Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

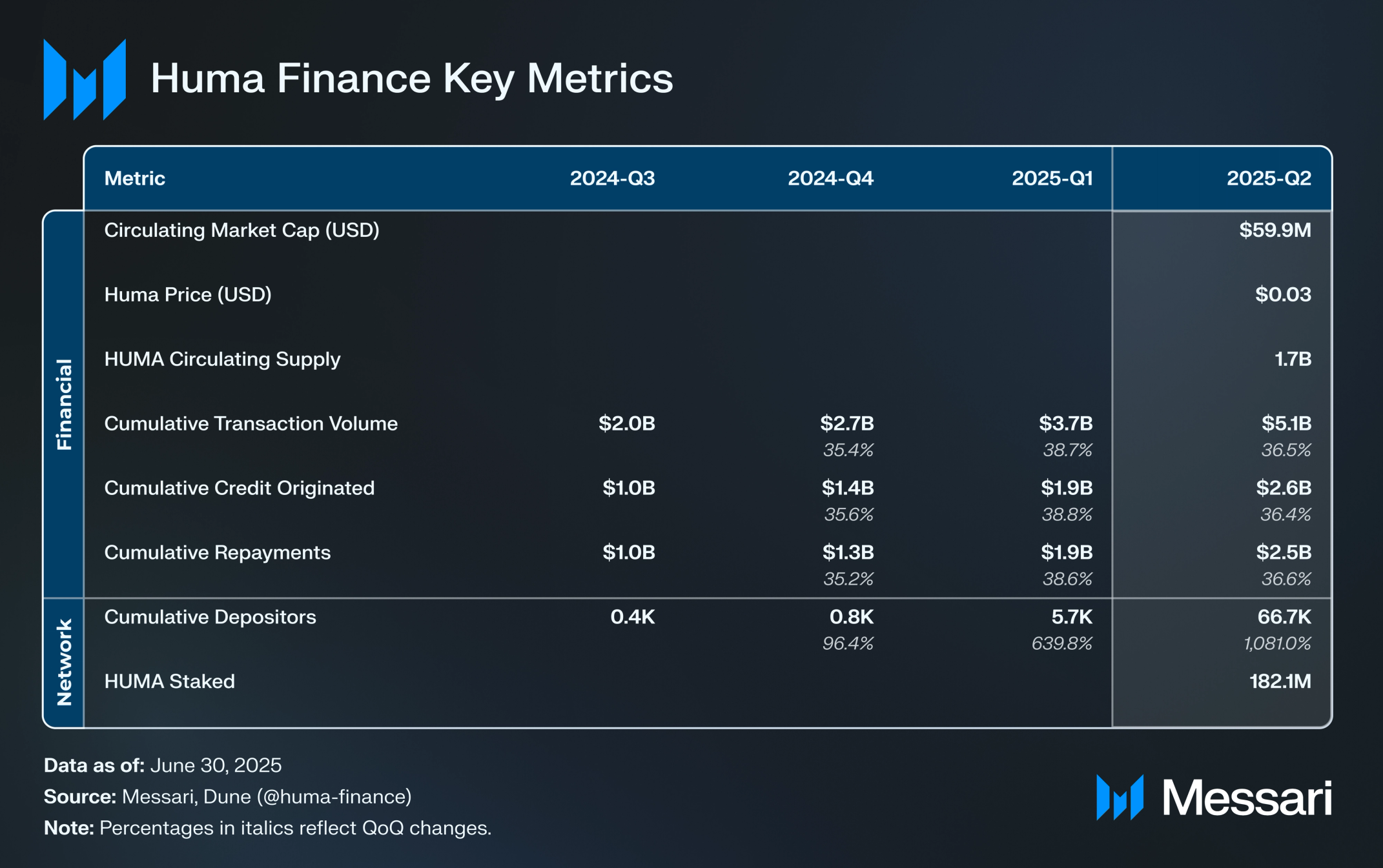

Huma Finance (HUMA) is a PayFi protocol that supplies settlement liquidity for cross-border transactions, payment service providers, credit card settlements, and similar use cases. The protocol connects liquidity providers (LPs) to borrowers through smart contracts and operates two products, Huma Institutional and Huma 2.0 (Permissionless), across 12 active lending pools, which generate yield from fees paid by borrowers.

Huma Institutional is a permissioned lending product for accredited investors in non-restricted countries with KYC/KYB and operates on Solana, Stellar, Polygon, and Celo.

Launched on April 9, Huma 2.0 is a Solana-based lending product available to depositors except in restricted countries or when a wallet is flagged by Chainalysis screening. Users deposit USDC and choose between:

In February 2023, Huma raised $8.3 million in a seed round. Thereafter, in April 2024, it merged with Arf, a cross-border payments liquidity provider, and in September 2024, raised a $38 million Series A led by Distributed Global. For a complete primer on Huma Finance, refer to our Initiation of Coverage report.

