. Allows users to lay stable cells in various Rwa vaults and receiving liquid ERC-20 tokens called tokens. These tokens can be composed throughout Plumo’s definitive ecosystem. For example, the user can lay down pusd in Nest Treasury vault To receive ntbill, then lay ntbill on the borrowing market like Prague borrow against it.

Other notable protocols that contribute to Plume’s TVL include:

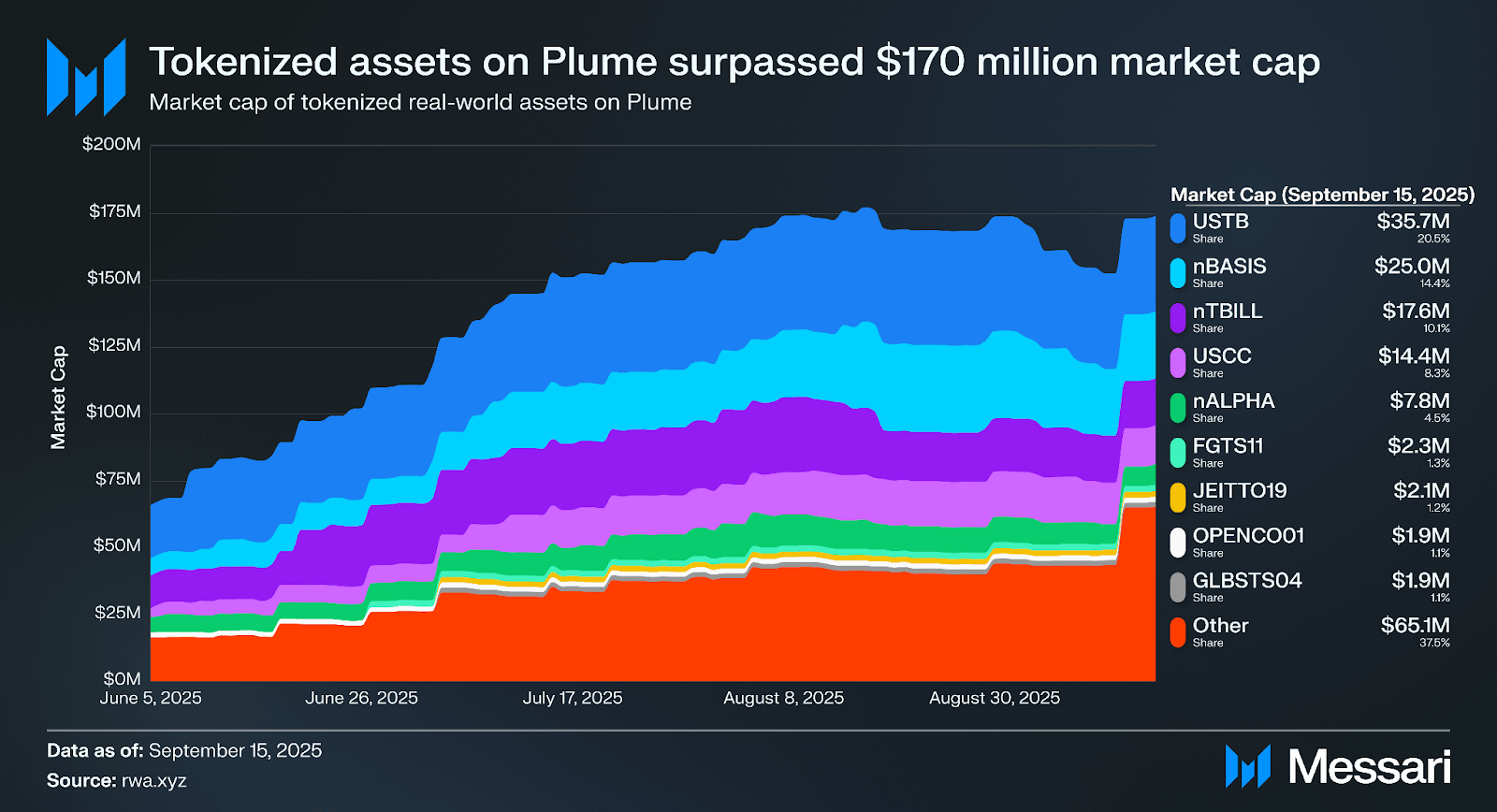

Plum was launched with $ 65.8 million tokenized property, which grown up to $ 170 million to September 15, 2025. According to rwa.xyzCurrently, there are 144 token assets on the network, distributed to more than 202,000 addresses. The largest property by market share is arranged Superparly,, Nestand Bitcoin market.

