Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

FLock.io (FLOCK) is a decentralized AI development platform that combines blockchain infrastructure with privacy-preserving federated learning. Its architecture is built around three core components: AI Arena, where models are collaboratively trained; Moonbase, a marketplace for publishing and using models; and FL Alliance, a federated learning framework that coordinates contributors with onchain incentives.

In traditional federated learning, models are sent to local devices for training, and only the updated parameters (not the raw data) are shared back. This preserves privacy but often depends on centralized servers and leaves challenges around incentives and security. FLock addresses these limitations by using blockchain for decentralized coordination, verifiable governance, and transparent incentives, allowing communities to propose, train, and deploy AI models in a trust-minimized way.

This design supports FLock’s broader vision: to democratize the AI lifecycle from data sourcing and model design to training, validation, and deployment. The platform is anchored in ongoing academic research, with multiple peer-reviewed publications in venues such as IEEE journals and NeurIPS workshops. For a full primer on FLock, refer to our Initiation of Coverage report.

Website / X / Discord / Telegram / LinkedIn

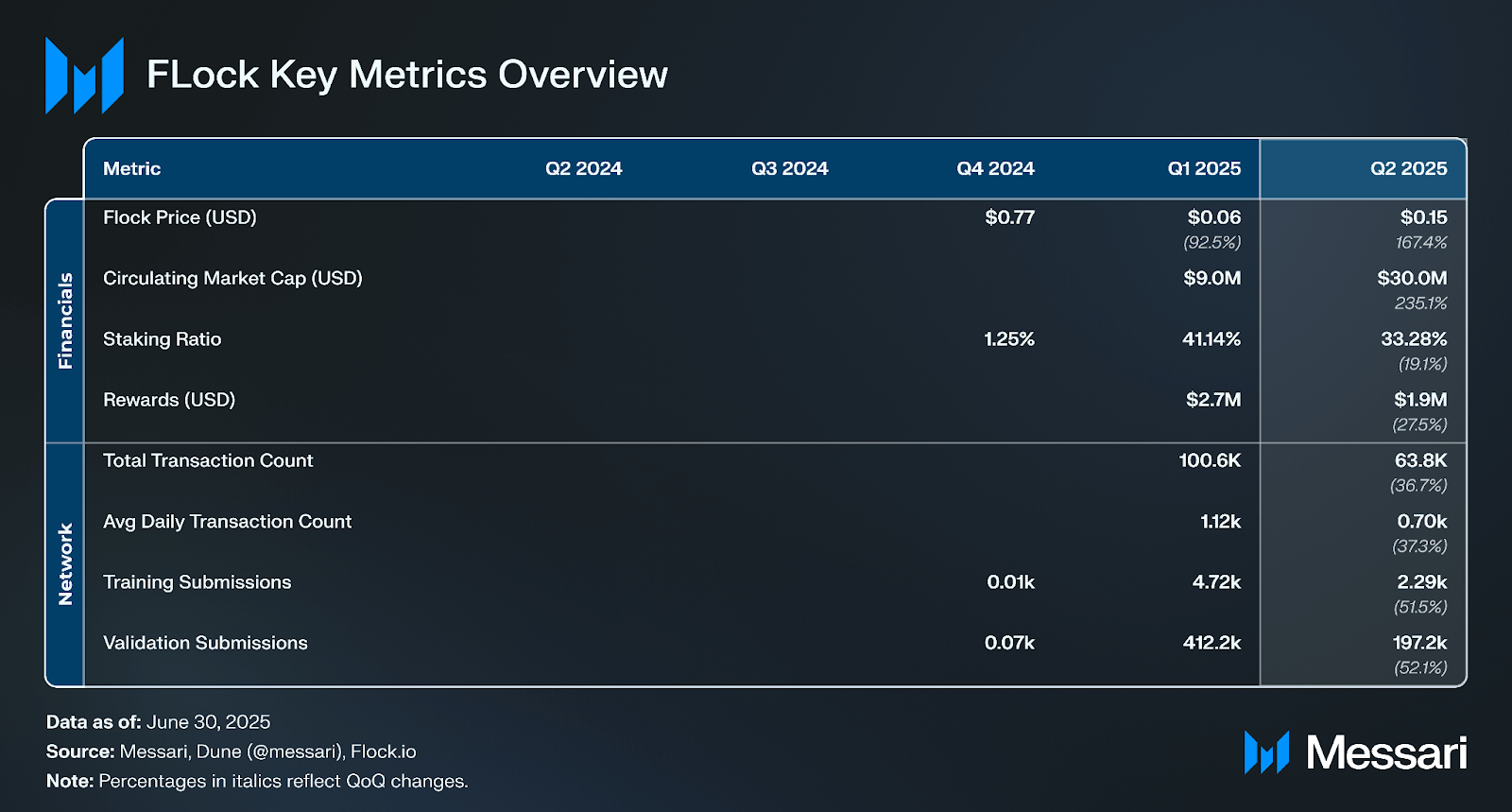

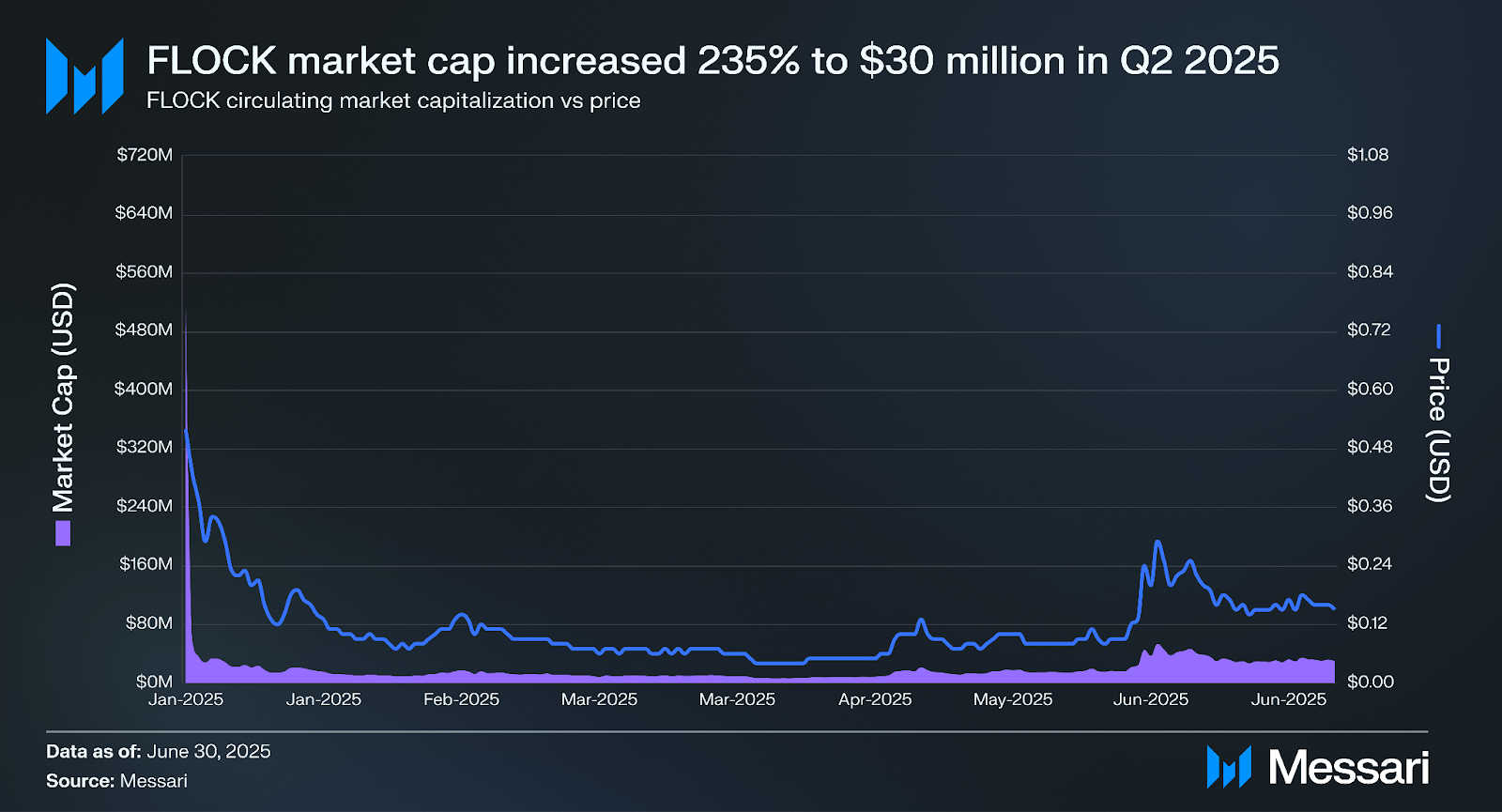

FLOCK’s circulating market capitalization increased 235% in Q2 2025, rising from $9 million to $30 million, while the token price grew 167%, from $0.06 to $0.15. The larger increase in market capitalization relative to price is due to circulating supply expanding over the quarter through staking rewards, ecosystem incentives, or scheduled token releases. The addition of Uniswap liquidity on Base also broadened market accessibility, increasing the share of tokens actively circulating. As a result, both higher valuation per token and a larger circulating supply contributed to the overall market cap growth.

Previously, staking FLOCK was required for all participants in AI Arena and was essential for role eligibility, task access, and incentive alignment. Participants in active tasks fell into one of three roles:

Staked tokens functioned as collateral to discourage dishonest behavior. Smart contracts automatically distributed rewards, and slashing penalties applied for protocol violations.