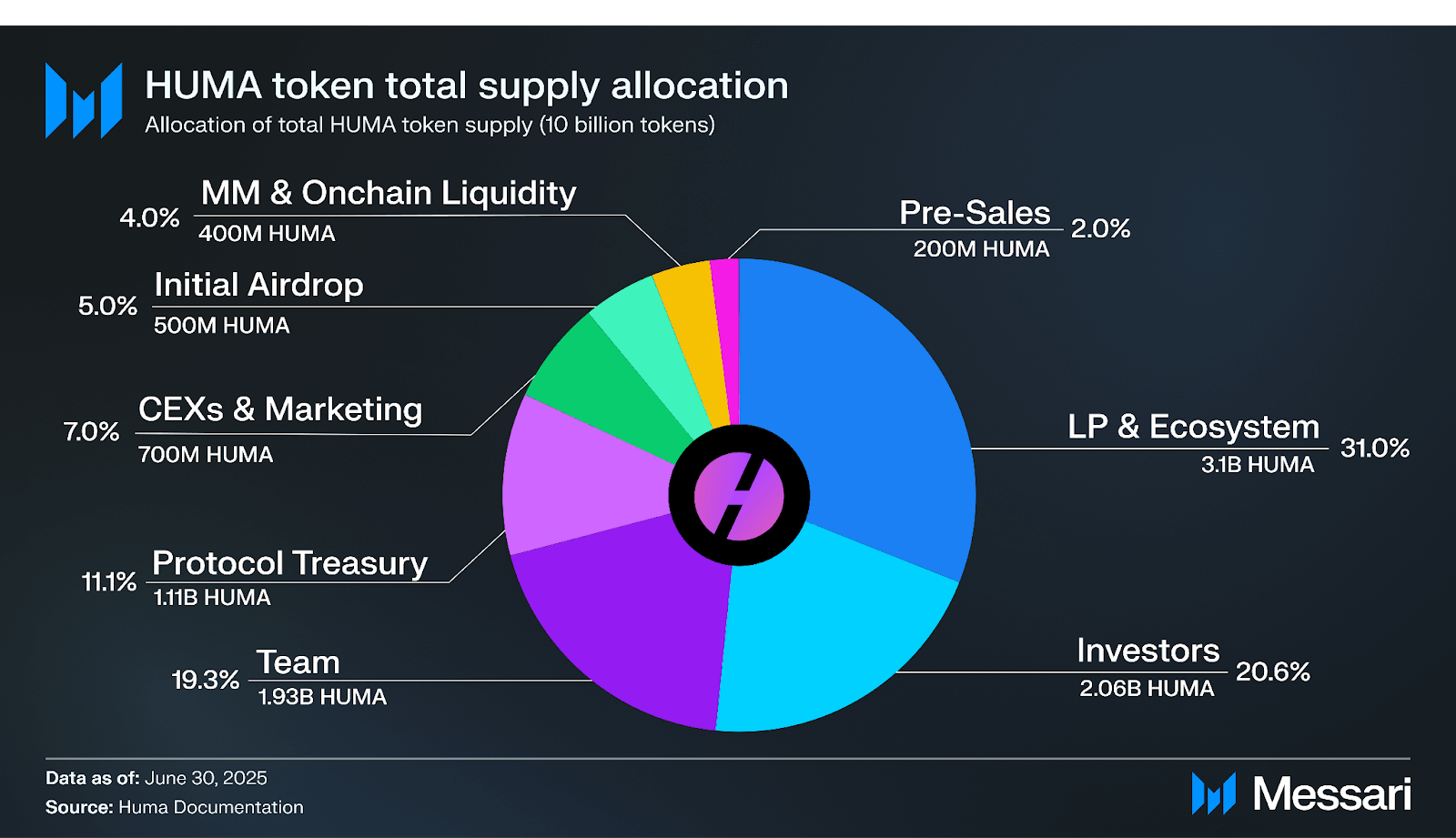

On May 26, Huma Finance launched HUMA, a utility and governance token with a total supply of 10 billion tokens to reward LPs, community contributors, and ecosystem partners (i.e., Huma-integrated protocols).

Token holders can stake HUMA to earn staking rewards, boost LP rewards, and vote on incentive allocations and protocol parameter changes. Longer staking durations increase voting power. Huma will publish governance process details in 2025.

The initial circulating supply was 1.733 billion HUMA (17.33% of total supply), which included the following allocations: the initial airdrop (500 million HUMA; 5%), CEX listings and marketing (700 million HUMA; 7%), and market-making and onchain liquidity (400 million HUMA; 4%). It also included 100 million HUMA (1%) from the protocol treasury, and 33 million HUMA (0.33%) from LP and ecosystem for a token swap with Jupiter DAO.

For the initial airdrop, LPs who provided liquidity to any Huma Institutional or Huma 2.0 pools received 325 million HUMA (65% of the airdrop), allocated proportionally based on Feathers (Huma Finance’s rewards program) earned as of the May 18 snapshot. Institutional LPs with pre-defined vesting schedules kept their tokens locked at TGE.

Ecosystem partners received 125 million HUMA (25% of the airdrop) allocated by the transaction volume facilitated and revenue generated for Huma. Of this, 41.7 million HUMA vested at TGE, the same amount will vest three months after, and the remainder six months after.

Community contributors received 50 million HUMA (10% of the airdrop), fully unlocked at TGE. This group included active Discord or Kaito social campaign participants and open-source protocol development contributors.