Superparly enables qualified investors that mint and redemption The ERC-20 Fund shares using USDC, with real-time prices and onchain food. His leading property on a splash are Ustb ($ 35.7 million in market limit) and USCC ($ 14.4 million in market caps). USTB is a short duration of the US State Securities Fund, which provides exposure to short -term treasury accounts. USCC is a Crypto Carry Fund, a strategy that records a yield from the expansion between the video market and the future for Bitcoin and Ethereum. This assets are limited to qualified investors, but they become composite within the def -he -nests.

Nestro’s upper assets include ntbill (Market limitations of $ 17.6 million) and Nbasis (A market drop of $ 25 million). ntbill aggregates Products of short-term yields, such as USTB and M0 are min one sign. NBASIS provides Delta exposure to neutral basic strategies, including USCC trade and Which is mbasiswhich targets Cryptumelut funding rates.

Bitcoin market (MB), one of the greatest publishers Tokenized private loan, has arranged 132 Somes assets with a combined market limit of $ 71.7 million. Top Tickers include FGTS11 ($ 2.2 million) and Jeitto19 ($ 2 million). FGTS11, created in partnership with Talk digitallysupported Brazilian salary claims and offers a Cdi+1.5% annual yield of retail investors. Jeitto19 is subject Microloana portfolio offers fixed yields above CDI reference value in exchange for exposure to Brazilian consumer loan.