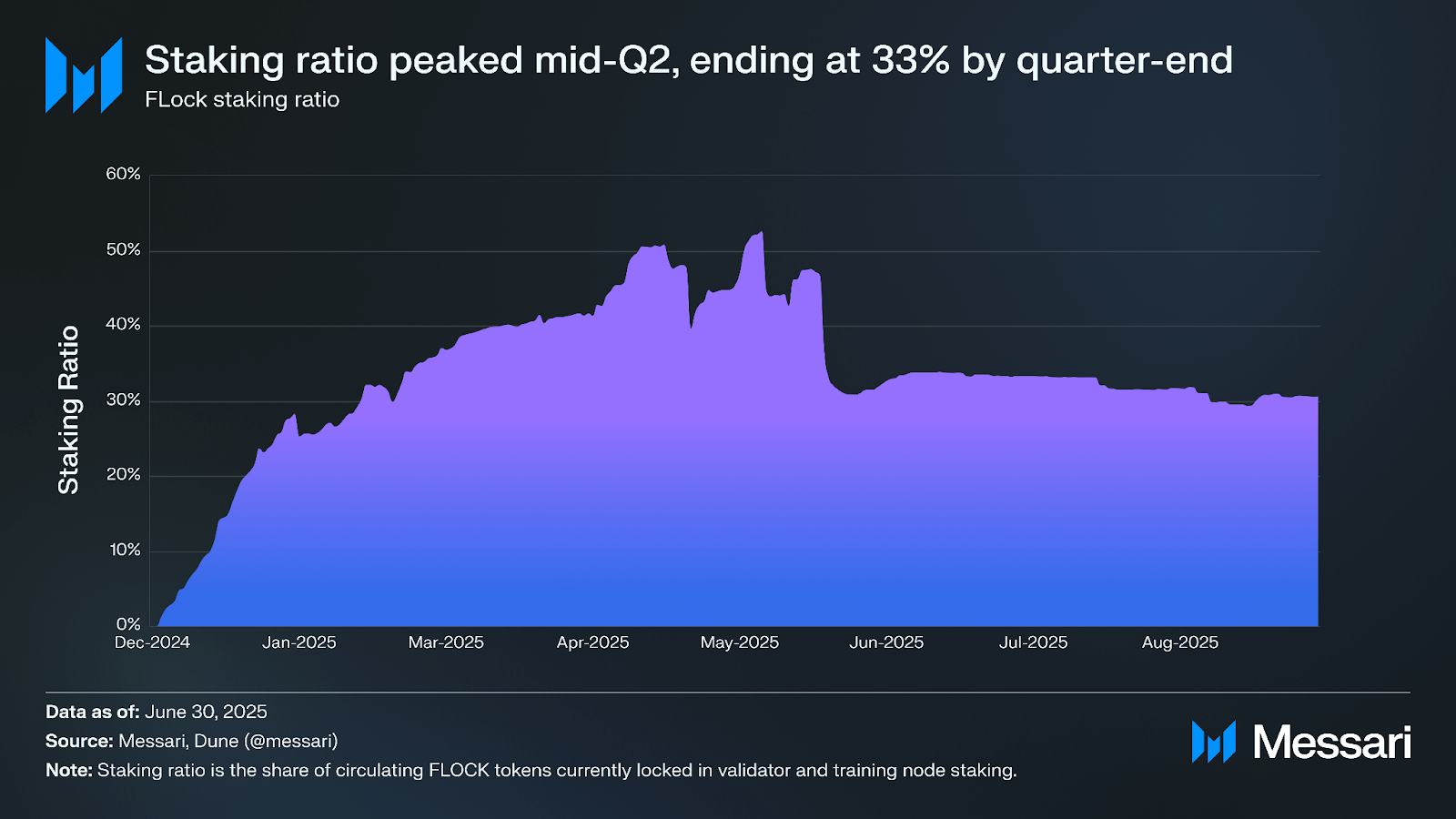

In Q2 2025, FLock introduced gmFLOCK as the staking unit for AI Arena participation. gmFLOCK is a non-transferable token generated by locking FLOCK for a user-selected period of up to 365 days, with longer lockups receiving higher multipliers. Training Nodes, Validators, and Delegators must now convert FLOCK into gmFLOCK to participate and earn rewards. The transition away from the prior staking model contributed to a sharp decline in the overall staking ratio, as previously staked tokens had to be re-locked under the new system.

FLOCK’s staking ratio declined in Q2 2025, falling from 41% at the end of Q1 to 33% by quarter-end. The ratio peaked at 53% on May 15 before a sharp correction in late May brought it back to the low-30% range, where it stabilized through June. The shift reflected weaker staking incentives, and the introduction of gmFLOCK in late April, which added an extra conversion step for participation. Staking rewards decreased from $2.7 million in Q1 to $1.9 million in Q2, reducing the financial appeal of remaining locked. At the same time, FLOCK’s price rose 167% over the quarter, likely encouraging some holders to unstake to realize gains or provide liquidity. The decline in staking increased the amount of liquid supply available in the market, amplifying the impact of price appreciation on market capitalization.

FLock’s network participation is measured through several core metrics:

Together, these metrics provide a view into FLock’s decentralization, activity levels, and incentive alignment.