Of the 500 million HUMA allocated for the airdrop, 335.8 million (67.2% of the airdrop) were claimed by 37,300 wallets, 144.2 million (28.8%) remained locked vesting, and 20 million (4.0%) was reclaimed by Huma Finance.

In addition to the 1.733 billion HUMA circulating at TGE, the remaining supply is allocated across LP and ecosystem rewards, investors, the team, the protocol treasury, and pre-sale contributors, and is set to fully vest by May 2029, four years after TGE.

LP and Ecosystem — 3.067 billion HUMA (30.67% of total supply)

The remaining HUMA in this allocation will compensate LPs and ecosystem contributors. LP rewards scale by deposit size and lockup length, while partner rewards scale by transaction volume and revenue. A second airdrop of 210 million HUMA (2.1%) is planned about three months after TGE. The remaining unlocks will follow a 7% quarterly decay schedule, subject to governance changes, with no defined end date.

Investors — 2.06 billion HUMA (20.6%)

Allocated to Seed and Series A investors, with a one-year lockup followed by linear quarterly vesting over three years.

Team — 1.93 billion HUMA (19.3%)

Allocated to core contributors and advisors, with a one-year lockup followed by linear quarterly vesting over three years.

Protocol Treasury — 1.01 billion HUMA (10.1%)

Allocated for development, grants, partnerships, and protocol-owned liquidity, vesting linearly by quarter over two years.

Pre-Sales — 200 million HUMA (2.0%)

On May 25, a pre-sale of HUMA tokens occurred for Jupiter stakers, early contributors, and strategic supporters of Huma’s development. These tokens became claimable three months later on Aug. 25.

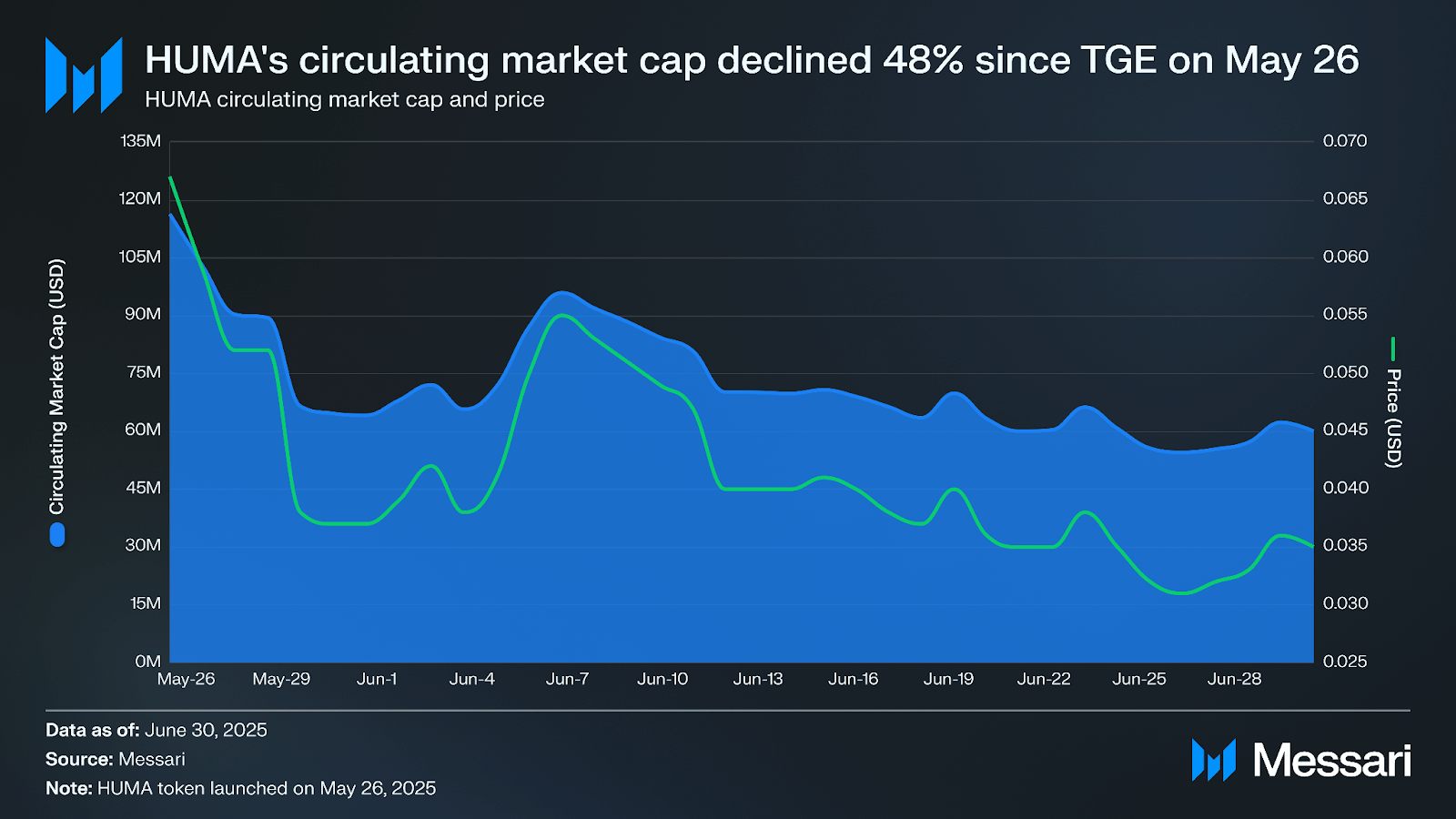

The HUMA token’s circulating market cap declined 48% since TGE on May 26, from $116.3 million to $59.9 million on June 30, in line with a 48% price drop from $0.067 to $0.035, as circulating supply held at 1.733 billion HUMA (17.33% of total supply). HUMA remains early in its lifecycle, and new tokens often experience price volatility as markets determine appropriate valuations.

