Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Rujira is an omnichain DeFi platform built on top of THORChain. It is designed to bring decentralized finance to native assets, most notably BTC, without relying on centralized bridges or wrapped tokens. Positioned as the App Layer on THORChain, Rujira offers a unified, CEX-like user experience while maintaining full decentralization and cross-chain composability.

What sets Rujira apart is its ability to support a comprehensive suite of DeFi products, spot and margin trading via an orderbook DEX, perpetuals, lending, borrowing, a BTC-backed stablecoin, liquidations, and options, all using native assets. At the core of this system are Secured Assets, a THORChain primitive that allows users to lock BTC (and other native tokens) in decentralized vaults and mint 1:1 backed representations usable within Rujira’s ecosystem, without introducing third-party custody risks.

Rujira integrates tightly with THORChain’s ~$150M liquidity layer, virtualizing it into the App Layer via AMM arbitrage strategies. This means Rujira’s DeFi products will be able to launch without facing the typical liquidity bootstrapping challenges, and users will be able to access deep, efficient markets from the moment the virtualization strategy launches.

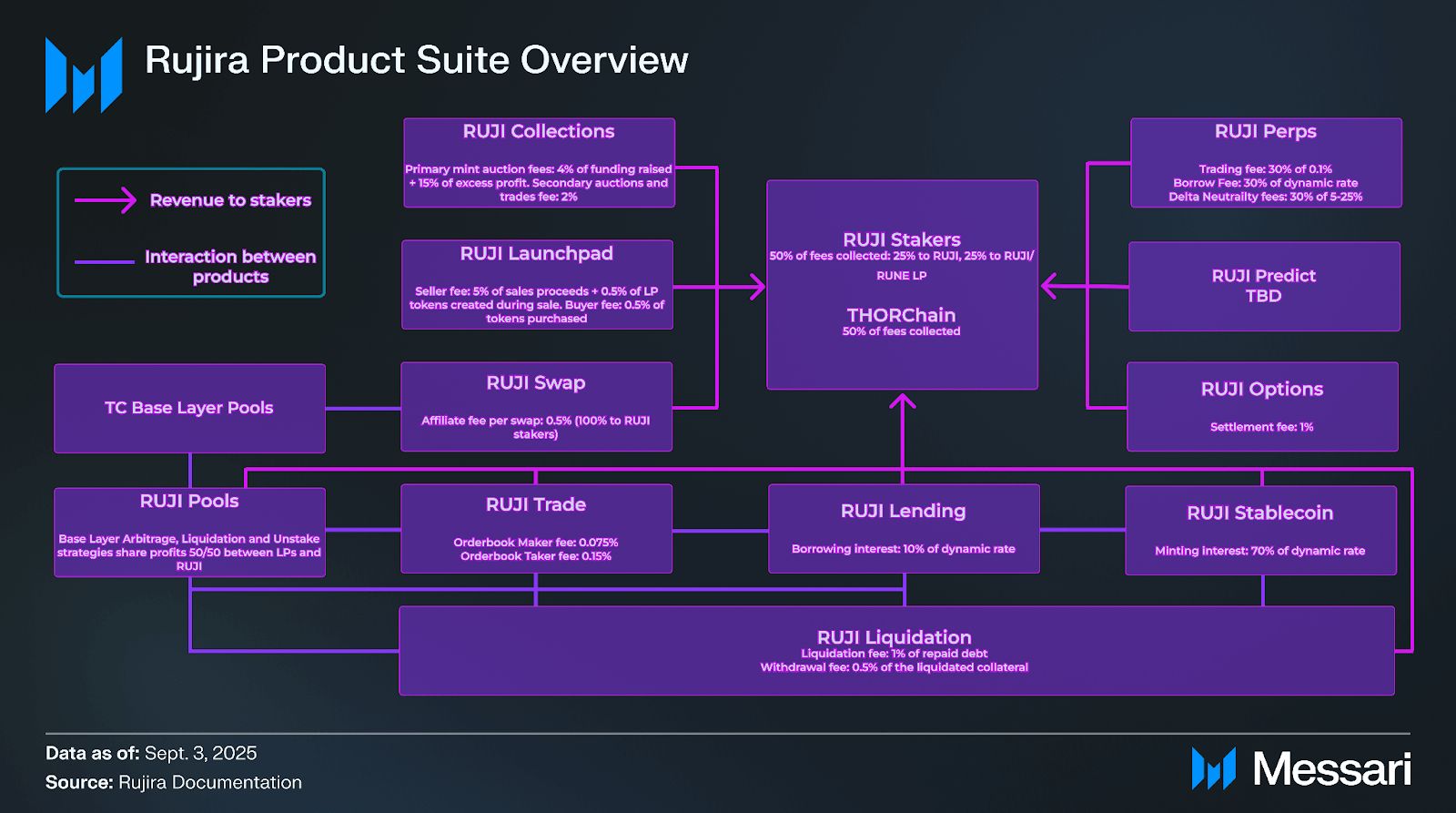

All protocol revenue, across all products, is distributed in USDC to RUJI stakers. With no token inflation, RUJI effectively represents a claim on the platform’s growing economic activity. For Bitcoin holders, Rujira represents a trustless path into DeFi.

Rujira emerged from a strategic alliance between Kujira, Levana, and THORChain, a merger designed to combine deep cross-chain liquidity with a full-stack DeFi suite. This union, known as the Rujira Alliance, consolidates Kujira, Levana, and several Kujira ecosystem projects (Fuzion, Unstake, and Gojira) into a single, unified platform: the App Layer on THORChain.