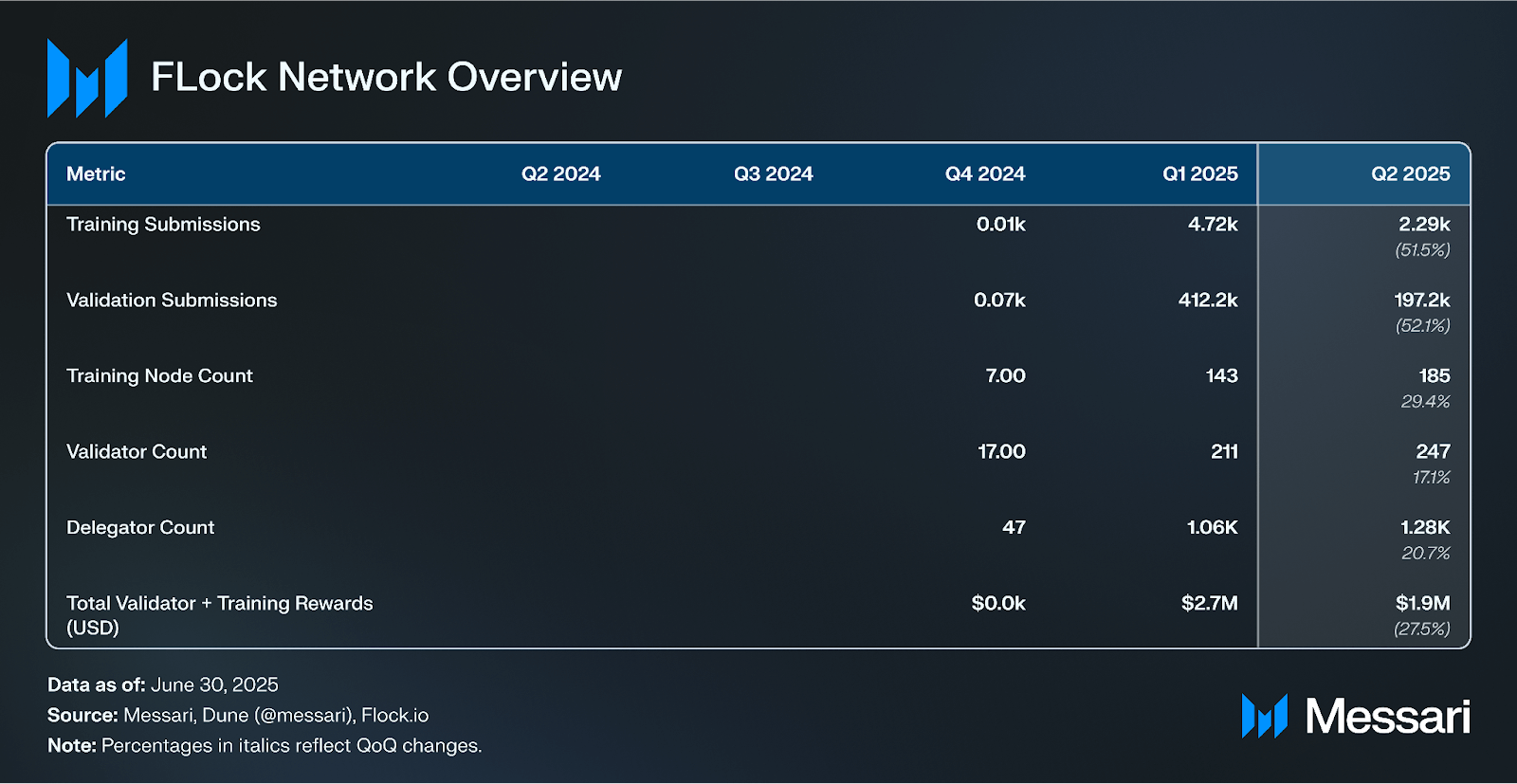

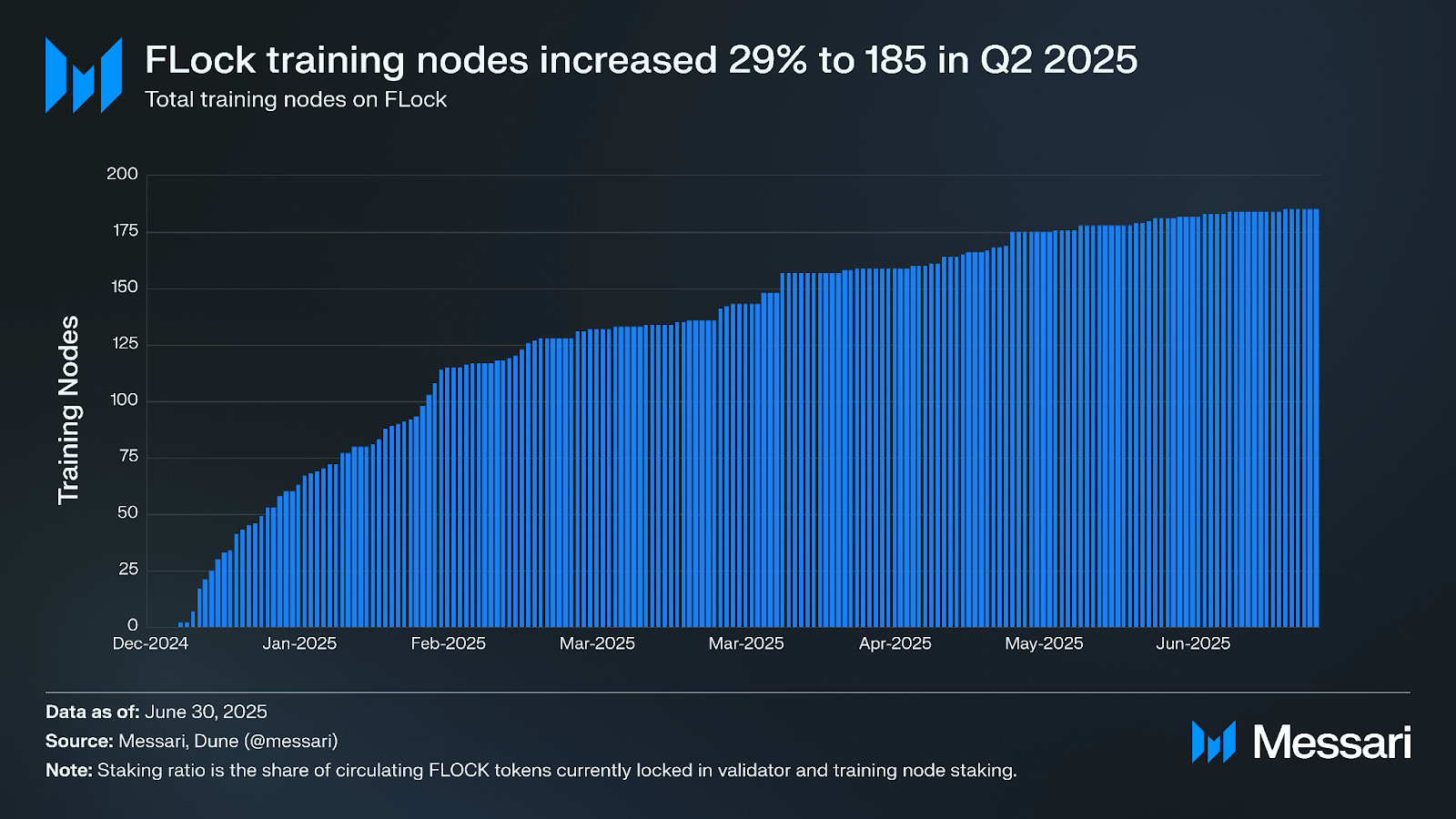

Training nodes expanded from 143 at the end of Q1 2025 to 185 by the end of Q2 2025, a 29% QoQ increase. This growth was supported by the introduction of gmFLOCK staking in late April and the AI Arena v2 upgrade in May, which reinforced incentives for node operators and delegators. New training tasks and partnerships, including integrations with Alibaba Cloud’s Qwen, Base’s Model Context Protocol, and application-focused initiatives like Baby4D and the DIMO + Beacon fuel-efficiency model, also broadened participation.