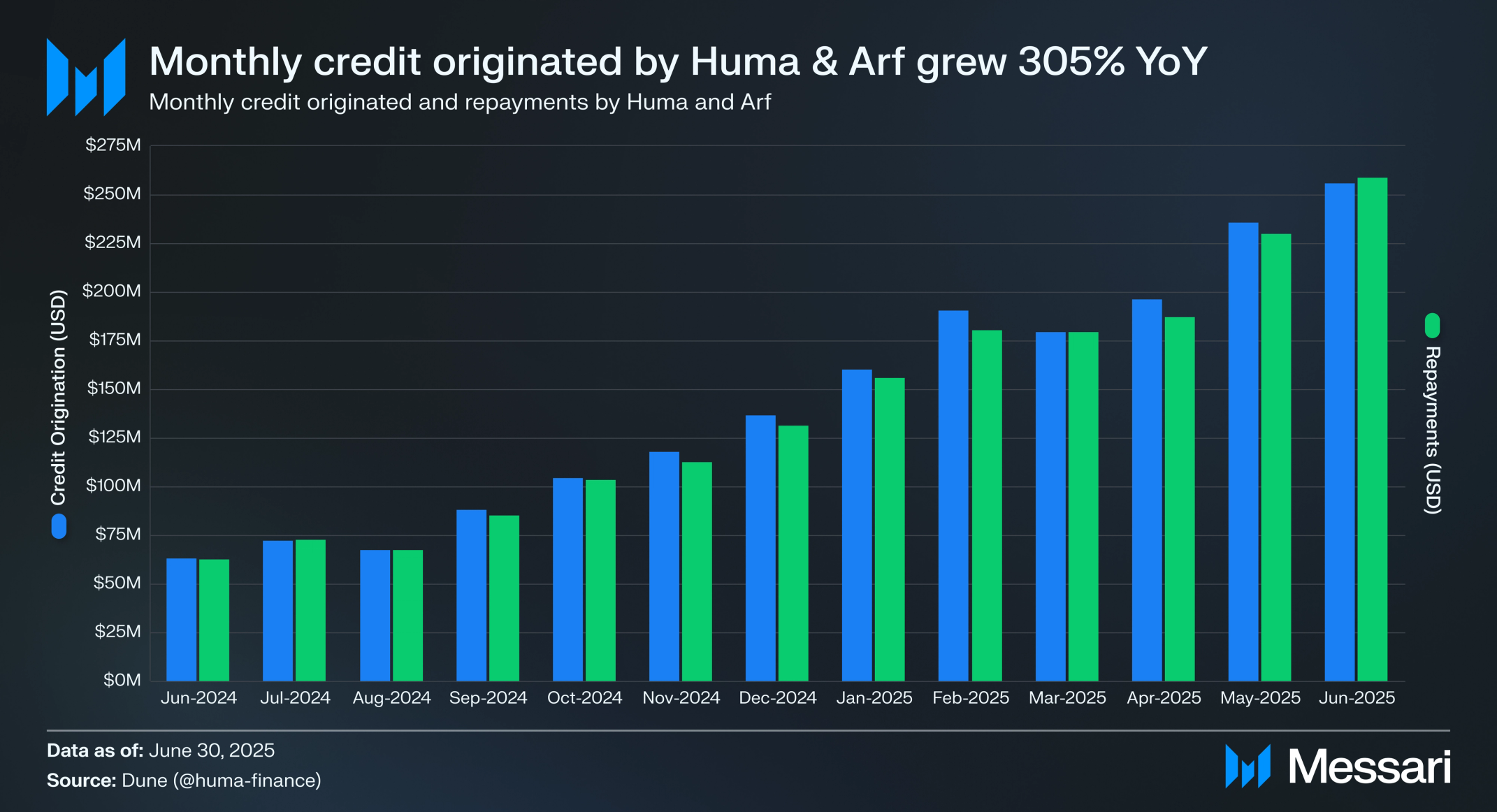

Credit origination is the value of loans issued through active lending pools, while credit repayment is principal returned by borrowers. Monthly originations through Huma pools totaled $255.8 million in June 2025, up 305% YoY from $63.1 million in June 2024. Monthly transaction volume across all pools, including originations and repayments, grew 309% YoY from $125.7 million to $514.5 million over the same period. Greater institutional adoption of alternative payment financing solutions over traditional options and rising global interest in onchain settlement and credit origination likely contributed to this growth.

Launched on April 9, Huma 2.0 is a Solana-based lending product that allows users to deposit USDC and choose between Classic Mode, which mints a PayFi Strategy Token (PST) earning USDC yield (currently 10% APY) from payment financing activity plus Feather rewards, or Maxi Mode, which mints a Maxi PayFi Strategy Token (mPST) that forgoes USDC yield for increased Feather rewards.