For Kujira, the move resolves long-standing challenges around liquidity access and visibility. For THORChain, it introduces a robust application layer powered by CosmWasm smart contracts, something THORChain itself didn’t natively support before Rujira. Levana, meanwhile, contributes its expertise in perpetual futures trading, co-developing RUJI Perps, a Bitcoin-backed perps exchange that leverages THORChain’s liquidity while enabling RUJI and RUNE stakers to earn from protocol fees.

The result is a vertically integrated ecosystem that combines native asset support, advanced DeFi tools, and a sustainable fee-sharing model, with RUJI becoming the central token of the App Layer, accruing real yield from all economic activity across the platform.

RUJI is the native token of Rujira, the application layer built on THORChain. It functions as the primary fee-sharing asset across all Rujira products and protocols. Stakers of RUJI receive real revenue generated across the ecosystem, with earnings distributed in USDC, net of the portion allocated to THORChain’s Base Layer to compensate for security and liquidity services.

The RUJI token was introduced as part of the broader merger between Kujira, Levana, and THORChain. Legacy tokens from Kujira’s ecosystem: KUJI, FUZN, NSTK, WINK, as well as Levana’s LVN, are eligible for conversion into RUJI through a structured migration process with a bonding curve that rewards early participation. The total RUJI supply is capped at 100 million, with no inflation.

RUJI’s tokenomics are built around value accrual from protocol usage. Applications integrated into the Rujira App Layer generate revenue from trading fees, lending markets, liquidations, and other services. This revenue flows to RUJI stakers, creating a direct link between product usage and tokenholder returns. The token also plays a governance-lite role, with allocation mechanisms designed to reward high-performing builders and align incentives across the ecosystem.

50% of the RUJI supply is allocated to the original Kujira and merged ecosystem tokens, 15% to operations, 15% to new investors, and the rest is earmarked for builder incentives and ecosystem growth. Importantly, the token’s design avoids inflation, relying solely on fee-based distribution to incentivize and drive value.