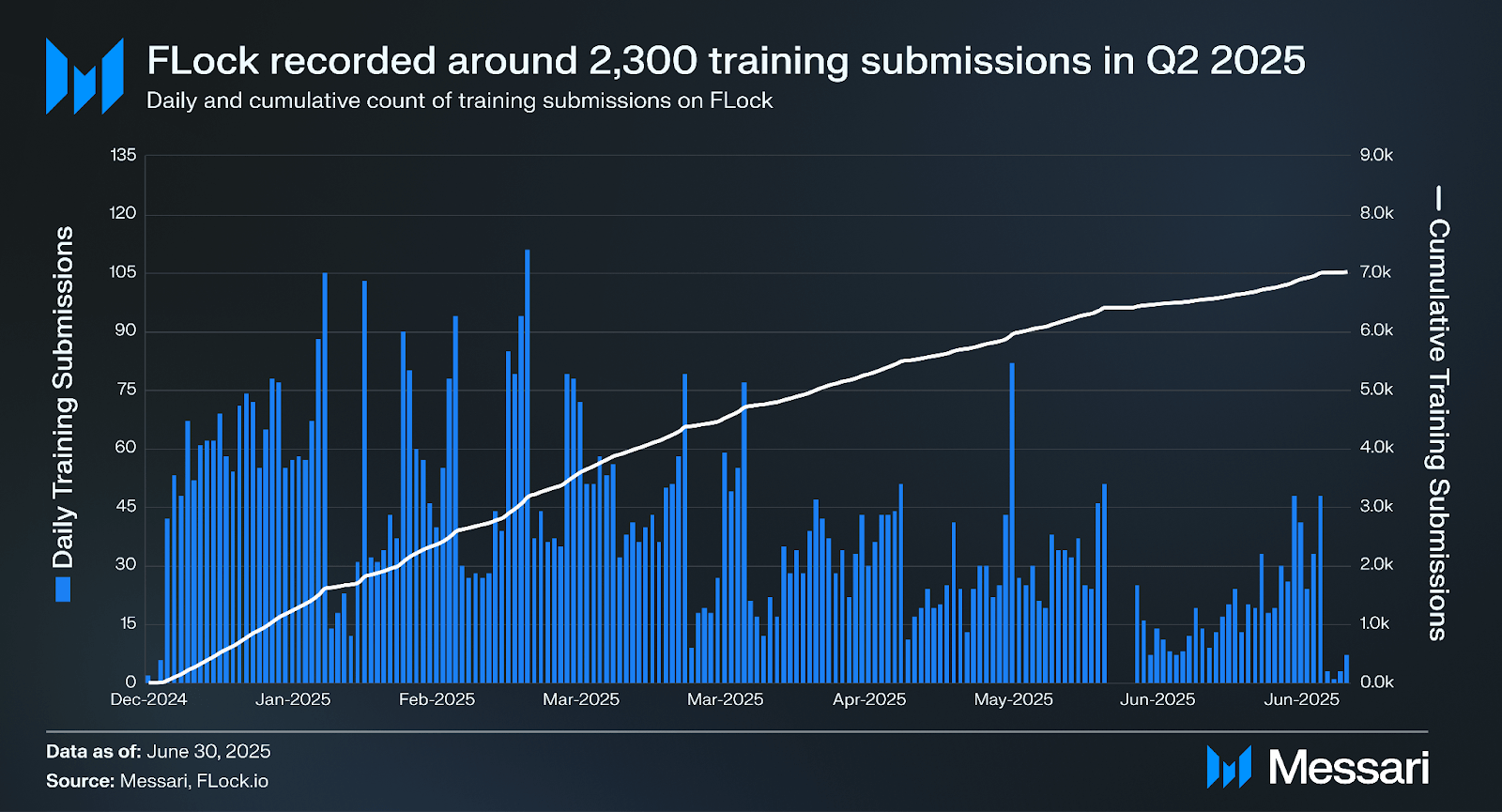

Training submissions grew sharply in Q1 before moderating in Q2. Daily submissions rose from near zero in Q4 2024 to over 4,700 in Q1, then fell to about 2,300 in Q2, a 52% decrease QoQ. Cumulative submissions continued to rise, showing that participation persisted despite the lower daily rate. The moderation reflected more specialized workloads introduced in Q2, which