Both modes share the same underlying pool mechanics, with about 80% of capital deployed into Huma PayFi pools and about 20% into liquid DeFi strategies such as Kamino, Aave, and Pendle. Depositors can choose no-lockup, three-month, or six-month commitments, with longer lockups earning higher rewards. Once an LP locks a position, the Feather reward rate is guaranteed at or above the lock-in rate. For example, a six-month Maxi deposit at a 17.5x multiple in May keeps that rate even if it drops to 15x in June for new deposits.

PST liquidity is available on Orca, Jupiter, and Meteora. Additionally, on May 12, RateX integrated with Huma 2.0, enabling users to split PST into yield tokens (YT-PST) for amplified returns or principal tokens (PT-PST) for fixed returns.

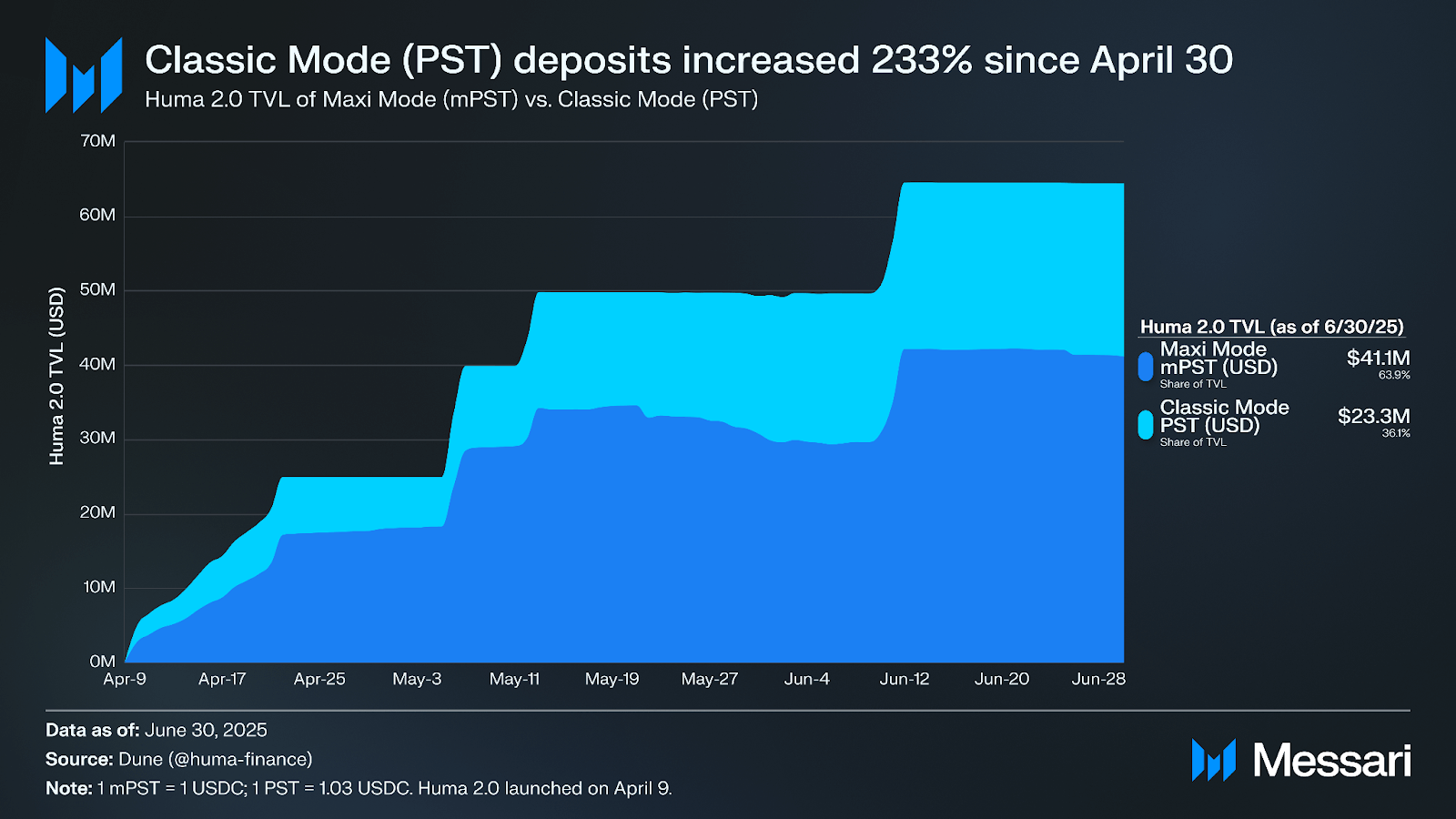

As of June 30, Huma 2.0 held $64.4 million in deposits, with $41.1 million in Maxi (63.9%) and $23.3 million in Classic (36.1%). The Maxi skew reflects users prioritizing greater Feather exposure over immediate USDC yield, suggesting confidence in Huma’s long-term rewards program. The initial pool hit its $25 million capacity on April 22, reopened on May 12, and reached capacity twice more before reopenings on June 11 and July 14.