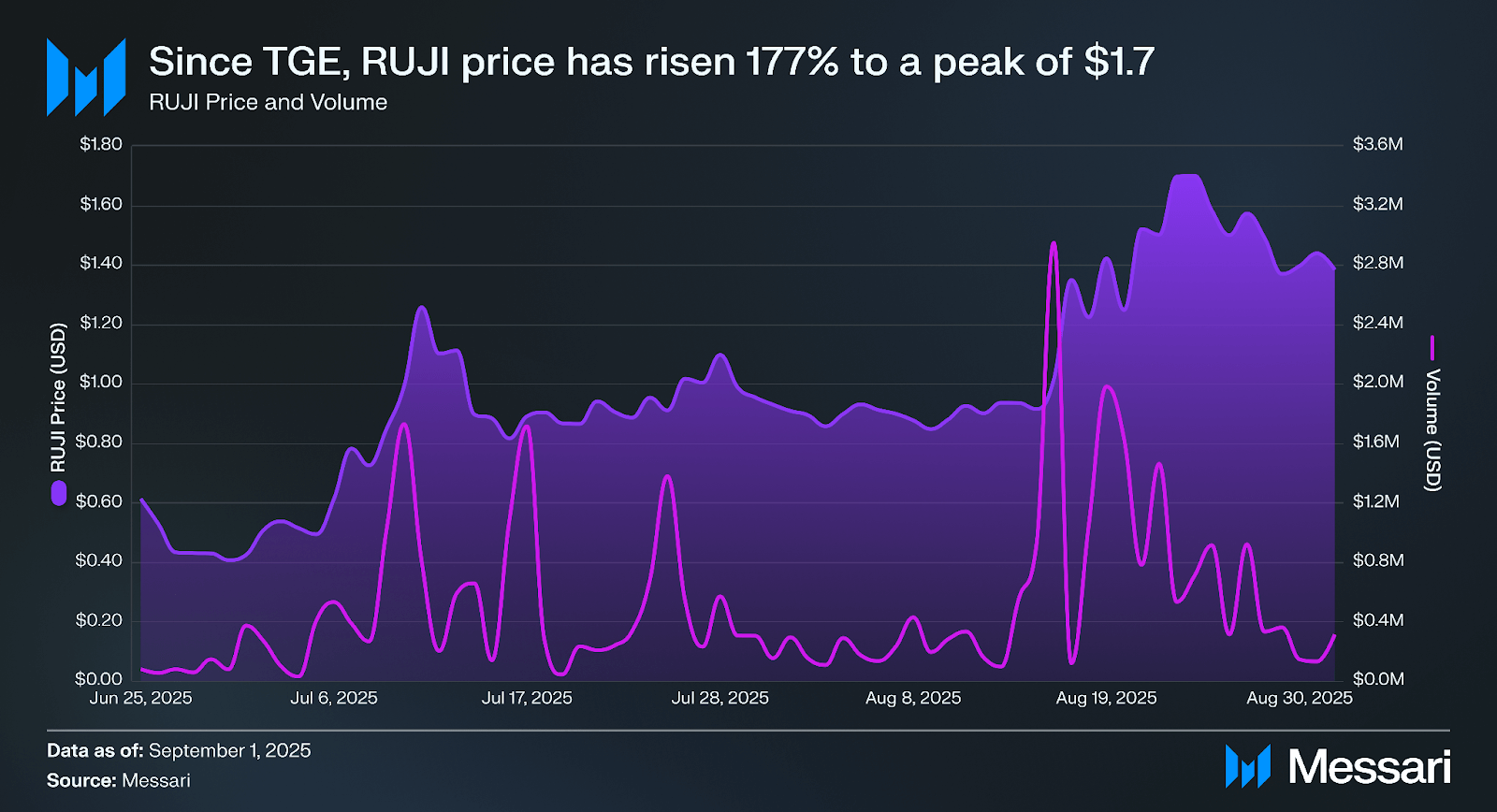

Since launch, RUJI has ranged between $0.41 and $1.70, steadily rising in price, and avoiding the common post TGE selloff. Daily trading volume has averaged around $511,494 per day, spanning from $30,838 to nearly $2.95 million.

While still early in its lifecycle, RUJI’s market behavior signals growing user interest and adoption, with liquidity levels that support healthy trading conditions across the App Layer.

Rujira’s product suite is designed to address long-standing limitations in decentralized finance, namely, the reliance on wrapped assets, fragmented liquidity, and complex cross-chain workflows. Built on THORChain’s decentralized settlement layer and secured by its native vault infrastructure, Rujira enables DeFi applications to operate with native assets across multiple chains, while preserving user custody and minimizing trust assumptions.

RUJI Trade is Rujira’s flagship trading venue, offering a decentralized orderbook experience built for native assets, starting with BTC. It’s the first DEX to support true orderbook-based spot and margin trading using native BTC, without wrapped tokens, bridges, or intermediaries.

Unlike traditional AMM-based DEXs, which often suffer from poor price execution and limited order types, RUJI Trade gives users granular control over trade execution. Limit orders, market orders, and tracking orders, all executed against a unified, aggregated orderbook, give users control over strategy execution. The system pulls liquidity from both its internal AMM pools and THORChain’s Base Layer, which – once the virtualization strategy launches – will provide access to roughly $150 million in native liquidity. This hybrid model gives Rujira the liquidity depth needed to rival centralized venues, while still enabling users to custody their own assets.

RUJI Trade will also enable margin trading with up to 10x leverage, again using native assets like BTC, ETH, and XRP. Traders can open leveraged positions directly from their self-custodied wallets, with all positions settled onchain. Rujira’s real-time UI, powered by its “optimistic block commitment” system, will give users a nearly instant view of state changes and trade confirmations.