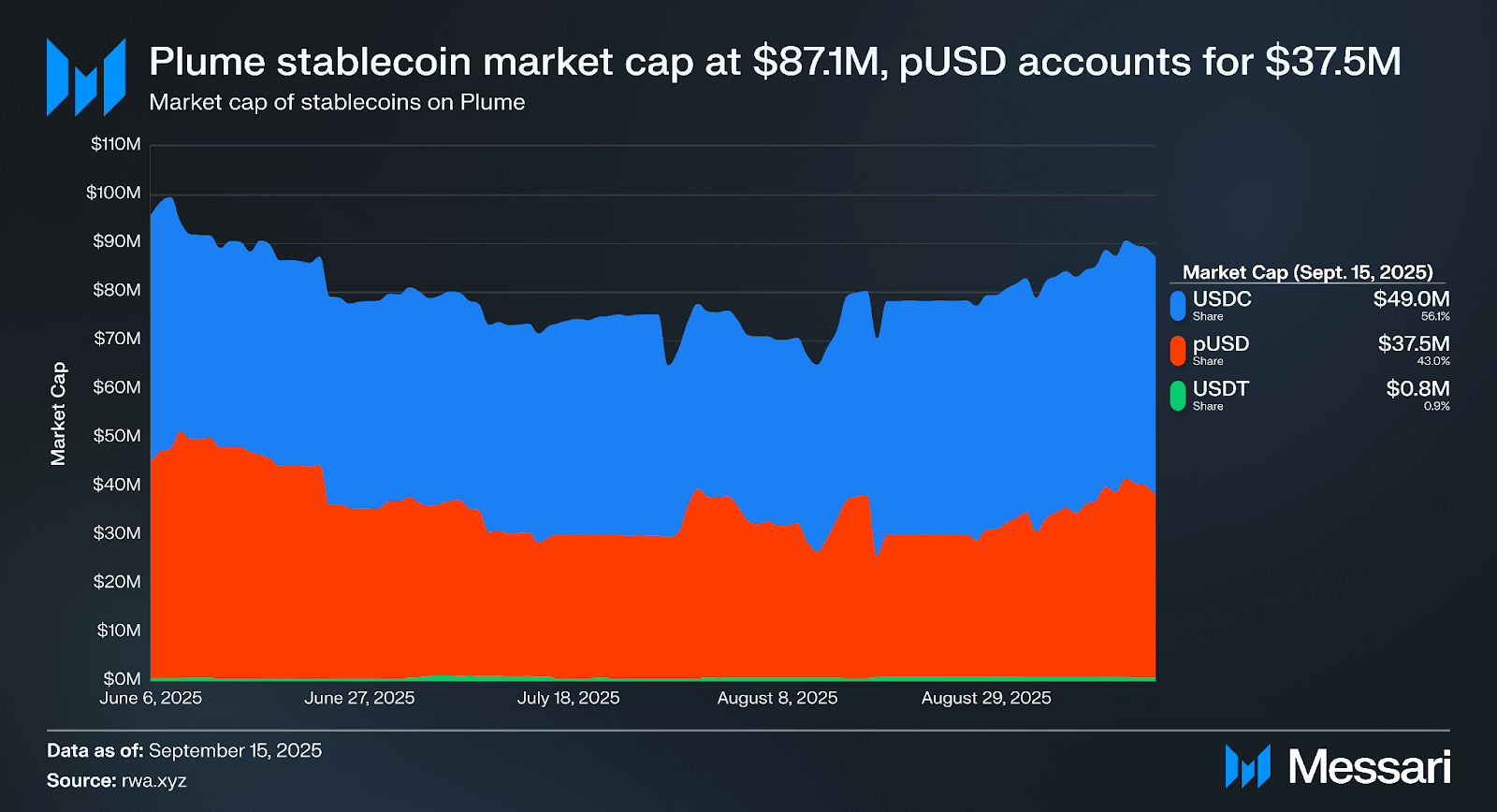

From September 15, 2025, the total cap of the Stablecoin market on the plow is $ 87.1 million. The biggest share belongs to the recess of USDC, which makes $ 49 million. Plume’s native Stablecoin, Pusd, has a market limit of $ 37.5 million. The bridged USDT makes the rest with $ 800,000 in circulating supply.

Plum USD (PUSD) is a leading stable network tree. Users can mint PUSD by depositing USDC or USDT in Boringvaultsthey manage Core. These Rebalanca Treasters retain liquidity and preserve a piston of $ 1: 1. Redemption is available on parity without protocol fees. The PUSD is distributed to both the etherum and the showers, allowing interoperability and simplified integration through the definite protocol. Although the PUSD itself does not offer, a team of plow develops an investment cover that will allow users to make a real yield.

Plum too announced Integrating plans Now AUSD. AUSD will serve two roles in the net: as an acceptable insurance within Nest -a as spare assets for PUSD. This integration is expected to improve liquidity and provide additional support from PUSD. AUSD is supported by a mixture of short -term American treasuries, cash and overnight repair repos. The reserves are managed by Vaneck and is maintained with State Street, which aligns with Plume’s emphasis on the design of the institutional class and transparent reserve management.

Plum is integrating Native USDC and CIRCH cross-sectional transmission (CCTP) V2, providing its ecosystem direct access to the largest regulated stabiblecoin. This upgrade replaces the reliance on the browned USDC and allows users to blackmail and buy Plumes Pusd Stablecoin directly against USDC. Adding the CCTP V2 also allows for faster, economical transitions of cross baskets.

The key initiator of the Pluma wound was his campaign for aviation and incentives. Before the mainnet, a showdown launched Airdrop “1 season” on a testnet that recorded more than 18 million wallets and 280 million transactions. This initiative distributed the initial tokens of the spit on the early adoptives and testers. After its launch of the Mainnet, Plum introduced “Season 2” to maintain swing and growing network. Plum Foundation has committed up to 150 million plow tokens for distributed prizes during different activities on the market. Distribution is coordinated through Royco marketsPartnership of Partnership Mining.

Customers can earn a showcase by disposing of property or providing liquidity on certain splash protocols, including nests of the vaults and pool pool of the rooster. In order to qualify, the property must remain in place for at least 90 days. This time lock discourages the short -term cultivation and encourages long -term engagement. Plum also launched Plum Stacking to participate in the Validator, which introduces a new flow of prize and can serve as a future furniture criterion for additional Airdrops.

Generally, these programs were effective in attracting a cryptic user in the ecosystem of the plum. Connecting prizes to actions that build liquidity and adopt protocols, such as the recess of property, interaction with RWA applications or security contributions, Plum has been interested in permanent growth early. Community, known as “Downpour“He continues to expand, with many participants now aligned with the long -term success of the network.

In his first month Mainnet surgery, Plum was established as a serious candidate in the new RWAFI sector. With more than $ 577 million in TVL, more than 200,000 wallet addresses interact with tokenized property and a growing catalog of integrated protocols, Plum has achieved early tow and strong infrastructure. The stem stablecoin network, PUSD, along with the main tokenized Superstate products, Nest -ai Mercado Bitcoin, created a base for onchain Rwafi.

As the plow continues to expand its ecosystem and deepen its integration with the crypto-mali and traditional finance players, it is positioned as a scalabal solution for the institutional and retail adoption of RWA. With the abstraction of technical obstacles and alignment of token design with significant use, the Plum has transformed the wound to curiosity into a measurable activity. If the momentum holds, the net can become a draft way in which RWA protocols of the MOST liquidity, composability and confidence in the future with more disturbance.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

This report was ordered by Plum Foundation. All content was produced independently by the author (s) and does not necessarily reflect the opinions of Messari, Inc. or an organization who requested a report. The release organization may contribute to the content of the report, but Messari maintains editorial control over the final report to retain the accuracy and objectivity of the data. The author (s) can hold the crypto currency named in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. The effect of any property so far does not indicate future results. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.