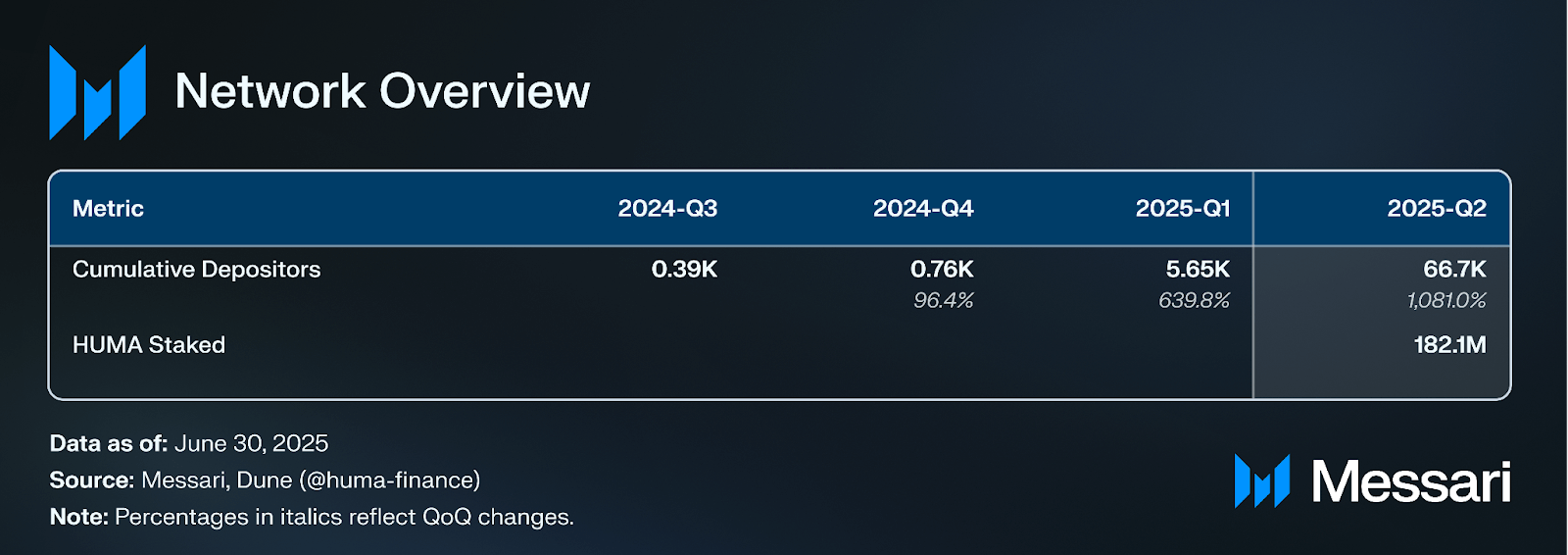

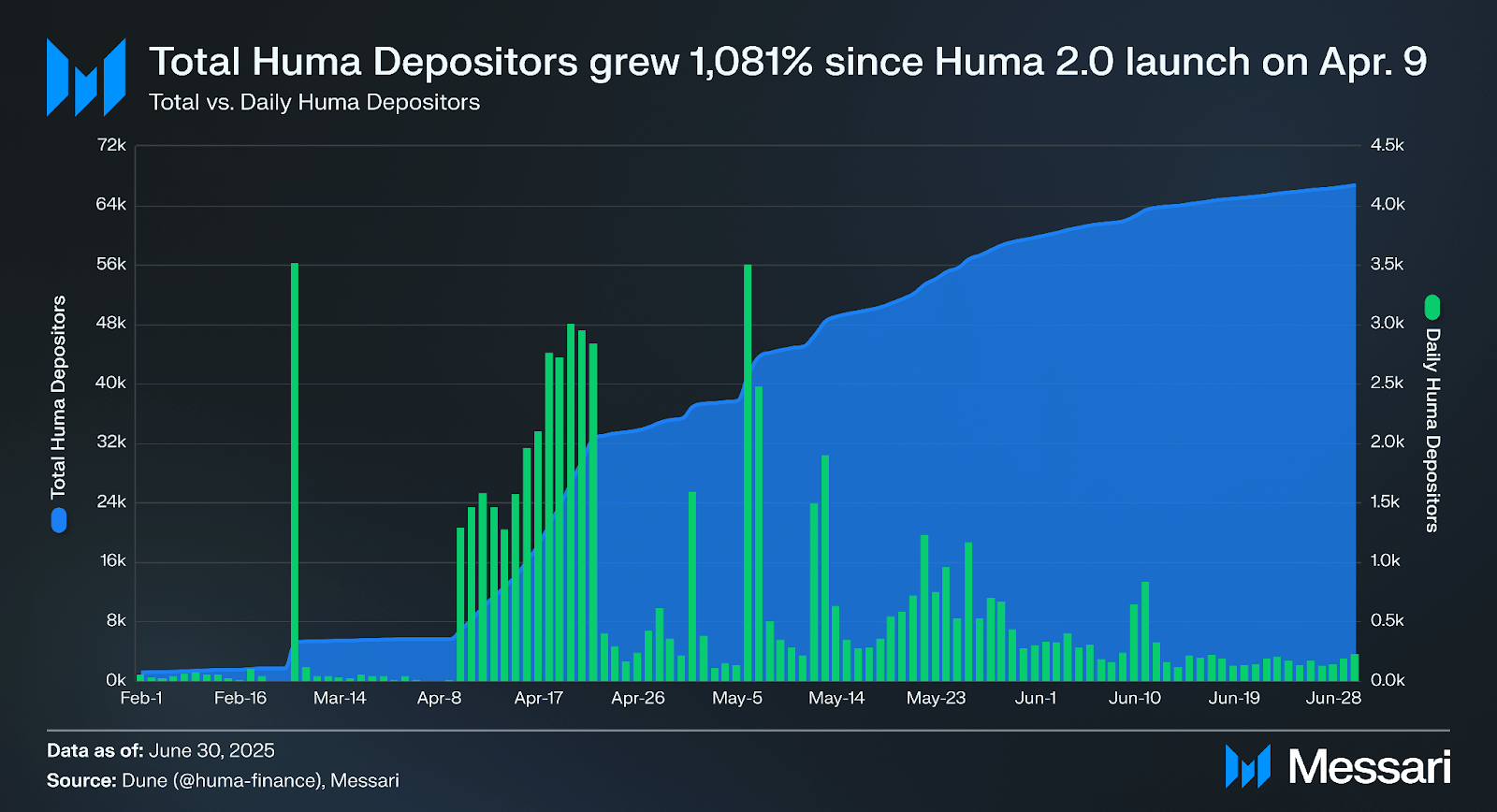

In Q2, average daily Huma pool depositors grew 462% QoQ from 128 to 719. The launch of Huma 2.0 drove a 1,081% increase in cumulative depositors from 5,700 on April 9 to 66,700 on June 30.

Huma Institutional required lenders to be accredited investors and pass KYC/KYB, which constrained depositor growth. Huma 2.0’s reduced requirements led to a surge of daily depositors in the two weeks after launch, averaging 1,900 depositors before the pool hit capacity on April 22, the highest two-week average in Huma’s history. Since the launch, no day has had fewer than 107 unique daily depositors, indicating consistent demand for the product.