Rujira is developing a native BTC-backed stablecoin, an overcollateralized stablecoin soft-pegged to the US dollar and backed 1:1 by native BTC locked in THORChain’s Asgard Vaults. The stablecoin will be overcollateralized, with an expected loan-to-value (LTV) cap of 70%, ensuring a buffer against volatility. Its peg will be maintained through a dynamic interest rate model that adjusts based on demand and system utilization. If the peg comes under pressure, interest rates can rise to incentivize redemptions and stabilize supply.

Collateral is held in decentralized vaults governed by THORChain’s threshold signature scheme (TSS), where key shares are split among 100+ rotating node operators. This makes the system resistant to centralized failure and censorship, and significantly more secure than multisig or validator-based bridge systems. Every dollar minted is verifiably backed by native BTC that can be withdrawn at any time, without intermediaries.

For Bitcoin holders, this will unlock a powerful utility: the ability to extract liquidity without selling, wrapping, or bridging their BTC. For stablecoin users, it will be a censorship-resistant dollar that doesn’t depend on opaque reserves or centralized trust. The stablecoin also has the potential to become the foundational unit for other Rujira DeFi primitives, used for borrowing, leveraged trading, liquidity provision, and more.

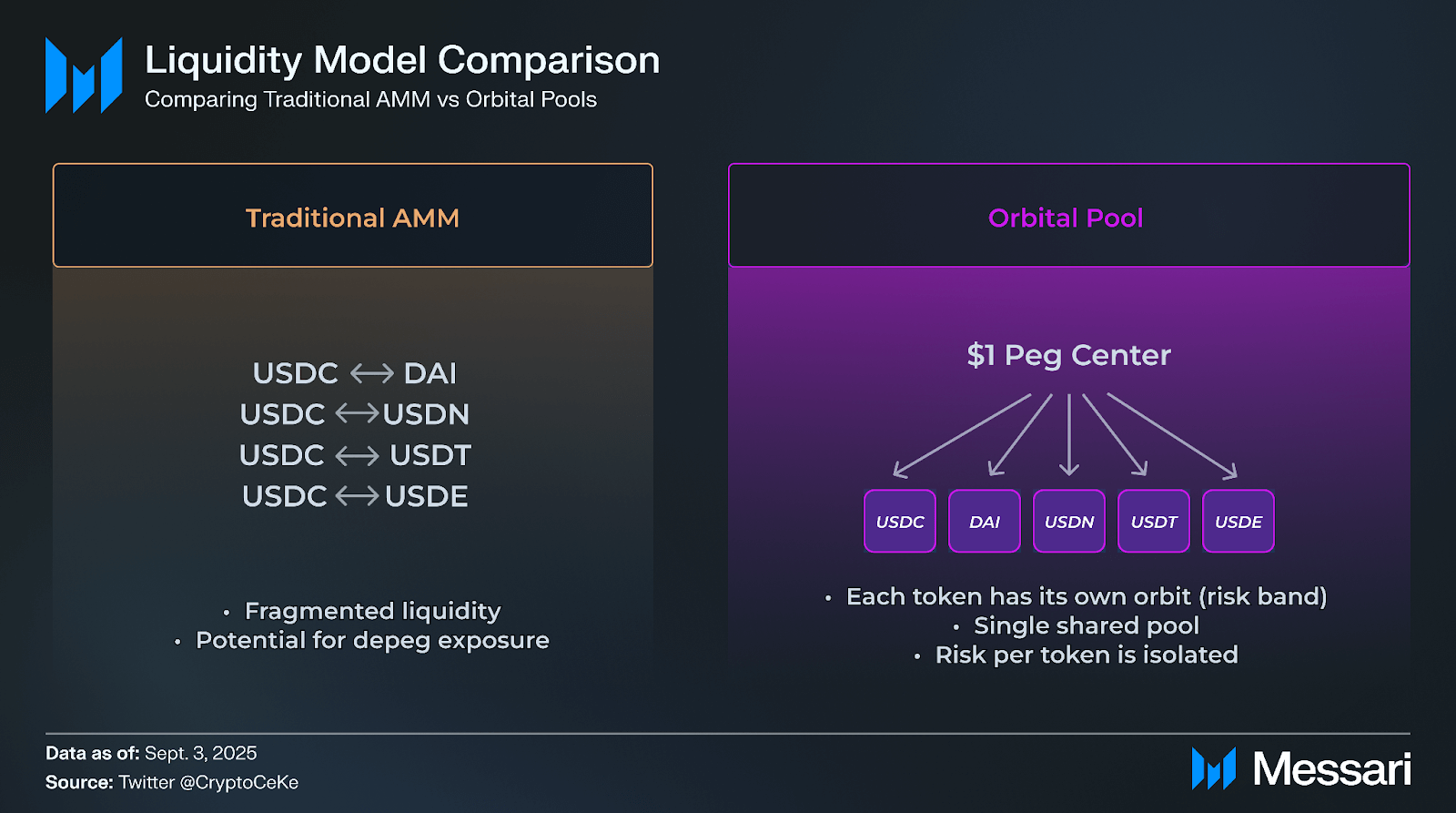

With a soft launch planned for Q4 2025, Rujira’s upcoming Orbital Pools are designed to eliminate the fragmentation of stablecoin liquidity across chains. Built on THORChain’s decentralized vault infrastructure and deployed via the Rujira App Layer, Orbital Pools introduce a novel financial primitive: Curve-style, like-asset AMMs extended across chains, without wrapping, bridging, or centralized custody.

At their core, Orbital Pools leverage THORChain’s Threshold Signature Scheme (TSS) vaults to custody and swap native stablecoins across multiple blockchains. Instead of issuing wrapped assets or relying on external validators, these vaults hold the actual stablecoins and coordinate swaps using THORChain’s settlement layer. When a user initiates a cross-chain stablecoin swap, Orbital executes it atomically, ensuring trustless finality and eliminating the need for third-party bridges.

The pool mechanics draw inspiration from Paradigm’s Orbital AMM, implementing a generalization of Curve’s stableswap model. These “orbital bonding curves” concentrate liquidity near the peg, minimizing slippage and maximizing capital efficiency. Unlike constant-product models, they’re purpose-built for like-kind asset pairs that tend to maintain parity, ideal for stable-to-stable swaps across chains.