reduced submission frequency but expanded the network’s application scope.

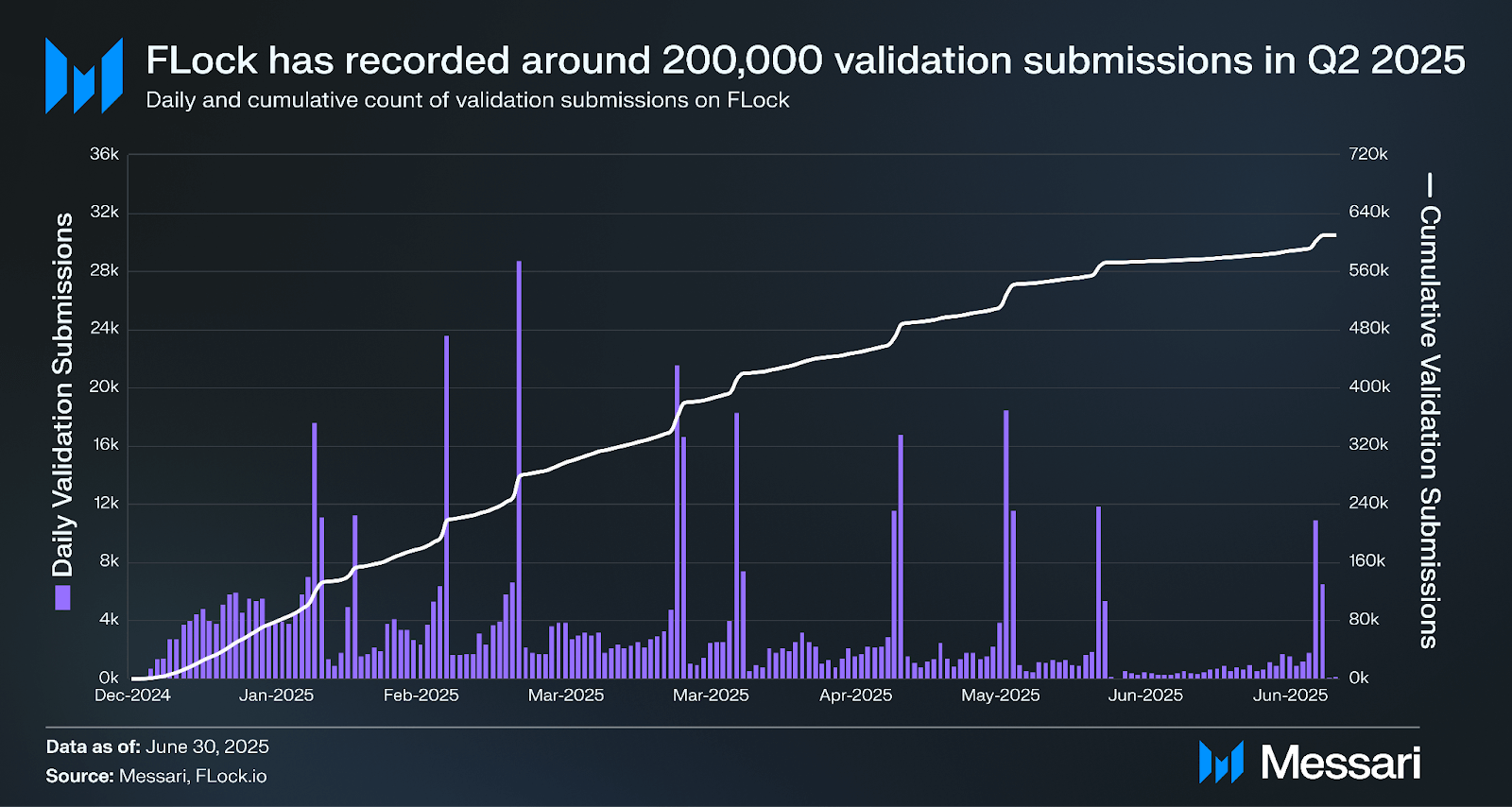

Validation submissions on FLock followed a similar trajectory to training activity. Daily submissions surged to over 412,000 in Q1 2025 but declined to about 197,000 in Q2, a 52% QoQ decrease. Despite this, cumulative validation submissions kept rising, indicating sustained engagement.