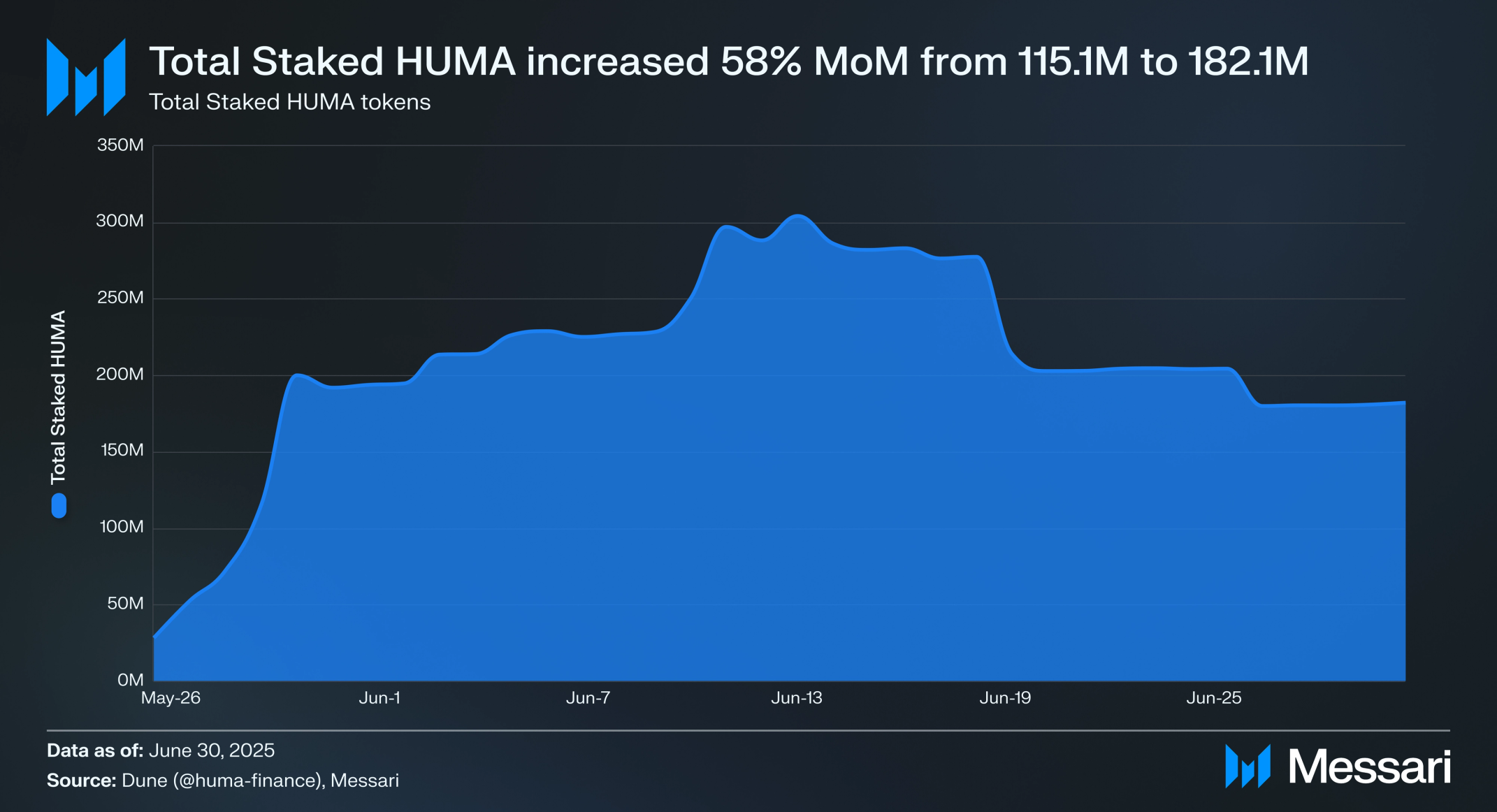

All HUMA circulating can be staked except for the 400 million allocated to market-making and onchain liquidity. As of June 30, users staked 182.1 million HUMA ($6.3 million), up 58% MoM from 115.1 million on May 30, representing 13.7% of staking-eligible supply.

On June 30, the Huma Foundation announced the rewards framework for HUMA stakers, which includes governance voting rights, Feathers-based rewards, a staking multiple on LP rewards, early access to deposit into Huma 2.0 vault reopenings, and eligibility for select ecosystem promotions and partner airdrops. Staking rewards are calculated over 30-day periods based on the amount of HUMA staked and two governance-controlled variables: the Staking Factor and α. The formula is 30-day staking rewards = (Staking Factor / α) × staked HUMA. At launch, the Staking Factor was 10 and α was 20, meaning 1,000 HUMA staked for 30 days would earn 500 Feathers.

Stakers who also LP receive a multiplier on their LP rewards, capped at 2x when the amount of HUMA staked exceeds three times their PST or mPST balance. If an LP has multiple positions, the multiplier applies to all. Stakers must wait 14 days after initiating an unstake request before tokens are eligible to be withdrawn.

Global Dollar Network (GDN)

On June 4, Huma joined the Global Dollar Network (GDN), a Paxos-led coalition promoting stablecoin adoption, regulatory clarity, and global payment use cases. The network includes members such as Robinhood, Kraken, and Worldpay. Paxos Digital Singapore issues GDN’s USDG stablecoin, backed 1:1 by U.S. dollars, and designed to comply with the Monetary Authority of Singapore’s stablecoin framework. GDN shares network revenue with partners who mint, transact, and hold USDG, incentivizing Huma to incorporate USDG functionality in the future.

Stargate

On June 6, the HUMA token launched on Stargate, enabling bridging between Solana and BNB Chain with zero slippage. Stargate uses LayerZero’s burn-and-mint mechanism to facilitate native chain transfers without using wrapped assets.

Superstate