Beyond swaps, Orbital Pools open up meaningful opportunities for liquidity providers. Since assets in the pool are stablecoins, providers can earn yield with minimal impermanent loss risk. This creates yield opportunities for users who want stable, capital-efficient returns without the volatility of traditional LP positions.

On the technical side, Orbital Pools will be deployed on Rujira’s App Layer, which decouples application logic from settlement infrastructure. This composability allows developers to plug directly into Orbital liquidity for any app that needs stablecoin routing, pricing, or yield, without needing to handle the cross-chain logic themselves. LP tokens from Orbital can even be used as collateral in Rujira’s money market or integrated into new primitives like stablecoin derivatives and structured products.

For users, Orbital means seamless, cross-chain stablecoin swaps from any supported wallet, with no third-party bridges, no synthetic assets, and no multi-step processes. For developers, it’s a plug-and-play cross-chain stablecoin layer. And for Rujira, it’s a high-volume, low-slippage liquidity engine that could become one of the most widely used pieces of the ecosystem.

Rujira introduces a new application layer on THORChain aimed at addressing structural challenges in decentralized finance, particularly around the use of native assets like BTC. By avoiding bridges, wrapped tokens, and centralized custody models, Rujira enables trust-minimized DeFi functionality across multiple chains while maintaining user control over assets.

Its product suite reflects this focus, offering infrastructure for native asset spot and margin trading, lending & borrowing, upcoming overcollateralized BTC-backed stablecoins, and cross-chain stablecoin liquidity through its forthcoming Orbital Pools. These tools are designed to improve capital efficiency, reduce fragmentation, and lower the barriers to participation in DeFi.

The RUJI token plays a central role in the ecosystem’s economic model. With a fixed supply and no inflation, it acts as a fee-sharing asset that distributes protocol revenue, denominated in USDC, to stakers. This structure provides a direct link between protocol usage and tokenholder returns, while aligning incentives across Rujira’s App Layer.

While still in the early stages, RUJI trading activity has shown steady growth, and key features like Base Layer Virtualization Strategy, Orbital Pools, and Concentrated LPs are expected to expand Rujira’s utility and user base. As the platform develops, its integration with THORChain’s native cross-chain settlement may position it as a viable layer for more capital-efficient and composable DeFi applications built around native assets.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by THORChain. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.