The validator set expanded from 211 to 247 during Q2 (+17%), meaning more participants were active even as the average number of validations per node fell. The moderation in throughput coincided with the rollout of gmFLOCK and Delegation Pools, which shifted incentives toward longer-term staking and away from maximizing short-term submission volume.

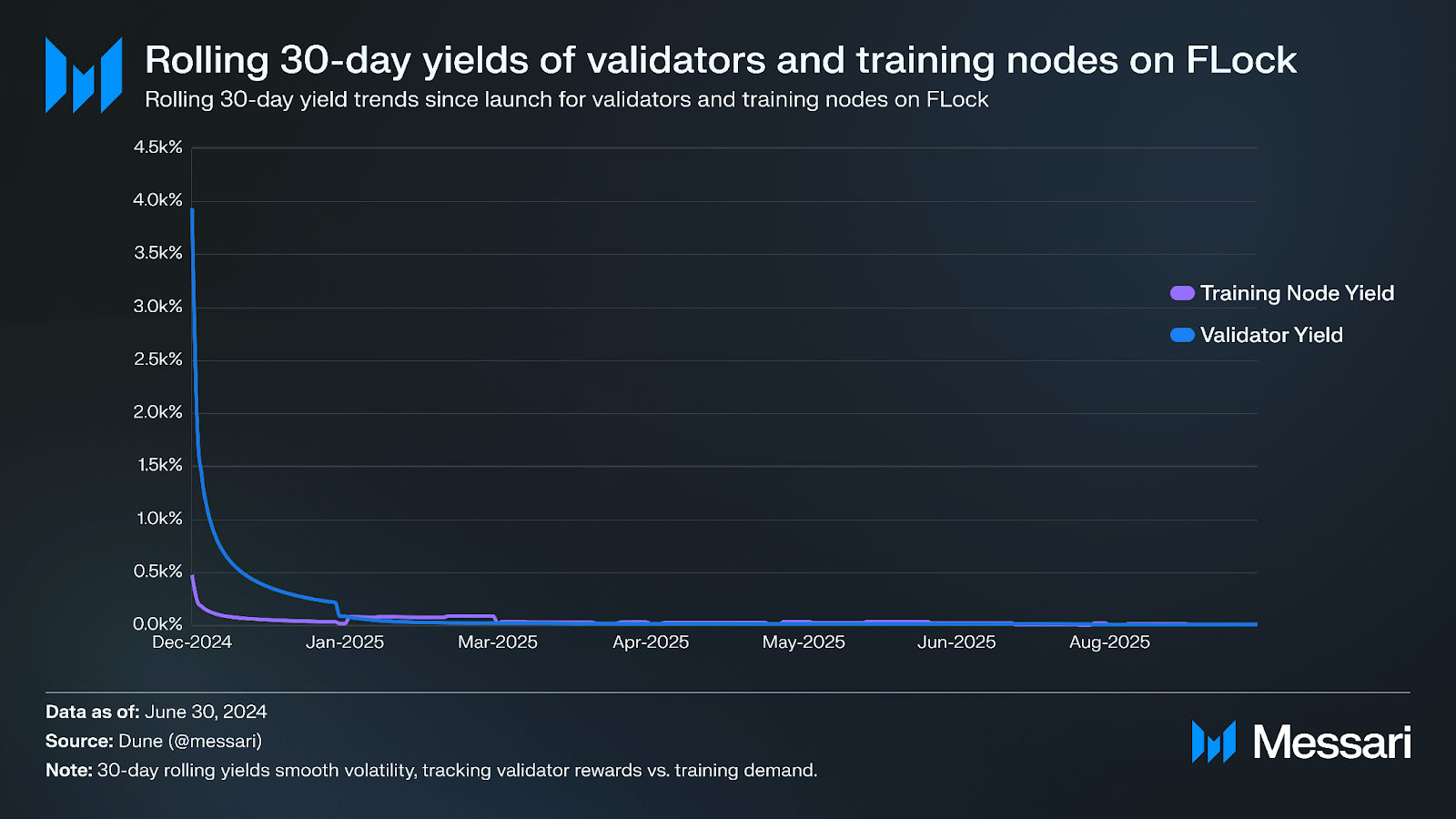

The rolling 30-day yield measures average rewards for training nodes and validators over the prior 30 days, smoothing short-term fluctuations to show incentive trends.

In Q1 2025, yields declined as participation scaled up: training node yields fell from 175% on January 1 to 29% by March 31, while validator yields dropped from 1,404% to 14%.

In Q2, yields stabilized in the double-digit range before shifting in late May, when training node yields briefly spiked above 34% and validator yields similarly touched 15%. At quarter-end, they stood at 7.8% and 5.8%, respectively.