On July 29, Huma partnered with Superstate, an asset manager of tokenized financial products, to support its liquidity strategy. Superstate operates two funds, USTB, a tokenized private fund backed byU.S. Government Securities including short-duration U.S. Treasuries, and USCC, a token representing ownership in the Superstate Crypto Carry Fund, which generates yield from crypto basis trades (a trade exploiting futures and spot price differences for the same asset) in BTC, ETH, and SOL, staking, and U.S. Treasuries. Integrating these assets allows Huma to manage liquidity with a balance of low-volatility, regulated instruments, and higher-yield PayFi strategies, while maintaining 24/7 onchain access.

On May 20, Huma Finance and the Solana Foundation co-hosted the PayFi Summit in New York to discuss stablecoin adoption in global payments, regulatory clarity to accelerate institutional participation, and Solana’s role in enabling scalable payment and credit applications. Discussions highlighted PayFi’s potential to connect traditional and digital finance, the importance of clear stablecoin regulations for broader adoption, and how Solana’s high-throughput infrastructure supports scalable payment and credit applications.

In Q2 2025, Huma Finance launched the HUMA token with an initial circulating supply of 1.733 billion (17.33% of total supply) and introduced its staking framework on June 30, which included governance rights, staking rewards, and LP reward multipliers. Huma 2.0 launched on April 9, which drove a 462% QoQ increase in average daily depositors from 128 to 719, while cumulative depositors rose 1,081% from 5,700 on April 9 to 66,700 by June 30. In Q2, Huma 2.0 deposits reached $64.4 million, with $41.1 million in Maxi mode (63.9%) and $23.3 million in Classic mode (36.1%). Monthly transaction volume in June increased 309% YoY from $125.7 million to $514.5 million, while monthly credit originations rose 305% YoY from $63.1 million to $255.8 million.

On June 4, Huma joined the Global Dollar Network, and on June 6, it enabled the HUMA token on Stargate to bridge between Solana and the BNB Chain. On July 29, Huma partnered with Superstate to implement their tokenized funds, while on May 20, it co-hosted the PayFi Summit with the Solana Foundation to advance discussions on stablecoin adoption, regulatory clarity, and scalable payment infrastructure. Huma’s growing depositor base, rising deposit volumes, and expanding cross chain capabilities position it for a deepened role in the PayFi ecosystem.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Huma Global Ltd. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.