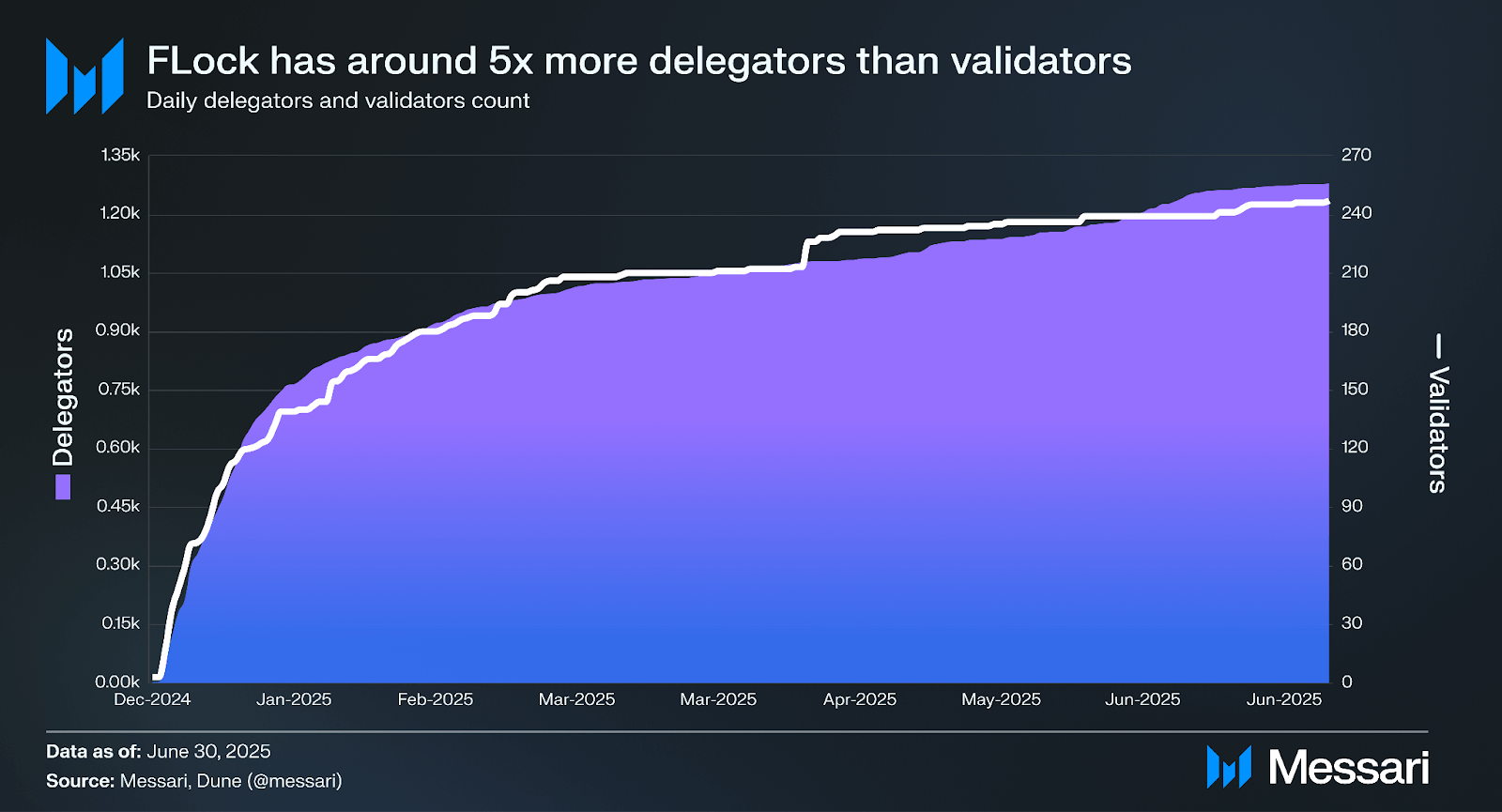

In Q2 2025, validator and delegator participation continued to expand, though at a slower pace than in Q1. Validators grew from 211 at the end of March to 247 by June (+17% QoQ), compared to an 11x increase in the prior quarter. Delegators rose from 1,060 to 1,280 over the same period (+21% QoQ), following a 22x jump in Q1. The delegator-to-validator ratio remained steady, moving slightly from 5:1 in Q1 to 5.2:1 in Q2, underscoring that delegation remained the preferred form of participation for tokenholders.

Validator growth moderated as the network approached operational stability after the rapid build-out of Q1. By contrast, delegator expansion was supported by the introduction of gmFLOCK staking and Delegation Pools which lowered barriers to entry and reinforced incentives for indirect participation. The persistence of a stable ratio highlights that incentives continued to balance direct and delegated roles within the network.

In Q2 2025, FLock’s circulating market capitalization rose 235% to $30 million, outpacing a 167% increase in token price as circulating supply expanded. The staking ratio declined from 41% to 33%, reflecting reduced incentives, profit-taking amid price appreciation, and the transition to gmFLOCK staking. Training nodes grew 29% QoQ to 185, validators increased 17% to 247, and delegators rose 21% to 1,280, while training and validation submissions fell 52% QoQ as workloads shifted toward more specialized tasks.

Strategic developments included the launch of gmFLOCK, AI Arena v2 with Delegation Pools, and the FLock OFF subnet on Bittensor, alongside integrations with Base’s Model Context Protocol, Alibaba Cloud’s Qwen, Infini, SpoonOS, and DIMO + Beacon. Recognition in CB Insights’ AI 100 list, awards at the IEEE Global Blockchain Conference, and participation in major Web3 and AI events elevated FLock’s profile as a decentralized AI platform.

Looking ahead, FLock enters the second half of 2025 with expanded tokenomics, a growing ecosystem, and a stronger industry presence, though participation trends highlight the need to balance incentives as the network scales into more complex, specialized AI workloads.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by FLock.io. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.